Get the free E #18

Get, Create, Make and Sign e 18

How to edit e 18 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out e 18

How to fill out e 18

Who needs e 18?

Your Comprehensive Guide to the e 18 Form

Understanding the e 18 form

The e 18 form is a crucial document widely used in various sectors, primarily related to tax, employment, and government processes. Its primary purpose is to collect consistent information that can be easily processed and analyzed by relevant authorities. This form acts as a standardized medium, which not only enhances efficiency but also minimizes the chances of errors that can arise from using varied document formats. The importance of the e 18 form transcends simple data collection; it fortifies compliance with legal standards and fosters smoother operational workflows across numerous industries.

When and why to use the e 18 form

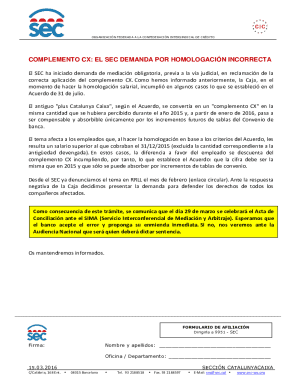

Understanding when to use the e 18 form is pivotal for compliance and operational efficiency. This form is typically required in situations involving tax disclosures, employment onboarding, and any formal application process that mandates verified information. Utilizing the e 18 form can streamline the way organizations manage documentation, effectively reducing time spent on paperwork and minimizing human error.

One of the key benefits of using the e 18 form is its adaptability across different platforms and its acceptance by various regulatory bodies. Common industries that often utilize this form include finance, healthcare, human resources, and government agencies. Each sector requires accurate data for reporting and compliance, making the e 18 form indispensable.

Accessing the e 18 form

Finding the e 18 form is straightforward, thanks to numerous online resources. One reliable platform where you can access the e 18 form is pdfFiller. Official government websites also provide downloadable versions of this form, ensuring you have access to the most updated information. Most versions are available in PDF format, making it easy for users to download and print as needed.

To download the e 18 form, follow this simple step-by-step process: First, visit the official website or pdfFiller. Next, navigate to the forms section and search for 'e 18 form'. Once located, click the download option to save it to your device. It’s essential to check regularly for updates to ensure you are using the current version of the form.

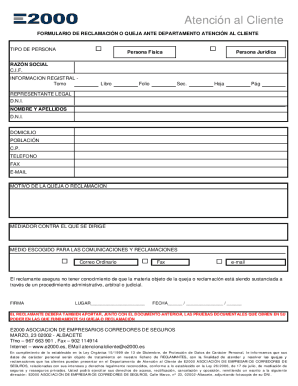

Filling out the e 18 form

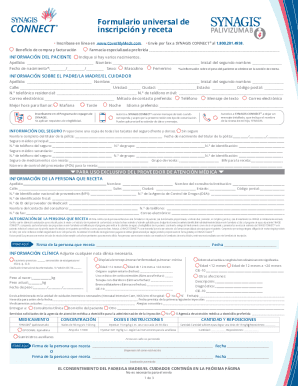

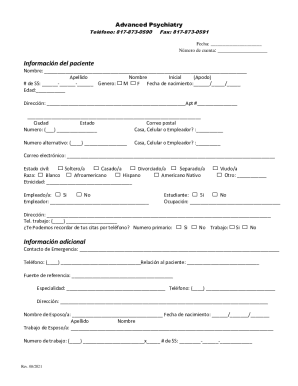

Filling out the e 18 form correctly is crucial for its acceptance and the avoidance of processing delays. The form typically contains several sections requiring essential information, such as personal identification details, employment history, and financial disclosures. Each section is designed to capture specific data, and providing accurate responses is vital.

When filling out the form, keep the following tips in mind: use clear and concise language, double-check for accuracy, and ensure you understand the information requested in each section. This not only enhances clarity but also prevents common mistakes like omitting essential information or providing incorrect data.

Editing the e 18 form

Sometimes, errors may be discovered after the e 18 form has been filled out. In such cases, using pdfFiller to edit your document can be a great solution. The platform allows you to upload your completed form easily and make necessary adjustments. Once uploaded, you can utilize editing features such as text editing, adding annotations, and rearranging sections to enhance the document's clarity.

The advantages of online editing extend beyond mere corrections. Editing through pdfFiller improves collaboration, enabling multiple users to contribute or comment on the document simultaneously. This collaborative feature ensures that everyone involved has a chance to review and suggest changes, fostering a more efficient and thorough completion process.

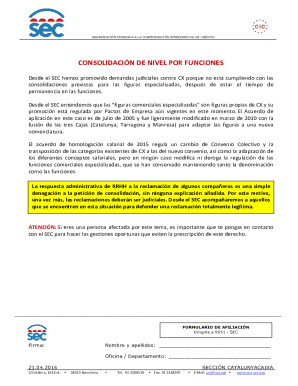

Signing the e 18 form

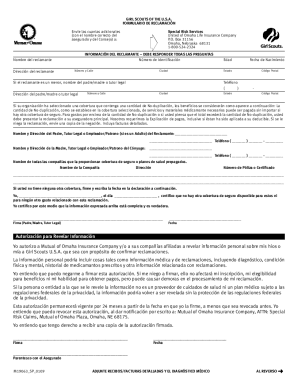

A critical component of the e 18 form is the required signatures. Including a signature on the form signifies consent and agreement, making it a legally binding document. The absence of a signature can result in delays or rejections, so it’s imperative to ensure that all required signatures are included.

Using pdfFiller, signing the e 18 form is a seamless process. Users can add a digital signature directly onto the document, which is often as legally valid as a handwritten signature. Alternatively, if you need to utilize a paper version, ensure you have a secure method for signing and returning the form, like using certified mail or an in-person handover.

Managing your e 18 form

Once the e 18 form is completed and signed, effective management becomes vital. Storing the completed form in a secure digital environment is recommended. Using pdfFiller, you can store your documents in the cloud, which allows for easy retrieval whenever needed. It’s wise to organize completed forms into folders based on categories or projects to streamline access.

Sharing the e 18 form securely is just as important. PdfFiller offers several methods to share documents via email or collaboration tools, ensuring that sensitive information is only accessible to authorized users. Utilizing advanced sharing options helps maintain document security and privacy, reducing the risk of exposure to unauthorized parties.

Troubleshooting common issues

While working with the e 18 form, users might encounter common issues. Misunderstanding the specific requirements of the form can lead to unnecessary complications, as can technical glitches when utilizing editing platforms. To address these problems, it's crucial to carefully read the instructions associated with the form and validate the data before submission.

If you experience technical difficulties, pdfFiller offers customer support that can assist you in navigating the platform. Additionally, consider exploring forums or user communities that focus on document management for further tips and resources.

Frequently asked questions (FAQs) about the e 18 form

Users frequently have questions or misconceptions regarding the e 18 form. Common queries include the necessary documents to accompany the form and the timeline for processing once submitted. It's crucial to clarify any uncertainties before attempting to complete the form, as this can contribute to a smoother process.

Navigating tricky parts of the form can also pose challenges. If you're unsure about specific sections, it’s recommended to seek guidance from professional resources or reach out to industry contacts who have experience with completing the e 18 form.

Real-world examples of the e 18 form usage

The e 18 form proves to be invaluable across various real-world scenarios. For instance, in the financial sector, businesses have used the e 18 form to report income accurately and avoid penalties during tax season. Similarly, healthcare providers often rely on the form for employee onboarding, ensuring that all necessary verifications are in place.

Testimonials from users highlight the e 18 form's efficiency. Many report that transitioning to a digital format via pdfFiller has drastically reduced the time needed to process forms, allowing their operations to run more smoothly and focus on core activities rather than administrative tasks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find e 18?

How do I fill out the e 18 form on my smartphone?

How do I fill out e 18 on an Android device?

What is e 18?

Who is required to file e 18?

How to fill out e 18?

What is the purpose of e 18?

What information must be reported on e 18?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.