Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990: A Comprehensive How-To Guide

Understanding Form 990

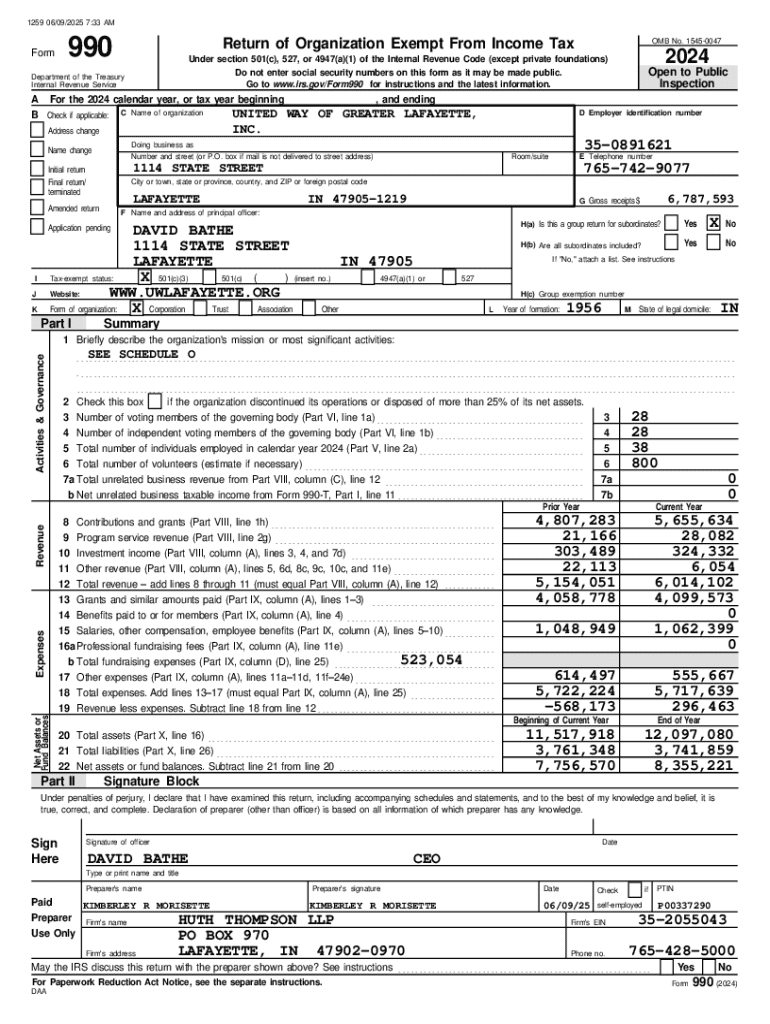

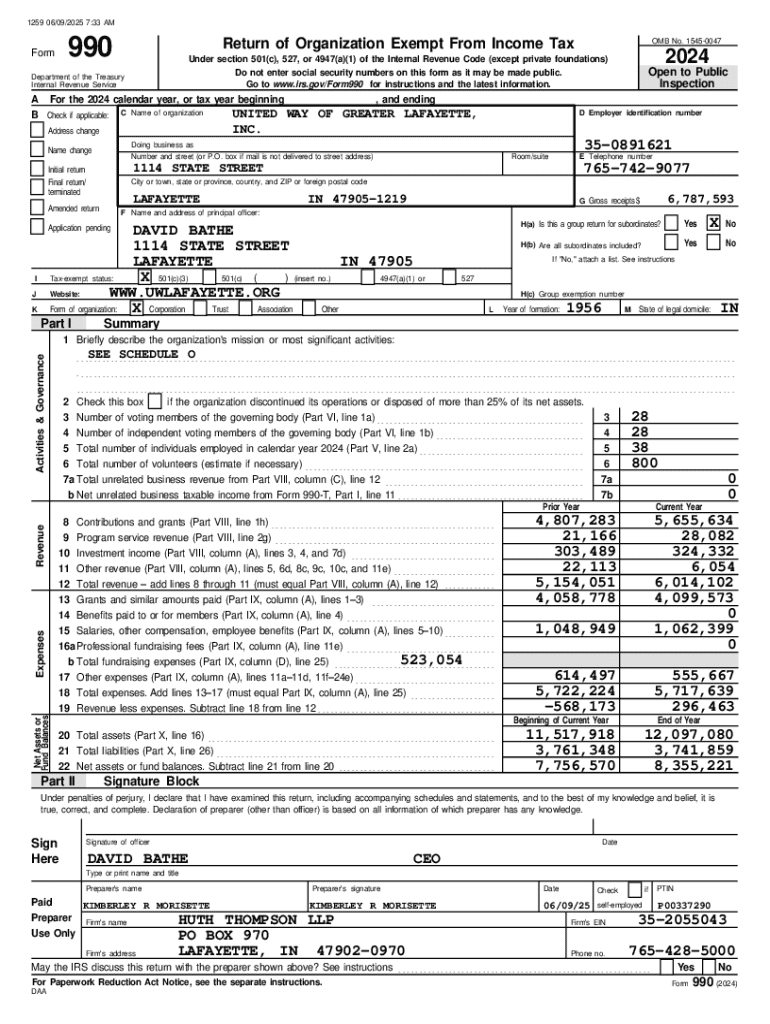

IRS Form 990 is a crucial document that nonprofit organizations must file annually to provide transparency about their financial activities. This form is essential not just for compliance but also for accountability to donors and the public. It outlines how the organization generates revenue and allocates funds, thereby playing a significant role in fostering trust.

Form 990 is particularly important for nonprofits because it provides insights into their governance, financial performance, and mission-related activities. By examining this form, stakeholders can assess an organization's effectiveness, sustainability, and overall impact on the community.

Who must file Form 990?

The eligibility criteria for filing Form 990 depend on the organization's gross receipts and type. Generally, organizations with gross receipts of $200,000 or more or total assets of $500,000 or more must file Form 990. However, smaller organizations might qualify for easier forms like the 990-EZ or 990-N.

Specific exemptions exist for certain types of nonprofits. For example, churches, certain governmental entities, and organizations that earn less than $50,000 annually may not be required to file. Additionally, different organizations have varied filing requirements based on their classification, which influences what form they need to submit.

Preparing to file Form 990

Before completing Form 990, organizations should gather essential documentation to ensure an accurate filing. This starts with financial statements that detail revenues and expenditures, along with the IRS determination letter that confirms the nonprofit’s tax-exempt status. Organizations should also compile a list of their board members and key staff to provide transparency in governance.

Understanding specific terms associated with Form 990, such as 'program service revenue' and 'unrelated business income,' will simplify the process. Establish a clear timeline for filing since the deadline typically falls on the 15th day of the 5th month after the end of your fiscal year. Extensions can be requested, but ensuring timely compliance is critical.

Step-by-step instructions for filling out Form 990

Filing Form 990 involves completing various sections, each designed to provide specific information about the organization. Starting with Part I, detail your mission and notable accomplishments. It's vital to succinctly convey your organization’s purpose and how it contributes to the community.

In Part II, focus on program service accomplishments, detailing how your organization's activities align with its mission. This includes qualitative and quantitative data supporting the effectiveness of your programs. Subsequent parts cover financial disclosures, including revenues, expenses, and compensation for your top staff members.

Filing modalities for Form 990

Organizations can file Form 990 either electronically through the IRS website or a third-party service, which can streamline the process and reduce errors. Electronic filing is generally faster and includes built-in checks for common mistakes. Alternatively, paper filing is an option but comes with its challenges, including longer processing times and the risk of lost documents.

Deadlines are crucial for compliance; most organizations have a due date of May 15 for fiscal year-end December 31. Extensions can be requested, extending the deadline by six months, although it's important to estimate taxes accordingly to avoid penalties.

Penalties for non-compliance

Failure to comply with Form 990 filing requirements can lead to significant penalties for nonprofits. Common reasons for late or incomplete filings include lack of understanding of the requirements or disorganization within the organization's financial management practices. Nonprofits may face fines starting at $20 per day up to a maximum of $10,000 for late submissions.

Beyond financial repercussions, organizations can face reputational damage, impacting their ability to secure future funding. If issues arise regarding compliance, organizations should promptly address them through the IRS and, if needed, seek legal or financial counsel to navigate the complexities of nonprofit regulations.

Public inspection regulations

Form 990 is available for public inspection, serving as a transparency tool for stakeholders. The information included can range from financial data to operational insights, allowing donors and community members to assess the organization’s effectiveness. This requirement underscores the importance of accuracy in reporting, as inaccuracies can result in public scrutiny and undermine trust.

To access full Form 990 documents, stakeholders can utilize resources like the IRS's Exempt Organizations Select Check tool or websites like Guidestar. Public inspection not only fulfills legal obligations but also enhances donor confidence, thereby supporting the nonprofit's fundraising efforts.

Utilizing Form 990 for charity evaluation and research

Form 990 serves as a vital resource for donors considering where to allocate their financial support. Donors can analyze an organization's financial health, operational efficiency, and program effectiveness by reviewing its reported data. Metrics such as fundraising costs versus program expenditures can offer valuable insights into how an organization maximizes its impact.

Case studies show that informed donors who leverage Form 990 information can select organizations that align with their values and maximize their philanthropic efforts. For instance, a donor might choose to invest in organizations that demonstrate a high percentage of resources spent directly on programs, ensuring that donations are substantially contributing to the advocated causes.

Navigating IRS Form 990 resources

The IRS website serves as the primary source for current and past Form 990 documents, providing organizations with access to a vast library of information. Users can find specific forms, filing instructions, and guidance through the IRS’s dedicated sections on nonprofit tax exemptions and filings. Additionally, various third-party platforms offer valuable tools for completing Form 990 efficiently.

pdfFiller also provides an array of resources, including templates and document management features that simplify the Form 990 filing process. Users can easily edit, eSign, collaborate, and manage documents—all from a single, cloud-based platform. This convenience empowers organizations to focus on their missions without getting bogged down in administrative tasks.

Historical insights on Form 990

Form 990 has undergone significant evolution since its inception, reflecting changing standards for nonprofit accountability and transparency. As awareness of nonprofits' roles and accountability has increased, so too have the expectations regarding their reporting requirements. Major reforms have sought to enhance the clarity and relevance of the information provided to stakeholders.

Notable changes over the years include the incorporation of new sections that address compensation, governance practices, and performance outcomes. These modifications focus more on how organizations operate rather than just their financials, enabling a more nuanced understanding of their missions and impacts. Current trends indicate a shift towards increased clarity and comparability, helping drive informed decisions among stakeholders.

Advanced considerations for nonprofits

Nonprofits facing special circumstances like mergers or compliance issues should understand the specific requirements attached to their situations. When organizations merge, it’s essential to analyze how the combined entities will report their finances and activities in Form 990. This process often requires additional disclosures to clarify the transitions and preserve stakeholder trust.

Additionally, multi-state organizations need to consider unique regulations that may apply based on their operational footprint. Filing varies for nonprofits with operations in multiple states, necessitating an understanding of each state’s requirements. Future trends indicate an increase in unified reporting standards as nonprofits seek to simplify their compliance landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 990 in Chrome?

How can I fill out form 990 on an iOS device?

Can I edit form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.