Get the free Direct Deposit Form

Get, Create, Make and Sign direct deposit form

Editing direct deposit form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct deposit form

How to fill out direct deposit form

Who needs direct deposit form?

Direct Deposit Form: Your Comprehensive How-to Guide

Understanding the direct deposit form

A direct deposit form is an essential document that allows individuals to authorize their employer, government entity, or any financial institution to deposit paychecks directly into their bank accounts. This form simplifies the payment process, ensuring that funds are securely transferred without any physical checks involved.

The purpose of using a direct deposit form is to facilitate timely and accurate payments. For businesses and organizations, it streamlines payroll processing, while for employees or recipients, it provides reassurance that funds will arrive without delay or the need for manual banking visits.

Key benefits of direct deposit

Direct deposit offers numerous advantages over traditional manual check payments. Firstly, it brings unparalleled convenience, eliminating the need for individuals to physically deposit checks. Once set up, employees can automatically receive their payments without any further action required on their part.

Moreover, it enhances security significantly. Direct deposits reduce the risk of lost or stolen checks, which can lead to identity theft and financial complications. With policy measures in place, electronic transfers typically come with better fraud protection that helps secure your banking information.

Lastly, funds are available immediately after the deposit is processed, allowing individuals to manage their finances efficiently. For anyone relying on timely payments, this quick access to funds ensures financial responsibilities are met without interruption.

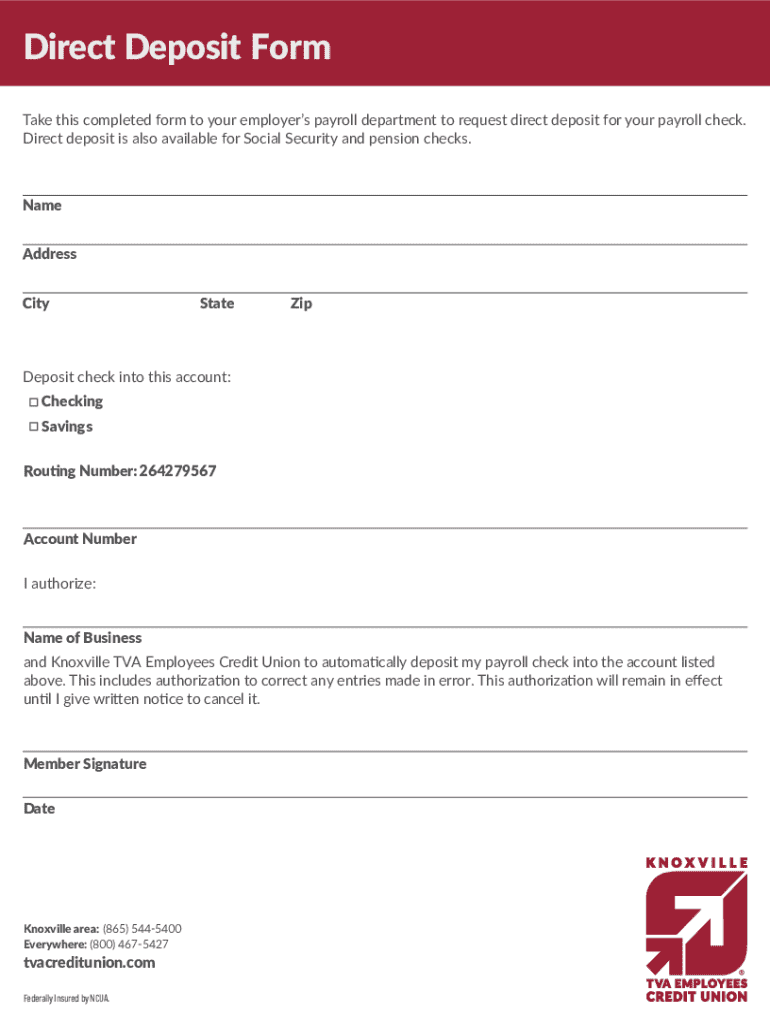

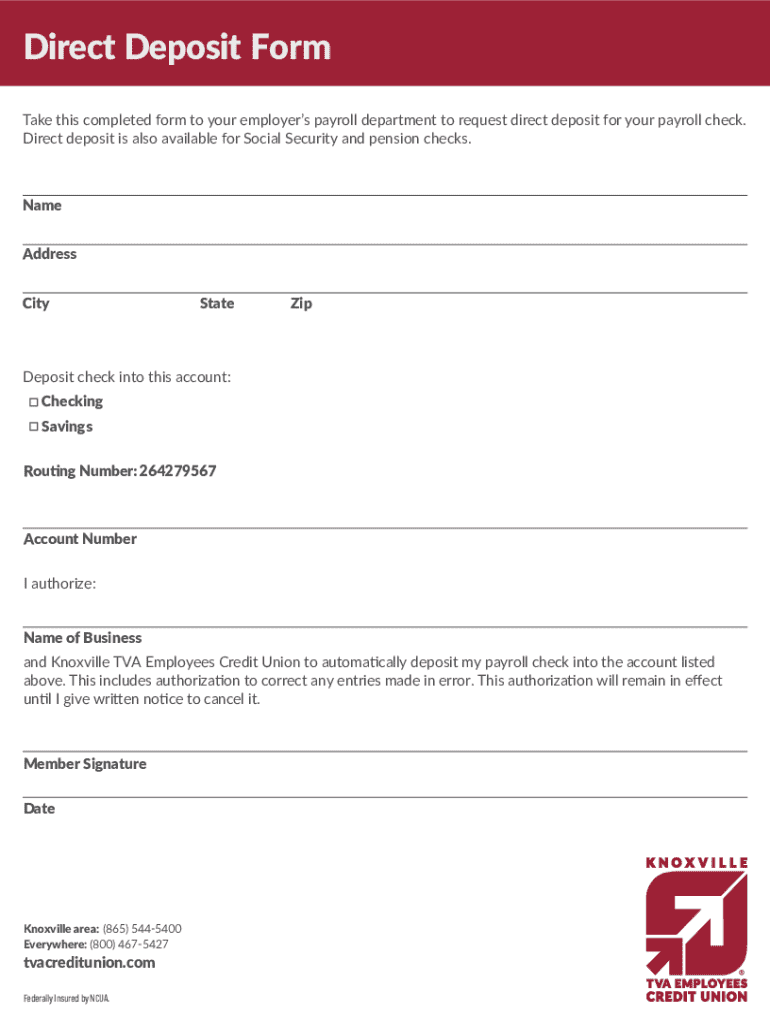

Essential components of a direct deposit form

A standard direct deposit form consists of several key components that must be filled out to ensure accurate processing. The first section includes personal information such as your full name, address, and contact details. This information helps verify your identity and links the payments to the correct recipient.

Next is the banking information, which is typically the most crucial part. It includes the account number and the routing number of your bank. It is critical to specify whether the account is a checking or savings account, as this determines where funds will be deposited. Lastly, employment information, including your employer’s name and address, may be requested to link your deposits to the payroll system.

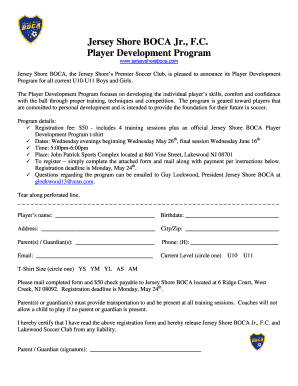

How to obtain a direct deposit form

Obtaining a direct deposit form is typically straightforward. Most banks and credit unions provide these forms on their websites. You can usually download or print the form directly from the bank’s online portal. Additionally, payroll websites often have templates available for employees, making the process accessible.

If you prefer, you can request a direct deposit form directly from your HR department. Approach your HR representative or payroll coordinator and ask about the procedures for setting up direct deposits. It’s helpful to inquire about any specific policies or requirements your organization may have concerning direct deposit.

Filling out the direct deposit form

Filling out your direct deposit form requires careful attention to detail. Start by entering your personal information accurately, as any discrepancies can delay your payments. Next, provide your banking information, ensuring you double-check your account and routing numbers. Taking time to verify this information is crucial.

Many people overlook the importance of reviewing their entries, but common errors can lead to significant delays. For instance, a wrong routing number may result in funds being sent to the incorrect bank. Carefully check each section of the form before signing it. If you're submitting online, use streamline tools provided through platforms such as pdfFiller to ensure no errors are made.

Submitting your direct deposit form

Once completed, your direct deposit form needs to be submitted correctly. Most employers accept forms via different methods, such as email, physical delivery, or their dedicated online portals. Choose the submission method that is most secure and fits within your company's guidelines.

Additionally, it’s wise to inform your bank after you’ve submitted the form. They might need to approve the changes or verify your account information. Checking with your bank ensures that everything is set for a seamless transfer of funds once your employer begins processing payroll.

Managing your direct deposit

Managing your direct deposits efficiently is key to maintaining financial wellness. A great first step is to track your deposits regularly. By checking your bank statements or using online banking tools, you can quickly verify that payments have been made to the correct account. Using a platform like pdfFiller can streamline this process, allowing for quick modifications and monitoring of document submissions.

Additionally, understanding when to update your direct deposit information is equally important. Situations such as changing banks or switching accounts necessitate updating the form to reflect accurate details. Keeping your employer and bank informed about any changes will help ensure a seamless transition and prevent interruptions in your payments.

Common issues and troubleshooting

Issues related to direct deposits can occasionally arise. If a payment hasn’t arrived as expected, the first step is to check with your bank. Verify if they show any incoming transactions. If there’s nothing recorded, it's advisable to communicate with your employer promptly to confirm that the payment was indeed processed for that pay period.

Another common problem is providing incorrect banking information, which may lead to funds being transferred to the wrong account. To rectify such mistakes, immediately contact your HR department and explain the error. They will guide you in making the necessary adjustments and can assist in retrieving misdirected funds.

Utilizing pdfFiller for direct deposit forms

pdfFiller offers an excellent platform for managing your direct deposit forms effectively. With its user-friendly interface, you can edit and customize your direct deposit form quickly, tailoring it to your specific needs. This flexibility is particularly valuable if you need to make frequent updates or changes.

Moreover, pdfFiller allows for easy eSigning and sharing of your forms, enhancing collaboration if you are working with your team. The platform provides real-time updates and notifications ensuring that all parties involved are kept informed throughout the submission process.

Compliance and security considerations

Using a direct deposit form requires awareness of legal regulations governing electronic payments. Employers are typically required to obtain consent from employees before initiating direct deposits, ensuring that individuals are aware of and agree to this payment method. Familiarizing yourself with these regulations can help both employees and employers navigate their obligations.

Security is paramount when sharing personal and banking information. Employing best practices such as using secure, encrypted platforms such as pdfFiller to handle your documents significantly reduces the risk of data breaches. Additionally, always ensure that any paper copies of your forms are stored securely to protect against potential identity theft.

Frequently asked questions (FAQs)

Direct deposit forms can raise various questions, especially regarding changes in banking details. For instance, if your bank changes your routing number, promptly update your employer with the new information to prevent payment disruptions. You may also wonder if having multiple direct deposit accounts is possible; many organizations allow you to distribute your payments across two or more accounts, providing increased flexibility.

Lastly, be aware that processing time for direct deposit may vary from one institution to another. Typically, payments reach your bank on the designated payday, but it's important to confirm specific timing with your employer's HR department.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit direct deposit form in Chrome?

Can I edit direct deposit form on an iOS device?

How do I edit direct deposit form on an Android device?

What is direct deposit form?

Who is required to file direct deposit form?

How to fill out direct deposit form?

What is the purpose of direct deposit form?

What information must be reported on direct deposit form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.