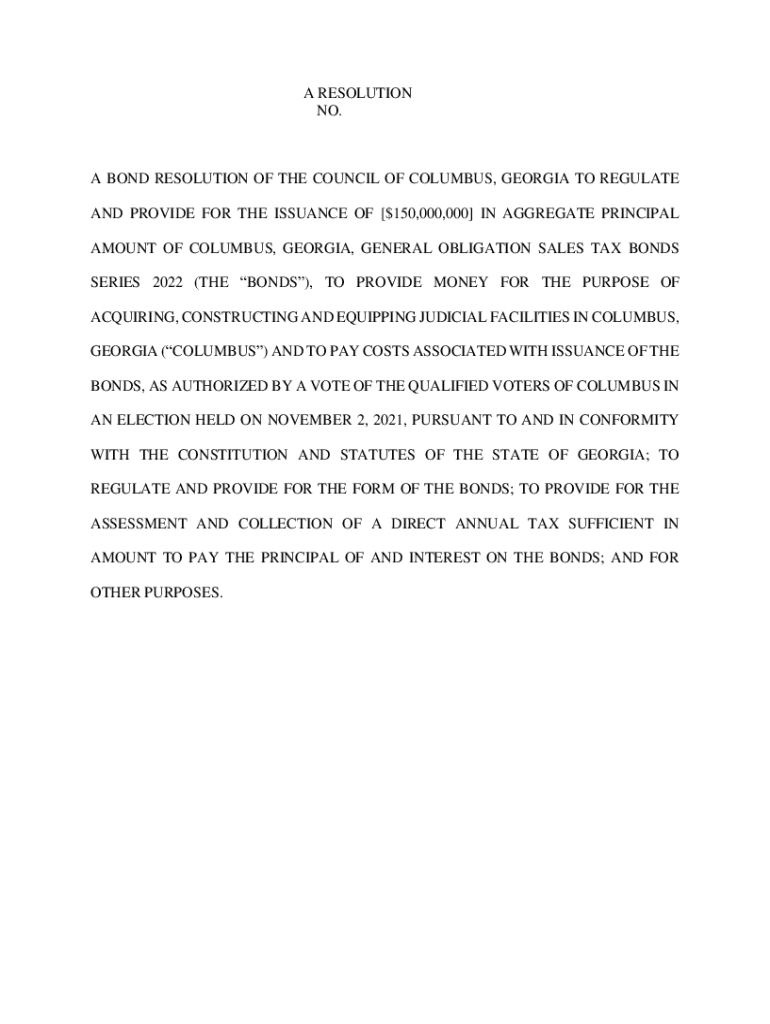

Get the free a Bond Resolution of the Council of Columbus, Georgia

Get, Create, Make and Sign a bond resolution of

Editing a bond resolution of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out a bond resolution of

How to fill out a bond resolution of

Who needs a bond resolution of?

A bond resolution of form: A comprehensive guide

Understanding bond resolutions

A bond resolution is a critical document in the financing realm, establishing the terms and conditions under which bonds are issued. It's the official record that provides authorization and describes the key elements of the bond issue, including the amount to be borrowed, the interest rates, and the payment schedule. A bond resolution acts as a charter that guides both the issuer and bondholders throughout the life of the bond.

The importance of bond resolutions cannot be overstated. They ensure transparency and legal compliance in the process of borrowing, while protecting the interests of investors. By clearly outlining the issuer's obligations and the rights of bondholders, a bond resolution creates a framework within which both parties can operate, fostering trust and accountability.

The issuer's role in bond resolutions

The issuer is the entity that advocates for and composes the bond resolution. Whether it’s a government body, a corporation, or a non-profit organization, the issuer is pivotal in determining the structure of the bond issuance and how it aligns with their financing needs.

Issuers bear the primary responsibility of ensuring all bond resolutions comply with state and federal regulations. They are also accountable for communicating key details about the bond issuance to potential bondholders and stakeholders, maintaining a transparent dialogue that is essential for fostering trust and confidence in the capital markets.

Essential bond resolution components

A properly structured bond resolution is typically composed of several essential elements. First, the title and date must be present, clearly identifying the document’s purpose. Additional authorizing language articulates the legal authority under which the bonds will be issued.

The document's body commonly includes recitals and findings—sections that provide background information—followed by more detailed authorization details. Financial provisions are also vital, outlining payment terms and detailing how proceeds from the bond sale will be used, ensuring that there is a clear plan for addressing the financial obligations created by the bond.

Key concepts related to bond resolutions

Understanding some key concepts related to bond resolutions will greatly enhance comprehension of the document itself. A conduit borrower, for instance, is an entity that borrows funds, allowing another party to access the financing indirectly. This arrangement can facilitate bond issuances without directly encumbering the borrowing entity.

Another essential term is the bond year, referring to the period in which the bond interest accrues. Reimbursement agreements are also worth noting; these contracts outline the terms under which an issuer can get reimbursed for certain expenses related to the bond issue, providing additional layers of financial planning.

Crafting the bond resolution

Crafting a bond resolution requires a systematic approach that starts with gathering the necessary information regarding the project requiring financing, the financial structures available, and the specific laws governing bond issuance in the issuer’s jurisdiction. Once all information is compiled, the drafting of the resolution can begin.

Legal review is an essential step in this process, ensuring that the language and terms outlined in the bond resolution align with applicable laws and protect all parties involved. Additionally, using templates can streamline this process. With the right templates at hand, issuers can customize a bond resolution to meet their unique needs more effectively.

Proper documentation and record-keeping

Accurate documentation and effective record-keeping play a vital role in managing a bond resolution. Proper documentation helps ensure all parties are on the same page regarding the bond's terms and obligations. It also serves as a protective measure should disputes arise or regulatory audits occur, providing a clear outline of actions and decisions made throughout the life of the bond.

Best practices for record-keeping include maintaining both digital and, where applicable, paper records. Using document management tools, such as pdfFiller, allows for efficient organization, allowing issuers to easily access and manage vital documents related to their bond issue anytime and from anywhere. This capacity not only simplifies record-keeping but enhances collaboration across teams involved in the process.

Reviewing and signing the bond resolution

The reviewing and signing phase of a bond resolution is crucial for ensuring all parties are aligned and consent on the document's terms. During this collaborative review process, stakeholders can provide feedback or raise concerns, fostering an environment that emphasizes transparency and cooperation. In many cases, adjustments may be required based on this feedback before the final resolution is endorsed.

The introduction of electronic signature tools, particularly pdfFiller, can enhance this process. Electronic signing not only saves time but also ensures compliance with eSignature laws that grant legal weight to electronic signatures, making it simpler for parties to finalize the bond resolution without the hassles of physical documentation.

Post-approval steps for bond resolutions

After a bond resolution is approved, several key steps must be undertaken to ensure compliance and proper execution. Filing and public disclosure are essential, as they make the details of the bond issue accessible to interested parties and the general public. This transparency is critical, as it helps maintain investor confidence and regulatory compliance.

Monitoring compliance after approval is another vital step. Issuers must keep track of how the sold bonds are being utilized and ensure that all covenants and obligations outlined in the bond resolution are adhered to throughout the life of the bonds. This ongoing vigilance protects the interests of bondholders and ensures smooth operations for the issuer.

Common terms and concepts related to bond resolutions

Understanding key terms related to bond resolutions is vital for anyone navigating these documents. Bonds, notes, and obligations all represent various forms of debt securities that come with specific rights and responsibilities for both issuers and holders. Covenants are conditions included in bond agreements that obligate issuers to maintain certain financial metrics or operational practices.

For anyone involved in the bond market, familiarizing themselves with these terms helps facilitate smoother negotiations and clearer communication among the parties. Having a glossary of bond resolution language is an excellent resource, providing clarity on the terminologies often encountered in bond discussions.

Interactive tools for bond resolution management

The advent of digital tools has transformed how bond resolutions are managed. pdfFiller offers various features that aid users in creating, editing, and managing these vital documents. With interactive document creation capabilities, users can ensure that every component of the bond resolution is accurately represented and compliant with legal standards.

Collaboration tools also empower teams to work together more effectively on bond resolutions, allowing for real-time updates and feedback. By utilizing platforms like pdfFiller, individuals and teams can streamline their workflow, ensuring that all bond-related documents are readily accessible and easily editable, ultimately enhancing the overall efficiency of the process.

Frequently asked questions (FAQs) about bond resolutions

FAQs around bond resolutions often center on the intricacies of the document itself and the process of securing bond funding. For example, how long it typically takes to receive approval for a bond resolution, or the types of supporting documents required for submission, are common inquiries. Answering these questions can clarify the complexities associated with bond issuance and help to demystify certain processes.

Additionally, there can be confusion regarding compliance obligations post-approval. Providing clear, concise answers to these common questions can greatly assist individuals and teams seeking to navigate the complexities of managing bond resolutions effectively.

Related forms and resources

Access to related forms and templates is invaluable for those engaged in bond resolution processes. pdfFiller provides numerous resources that support users in identifying and utilizing essential documentation, ensuring they have the appropriate instruments necessary for successful bond issuance and management.

Exploring further topics related to bond resolutions can enrich one’s understanding of the subject. Readers are encouraged to delve deeper into the intricacies of bond issuance, financing structures, and compliance requirements through additional documentation and related forms available on the pdfFiller platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send a bond resolution of to be eSigned by others?

Can I create an electronic signature for the a bond resolution of in Chrome?

How do I fill out a bond resolution of on an Android device?

What is a bond resolution of?

Who is required to file a bond resolution of?

How to fill out a bond resolution of?

What is the purpose of a bond resolution of?

What information must be reported on a bond resolution of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.