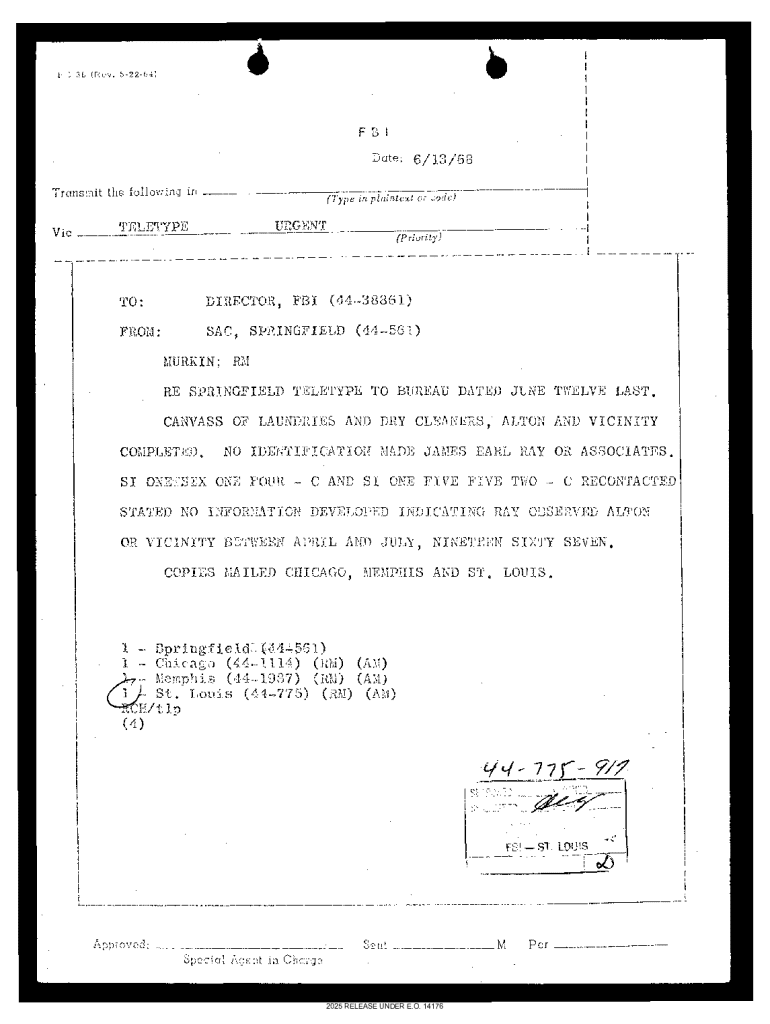

Get the free F 3 I

Get, Create, Make and Sign f 3 i

Editing f 3 i online

Uncompromising security for your PDF editing and eSignature needs

How to fill out f 3 i

How to fill out f 3 i

Who needs f 3 i?

Form F-3: A Comprehensive How-to Guide

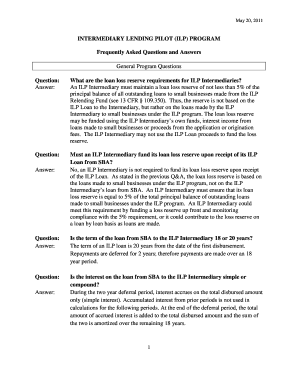

Understanding Form F-3

Form F-3 is an essential document used primarily in various administrative and legal processes. It serves as a streamlined method for individuals, teams, and organizations to submit relevant information effectively. The significance of Form F-3 lies in its ability to facilitate smooth and organized document management across multiple platforms, which is why familiarizing oneself with it is crucial.

Unlike other forms, Form F-3 is specifically designed for quicker processing, making it pivotal in high-demand situations. While many forms require extensive backgrounds or attachments, Form F-3 aims to simplify the process while maintaining essential compliance requirements. A comprehensive understanding of its specifications will surely enhance your efficiency in document management.

Eligibility criteria for Form F-3

To effectively utilize Form F-3, it's essential to determine who is eligible to submit the form. Generally, both individuals and groups such as teams and organizations can apply. However, specific conditions apply that dictate the eligibility for utilizing Form F-3.

Clearly, eligibility hinges on the fulfillment of specific conditions, including necessary paperwork and authorizations. Understanding these requirements mitigates risks and ensures that the form can be processed smoothly.

Before you start with Form F-3

Preparation is key before delving into the completion of Form F-3. By organizing your thoughts and gathering required information beforehand, you can prevent potential roadblocks. Begin by listing what you need to create a seamless filing experience.

Being preemptive is crucial; missing even a single piece of documentation or misinterpreting any requirements can lead to filing delays or rejections. Thus, a thorough preliminary step can save a considerable amount of time and stress.

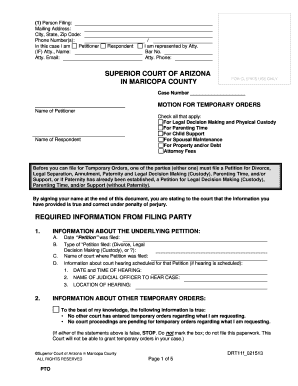

Step-by-step guide to completing Form F-3

Filling out Form F-3 may seem daunting, but by breaking it down into manageable sections, anyone can do it. Each section has specific requirements that need to be addressed adequately.

Remember to double-check your entries for accuracy and compliance before finalizing the form. Careful attention to detail can ensure your submission is accepted without issues.

Understanding Form F-3 amendments and updates

Circumstances may arise that require you to amend your Form F-3. Understanding the reasons for amendments and how to process them is vital in maintaining compliance and accuracy.

Understanding these nuances will not only smooth the process of filing an amendment, but it will also keep you informed about the evolving requirements of Form F-3.

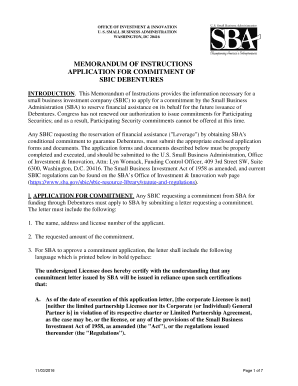

Form F-3 compliance and legal implications

Filing Form F-3 isn't just about filling out boxes; it carries significant compliance obligations. Understanding these requirements is crucial to avoid legal repercussions.

Non-compliance can result in fines, penalties, or greater scrutiny in future dealings, making it imperative to take these obligations seriously.

Comparing Form F-3 with Form F-1

In the realm of administrative processes, different forms serve varied purposes. Form F-3 and Form F-1 are often discussed, yet they possess differing functionalities.

By comparing these forms, users can determine the most suitable option for their needs, ensuring an efficient filing experience.

Avoiding common mistakes in Form F-3 filings

While completing Form F-3, many filers encounter common pitfalls. Awareness of these potential mistakes can save time and frustration during the submission process.

Adopting these best practices ensures that the filing process is as smooth as possible and encourages successful submissions without unnecessary setbacks.

Tips for managing and submitting Form F-3

Utilizing modern document management solutions can significantly ease the submission of Form F-3. Digital platforms provide various options for submission and tracking, which enhances manageability.

By effectively managing submissions, users are armed with the necessary tools to respond quickly to any issues, ensuring that all aspects of the filing process are well monitored.

Related products and solutions from pdfFiller

pdfFiller offers a multitude of document management solutions tailored to enhance your form filing experience, which includes tools specifically designed for handling Form F-3.

By leveraging these PDF management tools, users can enhance their efficiency and ensure a more streamlined document handling process.

Online learning resources

For those looking to deepen their knowledge about Form F-3, various online learning resources are available. These can help individuals and teams master the nuances of effective form filing.

Engaging with these resources ensures users are well-equipped with knowledge to complete Form F-3 with confidence.

What happens next after filing Form F-3?

After submitting Form F-3, understanding the subsequent process becomes essential. Knowing what to expect will reduce anxiety and provide clarity.

This proactive approach will equip you to navigate the post-filing landscape effectively, ensuring you are always ready for any next steps required.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my f 3 i in Gmail?

How can I send f 3 i for eSignature?

How do I fill out the f 3 i form on my smartphone?

What is f 3 i?

Who is required to file f 3 i?

How to fill out f 3 i?

What is the purpose of f 3 i?

What information must be reported on f 3 i?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.