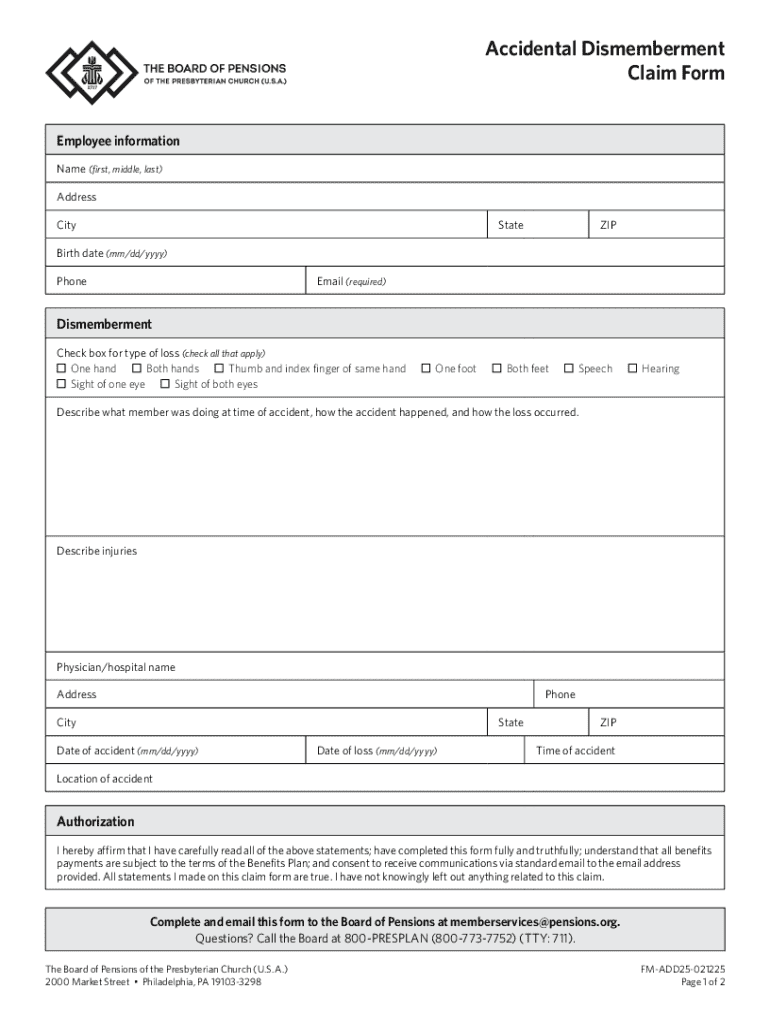

Get the free Accidental Dismemberment Claim Form

Get, Create, Make and Sign accidental dismemberment claim form

Editing accidental dismemberment claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out accidental dismemberment claim form

How to fill out accidental dismemberment claim form

Who needs accidental dismemberment claim form?

Navigating the Accidental Dismemberment Claim Form: Your Comprehensive Guide

Understanding accidental dismemberment

Accidental dismemberment refers to the loss of a limb or body part due to unforeseen circumstances, often resulting from accidents. This can significantly impact the victim’s quality of life, both physically and emotionally. Common causes of accidental dismemberment include workplace incidents, traffic collisions, and severe sports injuries. Recognizing the impact of such accidents highlights the need for adequate insurance coverage to help mitigate financial losses.

Filling out an accidental dismemberment claim form is crucial for recovering the financial support you may need after such an event. Timely filing ensures that you don’t miss out on the benefits you are entitled to, which can help cover medical costs, rehabilitation, and other associated expenses.

Preparing for your claim

Before submitting your claim, it's essential to determine your eligibility. Generally, individuals insured under a policy that includes accidental dismemberment coverage qualify for claims upon documented loss. Important factors influencing eligibility include the terms of your insurance policy, whether the incident was indeed accidental, and whether you have evidence of medical treatment following the accident.

Once you confirm your eligibility, collecting the necessary documentation becomes paramount. You'll generally need medical records detailing injuries, incident reports describing the event, and a copy of your insurance policy for reference. Organizing these documents efficiently can streamline the claims process.

Step-by-step guide to filling out the accidental dismemberment claim form

To start with, accessing the claim form through pdfFiller is straightforward. You can either download a PDF version or fill it out online, providing flexibility based on your preference. Once you have the form, the first step is to fill in your personal information accurately.

It's crucial to double-check all completed sections to avoid common mistakes, such as omitting information or providing inconsistent details. After filling the form, utilize pdfFiller’s editing tools for any necessary adjustments. The platform’s collaboration features also allow you to seek assistance from family or legal advisors easily.

Submitting your claim

Once you complete the form, submitting your claim is the next step. With pdfFiller, you can submit electronically, ensuring a faster and more efficient claims process. Alternatively, if you prefer the traditional method, carefully follow the mailing instructions provided within your form documentation.

Tracking your claim's progress is essential. Most insurance companies offer online tracking systems; you can also directly contact your insurance provider for updates.

Common pitfalls and solutions

Claims can be denied for several reasons. Incomplete applications or missing documentation are the most common culprits. To mitigate this risk, ensure all required information is filled out thoroughly and correctly before submission.

If your claim is denied, don’t be disheartened. You can appeal the decision by reviewing the insurance company’s reason for denial. Oftentimes, providing additional documentation or clarification of the incident can reverse the decision.

Frequently asked questions (FAQs)

After submitting your claim, what happens next? Typically, the insurance provider will review your application, which can take anywhere from a few days to several weeks. Processing times vary based on the complexity of the claim and the insurer's procedures.

Disputes or complications may arise. In such cases, understanding your policy particulars and remaining proactive in communication with your insurer is crucial.

Additional considerations

In situations involving significant claims like accidental dismemberment, seeking legal advice may be beneficial. Consulting a lawyer can help ensure you understand your rights and maximize your compensation. It’s best to seek legal representation during the initial stages to avoid potential pitfalls later.

Understand that making a claim may also impact your future insurance premiums. Notifying your insurer of the claim might lead to a reassessment of your coverage, which can alter your premiums going forward. Being informed about how accidents can influence your insurance strategy is essential for ongoing financial health.

pdfFiller's unique value proposition in claim management

pdfFiller offers a comprehensive solution for managing your accidental dismemberment claim effectively. The cloud-based platform allows you to edit, eSign, collaborate, and manage documents in one place — a significant advantage during a time when clarity and organization are vital.

The platform’s intuitive interface reduces the stress often associated with claim processes, ensuring that users can focus more on recovery and less on paperwork.

Interactive tools and resources

pdfFiller provides valuable interactive tools designed to make completing the accidental dismemberment claim form simpler. You can access customizable templates that require minimal input, guiding you step by step through the process.

These resources ensure that each user, regardless of their prior experience with document management, can confidently fill out and submit their claim.

Staying informed

Staying updated on changes to insurance laws and policies regarding dismemberment claims is essential. Regularly reviewing trustworthy sources of information will help you remain proactive, allowing you to adapt your strategies as necessary.

An informed individual is better equipped to navigate their rights and responsibilities, particularly when dealing with sensitive matters like accidental dismemberment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in accidental dismemberment claim form?

How do I make edits in accidental dismemberment claim form without leaving Chrome?

How can I fill out accidental dismemberment claim form on an iOS device?

What is accidental dismemberment claim form?

Who is required to file accidental dismemberment claim form?

How to fill out accidental dismemberment claim form?

What is the purpose of accidental dismemberment claim form?

What information must be reported on accidental dismemberment claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.