Get the free How to Track Corporate Sponsorships A Nonprofit's Guide

Get, Create, Make and Sign how to track corporate

How to edit how to track corporate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out how to track corporate

How to fill out how to track corporate

Who needs how to track corporate?

How to Track Corporate Form: Comprehensive Guide

Understanding corporate forms

Corporate forms serve as the foundational structure for any business entity. They define how a business operates, affects its tax obligations, and specifies the legal framework within which it must function. Whether you are starting a new venture or managing an established company, understanding and tracking corporate forms is essential.

There are numerous corporate structures, including Limited Liability Companies (LLCs), corporations, partnerships, and nonprofits. Each structure has unique characteristics regarding liability, taxation, and governance. For instance, an LLC offers personal liability protection and is advantageous for small businesses, while corporations are ideal for raising capital and can be either C-corporations or S-corporations, each subject to different tax treatments.

Tracking corporate forms is vital for compliance and governance. This includes ensuring timely filings with regulatory bodies, paying necessary fees, and maintaining accurate records. Failing to track these elements can lead to legal issues, fines, or, in severe cases, the dissolution of the business.

Key elements of corporate form tracking

To effectively track corporate forms, businesses must gather essential information. This includes identification numbers, such as Employer Identification Numbers (EIN) and Tax Identification Numbers (TIN), which are critical for tax and legal purposes. Additionally, understanding the organizational structure is crucial for compliance, especially as businesses expand or change ownership structures.

Beyond basic identifiers, tracking also involves being aware of key dates and deadlines. Businesses must understand when state and federal filings are due, as well as renewal schedules for licenses and permits. A well-maintained tracking calendar can serve as an essential tool to prevent missed deadlines and ensure continuous compliance.

Tools and resources for tracking

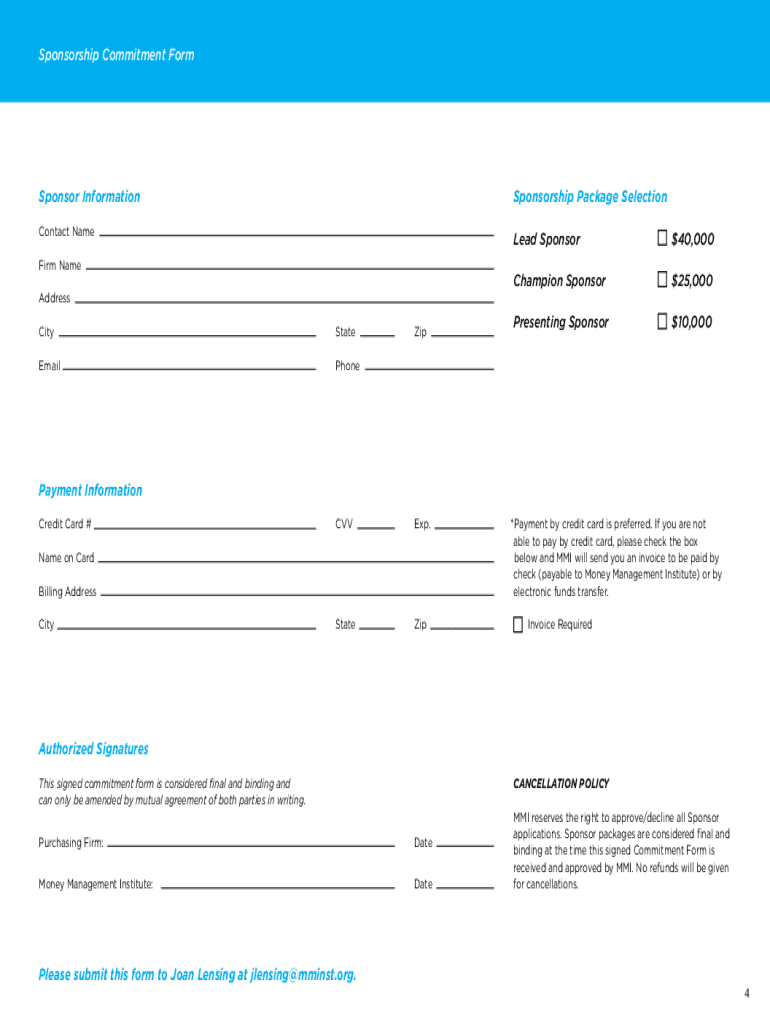

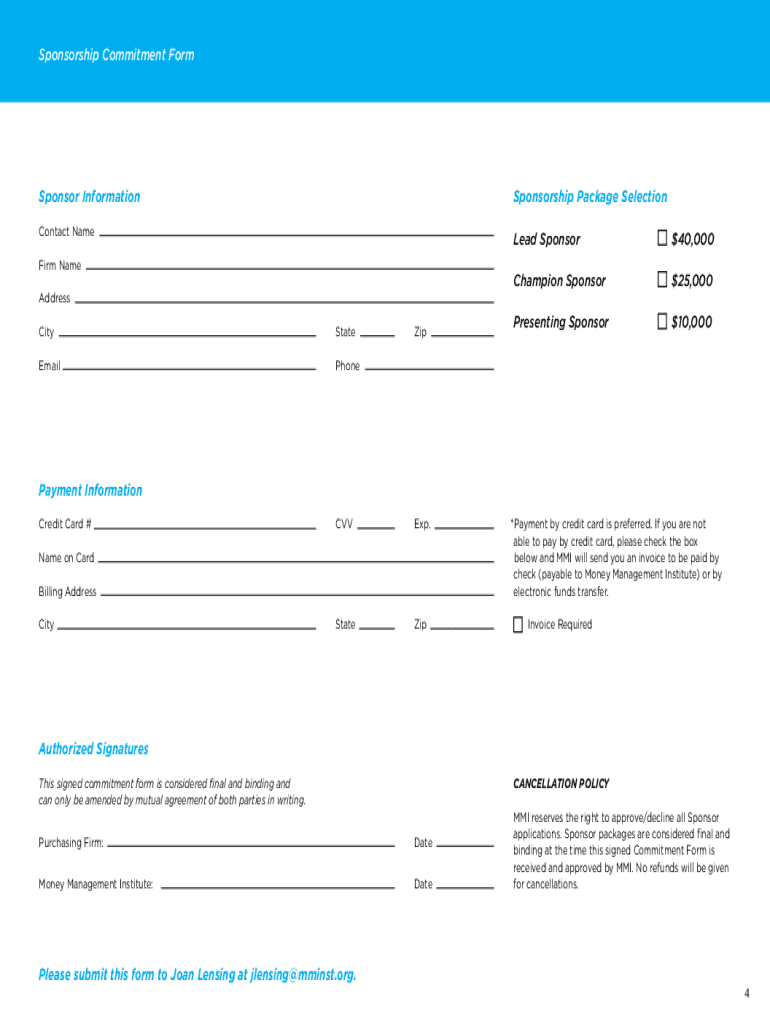

Today, myriad online platforms and software tools aid in tracking corporate forms. Using dedicated solutions allows businesses to manage their documentation more effectively. Software options such as pdfFiller provide features for editing, signing, and storing corporate documents securely from a cloud-based platform.

Alternatively, businesses may use Excel or spreadsheet management systems to create custom tracking sheets. This method allows for tailor-made efficiency; entries can be modified to suit specific corporate needs. However, accuracy is crucial. Establishing clear protocols for maintaining updated records can drastically reduce errors and enhance document management.

Step-by-step guide to tracking your corporate form

To track your corporate forms effectively, follow this structured process. Begin by identifying the type of entity you are tracking, as different structures have varying requirements and implications. For instance, regulatory obligations for nonprofits differ significantly from those for corporations.

Next, gather the necessary documentation. This list can include incorporation papers, bylaws, operating agreements, and any state filings relevant to your business's specific structure. Once you have compiled this information, set up your tracking system, whether through a dedicated online platform or a custom spreadsheet.

Regularly updating this information is crucial. It's essential to monitor changes in laws or business operations that might necessitate updates to your corporate records. Ensure that your tracking methods are compliant with local and federal regulations to avoid potential legal complications.

Interactive tools and features for efficient tracking

pdfFiller plays a crucial role in corporate form tracking, offering features that simplify the editing, signing, and management of business documents. Its interface allows users to fill out, e-sign, and store important forms securely, making the tracking process seamless and efficient.

Furthermore, team collaboration is facilitated through pdfFiller's platform, which allows multiple stakeholders to work on corporate documents simultaneously. This feature is particularly beneficial for businesses with distributed teams, enhancing communication and ensuring everyone is working with the most current documents.

Understanding corporate compliance and its impact

Corporate compliance is integral to tracking corporate forms. Regulations dictate how businesses operate, and compliance impacts every layer of document management, from filing deadlines to data privacy laws. Understanding these regulations helps businesses avoid pitfalls that could arise from negligence.

Non-compliance can have severe consequences, including fines, penalties, or even criminal charges in extreme circumstances. Businesses that fail to maintain accurate records or neglect filing deadlines can face serious legal challenges, which might jeopardize their operational capabilities.

Frequently asked questions (FAQs) about tracking corporate forms

Businesses often face challenges when it comes to tracking corporate forms. Common hurdles include understanding varying state regulations and maintaining accurate records across multiple filings. Factors such as turnover in staff can complicate the accuracy of tracking as well.

To overcome these challenges, creating a robust tracking system is the key. Regular training and updates for staff on compliance requirements also mitigates risks. By fostering a culture focused on meticulous documentation and regular reviews, businesses can stay ahead of potential risks.

Advanced strategies for corporate form tracking

As businesses grow, sophisticated methods for maintaining organized records become vital. Legal and compliance experts advocate for implementing automated systems that provide reminders for filings and ongoing compliance checks. Technology trends, including Artificial Intelligence (AI), are emerging to facilitate tracking efficiency and ensure businesses remain compliant.

Engaging in proactive monitoring of laws affecting corporate forms is crucial. Staying updated not only on local regulations but also on changes at the federal level can protect companies from unexpected legal challenges. Employing advanced tracking technologies can arm businesses with the necessary insights for future growth.

Case studies: businesses that excelled in corporate form tracking

Examining successful enterprises can shed light on the importance of diligent corporate form tracking. Companies that prioritize compliance not only shield themselves from legal repercussions but also enhance operational efficiencies. For example, a mid-sized firm that utilized pdfFiller to digitize and manage its corporate documents reported reduced filing times and improved accuracy in documentation.

Another case involved a startup that implemented an automated filing system, reducing overhead costs and ensuring timely compliance across multiple jurisdictions. These success stories highlight that effective tracking of corporate forms not only preserves the legal standing of a business but can also streamline operations and drive growth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit how to track corporate from Google Drive?

Can I create an electronic signature for signing my how to track corporate in Gmail?

Can I edit how to track corporate on an Android device?

What is how to track corporate?

Who is required to file how to track corporate?

How to fill out how to track corporate?

What is the purpose of how to track corporate?

What information must be reported on how to track corporate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.