Get the free Form 589

Get, Create, Make and Sign form 589

Editing form 589 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 589

How to fill out form 589

Who needs form 589?

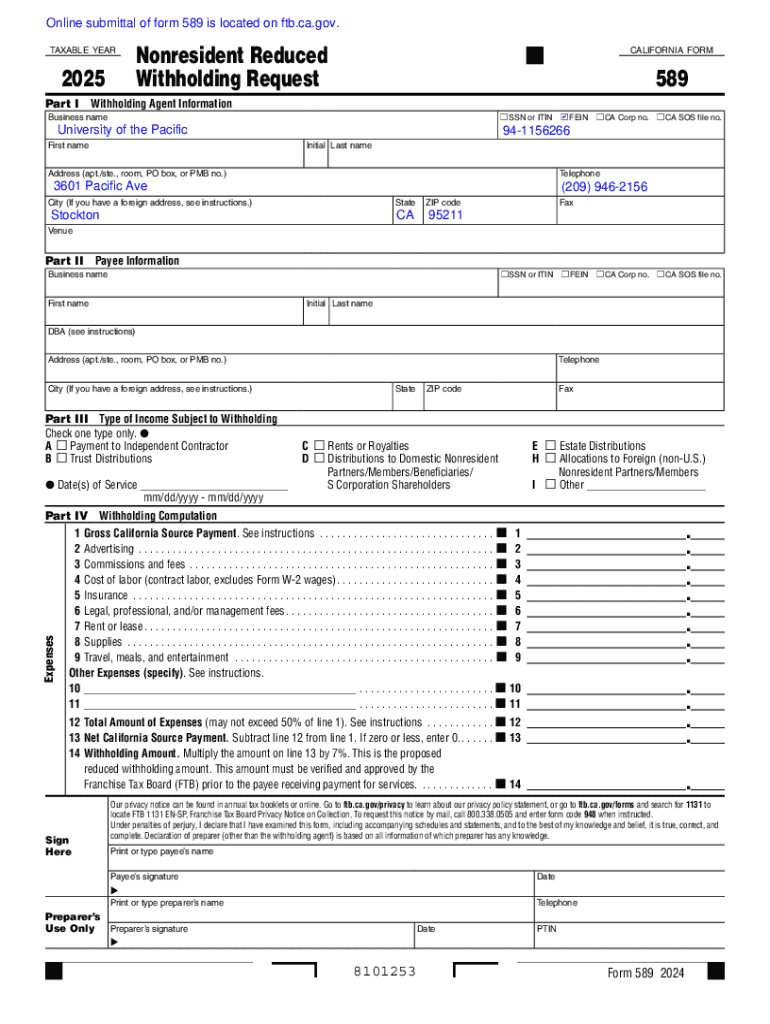

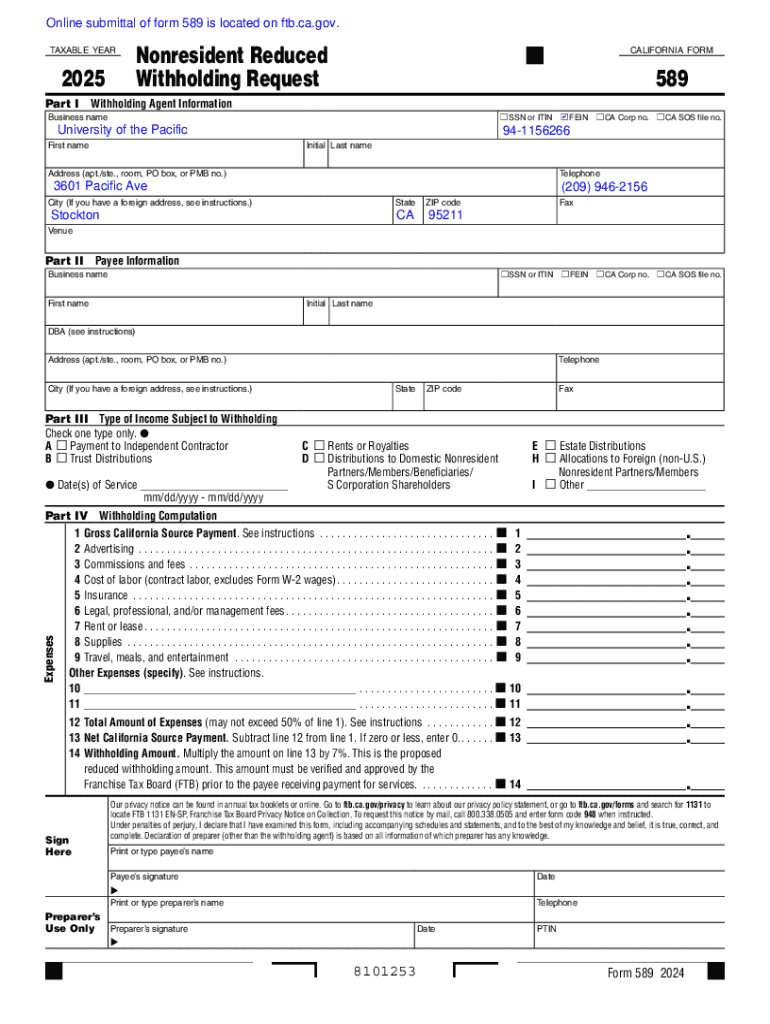

Form 589 form - A Comprehensive Guide to Nonresident Reduced Withholding Requests

Understanding Form 589: Overview and purpose

Form 589 is integral to tax compliance for nonresidents in the United States, particularly concerning reduced withholding tax requests. This form allows individuals and entities to claim exemption or reduced withholding rates on income that is otherwise subject to higher federal tax rates. Without Form 589, nonresidents may incur unnecessary tax burdens that could affect their financial obligations.

Utilizing Form 589 can effectively lighten the tax load for eligible individuals and corporate entities, making it an essential document for those navigating the complexities of U.S. tax law. Its importance lies particularly in its flexibility, allowing for different types of income—ranging from interest to royalties—to be covered under reduced tax provisions.

Prerequisites for filling out Form 589

Before filling out Form 589, it's crucial to gather necessary items to ensure that the application process is smooth and efficient. Having the correct documentation can prevent delays or rejections. Users should prepare the following items:

Step-by-step instructions for completing Form 589

Completing Form 589 requires careful attention to detail. Follow these steps to ensure accuracy in your submission:

Editing and customizing Form 589

pdfFiller offers robust tools to help you customize Form 589. Modifying documents can be as straightforward as adding or removing text or incorporating images and electronic signatures. This flexibility is beneficial for tailoring your form to specific requirements.

Users can save different versions of Form 589, allowing for quick access to past drafts or final versions. This feature not only enhances productivity but also ensures that you can refer back to your previous entries whenever necessary.

Signing and submitting Form 589

Once Form 589 is filled out and reviewed, the next step involves signing and submitting it. pdfFiller facilitates this process with multiple eSignature options available for users. Electronic signatures can expedite the filing process and maintain security through signature verification features.

When submitting Form 589, it's essential to know where to send it. Users can take advantage of online submission options or decide on mailing it directly to the designated IRS office. Always check for specific submission guidelines, as these can vary based on individual situations.

Post-submission: What to expect

After submission, tracking the processing timeframe for Form 589 is vital. Typically, processing times for IRS forms can vary depending on the time of year and the workload of the IRS. Generally, expect a wait of about four to six weeks for approval, although this can occasionally extend.

You can track the status of your submission through the IRS website or by contacting their support if there’s an unexpected delay. Staying informed about your submission can alleviate concerns and ensure compliance with tax regulations.

Additional considerations

Understanding potential issues that could arise during or after submission is crucial for managing your expectations. Common reasons for rejection of Form 589 include inaccuracies in your personal details, improper documentation, or failure to follow submission guidelines.

If you encounter any problems, the IRS has dedicated support options for tax form-related inquiries. Familiarizing yourself with your rights as a taxpayer is equally important, particularly pertaining to requests for withholding adjustments.

Language support and accessibility

For those needing support in languages other than English, pdfFiller facilitates access to Form 589 in multiple languages. This feature is crucial for ensuring that all users understand the form's requirements irrespective of their primary language.

Additionally, pdfFiller is equipped with tools that cater to users with accessibility needs. By adapting features and functionality, pdfFiller aims to ensure that every individual can navigate through the process of filing Form 589 effortlessly.

Community and support: Enhancing your experience

Engaging with a community of users can dramatically enhance your experience while dealing with Form 589. Forums and user groups dedicated to tax filing provide a platform to exchange tips, insights, and support for effectively managing tax obligations.

pdfFiller also welcomes user feedback as part of an ongoing commitment to improve resources. Through user input, the platform aims to refine tools and guides, ensuring that future users have an even smoother navigation experience when filling out essential documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 589 to be eSigned by others?

Where do I find form 589?

How do I fill out form 589 on an Android device?

What is form 589?

Who is required to file form 589?

How to fill out form 589?

What is the purpose of form 589?

What information must be reported on form 589?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.