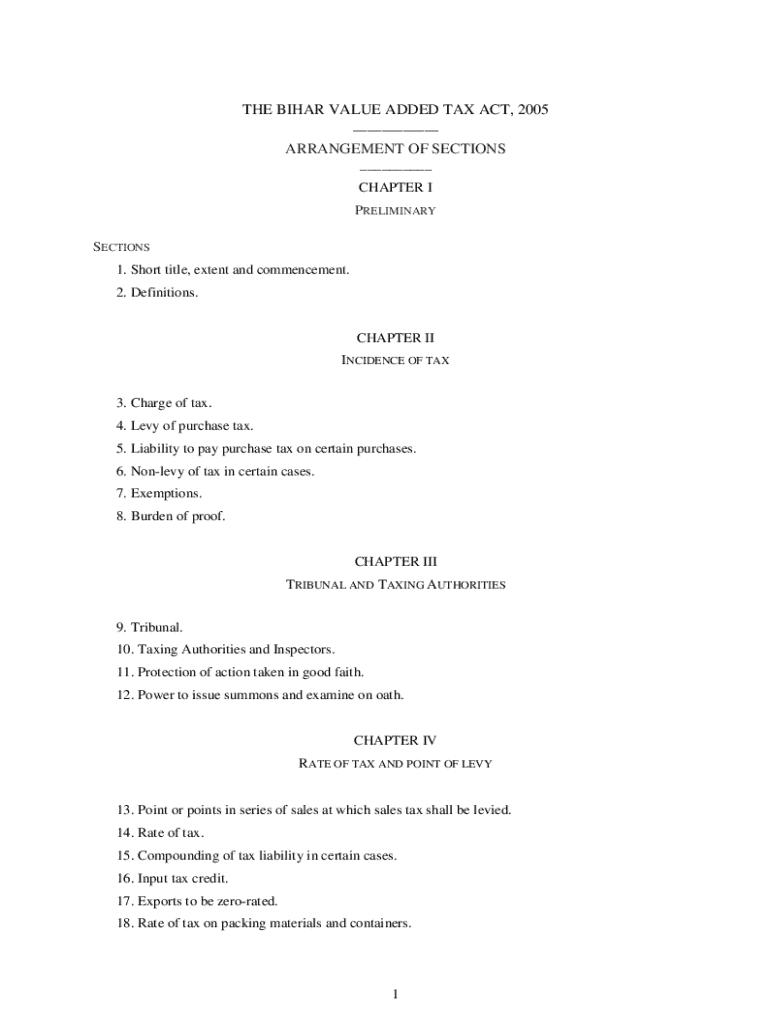

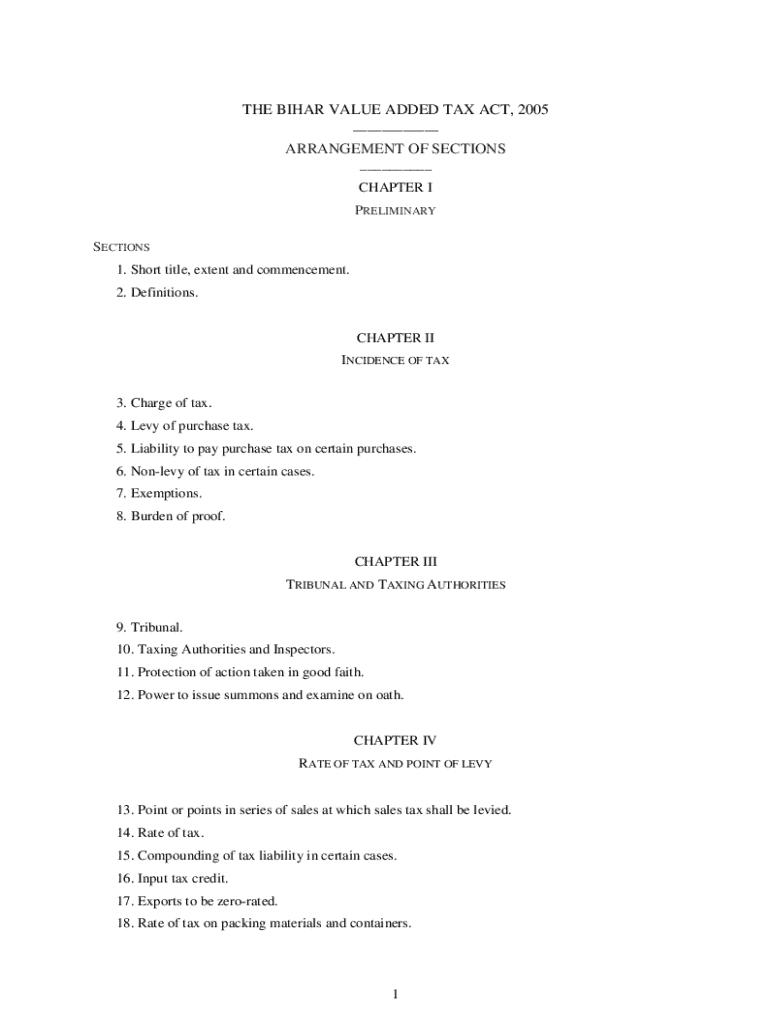

Get the free the Bihar Value Added Tax Act, 2005

Get, Create, Make and Sign form bihar value added

Editing form bihar value added online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form bihar value added

How to fill out form bihar value added

Who needs form bihar value added?

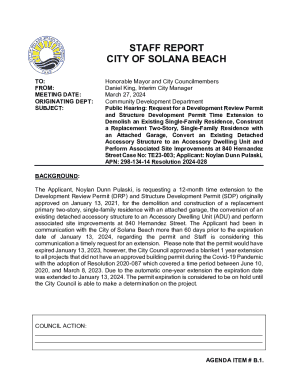

Comprehensive Guide to the Bihar Value Added Form

Overview of the Bihar Value Added Tax (VAT) System

The Bihar Value Added Tax (VAT) system is a multi-point taxation structure that operates at different stages of the distribution of goods and services in the state of Bihar. This tax is a significant source of revenue for the state government and aims to enhance the overall economic growth of the region. Understanding VAT is essential for businesses operating within Bihar, as it directly impacts pricing strategies and profitability.

VAT plays a crucial role in maintaining equitable tax collection while incentivizing businesses to comply with state tax regulations. One of the primary objectives of VAT is to ensure transparent business operations, thereby reducing tax evasion. By implementing a value-added tax system, businesses can benefit from a more streamlined tax process and overall improved cash flow.

Understanding the Bihar Value Added Form

The Bihar Value Added Form is a crucial document for businesses registering for VAT in Bihar. This form consolidates essential data regarding transactions, tax liabilities, and more, which businesses need to comply with statutory regulations. Filling out this form accurately is vital for maintaining updated records and ensuring adherence to tax deadlines.

The form encompasses various sections that require detailed information, including sales and purchase details, tax paid, and tax deducted at source. Organizations commonly use this form for reporting purposes, qualifying for refunds, and tracking their tax obligations throughout the financial year.

Key components of the Bihar Value Added Form

Detailed flow of goods: Section 52

Section 52 of the Bihar Value Added Form requires businesses to detail the flow of goods sold and purchased. Accurately completing this segment is essential for tax calculations and compliance verification. Businesses need to report the quantity of goods, their respective values, and the allocated VAT to ensure clarity.

To submit the flow of goods, businesses must ensure that they maintain organized records of all transactions. This aids in fulfilling requirements during audits or assessments.

Quarterly statement: Section 24

Section 24 concerns the quarterly statement that outlines a business's VAT liabilities. Completing this section involves detailing total sales, purchases, and computing the tax payable or refundable. It is imperative for businesses to review their records prior to filling out this section to avoid discrepancies.

The submission deadlines for the quarterly statement typically fall at the end of each quarter, and timely submission is crucial to avoid penalties. Businesses are required to submit this statement four times a year, ensuring they are transparent with their tax obligations.

Indemnity bond

The indemnity bond serves as a protective measure for tax authorities against any defaults in payment by dealers. This bond guarantees that businesses are liable for any tax dues incurred, thereby safeguarding the interests of tax revenue.

Completion of the indemnity bond requires carefully filled details of the business and the signatures of relevant stakeholders. Upon completion, it must be submitted according to state mandates to ensure compliance with local regulations.

Quarterly return for dealers paying tax

Dealers liable for paying VAT are required to submit a quarterly return that summarizes their tax data for each quarter. This submission includes total sales figures, tax collected, and details of any tax paid on purchases.

When filling this return, it's critical to verify calculations to avoid underreporting or discrepancies that could lead to audits or penalties. Regular updates and checks can significantly ease the submission process.

Certificate of registration

Obtaining the certificate of registration is essential for establishing a business as a VAT taxpayer in Bihar. This certificate confirms that a business has registered under the VAT system and must collect and remit tax on its sales.

The application process involves submitting necessary documents, such as proof of business registration, tax identification numbers, and detailed business information. Keeping this certificate updated is vital for continuous compliance with state regulations.

Annual return: Section 24

The annual return is a comprehensive overview that summarizes the entire year's transactions, capturing all sales, purchase details, and tax figures. Completing this section accurately is paramount to avoid any future discrepancies or audits from tax authorities.

Understanding the implications of annual returns can influence a business's tax payments significantly. Businesses need to keep meticulous records throughout the year to facilitate an accurate filling of this return.

Certificate of tax deducted at source

A certificate of tax deducted at source (TDS) is issued by the deductor to a taxpayer when tax is deducted from payments made. This certificate is critical for businesses as it acts as proof of tax paid, which can be claimed in the annual returns to offset tax payable.

Businesses should apply for this certificate as soon as TDS is deducted to maintain proper records and manage their tax obligations effectively.

Revised quarterly return: Section 24

In the event of errors in previously submitted quarterly returns, businesses can file a revised return under Section 24. This process is crucial for maintaining accurate tax records and ensuring compliance. Identifying the need for revision as soon as discrepancies are noticed can prevent complications later.

To submit revised returns effectively, businesses should follow the necessary steps outlined by tax authorities, ensuring all adjustments are documented accurately.

Tax clearance certificate

The tax clearance certificate is crucial for businesses to demonstrate compliance with tax obligations. Its significance lies in the fact that it is often a requirement for securing loans, contracts, or new business registrations. A valid tax clearance certificate provides assurance to stakeholders regarding a business's uninterrupted payment of dues.

The application for this certificate requires businesses to provide proof of tax payments and compliance records. Keeping this certificate up to date is essential for smooth business operations.

Statements required under various sections

Statement under Section 41

Under Section 41, a detailed statement must be filed that includes specific fiscal data concerning purchases, tax liabilities, and refunds. This information is used by tax authorities to assess compliance and rectify taxpayer information.

Accurate formatting and inclusion of all required points are critical for this statement, as any missing data could lead to miscalculations and subsequent audits.

Information under Section 58

Section 58 requires businesses to provide detailed information regarding sales and other relevant transactions. Accurate reporting in this section not only reflects the tax compliance status but also helps businesses track their performance throughout the fiscal year.

Businesses must ensure to regularly update records to facilitate a smooth filing process of these required statements, reducing the risk of potential issues during assessments.

Forms for specific applications

Application for enrollment as sales tax practitioner

Professionals aspiring to become sales tax practitioners in Bihar must complete an application form that outlines their qualifications and professional background. This form is crucial for gaining accreditation to advise clients on tax matters.

Filling out this application includes providing supporting documents proving eligibility and previous experiences, which contributes to gaining credibility in the tax consultancy field.

Application for refund of advance deduction of tax

When a business has paid excess advance tax deductions, it can apply for a refund through the designated application form. This straightforward process can help businesses recover unnecessary outflows and optimize their cash flow.

Key details and supporting documentation must be accurately included within the application to ensure quick processing and approval from tax authorities.

Common errors and troubleshooting

Filling out the Bihar Value Added Form correctly can be challenging, and certain common errors often occur. Frequently, businesses may miscalculate VAT amounts or forget to attach the necessary documentation. These mistakes can lead to penalties or delayed processing of returns.

To avoid these pitfalls, double-checking figures and ensuring all required documents are enclosed with submissions can mitigate issues significantly. Businesses should also consult tax guidelines provided by authorities to navigate complexities in the tax system.

Benefits of using pdfFiller for managing Bihar Value Added Forms

Using pdfFiller to manage the Bihar Value Added Form offers users a seamless experience in editing and completing documents. This cloud-based solution allows for efficient collaboration among team members, ensuring that multiple stakeholders can contribute to form submissions, which increases transparency and accountability.

Additionally, pdfFiller’s eSigning capabilities streamline processes significantly. Businesses can quickly send documents for signature and track their status, ensuring timely submissions without the hassle of paper trails.

Additional tips for effective form management

Effective management of the Bihar Value Added Form requires diligent record-keeping and timely submissions. Businesses should keep historical documentation and track their submissions meticulously to ensure no deadlines are missed. Following a calendared process for deadlines can also help alleviate the stress associated with submissions.

Regular training for staff on VAT regulations can also enhance compliance and reduce errors. By fostering a culture of accountability towards tax obligations, businesses can minimize the risks of audits and penalties.

FAQs about Bihar Value Added Form

Several questions often arise regarding the Bihar Value Added Form, including queries about filing deadlines and the necessary information to include. Understanding these aspects is crucial for maintaining compliance and avoiding fines.

Common queries related to complexity in reporting can discourage timely submissions; hence having a robust support system in place can be immensely beneficial for businesses.

Encouragement for professional guidance

Seeking professional guidance can save businesses time and resources, particularly for more complex VAT-related issues. Tax professionals can provide tailored advice based on specific business operations and ensure compliance with all regulations.

Resources like local tax consultancy firms or online platforms dedicated to professional tax advice can be extremely useful. By leveraging expert assistance, businesses can streamline their VAT processes and reduce the overall burden of tax compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form bihar value added in Gmail?

How can I send form bihar value added for eSignature?

How do I edit form bihar value added in Chrome?

What is form bihar value added?

Who is required to file form bihar value added?

How to fill out form bihar value added?

What is the purpose of form bihar value added?

What information must be reported on form bihar value added?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.