Get the free Ct-225

Get, Create, Make and Sign ct-225

How to edit ct-225 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-225

How to fill out ct-225

Who needs ct-225?

CT-225 Form: Comprehensive Guide on New York State Modifications

Overview of the CT-225 Form

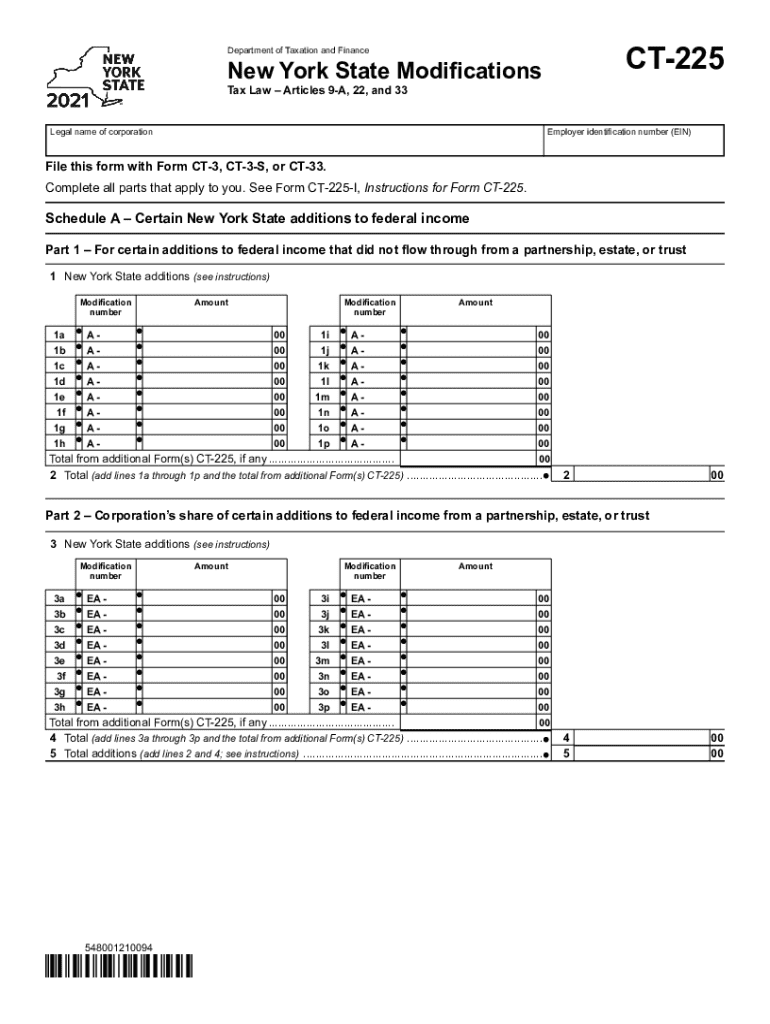

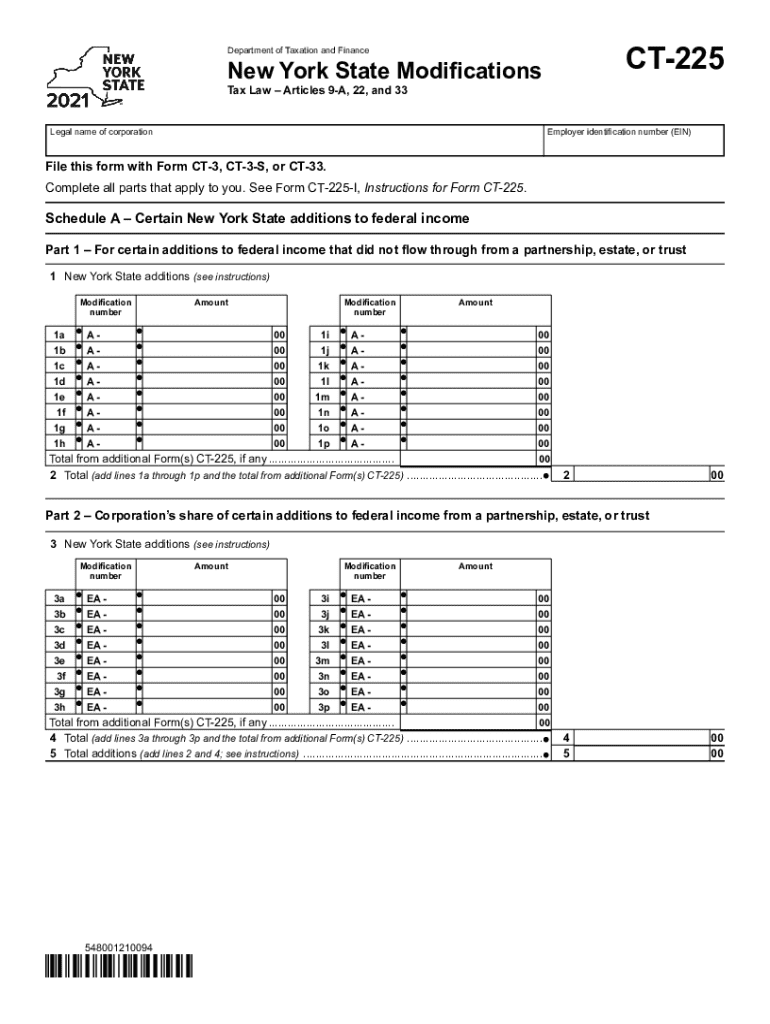

The CT-225 form is a crucial document for New York State tax filing, specifically designed to report modifications to the income of corporations. Its purpose revolves around reconciling federal adjusted gross income with New York State taxable income, thereby facilitating a clearer understanding of state-specific financial obligations. Utilizing the CT-225 ensures that tax returns accurately reflect any income adjustments that may affect the corporation's overall tax liability.

Key features of the CT-225 include its streamlined structure and the focus it places on both additions and subtractions to income. By filing this form, corporations gain benefits such as reduced risk of errors in reporting, potential tax savings through accurate deductions, and a clearer path to compliance with New York State tax regulations.

Who must file the CT-225 form?

Filing the CT-225 form is essential for corporations operating in New York State, particularly for those that need to report modifications regarding state adjustments to federal income. Eligibility for filing typically includes corporations subject to taxation under Article 9-A of the New York State Tax Law, essentially encompassing most corporations doing business within the state. Such corporations must be mindful of their responsibilities regarding accurate income representation.

A key factor to consider is the definition of combined groups, which include affiliated entities engaged in a unitary business. These groups may need to file a CT-225 collectively, showcasing how their combined income adjustments impact the overall group tax liabilities. Understanding this definition is critical for corporations to navigate their filing obligations correctly.

Preparing to complete the CT-225 form

Before diving into the actual completion of the CT-225 form, it's essential to gather all necessary information, which typically includes financial statements, previous tax returns, and documentation related to any modifications to income. This preparatory step ensures a smoother filing experience and minimizes potential errors that could arise from incomplete information.

Familiarizing yourself with common terms associated with the CT-225, such as 'additions,' 'subtractions,' and 'federal adjusted gross income,' enhances the understanding of the form's requirements. Additionally, consider these helpful tips for document preparation: double-check financial documents for accuracy, maintain organized records of financial transactions, and consistently refer to the New York State Tax Department's guidelines for up-to-date instructions.

Section-by-section breakdown of the CT-225 form

Using the CT-225 form

The CT-225 form is structured to facilitate comprehensive reporting through clearly defined sections. It generally consists of header sections where corporate identification information is recorded, followed by sections detailing addition and subtraction schedules. Various forms and schedules collaborate to reveal a complete picture of the corporation’s tax modifications.

Interactive tools, particularly those available on pdfFiller, can greatly aid in filling out the form by providing pre-populated fields, intuitive prompts, and step-by-step guidance to ensure accurate completion.

Completing schedules A and B

Schedule A identifies New York State additions to federal income and includes critical line items that require insightful reporting. Corporations need to meticulously list items that contribute to increased taxable income in New York, ensuring an accurate representation of their financial situation. Thorough guidance is available through detailed line-by-line instructions, which elucidate the requirements of each addition category.

On the other hand, Schedule B pertains to New York State subtractions from federal income. Each line must be tended to with care as subtractions can significantly affect the overall taxable income reported. Again, detailed instructions accompany these forms, allowing corporations to clarify any complicated aspects of their specific situations.

New York State modifications: addition and subtraction charts

For a quick reference, visual charts illustrating common additions and subtractions can be invaluable for preparing the CT-225 form. For example, common additions may include items like depreciation adjustments and non-taxable income inclusions, whereas frequently encountered subtractions might entail items such as local and state income taxes paid or contributions to qualified retirement plans.

These charts not only present an efficient way to review what specific modifications might apply but also serve as a check for ensuring that all necessary items are accounted for when assembling the tax return. Using these charts effectively can help avoid underreporting or overreporting income adjustments, ultimately making tax reporting smoother.

Specific situations in filing

Unique circumstances can arise while filing the CT-225 form. For example, the same modification number might be utilized multiple times. In these cases, meticulous tracking of each instance is crucial, as it ensures accurate representation and prevents confusion in reporting later on. This includes documenting how each instance of the modification specifically impacts the overall tax liabilities of the corporation.

Some corporations may also need to handle additional forms related to the CT-225, adding another layer of complexity. For instance, partnerships undergoing similar adjustments must be aware of their distinct filing requirements, given their different tax obligations. Clarity in distinguishing between the filing responsibilities of corporations and partnerships is paramount for accurate compliance with tax laws.

Need help with your CT-225 filing?

For those seeking assistance with the CT-225 filing, numerous resources are at hand. Tax professionals knowledgeable about New York State tax laws can provide valuable insights and personalized support tailored to specific situations. Consulting a tax professional can alleviate stress and deliver clarity on complex modifications.

Furthermore, pdfFiller offers an array of online support FAQs addressing common questions and potential concerns regarding the CT-225 form. Engaging with these resources can enhance one’s understanding and provide immediate help in navigating challenges during the tax preparation process.

Privacy notification and data protection in filing

When filing the CT-225 form, understanding privacy protections and data security commitments is vital. pdfFiller ensures user data privacy, compliant with relevant regulations to safeguard against unauthorized access or data breaches. Utilizing secure channels for submitting sensitive documents underscores the significance placed on users' information.

It's equally important for users to remain informed about their privacy rights while navigating the filing process. This knowledge empowers submitters to take ownership of their data and ensure their information's safety during the entire tax filing journey.

About pdfFiller and its tax document solutions

pdfFiller is dedicated to enhancing the document management experience, particularly for tax forms like the CT-225 form. By offering features such as eSigning, editing, and collaboration tools, users can streamline their workflows to complete tax filings efficiently. The platform ensures access from anywhere, accommodating the diverse needs of its user base.

Furthermore, pdfFiller’s user-friendly interface allows for easy navigation and effective document management, making the experience of filing tax forms like CT-225 not only simpler but more enjoyable.

Related tax forms and insights

Apart from the CT-225, other forms like IT-225 might be relevant to corporations considering various deductions and adjustments. Each of these forms plays a role in how businesses report their financials to the state and optimize tax obligations. Understanding the connections between different tax forms can enhance overall fiscal strategy, ensuring compliance while potentially maximizing returns.

Exploring in-depth guides on complex tax strategies can offer corporations unique insights. For example, methodologies like the 'Hire Your Kids Tax Strategy' cater to creative approaches for optimizing tax liabilities while maintaining compliance with tax laws.

Frequently asked questions (FAQs) about form CT-225

Common queries regarding the CT-225 often encompass aspects of filing, eligibility requirements, and specific modifications. For instance, many corporations are unsure about the type of additions or subtractions they can claim, making access to accurate information critical. Clearly addressing these questions not only clarifies confusion but also helps businesses to navigate their tax obligations more effectively.

Additionally, addressing explanations for convoluted aspects of filing enhances understanding. The complexities of tax forms like the CT-225 shouldn’t deter corporations from accurate reporting; having readily available answers to common questions fosters confidence in the filing process.

Language assistance and support services

Recognizing that language barriers can impact users' capabilities to effectively handle tax forms, pdfFiller offers language assistance services. This includes translation services for non-English speakers, ensuring that all users have equal access to the necessary tax documentation and guidance required for completing forms like the CT-225 accurately.

Moreover, clear communication with customer support is essential for efficient resolution of any queries or concerns. Providing avenues for effective communication enables users to seek help and navigate their filing journey with ease.

Connect with our team

Engaging with tax professionals or support teams can significantly enhance one's experience with filing the CT-225 form. For users seeking further assistance, multiple contact channels are available to reach out for personalized help or clarification regarding any concerns they may have.

Additionally, social media can serve as an effective platform for community engagement, where users can interact with others facing similar challenges around tax documentation, share insights, and remain informed about any updates in tax regulations that might affect their filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ct-225 on a smartphone?

How do I fill out the ct-225 form on my smartphone?

Can I edit ct-225 on an Android device?

What is ct-225?

Who is required to file ct-225?

How to fill out ct-225?

What is the purpose of ct-225?

What information must be reported on ct-225?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.