Get the free Form 1099-r

Get, Create, Make and Sign form 1099-r

Editing form 1099-r online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1099-r

How to fill out form 1099-r

Who needs form 1099-r?

Understanding Form 1099-R: A Comprehensive Guide

What is Form 1099-R?

Form 1099-R is a tax document used to report distributions from retirement plans, pensions, annuities, IRAs, and other similar accounts. The primary purpose of this form is to inform the Internal Revenue Service (IRS) and the taxpayer about the amount of money distributed from these accounts during the tax year. Essentially, it serves as official documentation that ensures all income received from retirement plans is accurately reported on tax returns.

Form 1099-R is typically issued in various scenarios. Common instances include when a taxpayer withdraws money from a traditional IRA or 401(k), receives a pension distribution, or makes a roll-over from one retirement account to another. Given its role in tax reporting, it’s crucial for taxpayers to retain Form 1099-R, as it provides the necessary information for completing tax returns accurately.

When will receive my 1099-R form?

Taxpayers typically receive Form 1099-R by January 31st of each year for the previous tax year. This timeline is essential as it allows individuals to prepare for tax filing well before the April deadline. However, this date can vary slightly depending on specific financial institutions and their processing times.

Distribution of Form 1099-R occurs in two primary ways: electronic delivery and paper mailing. Many institutions allow users to opt for electronic delivery, which can be faster and more secure. In contrast, paper forms may take longer to arrive via postal mail. If you have not received your form by mid-February, it’s advisable to check with the issuing institution for any delays or issues.

How to access your Form 1099-R

Accessing your Form 1099-R online is straightforward if your financial institution offers an online account portal. To retrieve the form, sign in to your online account and navigate to the tax documents section. This area typically houses all tax-related documents provided by the institution.

For those needing historical records, there are generally options to view previous years' 1099-R forms as well. Often, users can download or print the forms directly from their accounts. To save a copy, utilize the 'Download' button and ensure it’s stored in a secure location for your records.

Requesting a physical copy of your 1099-R

If you prefer a physical copy of Form 1099-R or have not received it, you can easily request one via mail. To do this, complete the request form provided by your issuing institution and send it to the appropriate address. It's wise to double-check their procedure on requesting forms, as the process may vary slightly between institutions.

Once your request is submitted, it may take several days or even weeks to receive the form via mail, depending on the institution’s processing times. Therefore, it's advisable to initiate this request sooner rather than later, especially as tax deadlines approach.

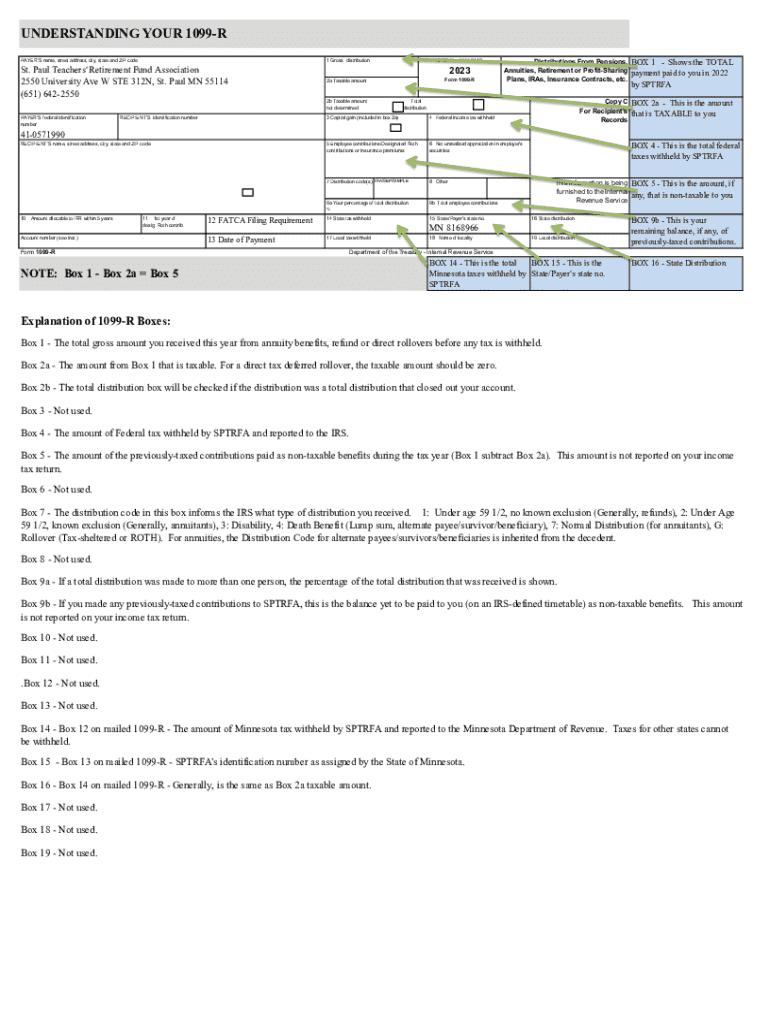

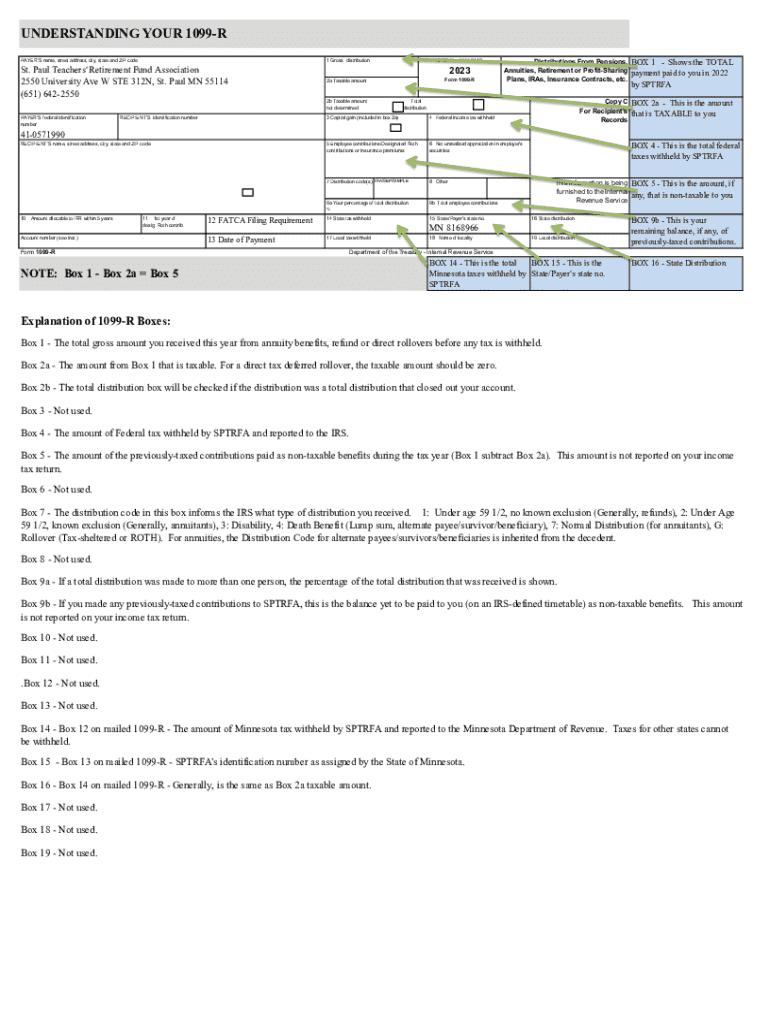

Understanding your 1099-R: Key elements explained

When reviewing Form 1099-R, understanding each box is crucial for accurate tax reporting. Key elements of the form include Box 1, which shows the gross distribution amount, and Box 2a, which outlines the taxable amount. Box 5 indicates any employee contributions, and Box 7 provides various distribution codes, which are particularly important for deciphering the nature of the distribution.

The distribution codes found in Box 7 are significant as they explain tax implications for the distributions received. For instance, a code of '1' indicates early distributions that might be subject to penalties, while ‘7’ denotes normal distributions taken after the age of 59½. Knowing these codes helps taxpayers ascertain their tax liabilities accordingly.

What to do if you received multiple 1099-R forms

Receiving multiple Form 1099-Rs is common for individuals who have several accounts or have switched providers during the tax year. Situations such as rolling over accounts, changing jobs, or having both a pension and IRA can generate multiple reports. It’s important to combine all these forms accurately when filing taxes.

When reporting these forms, simply add the taxable amounts listed on each form together for your total income. This total should then be reported on your tax return. Make sure to keep all documents in their entirety for future reference, as they can provide support should you face questions or audits from the IRS.

Potential issues with your 1099-R

Errors on Form 1099-R can impede tax filing. Common mistakes may include incorrect amounts reported, missing information, or the wrong distribution codes. Such errors can lead to potential delays in tax refund processing or difficulty in reconciling your income tax return with IRS records.

If you discover any discrepancies, it’s crucial to contact the issuing institution immediately to correct the errors. Typically, the institution will have a process to issue corrected forms. Failing to address these discrepancies can lead to complications, including fines or penalties from the IRS for incorrectly reported income.

Filing taxes with 1099-R

When filing taxes with Form 1099-R, it’s essential to report the income derived from distributions accurately. Keep in mind that while the gross amount is essential, the taxable amount indicated in Box 2a is what ultimately affects your income tax calculation. Depending on your tax bracket, you may also be eligible for various deductions related to your distributions.

To simplify your tax preparation, consider using tools such as pdfFiller. This platform allows users to fill out, sign, and manage their tax documents seamlessly, reducing the hassle of manual entry and paperwork.

Frequently asked questions about Form 1099-R

Many taxpayers often find themselves with questions regarding Form 1099-R. Typical inquiries include: 'Why did I receive a Form 1099-R?' The answer is generally linked to distributions made from retirement accounts during the tax year. Another common question is: 'What should I do if I lost my Form 1099-R?' In this case, retrieving it electronically or contacting the issuer for a replacement is advisable.

People often wonder how long they should keep their Form 1099-R. Generally, it’s a good practice to retain tax documents for at least three to six years, particularly if you plan to amend a return. Being proactive about record-keeping can save headaches during tax season.

Unique features of pdfFiller for 1099-R management

pdfFiller offers unique features tailored to enhance the management of tax documents, including Form 1099-R. One standout feature is seamless PDF editing, enabling users to fill out their forms directly on the platform without the need for printing. This can save time and improve accuracy when entering tax information.

In addition, pdfFiller’s eSignature functionality allows users to sign documents easily, quickening the approval process. Collaboration tools enable teams to work together on multiple documents, making it a favorable choice for tax professionals and organizations handling various clients. Moreover, it ensures secure storage and access to documents from anywhere, thus providing peace of mind for tax management.

Summary of the 1099-R form process

Understanding Form 1099-R is essential for taxpayers receiving retirement distributions. By knowing when to expect the form and how to retrieve it, taxpayers can prepare more effectively for tax season. Familiarity with the key elements of the form ensures accurate reporting and helps mitigate potential issues.

Utilizing pdfFiller’s cloud-based platform can simplify the management of Form 1099-R, providing users with an all-in-one solution for document editing, signing, and storage. Embracing these tools can promote a smooth and efficient tax preparation experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 1099-r?

How do I edit form 1099-r on an iOS device?

How can I fill out form 1099-r on an iOS device?

What is form 1099-r?

Who is required to file form 1099-r?

How to fill out form 1099-r?

What is the purpose of form 1099-r?

What information must be reported on form 1099-r?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.