Get the free Form 10-q

Get, Create, Make and Sign form 10-q

How to edit form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Understanding the Form 10-Q: A Comprehensive Guide

Overview of Form 10-Q

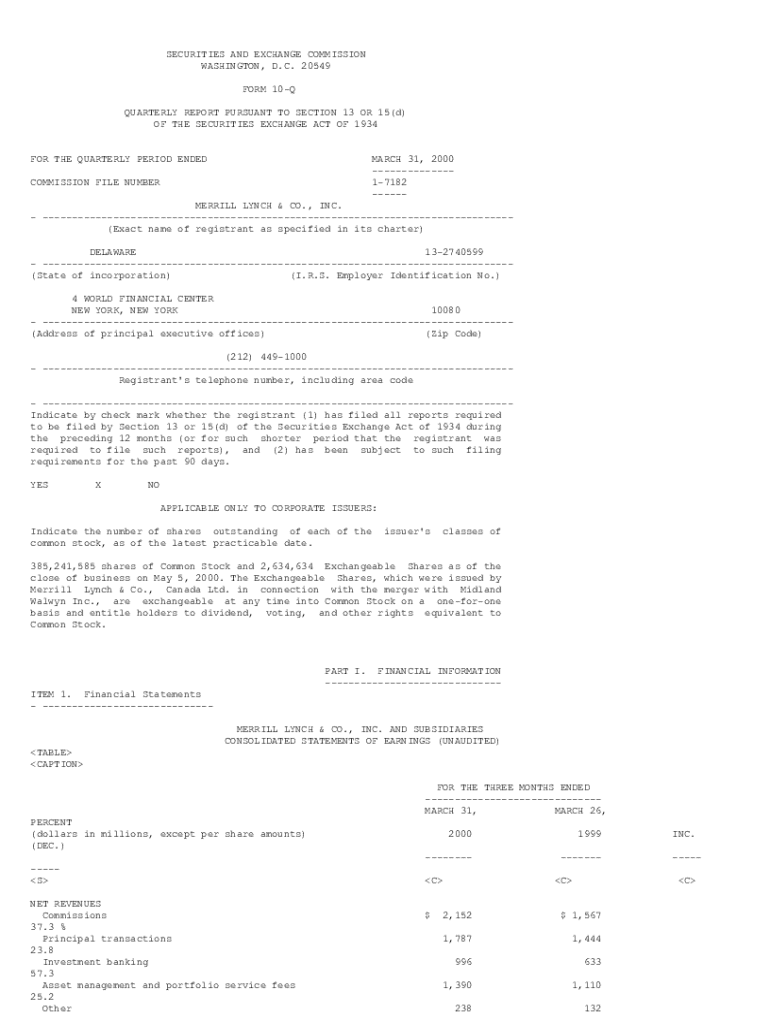

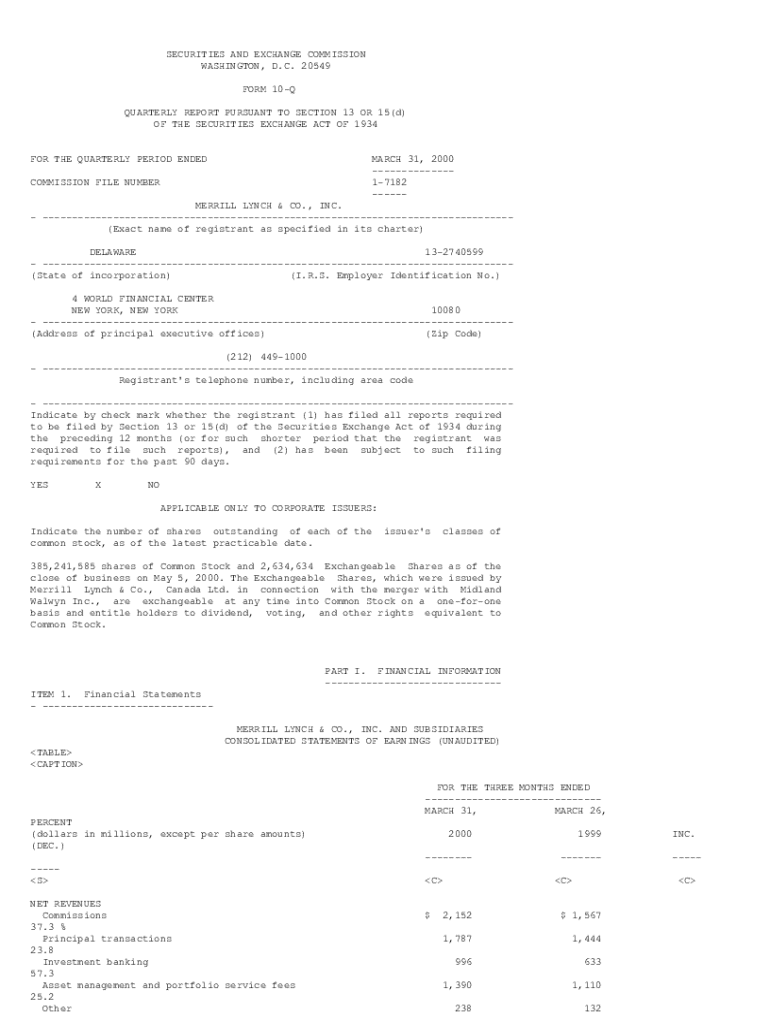

Form 10-Q is a quarterly report mandated by the SEC to provide a comprehensive overview of a company's financial performance and condition. Unlike the annual Form 10-K filing, the 10-Q presents interim financial information, allowing investors and stakeholders to gain insights on a company's operations over a shorter time frame. The importance of Form 10-Q lies in its role in regulatory compliance, ensuring that public companies are transparent about their financial health between annual reports.

The Form 10-Q includes essential financial data that helps investors make informed decisions. While the 10-K is a more exhaustive yearly report detailing everything from risks to governance, the 10-Q provides a snapshot of quarterly performance, highlighting significant changes or trends in revenues, expenses, and ongoing operations.

Contents of Form 10-Q

The Form 10-Q comprises several vital sections that collectively provide a holistic view of a company’s financial status. These include:

How to prepare a Form 10-Q

Preparing a Form 10-Q requires meticulous attention to detail. Follow this step-by-step guide to compile the form effectively:

Key highlights and considerations

Navigating the complexities of Form 10-Q can be challenging. Here are some essential tips to consider:

Filing deadlines for Form 10-Q

Companies must adhere to specific filing deadlines for Form 10-Q, which vary based on their classification. These classifications are as follows:

Missing these deadlines can lead to penalties, including fines or loss of reporting status, which may adversely affect investor confidence.

Failure to meet Form 10-Q filing deadline

Failing to submit the Form 10-Q on time can have serious implications for companies. Potential penalties include financial fines, enforcement actions from the SEC, and diminished investor trust.

To mitigate risks associated with late filings, companies should implement robust internal controls for financial reporting and offer training to staff involved in the filing process. Establishing a compliance calendar can also help keep track of important deadlines.

Finding Form 10-Qs

Investors and stakeholders can easily access Form 10-Q filings through several platforms. Key resources include:

Form 10-Q check guide: Form 10-Q checklist

To maintain completeness and accuracy in Form 10-Q filings, utilize this checklist as a guide:

External links and resources

When dealing with Form 10-Q, having the right tools can streamline the process. pdfFiller offers a cloud-based solution that allows users to edit, sign, and manage PDF documents with ease. Such tools can facilitate the preparation of Form 10-Q by providing templates, simplifying collaboration, and reducing time spent on document management.

By adopting solutions like pdfFiller, individuals and teams can ensure that their Form 10-Q filings are accurate, compliant, and efficiently managed, ultimately leading to smoother reporting processes.

Additional insights

Recent trends show an increasing shift towards digital solutions in the preparation and filing of Form 10-Q. Regulatory changes continuously affect filing requirements, and technology can help companies stay compliant by offering real-time updates and streamlined workflows. As regulations evolve, integrating efficient management platforms becomes crucial for companies aiming to maintain transparency and good standing with investors.

Emphasizing the importance of digital compliance solutions not only eases the filing process but also enhances accuracy, which is essential in today’s fast-paced financial environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the form 10-q in Gmail?

Can I edit form 10-q on an Android device?

How do I fill out form 10-q on an Android device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.