Get the free Ct-1065/ct-1120si

Get, Create, Make and Sign ct-1065ct-1120si

Editing ct-1065ct-1120si online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-1065ct-1120si

How to fill out ct-1065ct-1120si

Who needs ct-1065ct-1120si?

CT-1065 and CT-1120SI Form: A Comprehensive How-to Guide

Understanding CT-1065 and CT-1120SI Forms

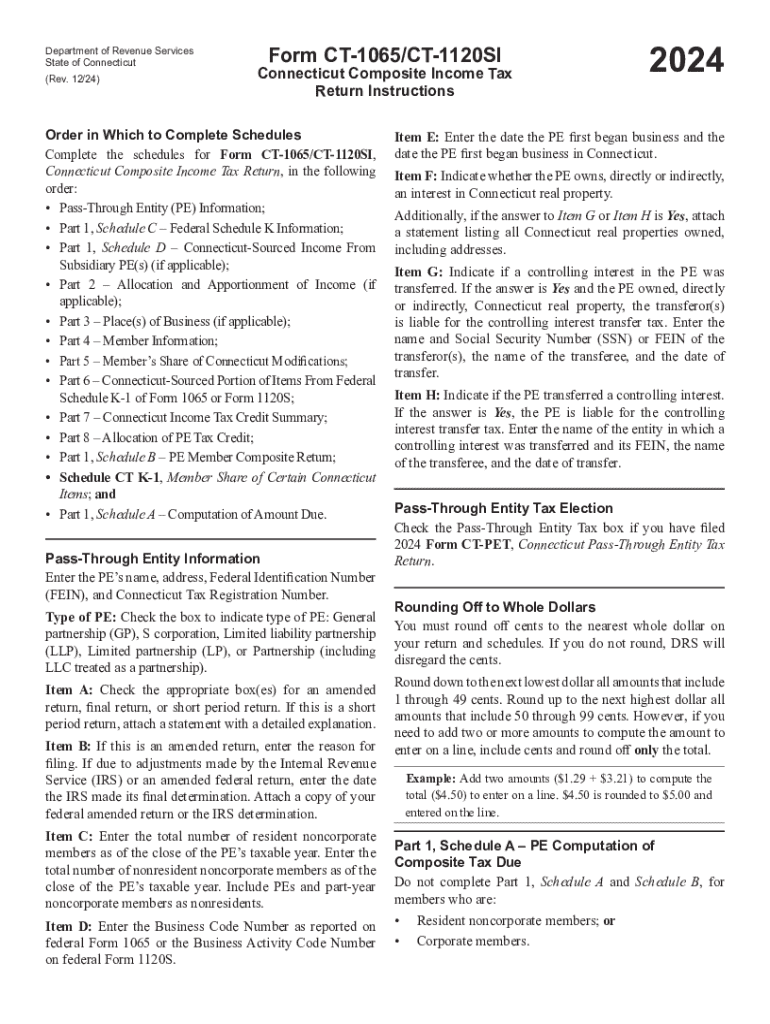

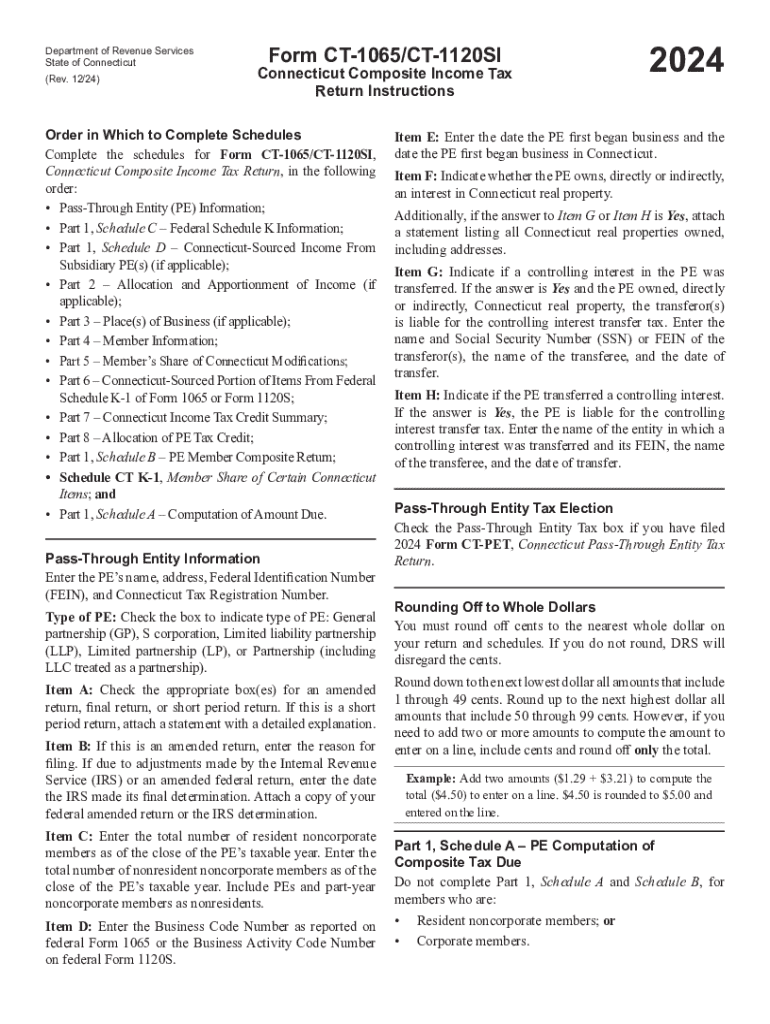

The CT-1065 and CT-1120SI forms are essential for tax filing, specifically designed for partnerships and S corporations operating in Connecticut. The CT-1065 form is used by partnerships to report income, deductions, gains, losses, and credits, while the CT-1120SI form is utilized by S corporations for similar reporting purposes. Both forms ensure that the respective entities comply with state tax regulations and accurately report their financial activities.

Filing these forms is not just a matter of compliance; it's critical for maintaining good standing with state authorities and ensuring partners or shareholders know their tax liabilities. Remaining diligent about accurate and timely completion can save partnerships and S corporations from substantial penalties.

Preparing to Fill Out CT-1065 and CT-1120SI Forms

Before diving into the CT-1065 and CT-1120SI forms, gathering the necessary documentation is crucial. Essential documents include your tax identification number, prior year’s financial statements, and details regarding each partner/shareholder and their ownership percentages. These details ensure that the forms are filled out accurately and represent the entity's financial standing correctly.

In addition to documentation, leveraging the right tools can streamline the preparation process. Software like pdfFiller not only allows for easy editing of forms but also provides a collaborative cloud-based platform. This makes it easier for multiple users to access and coordinate on tax documents, ensuring that all necessary parties are in sync before submission.

Step-by-step instructions for completing the CT-1065 form

Starting with the CT-1065 form, understanding its various sections is key to accurate completion. The first section asks for basic identification information about the partnership, including the name, address, and taxpayer ID. Following this, accurate reporting of income, deductions, and partners’ shares must occur in the subsequent sections. Each field has specific requirements that must be met to avoid delays or inquiries from the tax authorities.

One of the common pitfalls in this process is data entry errors, often stemming from a lack of cross-referencing information. Utilizing tools such as pdfFiller can significantly aid in this regard, allowing you to leverage interactive fields and guided completion features, ensuring accuracy as you progress through the form.

Step-by-step instructions for completing the CT-1120SI form

Moving on to the CT-1120SI form, it is structured similarly to the CT-1065 but tailored for S corporations. The form begins with basic corporate identification information before delving into the specifics of income, deductions, and shareholder information. Each segment of the form has its own requirements, which must be followed carefully to ensure compliance with Connecticut tax laws.

Common challenges include accurately reflecting shareholder information and managing their tax liabilities. Take care to cross-check ownership stakes and tax liabilities to avoid miscommunication or misreporting, which can lead to audits or additional taxes.

Editing and modifying your completed forms

Once the CT-1065 and CT-1120SI forms are completed, you may find the need to make adjustments. Using pdfFiller makes it simple to edit your forms directly within the platform. Locate the specific fields you need to modify and access the editing tools available, allowing for precise and quick corrections that keep your forms in compliance.

Best practices for document revision emphasize the importance of re-verification. After editing, go through a checklist to validate all modifications made. Ensure that all figures align with supporting documents and that no crucial data has been altered incorrectly. This practice helps to maintain accuracy and integrity in your submissions.

E-signing your CT-1065 and CT-1120SI forms

E-signatures have become a vital part of submitting tax forms, including the CT-1065 and CT-1120SI. An e-signature not only offers a streamlined approach to signing documents but also maintains legal standing in the eyes of tax authorities. This confirms the legitimacy of the submission and avoids delays that might arise from mailed signatures.

To e-sign your forms via pdfFiller, simply select the e-sign option within the platform. Follow the prompts to complete the signing process, which may involve verifying your identity through a multi-step authentication process to enhance security. Moreover, pdfFiller allows you to track your e-signature requests, giving you peace of mind that your documents are on their way.

Managing and storing your tax documents

Effective organization of your CT-1065 and CT-1120SI forms is essential. Establish a systematic approach to store and manage your documents, particularly in a digital format. Utilizing cloud-based solutions such as pdfFiller’s storage options can significantly improve your ability to access and retrieve documentation, ensuring that all members of your team have access to the latest versions.

Implementing organization strategies, such as using folders and naming conventions, allows for quick and efficient retrieval. By valuing document management, you reduce the risk of lost forms and enhance collaboration within your team, which ultimately leads to accurate and timely filings.

Filing your completed forms

When it comes to submitting your CT-1065 and CT-1120SI forms, you have several options: online submission or mailing. Online submission is generally more efficient, allowing for quicker processing times and reducing the likelihood of errors associated with postal services. Ensure that you comply with any specific submission protocols outlined by the Connecticut Department of Revenue Services.

Paying attention to deadlines is likewise crucial. Ensure that your forms are filed by the deadlines established for your entity type to avoid penalties, as late submissions can yield interest charges and fines. This proactive approach to filing is essential for maintaining good standing in financial compliance.

Troubleshooting common issues

While filling out the CT-1065 and CT-1120SI forms, common issues may arise. These can include errors in reported income, miscalculated deductions, and discrepancies in shareholder information. Identifying these concerns early can save time and prevent problematic situations with tax authorities.

If you encounter issues, utilizing pdfFiller’s customer support is advisable. Their team can guide you through troubleshooting steps and provide clarity on how to correct errors in your forms. Effective troubleshooting helps maintain the integrity of your tax submissions.

Enhancing your tax filing experience with pdfFiller

Utilizing pdfFiller for tax preparation not only simplifies the process but also enhances the overall user experience. The platform’s unique features facilitate easy editing, e-signing, collaboration, and management of documents from a single cloud-based interface. These functionalities make it easier to handle forms efficiently and effectively.

Users often report improved workflows and satisfaction through pdfFiller's intuitive design. Access to tools that simplify document collaboration and management leads to timelier submissions and fewer errors, illustrating the transformational impact on tax filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete ct-1065ct-1120si online?

Can I create an eSignature for the ct-1065ct-1120si in Gmail?

How can I fill out ct-1065ct-1120si on an iOS device?

What is ct-1065ct-1120si?

Who is required to file ct-1065ct-1120si?

How to fill out ct-1065ct-1120si?

What is the purpose of ct-1065ct-1120si?

What information must be reported on ct-1065ct-1120si?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.