Get the free Form 5500-sf

Get, Create, Make and Sign form 5500-sf

How to edit form 5500-sf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5500-sf

How to fill out form 5500-sf

Who needs form 5500-sf?

Understanding the Form 5500-SF Form: A Comprehensive Guide

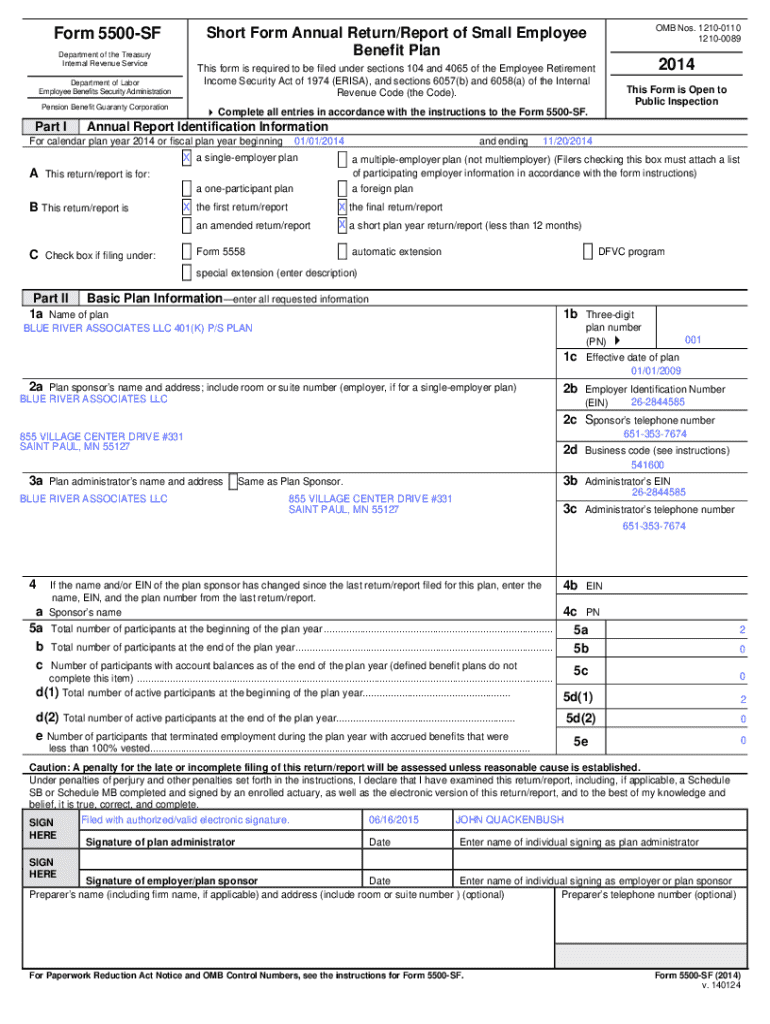

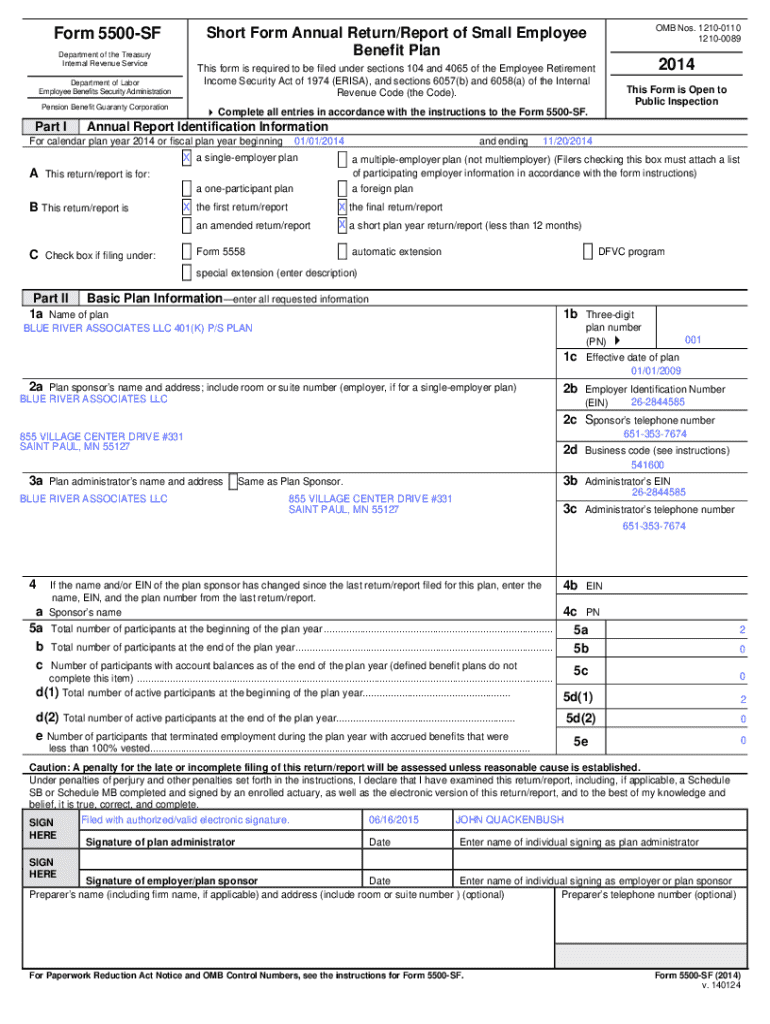

Understanding Form 5500-SF

Form 5500-SF is the Short Form Annual Return/Report designed specifically for small employee benefit plans. This streamlined version of the Form 5500 offers a simplified reporting process while still collecting necessary data about the plan's operations, financial conditions, and compliance with pertinent regulations. The primary purpose is to enhance transparency and protect the interests of plan participants, ensuring they receive adequate retirement benefits.

This form serves as a critical compliance tool for employers who sponsor pension and welfare benefit plans. By providing essential information about plan details and financial status, Form 5500-SF holds significance not only for the plan administrators but also for participants, beneficiaries, and regulators.

The key users of Form 5500-SF include various types of small plans, like defined contribution plans with fewer than 100 participants. Employers managing these smaller-scale plans should consider utilizing Form 5500-SF to fulfill their reporting duties efficiently.

Filing requirements

Eligibility for filing Form 5500-SF primarily depends on the type and size of the employee benefit plan. Organizations that sponsor plans with fewer than 100 participants usually meet the qualifications for this simplified filing. Specific types of plans eligible for Form 5500-SF include small defined contribution plans and certain welfare benefit plans, facilitating easier compliance for small businesses.

When it comes to submission, thorough documentation is crucial. Along with the Form 5500-SF itself, plan administrators may need to submit specific schedules if the plan involves unique characteristics. All required documentation must be filed electronically through the EFAST2 system, enhancing the efficiency of the reporting process.

Timeliness is vital when filing Form 5500-SF. Annual filing deadlines are established to ensure compliance and effective record-keeping. Typically, the deadline falls on the last day of the seventh month after the plan year ends. Extensions can be requested, but understanding the nuances related to late submissions is critical to avoid potential penalties.

Step-by-step instructions for completing Form 5500-SF

When tackling the completion of Form 5500-SF, it's essential to follow a structured approach. The form comprises several parts, each requiring specific information. Part I requires key identification details about the plan, including the name and sponsor information. Accurate data entry is pivotal in ensuring that the plan is properly represented.

Moving to Part II, essential plan information must be reported. This section captures the type of plan, plan year, and other pertinent characteristics. Each detail plays a vital role in categorizing the plan appropriately.

Part III focuses on financial reporting — critical financial data reflecting the plan's health and viability. Here, plan administrators summarize key financial information to offer a clear picture of the plan's status.

In Part IV, plan characteristics are elaborated upon, detailing specific features and services offered through the plan. This information helps stakeholders understand the offerings and benefits available to participants.

Part V encompasses compliance questions critical to regulatory adherence. Administers must authentically answer these questions to provide insights into compliance with legal requirements. Part VI addresses pension funding compliance, where metrics and guidelines are listed to ensure that pension funding meets federal mandates.

Lastly, Part VII focuses on what to report regarding plan terminations and transfers of assets. It's crucial to state details concerning any closures or changes to the plan's asset management, as this directly impacts the benefits available to participants.

Changes and updates in Form 5500-SF requirements

Each year, updates and changes to Form 5500-SF can impact how plans file their reports. For the 2023 filing period, notable changes may be introduced, including alterations to reporting requirements, compliance questions, or the overall structure of the form. Keeping abreast of such modifications is fundamental for ensuring compliance.

Moreover, the EFAST2 processing system has become an integral part of the filing process. This electronic filing system simplifies the submission process, providing a user-friendly interface for plan administrators. Familiarization with the EFAST2 system is key for efficient reporting.

Overcoming common filing challenges

Filing Form 5500-SF can present various challenges for administrators. Common errors often arise from improper reporting, such as typos, incorrect figures, or missing information. Being attentive to detail and double-checking entries can help mitigate these mistakes.

In cases where a filed form contains errors, knowing how to revise the submission is crucial. The steps to correct a filed Form 5500-SF typically involve submitting a Form 5500-SF Amendment, allowing administrators to rectify any discrepancies efficiently.

Delinquent Filer Voluntary Compliance (DFVC) program

The DFVC program serves as a pivotal resource for late filers of Form 5500-SF, offering an avenue for compliance without excessive penalties. This program provides a structured approach for organizations that failed to file on time, allowing them to rectify their oversight under lenient conditions.

To apply for the DFVC program, organizations must follow specific steps, including completing required submissions and paying applicable late fees. Engaging with this program can significantly mitigate repercussions associated with late filings.

Utilizing PDFfiller for efficient filing

Completing Form 5500-SF through PDFfiller simplifies the entire process. This cloud-based platform allows users to fill out, edit, and manage the form seamlessly. Accessing PDFfiller is straightforward; users can log in to easily navigate the form's requirements.

One of the standout benefits of PDFfiller lies in its flexibility. With features tailored for document management, users can collaborate in real-time, ensuring the submission process is cohesive and transparent. eSigning capabilities further enhance the platform's usability, allowing stakeholders to approve documents without hassle.

Resources for assistance

When diving into the intricacies of Form 5500-SF, having access to reliable resources is crucial. Various avenues exist for obtaining assistance, whether it be through the Department of Labor's official website or via consulting experts specializing in employee benefit plans. These resources provide valuable guidance for navigating compliance.

Engaging with professional advisors can be beneficial when dealing with complex questions or unique circumstances related to filing. Consulting a compliance expert ensures that plan administrators remain within legal boundaries and can enhance the accuracy of their submissions.

Navigating penalties and compliance risks

Understanding the potential administrative penalties for late or incorrect filings of Form 5500-SF is essential. Failing to comply with filing requirements not only jeopardizes the organization's standing but may also lead to substantial fines. The risks associated with late submissions highlight the importance of timely and accurate filings.

In addition to administrative penalties, organizations can face additional consequences for failing to file or misrepresenting information. These consequences may include heightened scrutiny from regulatory bodies or legal actions, underscoring the significance of utmost diligence during the filing process.

FAQs about Form 5500-SF

Understanding common queries surrounding Form 5500-SF can mitigate confusion and streamline the filing process. Questions regarding eligibility, filing specifics, or the consequences of late submissions often arise. Addressing these FAQs can significantly enhance administrators' confidence in navigating the complexities of this form.

Furthermore, familiarizing oneself with key terminology used in the context of Form 5500-SF can simplify the intricacies involved in the filing process. A glossary or list of commonly used terms serves as an effective reference tool for ensuring clarity and accuracy during form completion.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 5500-sf directly from Gmail?

How can I modify form 5500-sf without leaving Google Drive?

How can I get form 5500-sf?

What is form 5500-sf?

Who is required to file form 5500-sf?

How to fill out form 5500-sf?

What is the purpose of form 5500-sf?

What information must be reported on form 5500-sf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.