Get the free Crt-61 Certificate of Resale

Get, Create, Make and Sign crt-61 certificate of resale

Editing crt-61 certificate of resale online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crt-61 certificate of resale

How to fill out crt-61 certificate of resale

Who needs crt-61 certificate of resale?

Understanding the crt-61 Certificate of Resale Form: A Comprehensive Guide

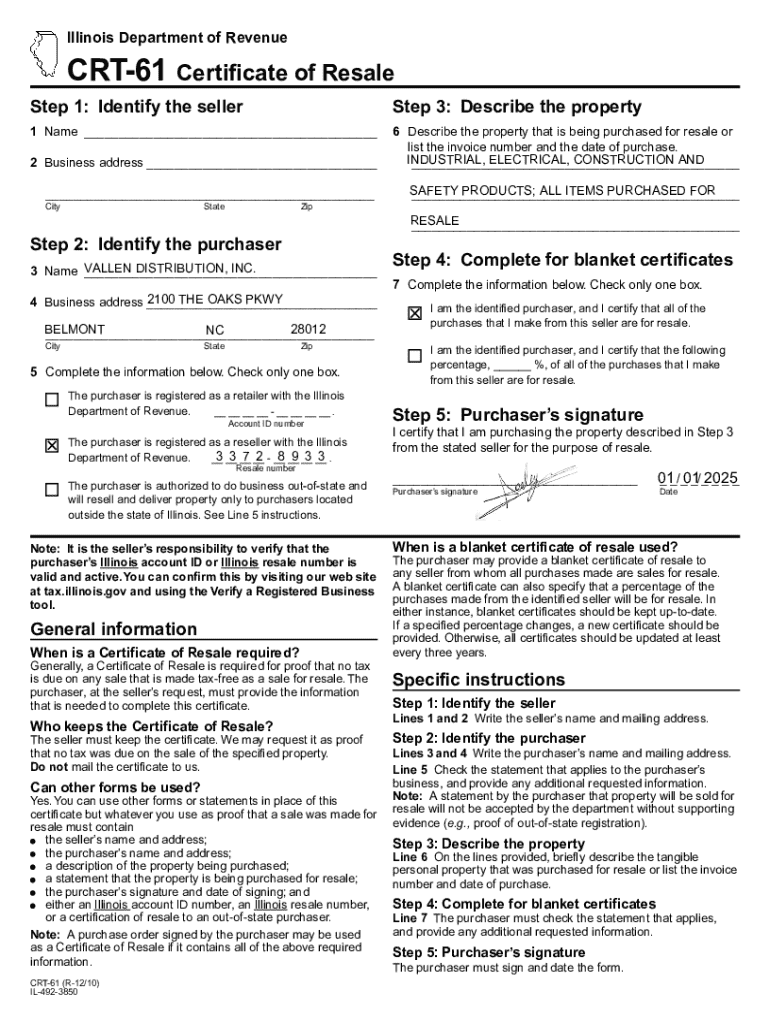

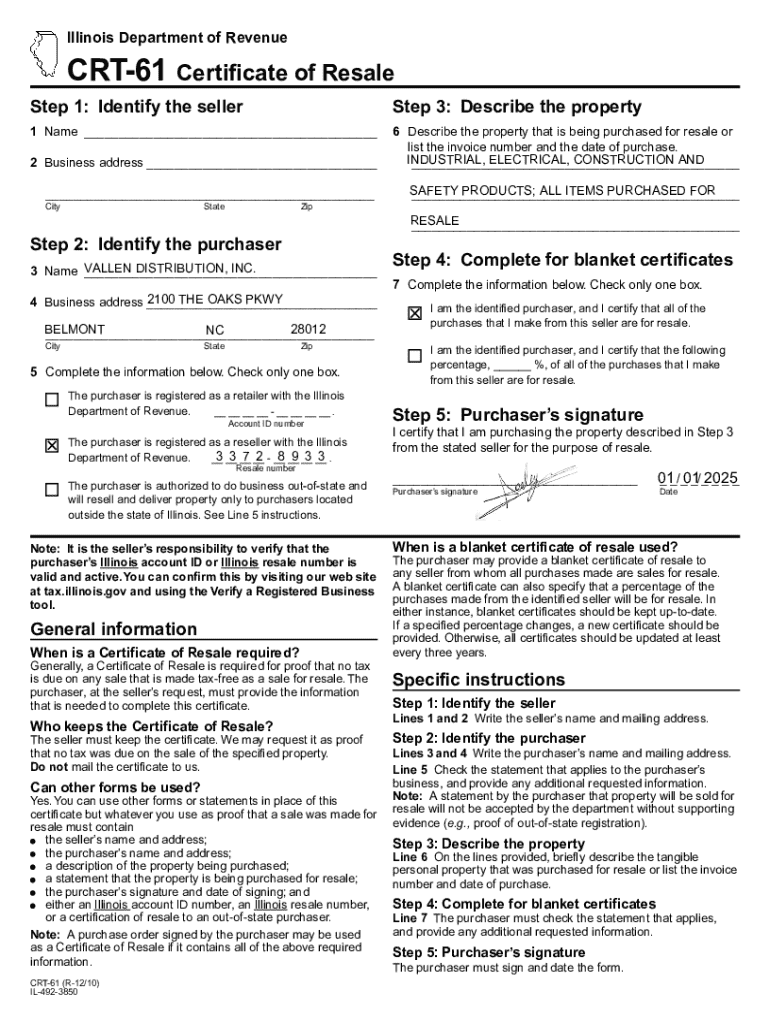

Understanding the crt-61 certificate of resale form

The crt-61 certificate of resale form is a crucial document used by businesses to purchase goods tax-free, provided those goods are intended for resale. This form essentially acts as a promise that the buyer will not use the merchandise for personal consumption, thereby allowing them to avoid paying sales tax upfront. It's integral in fostering a smooth transaction between wholesaler and retailer.

The importance of this resale form extends beyond mere tax avoidance. It assures sellers that the buyers are legitimate resellers, safeguarding them from the potential liabilities associated with sales tax. Sales tax exemptions are vital for maintaining the financial fluidity within the retail ecosystem, particularly for small businesses.

Key components of the crt-61 certificate of resale form

To effectively utilize the crt-61 certificate of resale form, it is important to understand its key components. Knowing what information is required can prevent delays in processing and ensure compliance with tax regulations.

The essential information typically includes: the business name, address, and tax ID number of the buyer; a description of the goods being purchased; and the signature of the buyer confirming the validity of the claim. It's worth noting that some states may have additional requirements or variations in the form.

Additionally, it's essential to understand the validity of the certificate. Generally, a resale certificate remains valid until the business changes — a new ownership or significant operational changes may necessitate a new form. Misuse of resale certificates can lead to serious legal implications, such as audits or fines.

How to obtain the crt-61 certificate of resale form

Acquiring the crt-61 certificate of resale form is straightforward. It's typically available through the official state tax authority's website. Businesses can download and print the form directly from this resource.

For those without online access, businesses can request a physical copy from their state tax office via mail or by visiting in person. Eligibility criteria may vary by state, but generally, a valid state tax ID is required to obtain this resale certificate.

Instructions for filling out the crt-61 certificate of resale form

Filling out the crt-61 certificate of resale form accurately is crucial to ensure compliance with tax laws. Each section has specific fields that need to be filled with precision.

Common fields include the business details, which must match the records at the tax authority. When describing the goods, be specific to avoid delays or misunderstandings with vendors. It’s also essential that the form is signed by an authorized representative of the business, as this legally binds the company to the claims made in the certificate.

Accuracy is vital; errors can lead to audits or denial of tax exemptions. Double-check all entries before submission.

How to use the crt-61 certificate of resale form

The crt-61 certificate of resale form is applicable in various business scenarios. Wholesalers and retailers across virtually every industry utilize this form when making wholesale purchases intended for resale.

Best practices recommend presenting this form to vendors at the point of purchase to ensure a seamless transaction. Examples of approved transactions could include a retailer purchasing clothing items from a wholesaler for resale or a restaurant buying ingredients from a supplier.

Important considerations when using a crt-61 certificate of resale form

Misuse of the crt-61 certificate can lead to significant legal and financial consequences. If a reseller uses it to buy items for personal use, they may face fines or back taxes from state authorities.

Best practices include keeping meticulous records of all transactions involving the resale certificate. This documentation can assist in case of audits or inquiries from tax authorities. Additionally, it’s important to know when to renew or update your resale certificate, especially if there are changes in your business operations.

Industry-specific use cases for the crt-61 certificate of resale form

The crt-61 certificate of resale form finds applications across various industries. In retail, it is commonplace for stores to present this certificate when purchasing inventory.

Similarly, e-commerce businesses, particularly those operating on popular platforms, often use the form to procure merchandise from wholesalers. Case studies abound showcasing how retailers successfully utilize resale forms to optimize tax efficiencies and streamline their operations.

Common FAQs about the crt-61 certificate of resale form

Understanding the nuances of the crt-61 can be tricky, leading to frequent questions. One common query is how this form distinguishes itself from other resale certificates. While all resale certificates serve similar purposes, the crt-61 is specific to certain states.

Another common question is whether the crt-61 can be used for online purchases. Yes, it can be used in conjunction with online transactions, as many online vendors require proof of resale status to exempt sales tax on purchases.

Managing sales tax exemptions with the crt-61 certificate of resale form

Effective management of sales tax exemptions is crucial for businesses relying on the crt-61 certificate of resale form. Each state has its laws regarding these exemptions, and businesses must stay informed to remain compliant.

Maintaining a file or digital record of multiple resale certificates becomes vital, especially for businesses that operate in multiple jurisdictions. It is important to regularly review these records to ensure that they are up to date and compliant with the most current tax regulations.

Additional tools and resources

Using tools like pdfFiller can streamline your management of the crt-61 certificate of resale form. This platform not only allows you to edit and eSign your documents but also supports easy sharing and collaboration with colleagues. With its cloud-based functionality, pdfFiller ensures that users can manage forms and certificates from anywhere at any time.

For businesses needing help with the crt-61 certificate or any resale-related documents, pdfFiller’s interactive features provide excellent support for editing, signing, and ensuring compliance with state regulations.

Exploring related topics

Understanding the crt-61 certificate of resale form opens the door to various related areas, such as the differences in resale certificates across states. Each state has varying regulations concerning taxes, creating the need for businesses to conduct thorough research.

Furthermore, concepts like economic nexus and their implications for sales tax compliance are vital for businesses operating across state lines. Keeping abreast of these changes helps businesses avoid penalties and ensures their operations remain tax-compliant.

Expert tips for businesses managing resale certificates

Consulting with a tax adviser is invaluable for businesses navigating the complexities of sales tax and resale certificates. Having expert guidance helps ensure compliance with all regulations while maximizing tax efficiency.

Additionally, keeping updated with the latest tax laws and exemptions can protect your business from potential pitfalls. This proactive approach not only mitigates risks but also positions your business to take advantage of any new opportunities arising from tax legislation changes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my crt-61 certificate of resale in Gmail?

How do I make changes in crt-61 certificate of resale?

Can I sign the crt-61 certificate of resale electronically in Chrome?

What is crt-61 certificate of resale?

Who is required to file crt-61 certificate of resale?

How to fill out crt-61 certificate of resale?

What is the purpose of crt-61 certificate of resale?

What information must be reported on crt-61 certificate of resale?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.