Get the free Crt-61 Certificate of Resale

Get, Create, Make and Sign crt-61 certificate of resale

Editing crt-61 certificate of resale online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crt-61 certificate of resale

How to fill out crt-61 certificate of resale

Who needs crt-61 certificate of resale?

Understanding the CRT-61 Certificate of Resale Form: A Comprehensive Guide

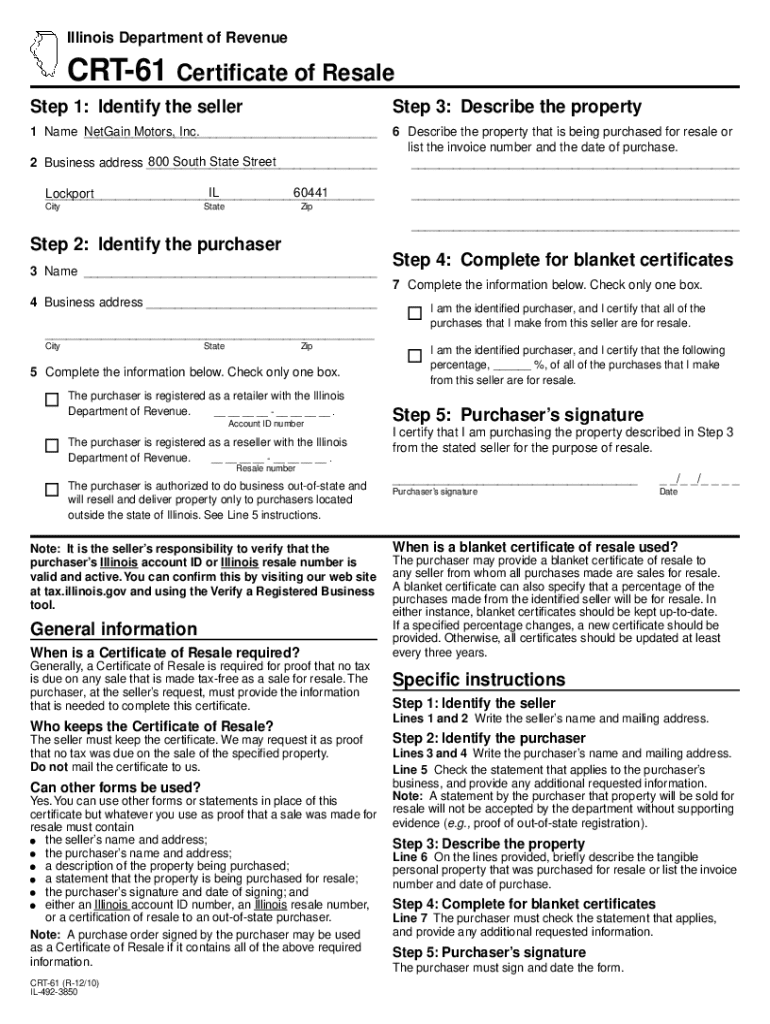

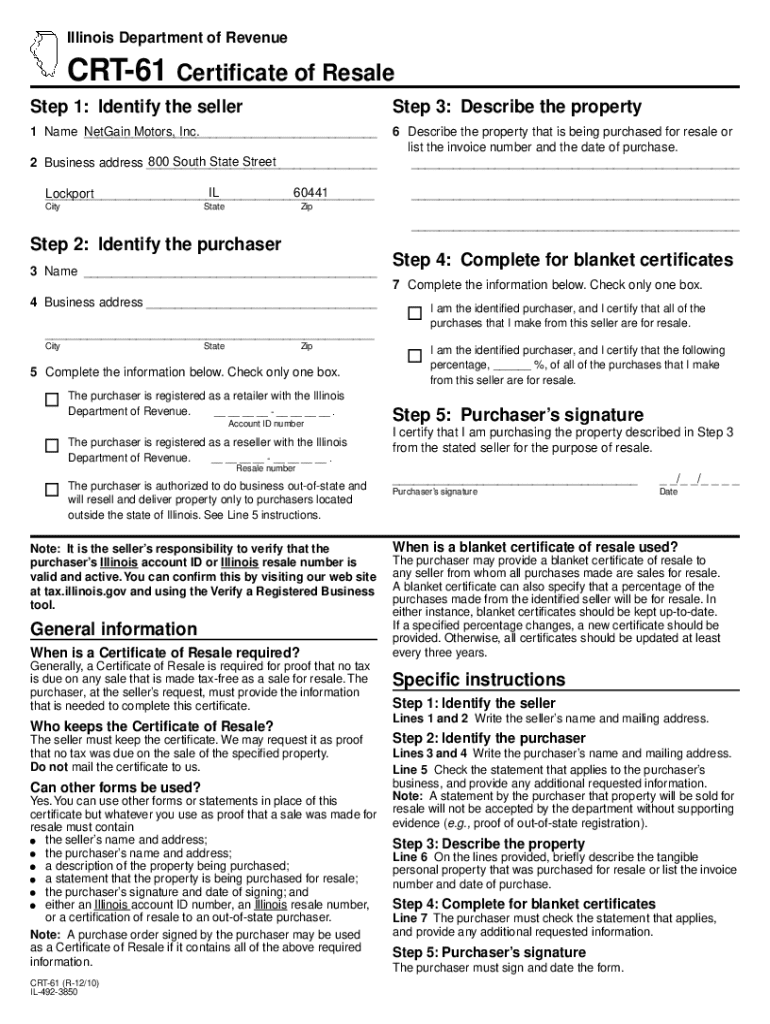

Overview of the CRT-61 Certificate of Resale

The CRT-61 Certificate of Resale is a critical document for businesses, particularly in Illinois, allowing retailers and resellers to purchase goods without paying sales tax. This form serves as a declaration that the buyer intends to resell the items in their business operations. Without this certificate, sellers are obliged to charge sales tax on all sales, which can impact pricing and profitability.

The importance of the resale certificate in business transactions cannot be overstated. It not only ensures compliance with sales tax regulations but also fosters healthy business relationships by providing transparency in sales transactions.

Who needs a CRT-61 Certificate of Resale?

Business owners and retailers who resell products in Illinois are the primary users of the CRT-61 form. This certificate is applicable in various scenarios, primarily when a retailer is purchasing stock for resale rather than for personal use. For example, a shop owner sourcing products to sell in their store must utilize this form to avoid upfront taxes on those purchases.

Understanding resale certificates and sales tax

Resale certificates are instrumental in exempting certain purchases from sales tax. When a business provides a resale certificate, it effectively tells the supplier that the purchase is for resale and not for personal consumption. This exemption not only streamlines cash flow for businesses but also simplifies sales tax remittance.

It's important to distinguish between a resale certificate and a sales tax permit. A sales tax permit is issued to businesses to collect sales tax from customers, while a resale certificate is specifically used to purchase items tax-free intended for resale. This difference can often lead to confusion; understanding the functionalities of both arms businesses with the knowledge to leverage them correctly.

State-specific requirements for using CRT-61

In Illinois, businesses must meet specific eligibility requirements to effectively use the CRT-61. Businesses must be registered with the Illinois Department of Revenue, possess a valid tax ID number, and should only use the CRT-61 for items intended for resale. Failure to comply can lead to penalties.

Other states and their resale certificate requirements

While the CRT-61 is specific to Illinois, other states have similar resale certificate requirements. States like California, Texas, and New York require their own specific forms, often with different submission protocols and acceptance processes. It's vital for businesses operating in multiple states to familiarize themselves with each state's regulations to ensure compliance.

Step-by-step guide to obtaining and using the CRT-61 form

To use the CRT-61 certificate, businesses must first obtain the form. This can typically be done by visiting the Illinois Department of Revenue website or accessible platforms like pdfFiller.

Completing the form correctly is crucial. Carefully fill in your business information, buyer information, and ensure any necessary notarization or verification is executed as needed.

Acceptance and validation of CRT-61 certificates

Retailers need to have a clear understanding of how to accept a CRT-61 certificate. It’s recommended that sellers maintain extensive records of all accepted resale certificates to protect themselves during audits by tax authorities.

Ensuring the validity of the CRT-61 certificate involves checking specific indicators, such as the business's registration details and the accuracy of the information provided.

Common mistakes to avoid with the CRT-61 form

When filling out the CRT-61 form, several common pitfalls can lead to issues. Errors such as incorrect tax ID numbers and missing signatures can render the form invalid.

Understanding the consequences of improper use is vital; misuse of the CRT-61 can lead to significant fines and back taxes owed, affecting overall business operations.

Managing your sales tax exemptions with the CRT-61

Integrating the CRT-61 into your sales tax strategy is essential for effective financial planning. This certificate serves not only to exempt specific purchases from sales tax but also streamlines your overall sales tax compliance workflow.

Reassessing your eligibility for sales tax exemptions is necessary as your business evolves. Key indicators that warrant a review include changes in business structure, expansions into new markets, or modifications in product offerings that could affect sales tax obligations.

Utilizing pdfFiller for your CRT-61 document needs

pdfFiller provides an efficient and user-friendly platform to manage your CRT-61 Certificate of Resale. The platform allows for seamless editing, signing, and sharing of the document, ensuring you remain compliant and organized.

The interactive tools offered by pdfFiller enhance form management, making it easier to customize templates that suit your business's specific needs.

Frequently asked questions (FAQs) about CRT-61 certificate of resale

Businesses operating in multiple states often wonder about the acceptance of their CRT-61. It's important to manage multi-state compliance diligently, as each state may have unique requirements for resale certificates.

Understanding these limitations is crucial to ensure that all transactions remain compliant and tax-efficient.

Key contacts for CRT-61 assistance

For questions or assistance with the CRT-61, businesses can contact their state tax authority directly. Additionally, various resources such as professional tax consultants and legal advisors can provide further insights into the use and implications of resale certificates.

Leveraging these contacts can help clarify any uncertainties and ensure compliance with local tax laws.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my crt-61 certificate of resale directly from Gmail?

How can I modify crt-61 certificate of resale without leaving Google Drive?

Can I create an electronic signature for signing my crt-61 certificate of resale in Gmail?

What is crt-61 certificate of resale?

Who is required to file crt-61 certificate of resale?

How to fill out crt-61 certificate of resale?

What is the purpose of crt-61 certificate of resale?

What information must be reported on crt-61 certificate of resale?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.