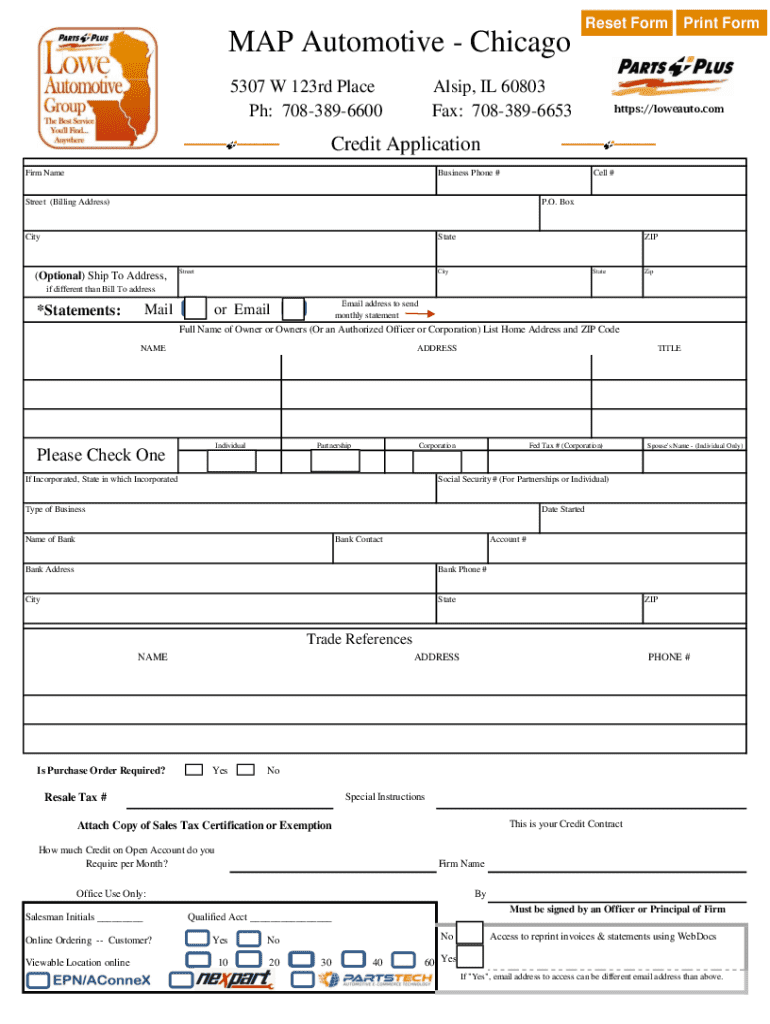

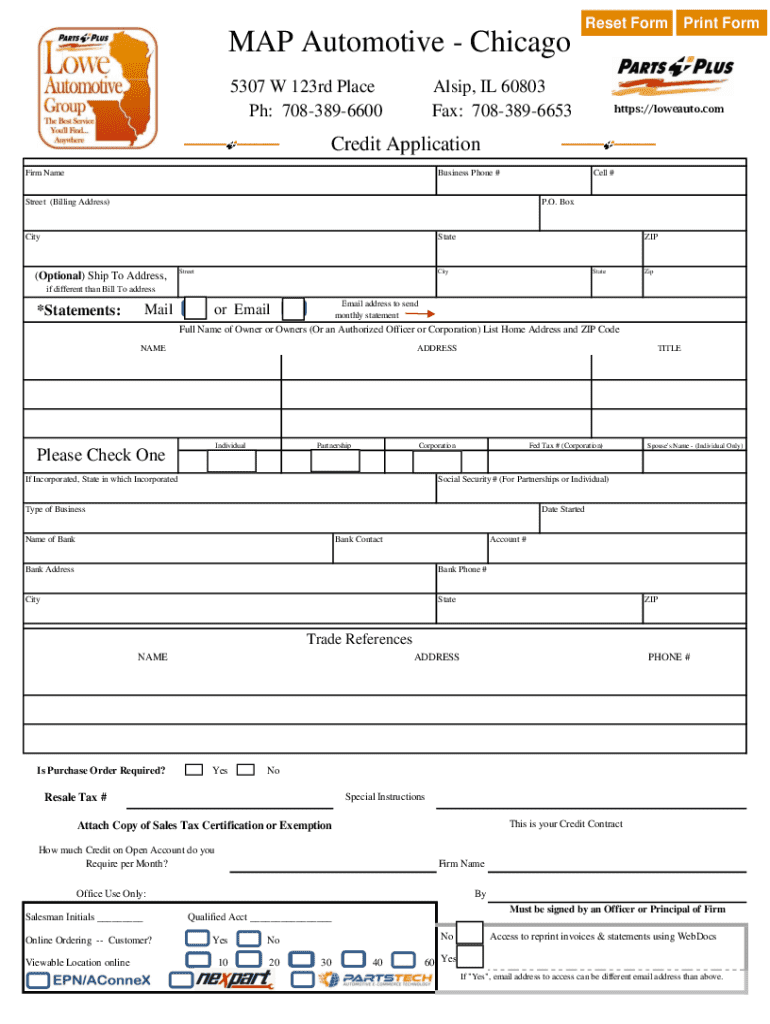

Get the free Credit Application

Get, Create, Make and Sign credit application

Editing credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

Credit application form: A comprehensive how-to guide

Understanding credit application forms

A credit application form is a document used by individuals and businesses to request credit from financial institutions or lenders. This form helps assess the applicant's eligibility for credit, whether it's for a personal loan, credit card, or a mortgage. Understanding how to properly fill out this form is crucial, as it significantly influences the decision-making process of lenders.

Credit application forms play a pivotal role in financial transactions, serving as a primary tool for assessing creditworthiness. They not only allow lenders to gather essential information but also provide borrowers with a clear understanding of their financial standing. Key components typically found in a credit application form include personal details, employment information, financial history, and the specifics of the credit request.

Types of credit application forms

There are several types of credit application forms tailored to different needs. Understanding these variations will help you select the appropriate form for your situation.

How to fill out a credit application form

Filling out a credit application form requires careful attention to detail. Following a structured approach can ensure accuracy and completeness. Here’s a step-by-step guide to assist you.

Editing and modifying your credit application form

When it comes to credit applications, precision is key. If you need to make edits, numerous tools exist to assist you. PDF files often require specific software for modifications, which is where pdfFiller shines. This platform allows you to easily edit PDF credit application forms without hassle.

With pdfFiller, users can make real-time edits, insert text, or even correct errors within the document quickly. This ease of modification enables applicants to ensure their forms are accurate and up-to-date before submission.

Signing the credit application form

An essential step in completing a credit application form is signing it. A signature not only affirms that the information provided is accurate but also serves as a formal declaration of your intent to secure credit. Many lenders now enable electronic signatures for convenience.

Using pdfFiller, users can easily eSign their credit applications. This platform allows for secure digital signatures, ensuring that documents retain their integrity during the submission process. Always ensure your signature is authenticated to prevent delays due to verification issues.

Submitting your credit application form

Once your credit application form is complete, the next step is submission. You can typically choose between digital submission and physical mailing, depending on the lender’s preferences.

Collaborating on credit application forms

In some instances, you may need to collaborate with co-applicants or internal teams when completing a credit application form. Cooperation is essential to ensure all necessary details are provided, especially in business applications.

pdfFiller facilitates real-time collaboration, allowing all parties to interact with the document simultaneously. This feature enhances communication through commenting and suggesting edits, streamlining the application process, and ensuring everyone involved stays on the same page.

Managing your credit application records

Proper document management is vital for retrieving and assessing past credit applications. This organization can facilitate future borrowing and provide insights into credit history.

With pdfFiller, users can easily organize their credit applications. The platform allows access to forms anytime and anywhere, offering a central repository for all documents. This level of accessibility ensures that applicants can review their history while applying for new credit.

Troubleshooting common issues with credit application forms

Even with meticulous preparation, applicants may face challenges during the credit application process. Familiarizing yourself with common issues can help facilitate a smoother experience.

Additional considerations

Understanding the broader landscape of credit checks is crucial. Lenders typically conduct credit checks to evaluate creditworthiness, and being aware of this can prepare you for any implications an application may have.

Moreover, privacy and data protection when submitting forms should be a priority. Financial institutions must handle personal information responsibly to safeguard against identity theft and fraud. Knowing the role of credit reporting agencies can also provide insights into how your data is used and valued in the lending process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in credit application?

How do I edit credit application straight from my smartphone?

Can I edit credit application on an Android device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.