Get the free Crt-61 Certificate of Resale

Get, Create, Make and Sign crt-61 certificate of resale

How to edit crt-61 certificate of resale online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crt-61 certificate of resale

How to fill out crt-61 certificate of resale

Who needs crt-61 certificate of resale?

Everything You Need to Know About the CRT-61 Certificate of Resale Form

Understanding the CRT-61 Certificate of Resale Form

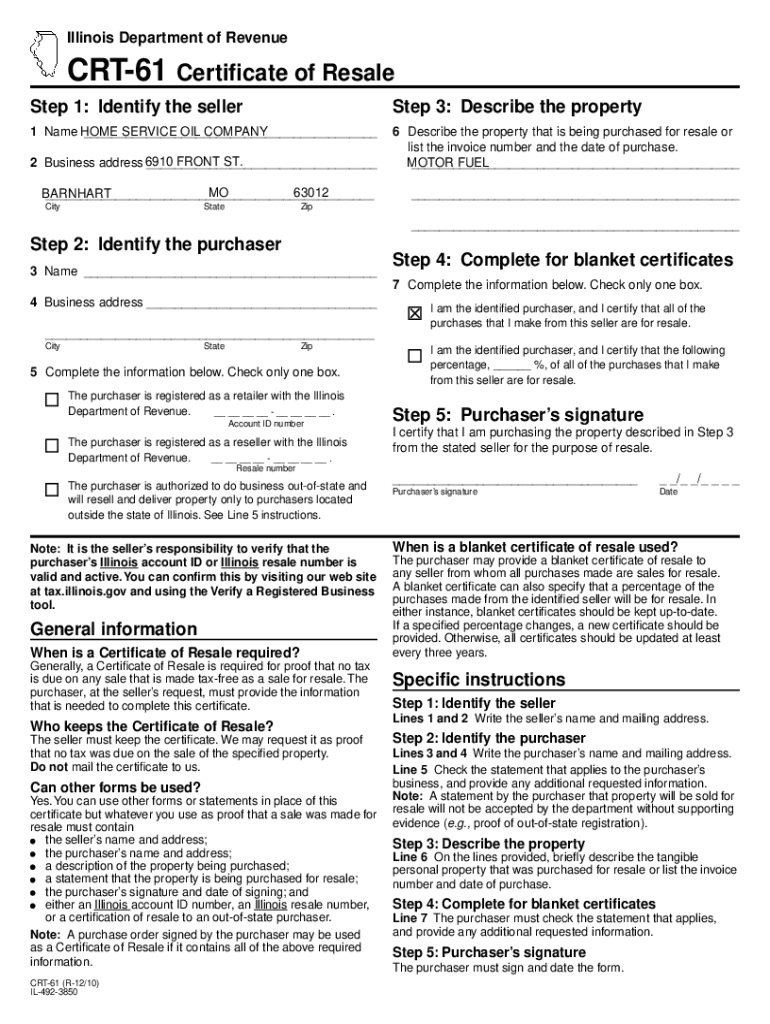

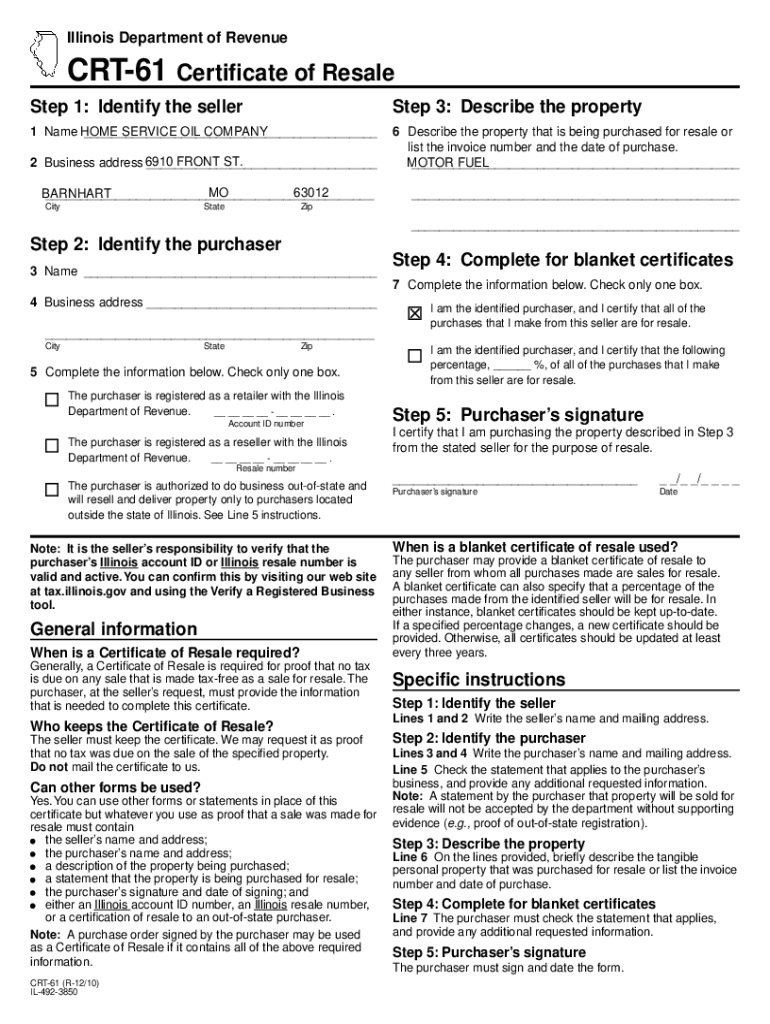

The CRT-61 Certificate of Resale Form is a crucial document designed to exempt businesses from paying sales tax on items they purchase for resale. This form effectively serves as a legal declaration that the goods acquired will not be subject to sales tax due to their intended resale. By utilizing this form, businesses can manage costs, optimize cash flow, and streamline their procurement processes.

Importance lies in its role for both businesses and individuals. For retailers, using the CRT-61 Certificate can save significant amounts on purchases, allowing them to maintain competitive pricing. Additionally, understanding when and how to utilize this form is essential for staying compliant with state tax regulations.

Who needs a CRT-61 Certificate?

The CRT-61 Certificate is primarily utilized by wholesalers and retailers involved in the sales of tangible personal property. Any individual or business purchasing goods with the intention of reselling them in their present form qualifies for a CRT-61 Certificate. This includes sectors such as retail, manufacturing, and even some service-oriented businesses offering products.

Moreover, state-specific requirements can vary. For example, while Illinois mandates the CRT-61 form, other states may have different forms or additional paperwork. It's vital for businesses to understand local regulations to avoid unnecessary expenses and penalties.

The essentials of using the CRT-61 form

Completing the CRT-61 Certificate of Resale Form requires attention to detail and accuracy. First, download the form, commonly available on tax authority websites or platforms like pdfFiller. Then, follow these step-by-step instructions to ensure you fill it out correctly:

Common mistakes include omitting necessary details, using outdated forms, or not signing the certificate. To avoid these errors, consider using online tools that guide you through filling out the form accurately.

Interactive tools like pdfFiller not only help fill out forms but also allow you to edit and save your completed documents for future use. This can simplify the process significantly, ensuring that you always have a compliant form ready.

Information required on the CRT-61

The CRT-61 Certificate must include specific information to be valid. A detailed breakdown of each field includes the following:

Accurate information is paramount; discrepancies can lead to tax liabilities and penalties. Always double-check your entries to maintain compliance with the law and uphold business integrity.

Accepting the CRT-61 certificate

For retailers and service providers, accepting a CRT-61 Certificate from customers comes with specific guidelines. First and foremost, always verify that the certificate is valid. This includes checking the seller’s permit number. Ensure you have a proper process for documenting these transactions, possibly using a checklist that includes:

It's also beneficial to establish a robust record-keeping system to document exemptions claimed through resale certificates, which can be crucial during audits.

Verifying a CRT-61 Certificate can be performed by cross-referencing the certificate details with state tax authority databases to ensure it's active and valid.

Managing sales tax exemption certificates

Understanding the sales tax implications of using the CRT-61 Certificate is essential for compliance. When dealing with resale certificates, it’s important to remember that a certificate does not equate to a sales tax exemption; rather, it confirms that the goods being purchased will not be for personal use but for resale. This distinction can become important in maintaining clarity in tax obligations.

Moreover, each state may have different laws regulating the use of resale and exemption certificates. Businesses should familiarize themselves with the specifics of their state to ensure that they adhere to legal requirements, especially in regard to the duration for which they must retain these certificates for records.

In dealing with potential audits, having a structured approach to data upkeep can immensely ease the strain of complying with state regulations. Creating a checklist of what documents to keep and for how long can facilitate this process.

Understanding resale certificates across states

The CRT-61 Certificate’s framework differs from other state resale certificates. Some states opt for different forms, while others have virtually identical structures but might require additional information or attachments. It becomes essential for businesses operating in multiple states to understand each state's requirements and how they compare with Illinois’ CRT-61 format.

This situation is particularly true in the case of online marketplaces where marketplace facilitator laws come into play. In Illinois, these laws dictate how sales tax must be collected and remitted for online sales, affecting sellers utilizing CRT-61 certificates for digital products or services. Sellers must stay aware of these nuances to optimize tax management effectively.

Practical applications of the CRT-61 form

Real-life applications of the CRT-61 Certificate showcase its importance in various business sectors. For instance, a local retailer used the CRT-61 to make significant savings on bulk purchases from a wholesaler, eventually allowing them to reduce retail prices, attract more customers, and boost overall sales. Lessons learned from such cases emphasize the value of understanding local tax regulations and effectively leveraging exemptions.

Technology plays a pivotal role in managing CRT-61 Certificates. Platforms like pdfFiller allow you to easily edit, share, and organize resale certificates. Using a cloud-based solution ensures that all relevant documentation is always accessible, keeping the workflow smooth and compliant with regulations.

Frequently asked questions (FAQs)

Users frequently have queries about the CRT-61 Certificate. Common concerns include what information is absolutely required, how to handle potential issues during audits, and, importantly, the duration for which records of these certificates should be maintained. It's crucial to clarify that signatures on the form must be authentic to validate the certificate, and failure to do so can lead to disputes.

Understanding form requirements and common pitfalls can ease the filing process. For instance, ensuring that you do not alter the original form, and using the correct version as specified by your state, are key to avoiding complications.

Pro-Tips from experts suggest consistently revisiting state tax regulations and using platforms like pdfFiller for managing all related documents can streamline this process even further.

Important links and resources

For further information on the CRT-61 Certificate, users can navigate to their local Department of Revenue’s website. These resources typically include the official forms, guidance documents, and regulations that govern resale certificates. Additionally, platforms like pdfFiller provide editable templates that simplify the process of filling out the CRT-61 form.

If you need assistance, professional help is available through tax consultants and advisors who can provide personalized support tailored to your specific situation. Utilizing online guides and customer support, particularly from pdfFiller, can also improve your understanding of sales tax compliance and management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify crt-61 certificate of resale without leaving Google Drive?

How can I send crt-61 certificate of resale for eSignature?

How do I complete crt-61 certificate of resale on an Android device?

What is crt-61 certificate of resale?

Who is required to file crt-61 certificate of resale?

How to fill out crt-61 certificate of resale?

What is the purpose of crt-61 certificate of resale?

What information must be reported on crt-61 certificate of resale?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.