Get the free 2024 Form or-37

Get, Create, Make and Sign 2024 form or-37

Editing 2024 form or-37 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 form or-37

How to fill out 2024 form or-37

Who needs 2024 form or-37?

2024 Form OR-37: A Comprehensive Guide to Filling Out the Oregon Tax Credit Form

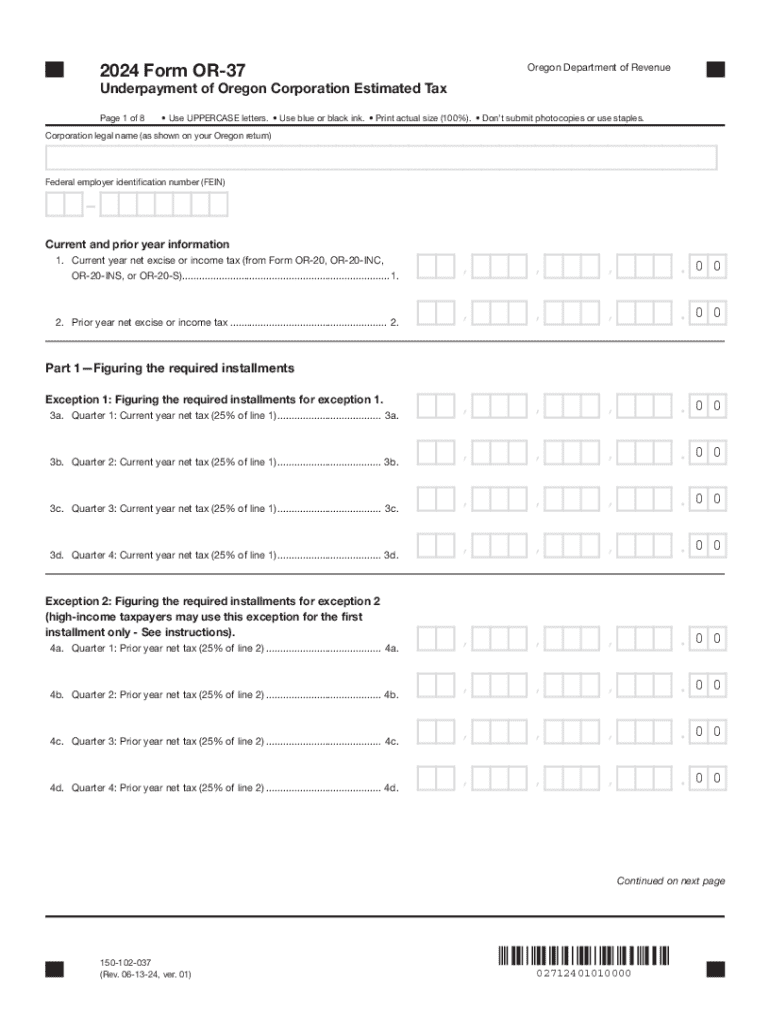

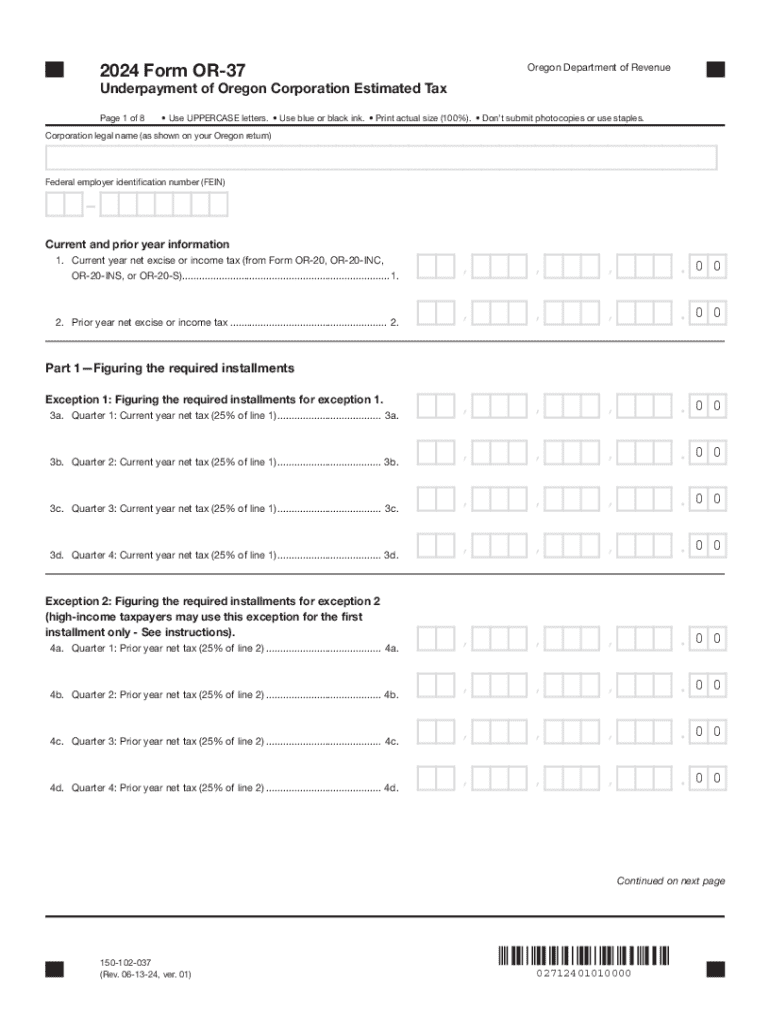

Understanding the Form OR-37

The Form OR-37 is the Oregon tax credit form specifically designed to assist taxpayers in claiming the Oregon credit for taxes paid to other states. This form is crucial for individuals who have income sourced from outside Oregon and wish to avoid double taxation on those earnings. Filling out this form correctly is vital to ensure that you maximize your credits and minimize your tax liability.

To be eligible for filing the Form OR-37 in 2024, certain criteria must be met. These typically include having residence or income in both Oregon and another state, as well as having paid taxes to that other state. Taxpayers should also ensure they comply with the updated regulations for the 2024 tax year, which may include changes in income thresholds or deductible amounts.

Importance of the 2024 tax year

The tax landscape for 2024 brings several changes that are particularly important for users of Form OR-37. New regulations around tax credits, adjustments to income brackets, and updates to the state's budget can influence the amount of credit you can claim. This year, Oregon's tax incentives are designed to encourage more residents to file accurately and engage with cross-state income reporting, making it essential to stay informed on recent updates.

Tax advisors recommend closely reviewing all IRS and Oregon Department of Revenue updates to ensure compliance and maximize your potential refunds or credits. Proper attention to these details can be the difference between a simple filing experience and a complicated one, especially for those with diverse income sources.

Steps to complete Form OR-37

Completing Form OR-37 is a straightforward process if you follow these key steps carefully.

Submission process

Once you have completed Form OR-37, the next step is submitting it. You have a choice between e-filing and traditional paper submission. E-filing offers faster processing times and often allows for more immediate confirmation of your filing status, while paper submissions can be more familiar for some users but may take longer to process.

To file electronically, consider using reputable tax software that supports Oregon tax forms or submit directly through the state’s revenue website. Ensure that you are aware of the important filing deadlines for 2024 to avoid late penalties. Generally, taxpayers must submit their forms by April 15, unless extensions are granted under special circumstances.

Managing your tax information

After submission, it is crucial to track the status of your Form OR-37. This can typically be done through the Oregon Department of Revenue's online portal. If issues or discrepancies arise during the processing period, promptly address them by following the provided guidelines on the website.

Additionally, you should store a copy of your submitted form and any supporting documents securely. Maintaining organized records is vital not only for your safety but also for potential audits or future filing needs. Utilize cloud-based platforms like pdfFiller to manage these documents effectively.

Interactive tools

pdfFiller offers an expansive range of interactive tools to assist in filling out Form OR-37. You can take advantage of editing features that allow you to customize the form according to your specific financial details. The platform supports eSignature options, providing a secure way to sign your documents without the need for printing.

Moreover, if you need to combine Form OR-37 with other tax documents, pdfFiller's integration features simplify this process significantly. By collaborating with tax professionals or team members through pdfFiller, you can streamline your filing preparations.

Resources for further assistance

While many taxpayers prefer to handle form preparation independently, there are times when seeking professional help becomes necessary. If you find yourself struggling with specific deductions or credits, contacting a qualified tax preparer can provide clarity and ensure accurate filing. Look for resources through local tax associations or the Oregon Department of Revenue for referrals.

Additionally, community forums can serve as support networks where taxpayers share personal experiences regarding Form OR-37 and other tax-related questions. Engaging in these platforms can also help to demystify complex tax topics.

Recent updates and news

Tax laws can change rapidly, impacting how forms like OR-37 function. For the 2024 tax year, it’s essential to stay updated on the latest changes surrounding Oregon’s tax regulations. The state may implement new allowances, while previous credits can be discontinued. Keeping abreast of these updates will help ensure your filing remains compliant with current laws.

It is advisable to regularly check the Oregon Department of Revenue's website and reputable tax news outlets for announcements regarding pertinent changes in regulations that may affect your tax filing strategies.

Footer

For more assistance and resources regarding Form OR-37, feel free to explore the support avenues available on pdfFiller’s site. Staying connected with pdfFiller ensures you receive timely updates on the latest tax forms and features that help streamline your filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2024 form or-37 online?

How do I edit 2024 form or-37 online?

How can I edit 2024 form or-37 on a smartphone?

What is form or-37?

Who is required to file form or-37?

How to fill out form or-37?

What is the purpose of form or-37?

What information must be reported on form or-37?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.