Get the free De-305

Get, Create, Make and Sign de-305

How to edit de-305 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out de-305

How to fill out de-305

Who needs de-305?

Comprehensive Guide to the DE-305 Form

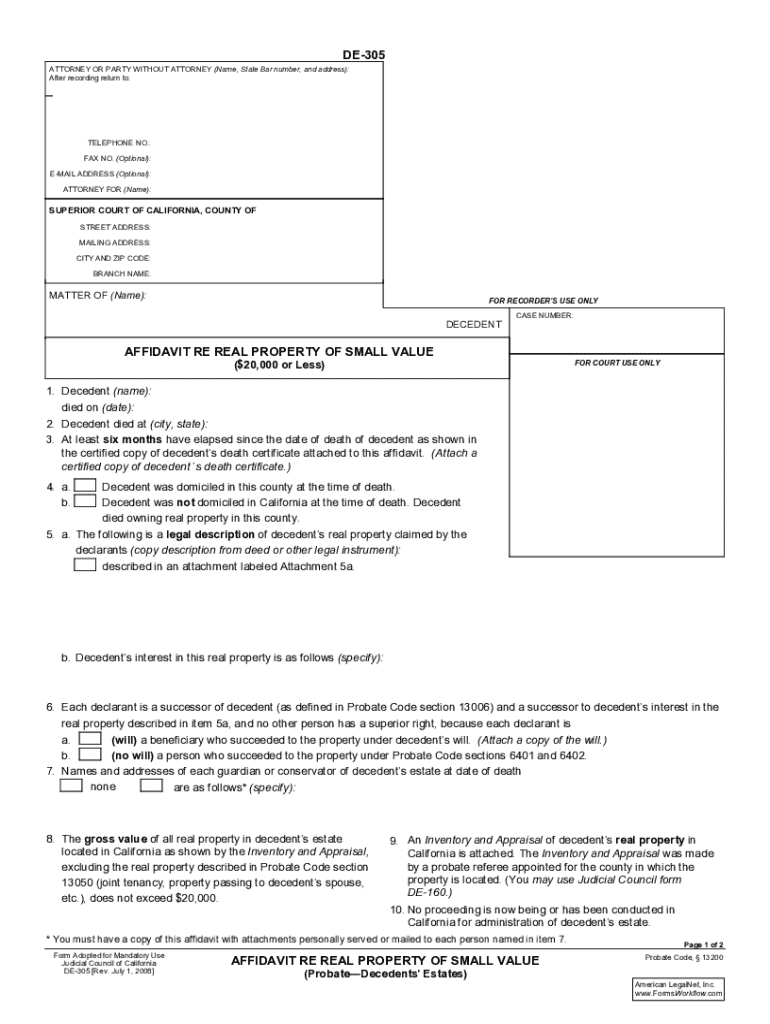

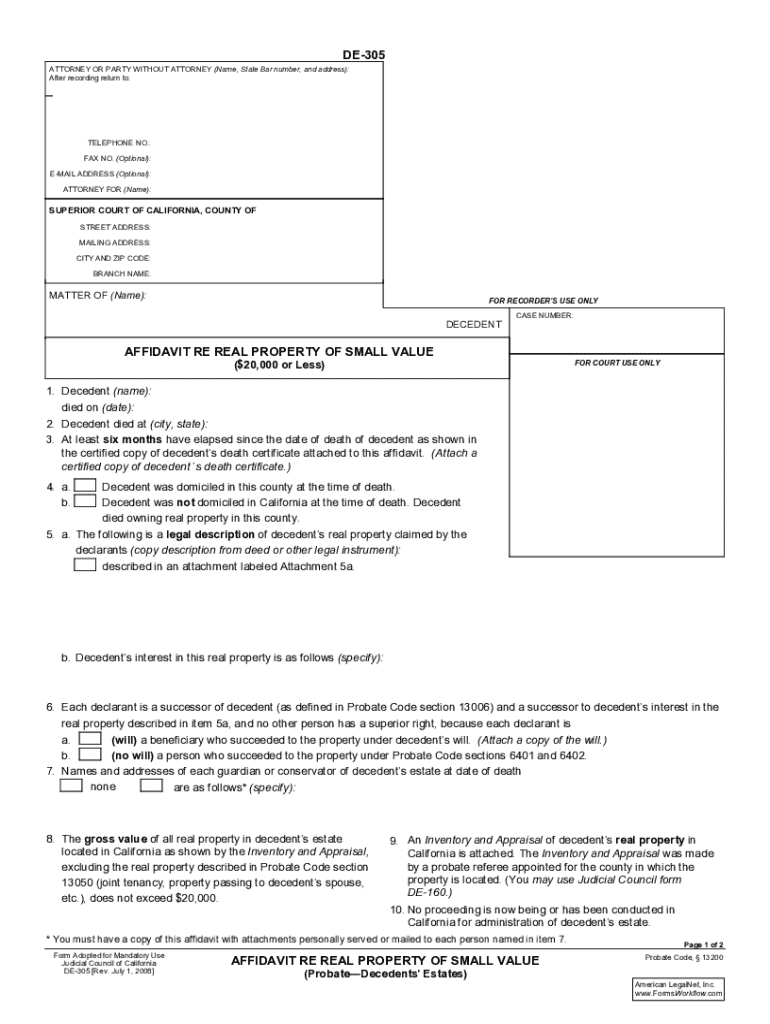

Overview of the DE-305 form

The DE-305 Form, officially termed the 'Small Estate Affidavit,' plays a crucial role in the probate process, allowing for the simplified transfer of property from a deceased individual. This form is specifically designed for estates that meet a certain threshold in value, enabling heirs to claim assets without undergoing a lengthy probate court procedure.

The DE-305 Form simplifies the transfer of property by allowing eligible heirs to affirm their rights to the estate, thereby avoiding additional layers of complexities typically associated with the probate process. Understanding its function is essential for anyone involved in the settling of an estate.

Importance of the DE-305 form in probate law

In legal terms, the DE-305 Form serves as a pivotal tool that streamlines property transfer. Estates that qualify under the small value criterion experience a smoother transition as this form circumvents the traditional court-required probate process, saving time and legal fees.

Eligibility criteria

Not everyone can file a DE-305 Form, as specific eligibility criteria must be met. Generally, the form is available to individuals who are either direct heirs or have obtained the necessary rights through legal channels. The key to successfully using the DE-305 Form lies in understanding the type of estate being managed.

A 'small value estate' is generally defined as one where the total value of the assets is below a certain threshold established by state law. This value can vary, thus it’s critical to confirm what constitutes a small value estate in your jurisdiction.

Understanding small value estates

A small value estate typically refers to assets that are easily transferrable and do not require formal probate. This includes items like bank accounts, personal property, and in some cases, real estate, depending on its current market value.

Step-by-step instructions for completing the DE-305 form

Filling out the DE-305 Form may seem daunting, but following a structured approach can make the process manageable. Gathering required information is the first step towards ensuring a seamless filling experience.

Collecting this information beforehand will not only save you time but also increase the accuracy of the form. The next step is to ensure that you understand each section of the DE-305.

While filling out the form, be meticulous. Each section includes crucial elements, from the personal details of the deceased to the listing of heirs entitled to the estate. Common mistakes, such as incorrect asset valuations or omissions of essential details, can lead to challenges down the road. Therefore, take special care to avoid these pitfalls.

Submission process

Once the DE-305 Form is filled out, the next step is submission. This can typically be done via several channels, including in-person at local probate court, through the mail, or, if available, via electronic filing.

Regardless of the submission method, be aware of any associated fees. Filing fees vary by location and can influence how quickly the estate can be resolved. Moreover, understanding the importance of deadlines in this process is crucial—submissions typically need to occur within a certain timeframe following the decedent's death.

Important deadlines

Timeliness can significantly affect the success of your submission. Generally, it's advisable to submit the DE-305 Form as soon as possible after the death, ideally within four months. Missing this deadline can complicate matters and potentially require a different procedural path.

What happens after submission?

After submitting the DE-305 Form, it undergoes a review process by the probate court. This review aims to confirm the validity of the documentation and ensure that all legal requirements are met. Heirs can expect to receive notifications regarding any necessary actions or clarifications required by the court.

In case of discrepancies or challenges regarding the DE-305 Form, having legal counsel is crucial. They can assist in navigating these complexities and provide guidance on how to handle disputes effectively.

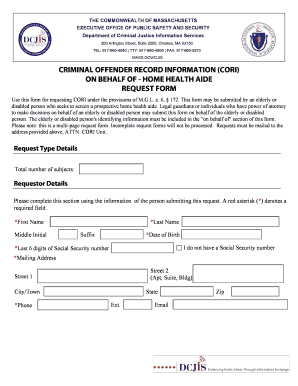

Additional forms and documents related to the DE-305

Multiple forms may accompany the DE-305 Form, based on the specifics of the estate and the jurisdiction. Familiarity with these documents can help streamline the filing process and ensure compliance with state laws.

Accessing these forms can be done through local governmental or court websites. Additionally, platforms like pdfFiller offer easy downloads and completion options.

Frequently asked questions (FAQs)

Addressing common concerns can alleviate uncertainties associated with the DE-305 Form. One frequent question is what happens if the decedent did not leave a will, which generally necessitates navigating intestate succession laws.

Queries about joint tenancy properties also arise, as such assets often automatically pass to the surviving owner. Regarding amendments to the DE-305 Form, it’s advisable to check local regulations for procedures on submitting corrections post-filing.

Quick tips for successful filing

To ensure a smooth filing experience when handling the DE-305 Form, adopt best practices throughout the process. Proper preparation will mitigate potential issues and help avoid last-minute scrambles.

Providing support options through platforms like pdfFiller enhances the likelihood of successful filing. Users can utilize available resources for a more guided approach.

Interactive tools and resources

Utilizing interactive tools can simplify complex forms like the DE-305. pdfFiller offers a variety of features to help users create, edit, and sign the DE-305 Form smoothly.

For those who prefer visual aids, pdfFiller provides online tutorials and webinars about navigating the DE-305 Form and other related documents for improved understanding.

Contact for support

For further assistance when managing the DE-305 Form, pdfFiller offers multiple support options to help users find solutions efficiently. Support options include email, chat, and phone services to address any queries users may have.

In scenarios where legal complexities must be addressed, seeking outside legal counsel is beneficial. Although the DE-305 Form simplifies many aspects, legal advice ensures compliance with your local laws.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my de-305 in Gmail?

How can I modify de-305 without leaving Google Drive?

How do I fill out de-305 on an Android device?

What is de-305?

Who is required to file de-305?

How to fill out de-305?

What is the purpose of de-305?

What information must be reported on de-305?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.