Get the free Cdtfa-810 (s1f)

Get, Create, Make and Sign cdtfa-810 s1f

Editing cdtfa-810 s1f online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cdtfa-810 s1f

How to fill out cdtfa-810 s1f

Who needs cdtfa-810 s1f?

Comprehensive Guide to the CDTFA-810 S1F Form

Understanding the CDTFA-810 S1F Form

The CDTFA-810 S1F form is a vital document issued by the California Department of Tax and Fee Administration (CDTFA). This form is used primarily for the purposes of sales and use tax adjustments. Understanding the intricacies of this form can make a significant difference in managing compliance and ensuring accurate tax reporting. The CDTFA-810 form allows taxpayers to detail adjustments related to previously reported sales and use tax liabilities, ensuring that their tax filings accurately reflect their financial activities.

Key users of the CDTFA-810 S1F typically include businesses and individual sellers who have what is known as a tax obligation within California. For instance, retailers needing to amend tax returns due to changes in sales figures, or refunds, find this form particularly critical. Individuals and businesses alike must be familiar with scenarios that require the filing of this form, such as correcting errors or reporting returns on taxable transactions.

Accessing the CDTFA-810 S1F Form

To access the CDTFA-810 S1F form, users can visit the official California Department of Tax and Fee Administration's website. The form is available for download in PDF format, which can be printed or filled digitally. Additionally, pdfFiller streamlines this process by providing tools to access and manage the form directly from their platform.

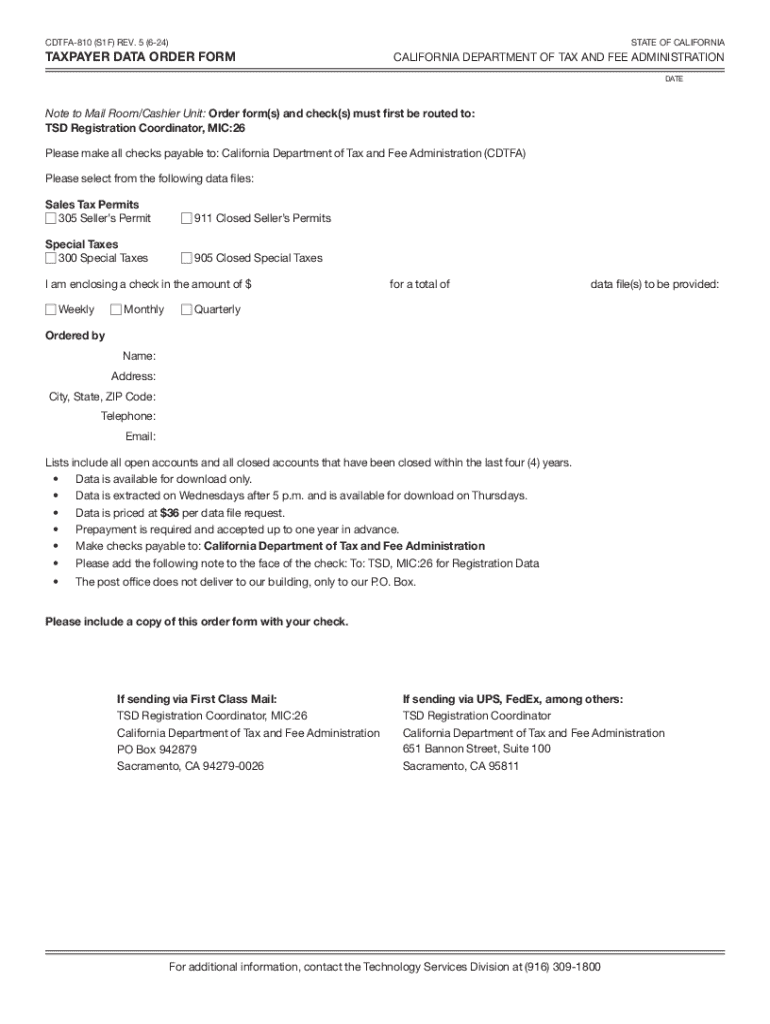

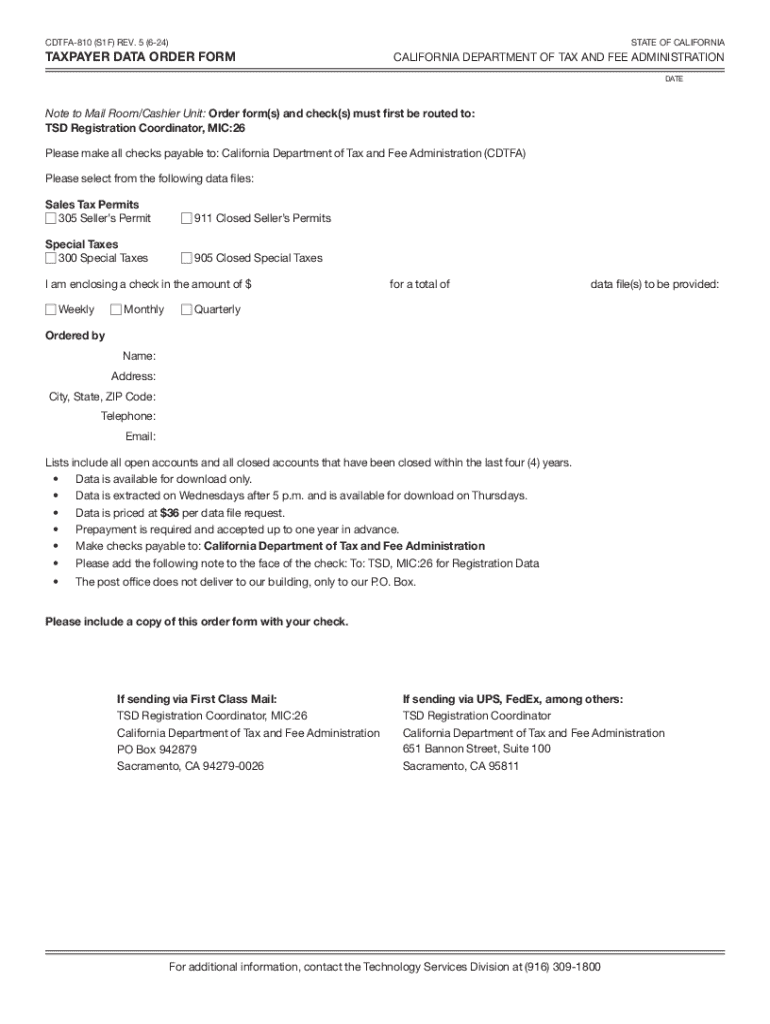

The document layout of the CDTFA-810 S1F consists of multiple sections, each serving a specific purpose. The form typically includes fields for personal information, sales figures, certification declarations, and signatures. Knowing how to navigate these sections is fundamental to efficiently completing the form.

Step-by-step instructions for completing the CDTFA-810 S1F Form

Completing the CDTFA-810 S1F form may initially appear daunting, but breaking it down into manageable sections can simplify the process. First, the Personal Information section requires details such as your name, business name, and contact information. Accuracy is paramount here; incorrect or missing information can lead to delays or complications.

Next is the Financial Information section, where you will enter sales figures and the adjustments being claimed. Accurate financial data ensures your tax liabilities reflect the actual transactions. In the Certification and Signature section, remember that your signature is a declaration of the truthfulness of the information provided—a phony entry can lead to legal repercussions. Utilizing pdfFiller allows for digital signing, which can simplify this process.

Editing the CDTFA-810 S1F Form using pdfFiller

pdfFiller provides an intuitive interface for editing the CDTFA-810 S1F form. The platform includes interactive tools such as text boxes, checkboxes, and highlighting features that make it easy to fill and modify information. When using pdfFiller, pay careful attention to accuracy when inputting data, as errors can hinder your tax reporting.

Once you have completed editing the form, pdfFiller allows you to save it in various formats, including PDF, Word, or as a fillable form for future use. This flexibility ensures that your documentation stays organized and easily accessible.

eSigning the CDTFA-810 S1F Form

Utilizing eSignatures for the CDTFA-810 S1F form has several advantages, including legal standing and convenience. eSignatures are accepted by the CDTFA, eliminating the hassle of printing, signing, and scanning documents. When using pdfFiller, the signing process is straightforward and can be completed in just a few clicks.

To add your eSignature, simply navigate to the eSignature section in pdfFiller, select the signature option, and follow the prompts to sign digitally. This saves time and ensures all documentation remains electronic and easily manageable.

Collaborating on the CDTFA-810 S1F Form with your team

Collaboration on the CDTFA-810 S1F form becomes effortless with pdfFiller. Users can easily share the form with team members for feedback or input. By utilizing collaborative features within the pdfFiller platform, multiple stakeholders can review, comment, and edit the document, ensuring that every aspect is accurately addressed.

Managing inputs and changes effectively is vital to maintaining clarity throughout the process. pdfFiller offers tracking features that log changes and contributions, allowing you to revert to earlier versions if needed. This efficient document management ensures everyone stays on the same page.

Submitting the CDTFA-810 S1F Form

Filing methods for the CDTFA-810 S1F form can be categorized into online and offline submissions. While online submissions are generally quicker and more efficient, offline methods, whether mail-in or in-person, can also be used based on user preference. Each method has implications for processing time and documentation security, so choose based on your specific needs and resources.

Key deadlines for submission must be monitored to maintain compliance with tax regulations. Be aware of filing dates as they can affect potential late fees or penalties. Prompt submission is essential as once the form is submitted, the CDTFA will process your fiscal adjustments and inform you of acceptance or further actions required.

Troubleshooting common issues

Common issues encountered when completing or submitting the CDTFA-810 S1F form can include missing information, incorrect entries, and misfiling. It’s crucial that taxpayers consult FAQs or troubleshooting sections provided by the CDTFA for guidance on common errors. Form complexities can create confusion, but resources are available to assist in addressing these hurdles.

Should you encounter issues while using pdfFiller, their support system can provide immediate assistance. Access to customer service enables you to resolve errors and file correctly, ensuring you remain compliant with California tax regulations.

Additional features of pdfFiller for form management

Having all relevant forms organized digitally provides significant benefits for efficiency and compliance. pdfFiller's cloud-based document management system enables users to easily store, retrieve, and organize forms securely. Centralized storage translates to enhanced productivity, as access is streamlined from any location.

Moreover, pdfFiller’s template capabilities allow users to create and modify templates from the CDTFA-810 S1F form, making it convenient for future use. Access to customer support ensures you can obtain assistance with any questions or issues that may arise during the form management process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit cdtfa-810 s1f from Google Drive?

How do I make changes in cdtfa-810 s1f?

Can I create an electronic signature for the cdtfa-810 s1f in Chrome?

What is cdtfa-810 s1f?

Who is required to file cdtfa-810 s1f?

How to fill out cdtfa-810 s1f?

What is the purpose of cdtfa-810 s1f?

What information must be reported on cdtfa-810 s1f?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.