Get the free Boe-305-ah (p1) Rev. 11 (05-22)

Get, Create, Make and Sign boe-305-ah p1 rev 11

How to edit boe-305-ah p1 rev 11 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out boe-305-ah p1 rev 11

How to fill out boe-305-ah p1 rev 11

Who needs boe-305-ah p1 rev 11?

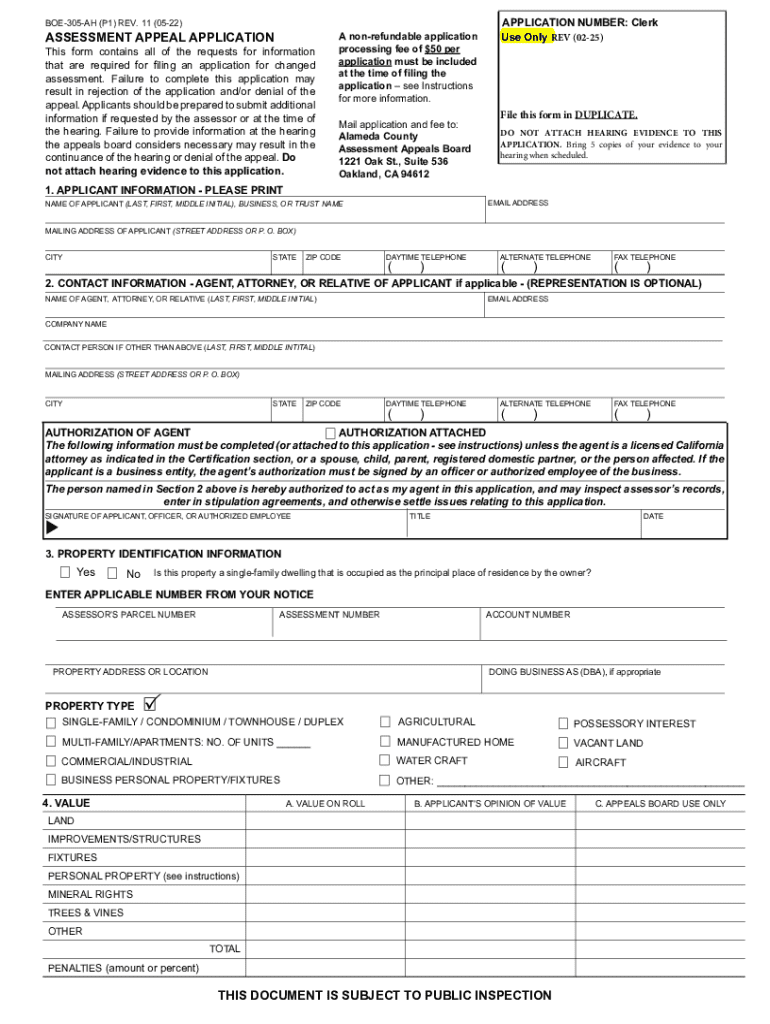

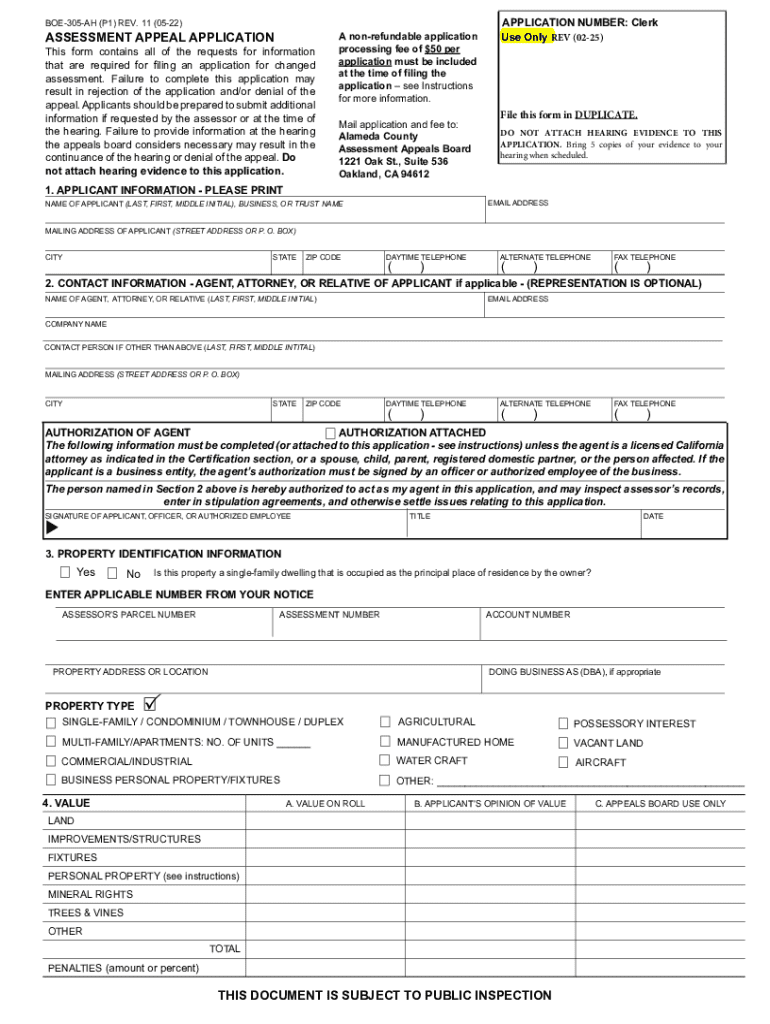

Comprehensive Guide to the BOE-305-AH P1 Rev 11 Form

Understanding the BOE-305-AH P1 Rev 11 Form

The BOE-305-AH P1 Rev 11 form is a crucial document utilized in California for assessing property tax exemptions. This form is specifically aimed at individuals and businesses claiming a property tax exemption as a result of certain qualifying circumstances. Understanding the purpose and the significance of this form is essential for anyone involved in property ownership, as it ensures that they correctly report their eligibility for exemptions, potentially leading to considerable tax savings.

The current revision of this form incorporates key updates that reflect changes in tax regulations and policies. These updates are intended to streamline the application process, improve clarity for users, and reduce the frequency of errors that could lead to delays in processing. It's important to utilize the most recent version to ensure compliance and maximize the potential benefits.

Eligibility criteria for using the BOE-305-AH P1 Rev 11 form

To successfully utilize the BOE-305-AH P1 Rev 11 form, applicants must meet specific eligibility criteria. This typically includes homeowners or businesses that believe they qualify for a property tax exemption based on the criteria outlined by California's property tax guidelines. It's essential for applicants to fully comprehend these requirements before proceeding, as misapplying the form can lead to a rejection of the claim.

Common qualifying scenarios include being a previously approved claimant for tax exemptions, utilizing the property as a primary residence, or being designated as a nonprofit organization. Applicants should gather any supporting documentation that may be required, such as proof of residence or business operation, to avoid delays in processing their request.

Step-by-step guide to completing the BOE-305-AH P1 Rev 11 form

Completing the BOE-305-AH P1 Rev 11 Form requires careful attention to detail, particularly since accurate information is paramount in tax-related submissions. Here’s a section-by-section breakdown of how to fill out the form:

To ensure accuracy, double-check all entered information and adhere to any specific instructions provided with the form to avoid common mistakes such as incorrect property descriptions or omitted documentation.

Editing the BOE-305-AH P1 Rev 11 form

If you need to make modifications to the BOE-305-AH P1 Rev 11 form, using pdfFiller’s editing tools can enhance the process significantly. The platform allows users to easily edit their forms, making it simple to correct errors or update information as needed.

Once you’ve edited the form, make sure to save your changes efficiently. To keep track of various versions of the form, it's useful to save them under different file names or in organized folders within your pdfFiller account.

eSigning the BOE-305-AH P1 Rev 11 form with pdfFiller

The ability to electronically sign the BOE-305-AH P1 Rev 11 form through pdfFiller offers numerous benefits. It not only speeds up the submission process but also enhances the security of your signature compared to traditional methods.

To eSign the form, simply navigate to the eSignature feature within pdfFiller, follow the prompts to add your electronic signature, and then save your document securely. PdfFiller implements robust security measures to ensure your signed documents are protected from unauthorized access.

Collaborating on the BOE-305-AH P1 Rev 11 form

Collaboration is essential when multiple stakeholders are involved in the submission of the BOE-305-AH P1 Rev 11 form. PdfFiller enables users to share the form easily with team members or involved parties, facilitating real-time collaboration.

Managing your BOE-305-AH P1 Rev 11 form documents

Efficient document management is vital for successful form submissions. PdfFiller offers various features to help users organize their BOE-305-AH P1 Rev 11 forms effectively. You can create folders for different categories of forms, making retrieval straightforward and efficient.

Additionally, setting reminders for submission deadlines can prevent last-minute rushes. PdfFiller's built-in reminder tools can send alerts, ensuring you never miss a crucial date regarding your exemptions.

Common issues and troubleshooting

Users may encounter various issues while using the BOE-305-AH P1 Rev 11 form. Some common problems include incorrect information submission, documents not saved properly, or difficulties in accessing the form.

Frequently asked questions about the BOE-305-AH P1 Rev 11 form

Many users have questions regarding the BOE-305-AH P1 Rev 11 form, specifically concerning eligibility, submission processes, and modification options. It's crucial to clarify these points to avoid confusion during the form preparation and submission stages.

Keeping updated with changes to the BOE-305-AH P1 form

Staying informed about changes to the BOE-305-AH P1 form is essential for applicants to ensure compliance and maximize benefits. Regular updates may occur, and it's advisable to keep an eye on official resources or subscribe to notifications from relevant tax authorities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my boe-305-ah p1 rev 11 directly from Gmail?

How do I edit boe-305-ah p1 rev 11 in Chrome?

Can I create an electronic signature for signing my boe-305-ah p1 rev 11 in Gmail?

What is boe-305-ah p1 rev 11?

Who is required to file boe-305-ah p1 rev 11?

How to fill out boe-305-ah p1 rev 11?

What is the purpose of boe-305-ah p1 rev 11?

What information must be reported on boe-305-ah p1 rev 11?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.