Get the free Form 10-k/a

Get, Create, Make and Sign form 10-ka

Editing form 10-ka online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-ka

How to fill out form 10-ka

Who needs form 10-ka?

Understanding and Completing the Form 10-K: A Comprehensive Guide

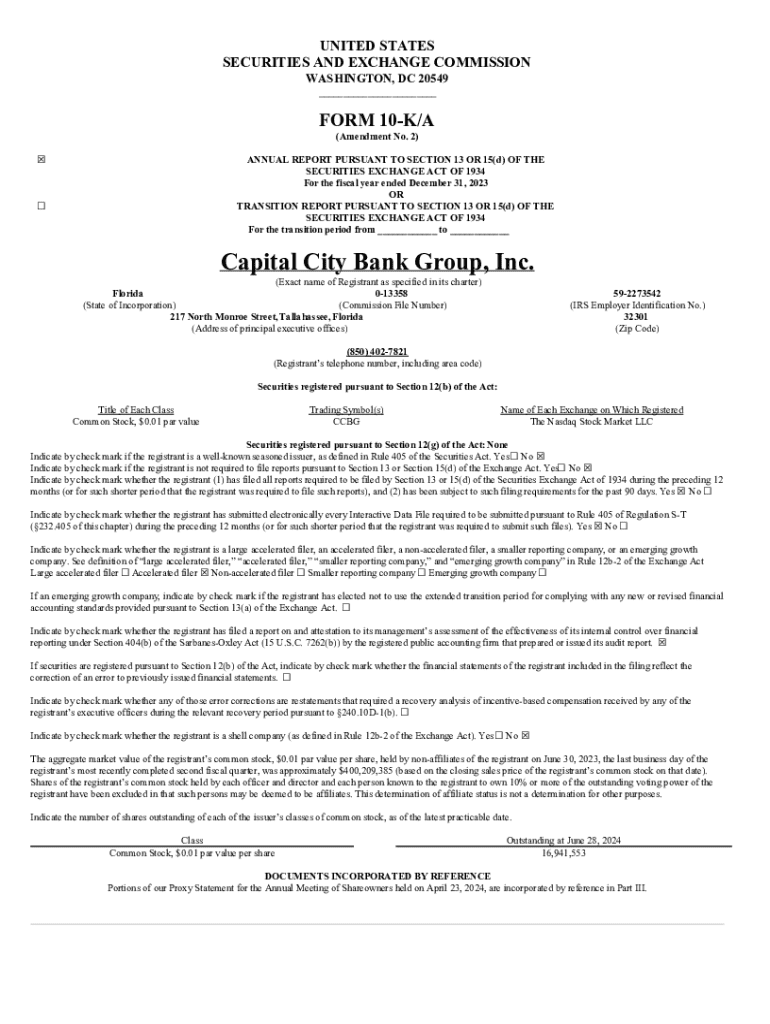

Understanding Form 10-K

A Form 10-K is an annual report mandated by the U.S. Securities and Exchange Commission (SEC) that provides a comprehensive summary of a company's financial performance. The document serves multiple purposes, primarily to inform investors about the company's financial status, management, and business risks. Companies listed on U.S. exchanges must file this document annually, and it is an essential tool for investors seeking to understand a company's investment potential.

Differences between Form 10-K and other forms

Form 10-K differs from other SEC filings primarily in its depth and scope. For instance, Form 10-Q is a quarterly report that is less detailed than the 10-K and is filed three times a year. Unlike the 10-K, which requires detailed financial information and risks over the past year, the 10-Q updates investors on weekly performance but lacks the same level of comprehensive analysis.

Key components of Form 10-K

Form 10-K consists of several mandatory sections that provide vital information about the company's financial performance, operations, and governance. Understanding these components is crucial for both companies preparing the document and investors analyzing it. Each section plays an important role in forming a complete picture of the company.

Filing and deadlines

Filing a Form 10-K involves adhering to specific deadlines set by the SEC. Companies must submit this form within 60 to 90 days following the end of their fiscal year, depending on their public float. Failure to file on time can result in significant penalties for the company, including fines and increased scrutiny from regulatory bodies. Therefore, understanding these deadlines is critical for compliance.

How to submit a Form 10-K

Submitting a Form 10-K requires navigating the SEC's EDGAR system. This online platform allows companies to file necessary documents electronically. Preparation is key, and companies should have their financial information and disclosures ready before starting the submission process. Proper preparation can help streamline the experience and ensure the accuracy of the submission.

Interactive tools for Form 10-K preparation

With advancements in technology, various tools can assist in preparing Form 10-K. Services like pdfFiller provide a range of features designed for document management, including PDF editing, eSigning, and collaboration options. These tools can significantly ease the burdens associated with preparing such a complex filing.

Accessing and searching for Form 10-Ks

Finding specific Form 10-K filings can be streamlined using the EDGAR search tools. Investors and analysts can filter documents by date, company name, or other criteria, making it easier to locate pertinent information. Analyzing existing Form 10-Ks provides valuable insights into a company’s financial health and operational strategies.

Common challenges and solutions

Preparing a Form 10-K can present challenges, particularly in accurately recording assets and liabilities, identifying key risks, and ensuring compliance with the SEC’s regulatory standards. Companies may struggle with complex financial data and narrative disclosures that must align with legal requirements. Utilizing modern tools like pdfFiller can help alleviate these difficulties through collaborative features and streamlined document management.

Importance of compliance and best practices

Compliance with SEC regulations is not just a legal obligation but reinforces the trustworthiness and integrity of the financial reporting. Companies that aim for high standards of clarity and transparency enhance their credibility with investors. Following best practices not only aids in compliance but also improves the overall quality of the information presented in the Form 10-K.

Additional insights and resources

Learning from successful filings can provide valuable lessons for teams preparing their Form 10-K. Reviewing high-quality examples can highlight effective communication strategies and exemplary disclosure practices. Common questions about the 10-K process also arise, and addressing these inquiries can assist teams in enhancing their understanding of filing requirements.

Future trends in Form 10-K reporting

The landscape of Form 10-K reporting is evolving. Companies are increasingly adopting technology that simplifies the reporting process, allowing for quicker and more efficient filings. Expectations from regulators and investors are shifting towards more real-time reporting and sustainability disclosures, indicating that firms will need to adapt their practices in response to these trends.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 10-ka to be eSigned by others?

Where do I find form 10-ka?

How do I complete form 10-ka on an Android device?

What is form 10-ka?

Who is required to file form 10-ka?

How to fill out form 10-ka?

What is the purpose of form 10-ka?

What information must be reported on form 10-ka?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.