Get the free Private Education Loan Applicant Self-certification - environment yale

Get, Create, Make and Sign private education loan applicant

How to edit private education loan applicant online

Uncompromising security for your PDF editing and eSignature needs

How to fill out private education loan applicant

How to fill out private education loan applicant

Who needs private education loan applicant?

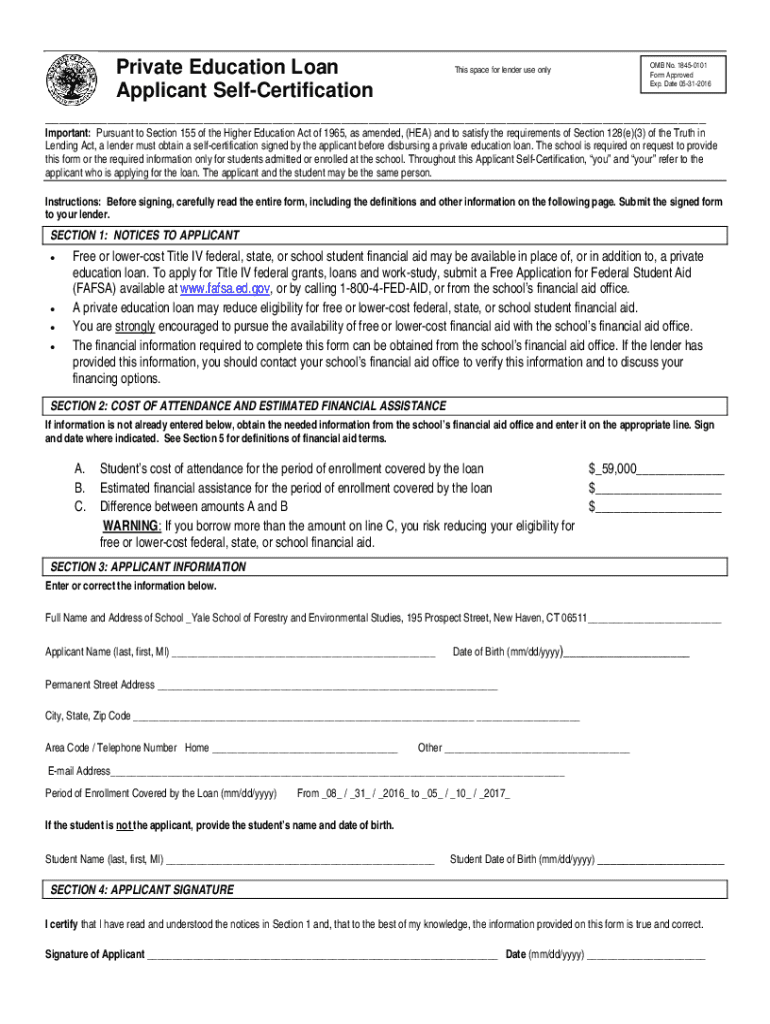

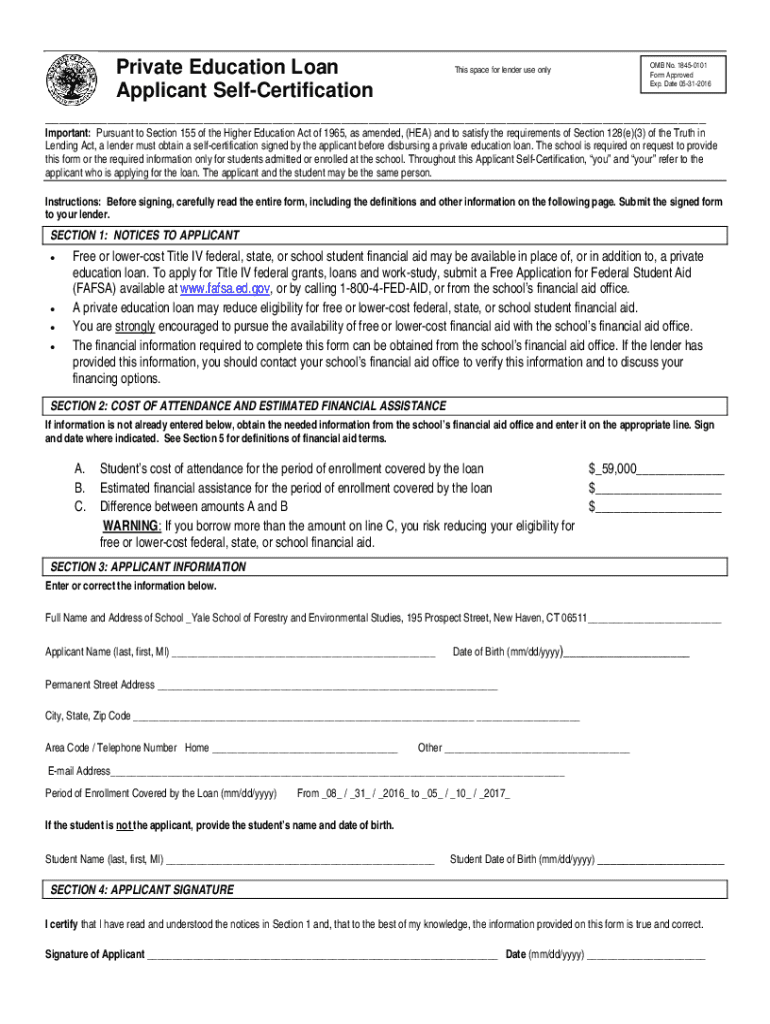

A Comprehensive Guide to the Private Education Loan Applicant Form

Understanding the private education loan applicant form

The private education loan applicant form is a crucial document designed to collect essential information from individuals seeking funds to finance their education. Its primary purpose is to enable borrowers to apply for private loans that cover tuition, fees, and related education expenses that federal loans may not fully address. Proper completion of this form is vital for ensuring a smooth loan application process, impacting everything from approval chances to loan amounts granted.

Private education loans can be a significant financial tool for students and their families, particularly in the face of rising tuition costs. They often come with varied interest rates, terms, and repayment options, specifically tailored to fit the borrower's financial situation. Understanding the implications of private loans compared to federal loans is fundamental before submitting an application.

Components of the private education loan applicant form

Navigating the private education loan applicant form requires familiarity with its key sections. Each component serves a specific purpose, and understanding them can significantly streamline the application process.

Step-by-step instructions for filling out the form

Filling out the private education loan applicant form can feel daunting, but breaking it down into manageable steps can help. Start with a pre-application checklist to ensure you have everything you need.

Editing and managing your application form

Once you've filled out the private education loan applicant form, utilizing editing tools can enhance clarity and professionalism. Using pdfFiller tools allows for efficiently managing your submissions.

Signing and submitting the private education loan applicant form

After ensuring everything is accurate, it’s time to sign and submit the application. Understanding the eSigning options available through pdfFiller can simplify this process.

Troubleshooting common issues

Facing challenges with your application can be disheartening. However, knowing how to troubleshoot common issues can alleviate stress.

Frequently asked questions about private education loans

Navigating the landscape of private education loans can raise numerous questions. Understanding the common inquiries can prepare you for what lies ahead.

Alternative resources and tools

When applying for private education loans, supplemental resources can enhance your understanding and preparation.

Related document templates to consider

As you prepare for a private education loan application, it can be beneficial to familiarize yourself with other related financial documents.

Testimonials and success stories

User experiences can provide insights into the private education loan process. Many users have successfully navigated their applications with the help of pdfFiller.

Success stories often highlight how streamlined document management, clear instructions, and efficient submission processes contributed to favorable outcomes.

Navigating financial literacy

Understanding the differences between private loans and federal loans is essential for making informed decisions. Educational resources can help students recognize which funding option fits their circumstances best.

Accessing ongoing support

Access to support during the application process is invaluable. Keeping contact with customer support through platforms like pdfFiller can help resolve queries and issues quickly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit private education loan applicant online?

Can I sign the private education loan applicant electronically in Chrome?

Can I create an eSignature for the private education loan applicant in Gmail?

What is private education loan applicant?

Who is required to file private education loan applicant?

How to fill out private education loan applicant?

What is the purpose of private education loan applicant?

What information must be reported on private education loan applicant?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.