Get the free Form 5500-sf

Get, Create, Make and Sign form 5500-sf

How to edit form 5500-sf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5500-sf

How to fill out form 5500-sf

Who needs form 5500-sf?

Form 5500-SF Guide: Everything You Need to Know

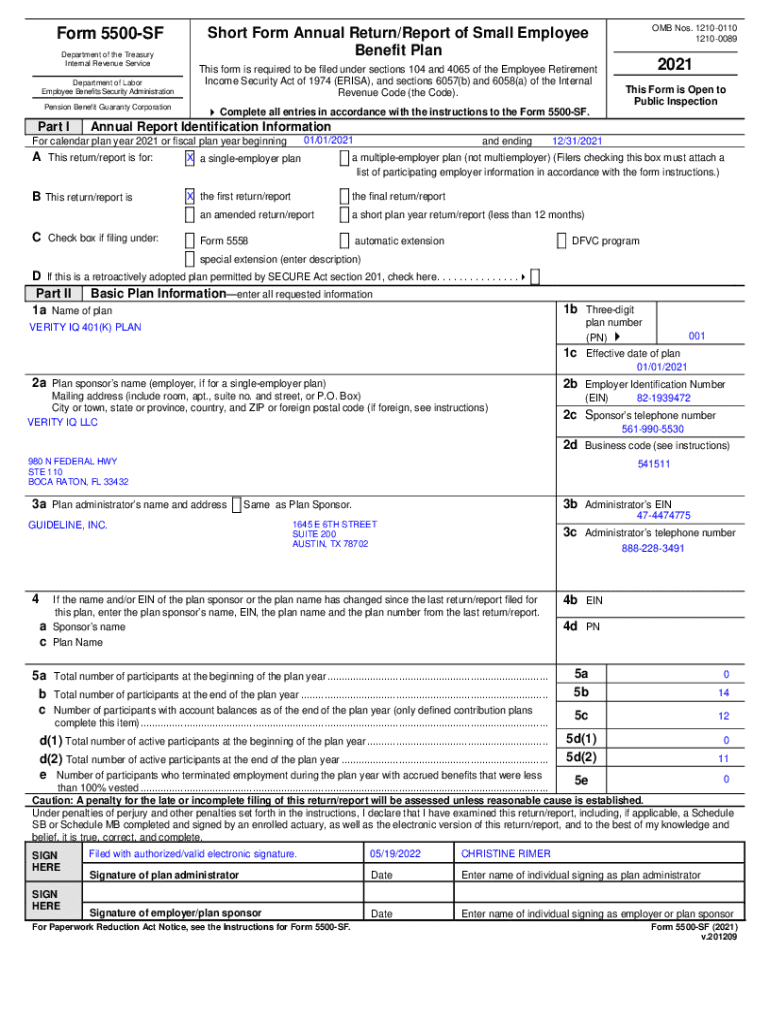

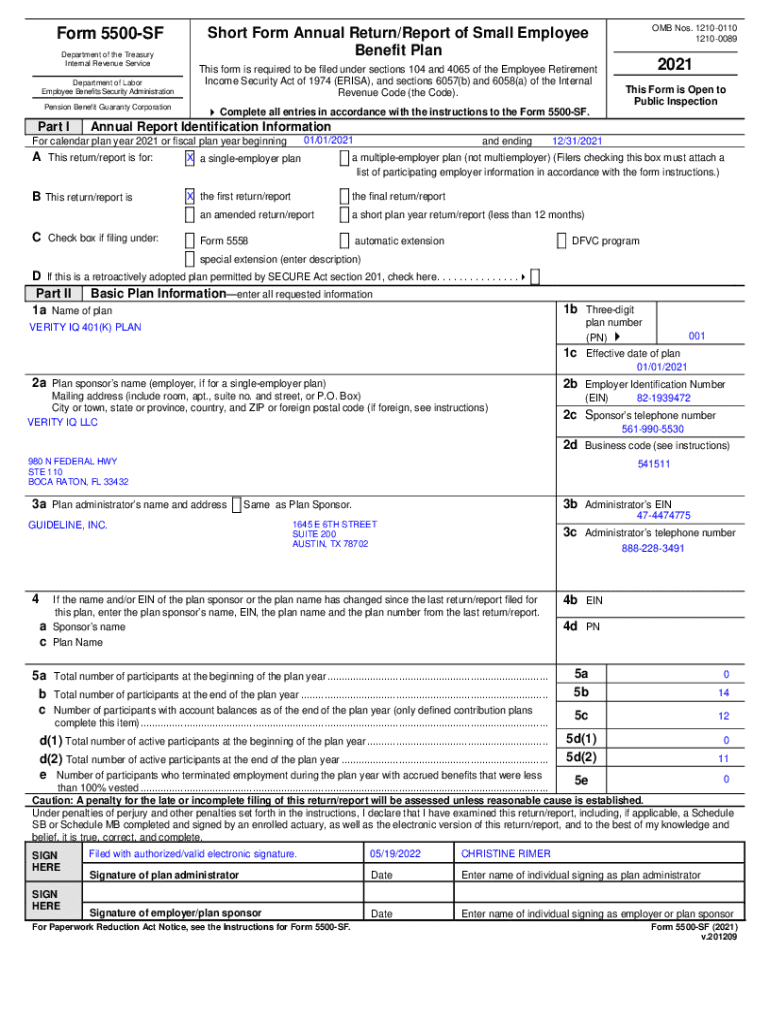

Overview of Form 5500-SF

Form 5500-SF, or the Short Form Annual Return/Report of Employee Benefit Plan, is a simplified reporting form established by the Employee Benefits Security Administration (EBSA) under the U.S. Department of Labor. This form is specifically designed for small employee benefit plans, making it easier for plan sponsors to comply with federal reporting requirements.

The primary purpose of Form 5500-SF is to streamline the reporting process for small investment plans and simplify the requirements for compliance under the Employee Retirement Income Security Act (ERISA). As these small plans often have fewer complexities, the decision to use Form 5500-SF instead of the comprehensive Form 5500 can alleviate reporting burdens.

Eligibility and filing requirements

To determine eligibility for filing Form 5500-SF, it is crucial to assess the number of participants in your retirement plan. Plans with fewer than 100 participants at the beginning of the plan year are generally required to file this form, provided they are covered under ERISA. This threshold is especially important for small businesses, as it is one of the primary criteria for utilizing this streamlined reporting form.

Types of plans required to file Form 5500-SF include profit-sharing plans, defined contribution plans, and defined benefit plans that have fewer than 100 participants. However, certain plans may be exempt from filing, such as those consisting solely of a deferred compensation plan or excess benefit plan, among others.

Structure of Form 5500-SF

Form 5500-SF consists of several sections, each focused on different aspects of the employee benefit plan. Understanding the structure is vital to ensure accurate completion. Below are the primary parts of Form 5500-SF:

Detailed instructions for completing Form 5500-SF

Completing Form 5500-SF requires careful attention to detail. Below is a step-by-step guide for each part of the form, including line-by-line instructions that are essential for successful filing.

When completing Part I, ensure accuracy in entering the plan's identifying details. Mistakes here can lead to processing delays. In Part II, be clear on the number of participants to avoid penalties for misrepresentation. Common mistakes include miscalculating participant numbers or neglecting to report all plan assets, especially in Part III. This can result in higher penalties during audits.

Electronic filing requirements

Filing Form 5500-SF electronically through the EFAST2 processing system is mandatory. This system simplifies the submission process and facilitates faster processing. To prepare for electronic submission, ensure that your data is correctly formatted and up to date.

When utilizing pdfFiller, users have a cloud-based platform that provides easy document management, ensuring that all signatures and dates comply with required formats. It's also advisable to confirm that any third-party service provider authorized to e-file on your behalf has appropriate access and permissions.

Implications of non-compliance

Failing to comply with Form 5500-SF filing requirements can lead to significant penalties. Administrative penalties can be levied for late filings, with fines reaching up to $2,259 per day, depending on the severity of the non-compliance. In addition to administrative penalties, plans that fail to file may also face IRS penalties related to tax qualifications.

To manage any potential issues, consider participating in the Delinquent Filer Voluntary Compliance (DFVC) program. This program allows delinquent filers to come into compliance with reduced penalties. If you discover filing issues, the quickest resolution lies in consulting with compliance specialists or utilizing platforms like pdfFiller for document management.

Alternative forms and extensions

If you're unable to meet the filing deadline for Form 5500-SF, you can request an extension through Form 5558. This can grant an additional two-and-a-half months to file your report. It's essential to submit Form 5558 at least 30 days before the standard deadline.

Other filing extensions may also be available in specific circumstances, but it’s crucial to understand when to use them. For example, if the plan is terminated, different filing requirements apply. Understanding these nuances is vital for ensuring compliance.

Common questions and troubleshooting

Filing Form 5500-SF often raises several questions for plan sponsors. One prevalent query is related to the choice between Form 5500-SF and the full Form 5500. It's generally recommended to opt for Form 5500-SF when eligible, as it is streamlined and more manageable.

For specific scenarios such as changes in participants or merging plans, guidance may be necessary. It's helpful to consult forums or resources on compliance, or reach out to experts who can clarify these complex situations.

Interactive tools on pdfFiller

pdfFiller provides valuable resources and tools for managing your Form 5500-SF filing process. Users can create and edit documents on the platform, ensuring that each version reflects accurate and updated information. The eSignature capabilities allow for quick approvals, enabling teams to streamline their workflows.

Moreover, collaboration tools available on pdfFiller promote teamwork, as multiple users can work on the document simultaneously. With cloud-based accessibility, you can manage your filings from anywhere, offering invaluable flexibility to plan sponsors.

Updates and changes for 2023

As of 2023, key changes have been made to Form 5500-SF, particularly with regard to reporting requirements. It's essential for plan sponsors to stay updated on these changes to ensure compliance. For example, amendments in reporting deadlines may affect small plans differently compared to larger ones.

Moreover, important filing deadlines for 2023 remain the same, with filings due on the last day of the seventh month following the end of the plan year. As adjustments continue to evolve within ERISA and IRS regulations, monitoring these updates will facilitate smoother compliance for organizations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 5500-sf online?

Can I create an eSignature for the form 5500-sf in Gmail?

How do I edit form 5500-sf on an iOS device?

What is form 5500-sf?

Who is required to file form 5500-sf?

How to fill out form 5500-sf?

What is the purpose of form 5500-sf?

What information must be reported on form 5500-sf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.