Get the free Return of Organization Exempt From Income Tax

Get, Create, Make and Sign return of organization exempt

How to edit return of organization exempt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out return of organization exempt

How to fill out return of organization exempt

Who needs return of organization exempt?

Return of Organization Exempt Form: A Comprehensive How-to Guide

Understanding the Return of Organization Exempt Form

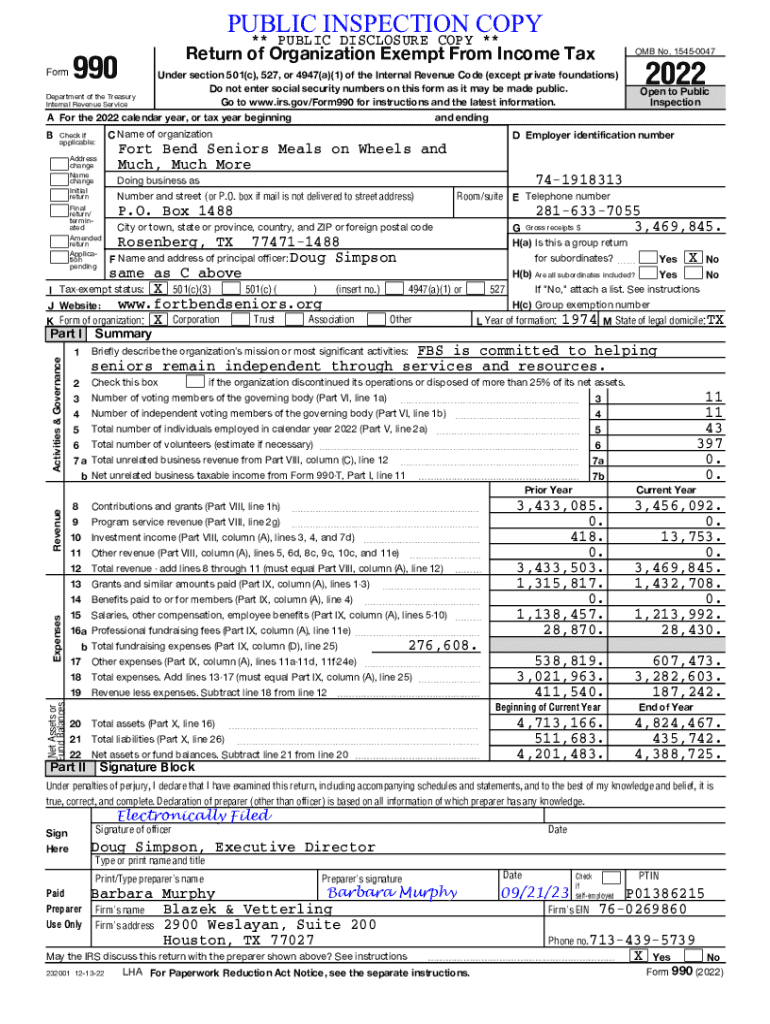

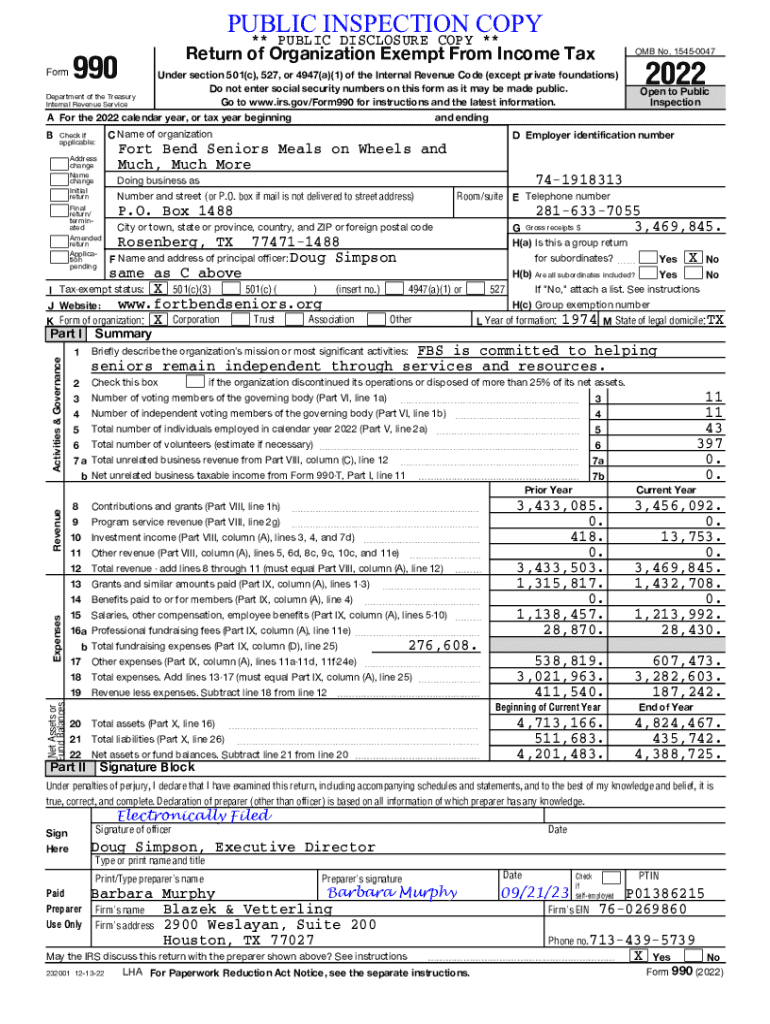

The Return of Organization Exempt Form, often referred to as Form 990, is crucial for any organization seeking tax-exempt status under Section 501(c) of the Internal Revenue Code. This form is designed to provide the IRS with information about the organization's activities, finances, and governance structures—a transparent practice that ensures tax-exempt entities adhere to legal standards.

Filing this form is not just a bureaucratic obligation; it serves a vital purpose in safeguarding the integrity of tax-exempt organizations within the community and ensuring they operate in accordance with their stated missions.

Who needs to file?

Organizations that operate as nonprofits and have been granted tax-exempt status are required to file the Return of Organization Exempt Form annually. This includes charitable organizations, religious institutions, and advocacy groups, among others.

However, not all organizations are required to file. Smaller nonprofits with gross receipts under a specified threshold may qualify for simplified filing options or may be exempt altogether. Understanding these criteria is crucial for compliance.

Key terminology

Navigating the Return of Organization Exempt Form necessitates familiarity with specific terminology. Key terms include 'tax-exempt status,' which refers to an organization’s ability to be free from federal income tax, and 'governance,' which encompasses the rules and practices that direct the organization.

Understanding these terms is essential for accurate filing. For instance, recognizing what qualifies as direct public support versus unrelated business income will affect how organizations report their revenue.

Filing requirements

Filing the Return of Organization Exempt Form requires meticulous attention to detail. Organizations must gather comprehensive data, including financial statements, governance documents, and descriptions of programs and activities that fulfill their missions. This data is pivotal to ensure that the IRS can properly assess the organization's eligibility for tax-exempt status.

In addition to the required information, understanding the deadlines associated with filing is critical. Generally, most organizations need to submit their forms by the 15th day of the 5th month after the end of their fiscal year. Failure to meet this deadline can result in significant penalties.

Deadlines for filing

Adhering to deadlines is fundamental in the filing process for the Return of Organization Exempt Form. Organizations typically have a specific timeframe to submit their form based on their fiscal year-end. The general timeline is as follows: 15th day of the 5th month. This means that organizations with fiscal years ending on December 31st must file by May 15th of the following year.

Organizations that miss this deadline may incur penalties or even risk losing tax-exempt status. Additionally, those applying for an extension must do so through Form 8868, but this can only provide a temporary reprieve.

Filing methods

Today, organizations have several options for filing their Return of Organization Exempt Form. Many prefer online submission as it is quicker and allows for real-time validation of information. At pdfFiller, the streamlined submission process enhances efficiency, making it easier for organizations to complete their forms without errors.

By uploading the necessary documents, organizations can create a complete submission package with user-friendly tools that allow for checking accuracy and correcting mistakes effectively.

Detailed instructions for completing the form

Completing the Return of Organization Exempt Form requires itemized attention to each section of the form. Start by checking the organization's details, ensuring that the name matches exactly how it appears in IRS records. Next, accurately document financial information, including revenue, expenses, and changes in net assets, ensuring that the figures align with supporting financial statements.

Each section of the form must be filled accurately, as errors can lead to delays in processing or even penalties. Collaborating with accountants or legal professionals experienced in nonprofit filings can help organizations navigate these intricate sections.

Common mistakes to avoid

Navigating the complexities of the Return of Organization Exempt Form can lead to some common pitfalls. One prevalent mistake is providing incorrect or incomplete financial data, which can arise from relying on outdated statements or miscalculating figures. Additionally, failing to disclose related entities or potential conflicts of interest can cause major issues and might even trigger audits.

Reviewing the form thoroughly before submission is imperative. Establishing a checklist of common errors can help to ensure that the most critical details are captured and accurately reported.

Editing and collaborating

Leveraging pdfFiller's interactive tools allows for easy editing and collaboration when completing the Return of Organization Exempt Form. Users can make modifications quickly, add comments, or highlight areas that require further discussion or clarification within the document. These features enhance teamwork and ensure that all stakeholders have input before the final submission.

Collaboration can be particularly beneficial for organizations with multiple board members or accounting staff involved in the completion process. Utilizing pdfFiller's cloud-based platform ensures everyone has access and can contribute, regardless of their location.

After filing: what’s next?

Once the Return of Organization Exempt Form has been filed, organizations need to confirm that the IRS received their submission. Documentation of the submission, including a confirmation email or tracking number from the submitted form, should be retained for organizational records. This confirmation serves as proof of compliance and is crucial in the event of future inquiries or audits.

Understanding public inspection regulations is also vital, as filed forms must be made available for public inspection, contributing to transparency. This practice can enhance public trust but also necessitates a careful approach to what information is shared.

Penalties for non-compliance

Failure to file the Return of Organization Exempt Form not only jeopardizes compliance but can lead to severe consequences. Organizations that do not submit may face financial penalties, which can escalate depending on the length of delay. Furthermore, inaccurate filings can result in legal repercussions or audits from the IRS, which can be costly.

The ramifications extend beyond immediate fines; non-compliance can result in a loss of tax-exempt status altogether. Therefore, understanding the need for diligence in filing and accuracy is paramount for the health of any tax-exempt organization.

Variants of the Return of Organization Exempt Form

Understanding the different variants of the Return of Organization Exempt Form is essential to ensure organizations file appropriately based on their size and type. Larger organizations, typically with gross receipts over $200,000 or total assets exceeding $500,000, are required to file Form 990. Smaller organizations, however, might qualify for Form 990-EZ or Form 990-N (e-Postcard), simplifying their reporting obligations.

Organizations must assess their financial thresholds regularly, as growth in revenues might necessitate a change in the form being filed. Regular review ensures compliance and helps organizations maintain their tax-exempt standing.

Frequently asked questions about variants

Many organizations have common queries regarding the variants of the Return of Organization Exempt Form. A frequent question revolves around determining the right form to use. Organizations often wonder what the revenue thresholds are that dictate form eligibility. To clarify, organizations with gross receipts under $50,000 can file Form 990-N, while those exceeding this will likely need Form 990 or Form 990-EZ.

Additionally, understanding when changes in an organization’s size trigger the need for a different filing status can reduce compliance risks and penalties significantly.

Historical context and updates

The Return of Organization Exempt Form has undergone several iterations since its inception, reflecting the evolving landscape of compliance and oversight within the tax-exempt sector. Originally launched in the 1960s, the form has been updated frequently to include new requirements and streamline the filing process, maintaining its relevance as compliance expectations change.

Recent updates have focused on improving transparency and accountability, addressing the public's need for reliable information about how tax-exempt organizations operate and allocate resources.

Recent changes to consider

Staying abreast of the most recent changes to the Return of Organization Exempt Form is critical for compliance. The IRS regularly implements new guidelines and requirements that can affect how organizations need to report their activities, financial information, and general operations. For instance, formatting changes and the introduction of new supplemental schedules can significantly impact the filing process.

Failure to account for these changes can result in inaccuracies, which may elevate the risks of penalties or audits. Organizations must therefore cultivate a habit of regularly reviewing IRS updates and adapting their filing practices accordingly.

Special use cases

The Return of Organization Exempt Form also serves as a critical tool for charity evaluation and research purposes. By analyzing data submitted in the form, researchers, regulators, and the public can assess how organizations are utilizing their funding, their operational effectiveness, and the overall impact they have within the community.

Unique situations, such as organizational mergers or dissolutions, can warrant additional considerations when completing the form. It's essential for organizations entering these transitions to consult with experts who understand the nuances of filing under new conditions to avoid pitfalls.

Interactive tools and resources available on pdfFiller

At pdfFiller, users are equipped with a suite of interactive tools designed to simplify the filing process for the Return of Organization Exempt Form. These tools allow for intuitive editing, e-signing, and customizing forms while ensuring compliance with IRS guidelines. The platform's assistance in mitigating common errors empowers organizations to file with confidence.

Additionally, collaborative features ensure that teams can work together on the same document, making it easier to incorporate feedback from various stakeholders, track changes, and finalize submissions without confusion. This cooperative approach enhances overall accuracy and expedites the filing process.

Using pdfFiller to streamline the filing process

The ease of utilizing pdfFiller for the Return of Organization Exempt Form cannot be overstated. Users can upload existing documents to edit or create their form from scratch, benefiting from the platform's user-friendly interface. pdfFiller’s integration with cloud storage makes accessing documents straightforward, reducing the chances of losing vital information.

With built-in templates and the ability to adapt forms rapidly, organizations can submit compliant filings while saving significant time and resources. The platform supports personalized adaptations, ensuring each form submitted meets unique organizational needs.

Testimonials and success stories

Users frequently share their success stories when utilizing pdfFiller for their filing needs. Testimonials highlight how the platform has transformed the experience of managing the Return of Organization Exempt Form, offering efficiency and peace of mind. Many organizations appreciate the clarity and assurance pdfFiller provides when handling complicated documents—allowing them to feel confident in their compliance.

From small community groups to large nonprofit organizations, users report time savings and reduced anxiety surrounding the filing process. These endorsements bolster the platform's credibility, encouraging others to take advantage of its robust features.

Related forms and resources

Organizations looking into the Return of Organization Exempt Form should also familiarize themselves with other essential forms and resources associated with the tax-exempt landscape. Forms such as Form 990-T (for unrelated business income tax) and Form 1023 (application for tax-exempt status) are critical in ensuring comprehensive compliance across all operational aspects.

In addition, keeping guidelines established by the IRS for nonprofits readily accessible can further an organization’s understanding of compliance requirements, aiding in the preparation for potential audits or inquiries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my return of organization exempt directly from Gmail?

How can I send return of organization exempt to be eSigned by others?

Can I create an electronic signature for the return of organization exempt in Chrome?

What is return of organization exempt?

Who is required to file return of organization exempt?

How to fill out return of organization exempt?

What is the purpose of return of organization exempt?

What information must be reported on return of organization exempt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.