Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

A comprehensive guide to the Form 990

Understanding Form 990

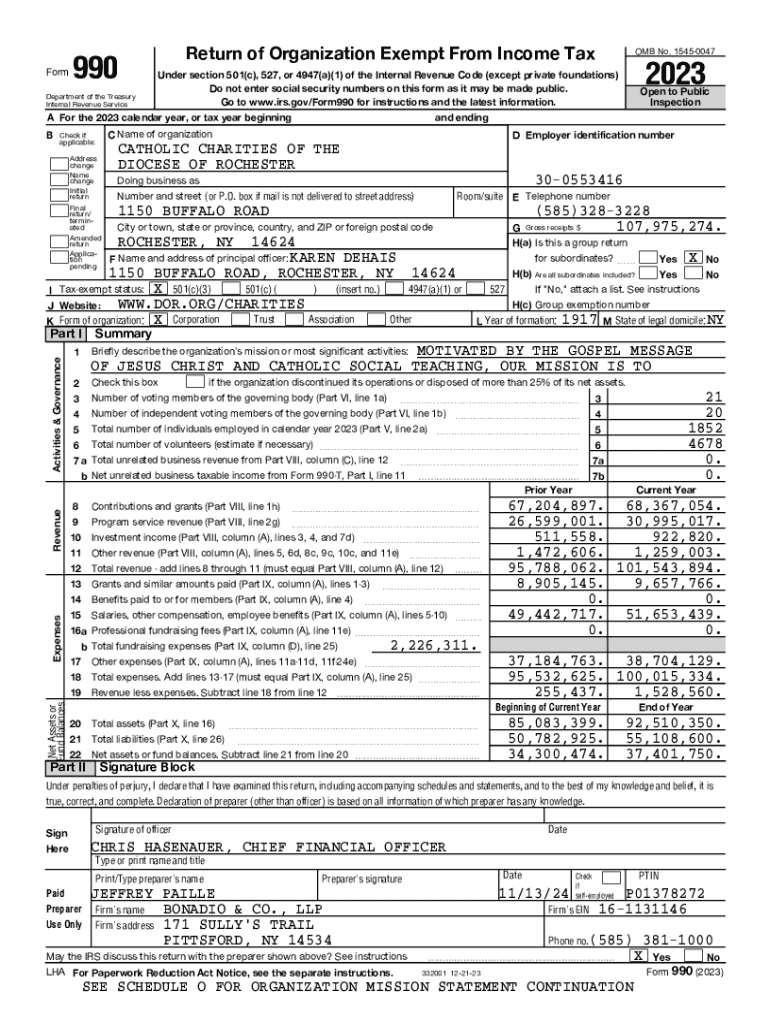

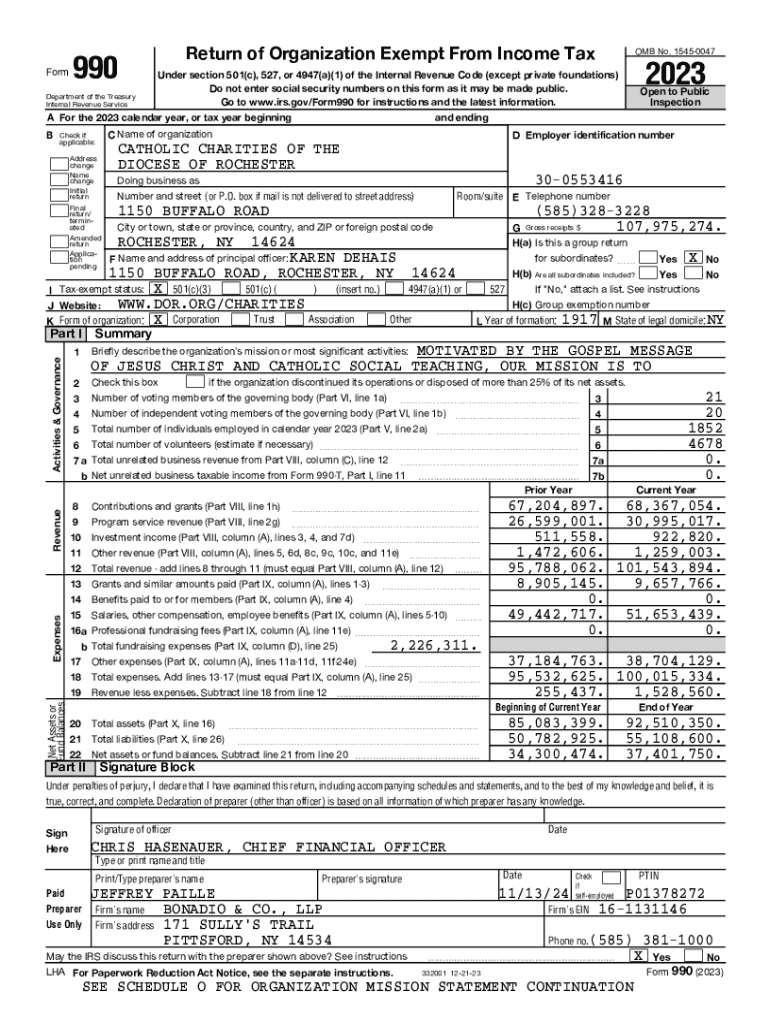

Form 990 is a crucial document required by the Internal Revenue Service (IRS) for specific tax-exempt organizations in the United States. It serves as an annual information return that provides transparency about a nonprofit’s financial status, adhering to public accountability standards. While its primary purpose is to ensure compliance with tax laws, it also serves as a vital tool for stakeholders interested in understanding the workings and financial health of nonprofit organizations.

Organizations required to file Form 990 include public charities, private foundations, and other tax-exempt entities that exceed certain revenue thresholds. The requirement helps maintain transparency in the nonprofit sector and provides a collective resource for funders and the public to assess organizational performance and governance.

Different variants of Form 990

Form 990 comes in several variations tailored to different types of nonprofits depending on size and financial activity. The primary forms include Form 990, which is the comprehensive return for larger organizations, and Form 990-EZ, a shorter version for small to mid-sized nonprofits. For very small organizations with gross receipts normally under $50,000, Form 990-N, commonly known as the e-Postcard, is available for simpler reporting.

Additionally, private foundations are required to file Form 990-PF, which focuses on their specific operational and distribution requirements. Choosing the correct version of Form 990 based on an organization’s financial standing is crucial. Organizations must assess their revenue and assets accurately to comply with IRS requirements efficiently and avoid penalties.

Key sections of Form 990

Form 990 is composed of several distinct sections that provide a comprehensive view of an organization’s activities. Each part serves a specific purpose to capture various aspects of nonprofit operations.

Filing requirements for Form 990

Organizations that are required to file Form 990 must meet specific criteria. Generally, nonprofits must file if they have gross receipts over $200,000 or total assets exceeding $500,000. However, certain organizations like churches are exempt from filing. Smaller organizations that do not meet these thresholds can use the e-Postcard version (Form 990-N) for reporting.

It’s essential to be aware of the minimum thresholds and the obligatory filing calendar. Nonprofits typically must file their Form 990 by the 15th day of the 5th month after the close of their fiscal year. With organizations operating on a calendar year, the due date becomes May 15. Missing the deadline can lead to significant penalties.

Filing modalities

When it comes to submitting Form 990, organizations have the choice between electronic and paper filing. Electronic filing is highly recommended as it offers several advantages, including immediate confirmation of the submission and reduced chances of clerical errors.

Using platforms such as pdfFiller streamlines the e-filing process by allowing organizations to fill, edit, and submit their forms digitally. Here’s a simple guide to help organizations file Form 990 through pdfFiller:

Common mistakes to avoid

Filing Form 990 can be complex, and it’s easy to make mistakes along the way. Common errors include incorrect reporting of revenues and expenses, failing to respond to all required questions, or omitting relevant schedules. Being mindful of these issues can save an organization from potential penalties.

Another frequent oversight is incomplete documentation. Always ensure that additional schedules, supporting documents, and financial statements are accurately prepared and attached. Before submission, it’s advisable to double-check all figures and answers to confirm they align with the organization’s records.

Understanding penalties and compliance

Organizations that fail to file Form 990 on time can face significant penalties from the IRS. The default penalties for late filings can range from $20 per day, up to a maximum of $10,000, depending on the organization’s size. Additionally, inaccurate filings can lead to further financial ramifications, including the risk of losing tax-exempt status, which is essential for nonprofit operations.

Ensuring compliance with all filing requirements not only protects the organization from penalties but also safeguards its reputation with stakeholders who rely on the information disclosed in the Form 990. Implementing a diligent filing process and maintaining updated records will significantly mitigate compliance risks.

Public inspection regulations

Form 990 filings are subject to public inspection, making them a vital resource for accountability in the nonprofit sector. Any member of the public can view an organization’s Form 990 through online databases or directly from the organization itself. This transparency fosters greater trust and confidence among donors and the community.

To locate specific Form 990 filings, platforms like GuideStar or the IRS’ own database can be utilized for accessing nonprofit documents. Organizations should embrace this public access, as it promotes ethical behavior and accountability, critical components in the nonprofit sector.

Using Form 990 for charity evaluation research

Form 990 serves as a rich source of data for evaluating the effectiveness and efficiency of nonprofit organizations. Donors can leverage the information contained within Form 990 to make informed giving decisions, ensuring their contributions support organizations committed to transparency and efficient service delivery.

Analytical tools and websites compile Form 990 information, making it easier for potential donors to assess various aspects such as program expenses, administrative costs, and overall financial performance. Even casual supporters can benefit from reviewing metrics and insights shared in Form 990 filings to ensure their funds are supporting worthy causes.

Historical context of Form 990

Form 990 has evolved significantly since its inception. Originally designed to provide tax-exempt organizations a means of reporting basic information, it has adapted to include more rigorous disclosure requirements and focus on accountability. The IRS regularly updates Form 990 to address changing societal expectations and regulatory frameworks within the nonprofit sector.

Recent amendments have introduced new schedules and expanded reporting requirements, compelling organizations to improve their transparency and governance structures. As the nonprofit landscape continues to evolve, staying informed about changes to Form 990 is imperative for compliance and effective tax-exempt status maintenance.

Advanced tips for managing Form 990

Managing Form 990 efficiently can significantly enhance an organization’s administrative workflow. Implementing best practices around document management will create efficiencies for organizations. Regular training on Form 990 requirements for staff involved in the filing process assures that everyone understands current compliance expectations.

Moreover, it is crucial to continuously monitor regulatory changes and ensure that the organization’s processes are aligned with any updates. Harbored in platforms like pdfFiller, document tracking tools can help organizations integrate Form 990 management into their workflows seamlessly.

Frequently asked questions

Many organizations have questions regarding Form 990 that can be critical to their compliance and operational effectiveness. Common inquiries include the specifics of which organizations must file, allowable exemptions, and how to access Form 990 data effectively. Additionally, some misconceptions persist about the ease and process of filling out and submitting this critical document.

Addressing these queries allows nonprofits to navigate the complexities of the IRS requirements more effectively. Resources, including the IRS website and nonprofit-focused information portals, offer further guidance on understanding Form 990. By demystifying the filing process, organizations can foster an environment of compliance and transparency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 990 to be eSigned by others?

How do I edit form 990 in Chrome?

How do I edit form 990 straight from my smartphone?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.