Get the free W-9

Get, Create, Make and Sign w-9

Editing w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9

How to fill out w-9

Who needs w-9?

W-9 Form: A Comprehensive How-To Guide

Understanding the W-9 form: An overview

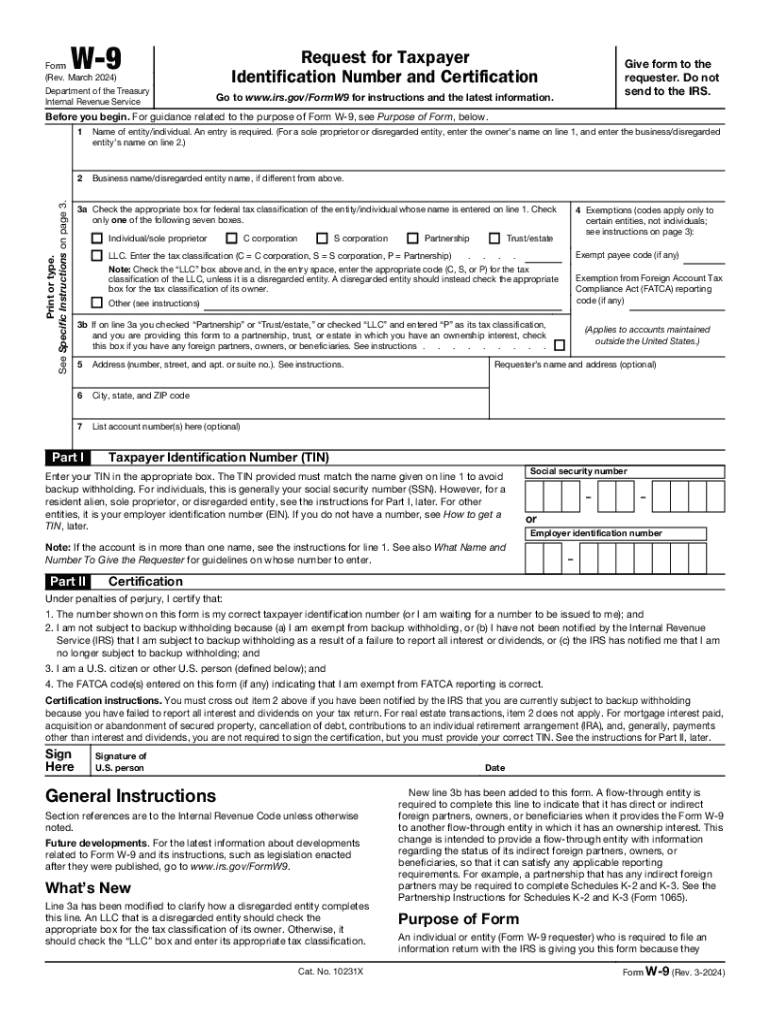

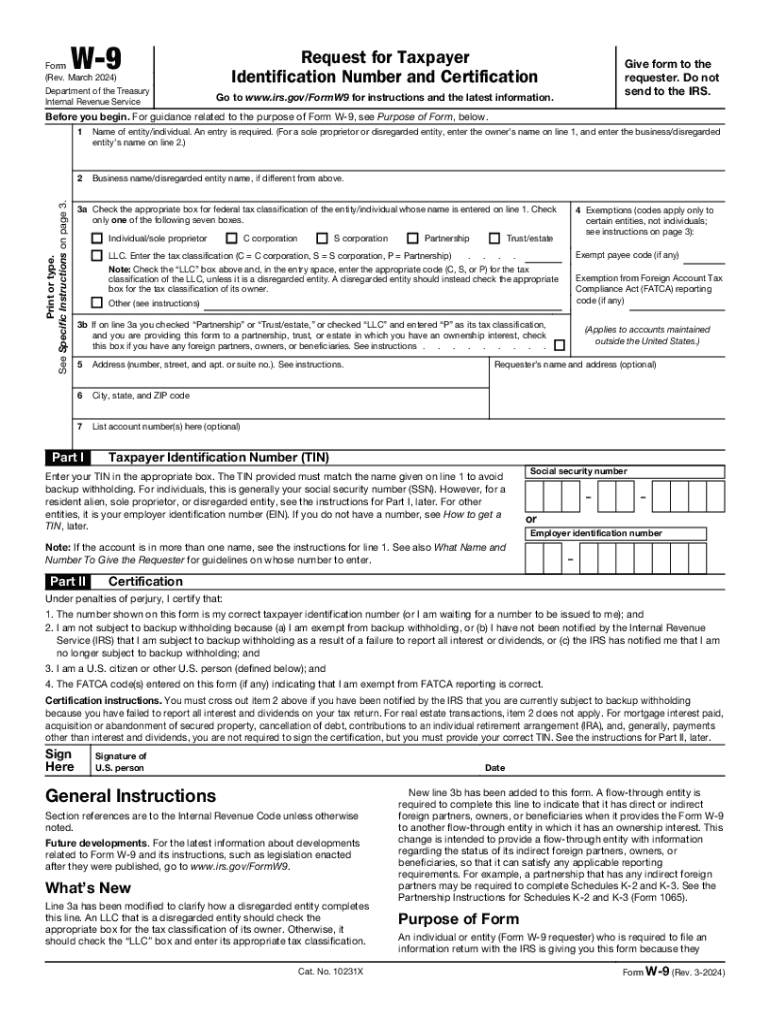

The W-9 form serves as a crucial tool in the U.S. tax system, allowing individuals and entities to provide their Taxpayer Identification Number (TIN) to the party asking for it. This form is particularly vital for freelancers, contractors, and businesses to report income to the IRS. Understanding its purpose and importance is the first step in ensuring compliance with tax regulations.

Filled out correctly, a W-9 form ensures that the payee, whether an individual or an organization, can receive payments without being subjected to backup withholding. Backup withholding is a tax withholding that applies when the IRS believes a taxpayer might not comply with tax laws. In this context, any contractor or business receiving payments should know who must complete a W-9 form and the various situations that require it.

Detailed breakdown of the W-9 form

The W-9 form comprises several key sections that need careful attention to detail. The first section requests personal information, including your name and address. This is followed by tax classification, where individuals and businesses can select the appropriate category under which they are taxed. Lastly, the certification requires a signature affirming the accuracy of the provided information.

Understanding the terminology used in the W-9 is equally significant. The IRS defines specific terms that hold weight in compliance and reporting. For instance, knowing the difference between an individual/Sole Proprietor and an LLC is essential for proper tax classification and avoids complications down the line.

How to fill out the W-9 form

Filling out the W-9 form accurately is paramount to ensuring smooth transactions with clients or payers. Begin by entering your name exactly as it appears on your tax return. If you operate a business under a different name, you will need to complete that next. Following that, select the appropriate tax classification from the options outlined on the form.

Next, fill in your current address, making sure it's accurate to avoid potential issues. An essential part of the form is providing your TIN, which is crucial for tax reporting purposes. This could be your SSN or EIN, depending on your business setup. Finally, affirm the accuracy of your entries by signing and dating the form.

Electronic W-9 submission process

Using digital tools to manage W-9 forms enhances efficiency and reduces redundancy. pdfFiller stands out as an excellent platform for creating and submitting W-9 forms. With pdfFiller, users can not only fill out forms but also edit and eSign them within a secure digital environment. This leads to greater convenience and easier document management.

To utilize pdfFiller, users can upload their W-9 forms, make necessary edits, and add eSignatures directly on the platform. Features designed for collaboration can also facilitate communication with clients or employers regarding the document. The digital format ensures that sensitive information is secured, making it safer than traditional methods of submission.

Filing and managing your W-9 form

Once your W-9 form is completed and submitted, it’s important to understand who should receive it. Typically, clients or companies that hire independent contractors will request a W-9 to ensure that tax reporting aligns. In situations involving multiple clients or varying payments, you may need to issue multiple W-9 forms, particularly if the information changes.

Proper record-keeping is crucial after submitting your W-9. It's recommended to keep a copy of the completed form for your records for at least four years after the submission. Organizing your documentation, categorizing by client or tax year, will streamline your processes and make future tax filing simpler.

Practical use cases for the W-9 form

The applications of the W-9 form are vast, particularly in business environments. One prominent case is in independent contractor arrangements. By providing a W-9, contractors enable businesses to document their relationship and facilitate accurate income reporting for tax purposes. This becomes pivotal when it comes to fulfilling IRS requirements.

Moreover, banks and financial institutions typically request a W-9 when customers attempt to open accounts or engage in new financial services, requiring assurance of taxpayer compliance. Understanding when and how to use the W-9 effectively can simplify tax reporting both for self-employed individuals and businesses alike.

The impact of not submitting a W-9 form

Failing to submit a W-9 form can have significant financial consequences. Businesses required to collect a W-9 from their contractors may face penalties from the IRS if they don’t obtain this form. Irs may impose backup withholding taxes—up to 24%—on payments made to payees without this necessary documentation. This can lead to confusion for contractors who later might have to pay the IRS accumulated taxes that they did not originally expect.

Moreover, the burden of resolving these discrepancies falls on the payee, making it crucial for consistent, accurate responses regarding IRS documentation. To avoid these complications, contractors should ensure that their W-9 forms are proactively submitted when requested by clients.

Frequently asked questions (FAQs) about the W-9 form

Mistakes can happen even with awareness. If you realize there’s been an error on your submitted W-9 form, you may re-submit a corrected version. It is essential, however, to inform the party who received your initial W-9 to ensure proper communication and updates in their records. Regular updates are recommended, especially if your business information changes or if you change to a different tax classification.

For foreign entities or individuals, the process may differ slightly as they should refer to specific IRS forms designed for non-U.S. persons, such as the W-8 family of forms. These forms communicate tax responsibilities and exemptions and ensure compliance without erroneously blending into W-9 protocols.

Additional insights on W-9 form usage

The W-9 form does not exist in isolation; it connects integrally with other tax forms, particularly the 1099 series. Businesses are required to report payments made to contractors using the 1099-MISC or 1099-NEC forms, which in turn require the information provided in the W-9. Understanding this flow ensures that businesses remain compliant with IRS guidelines and can accurately represent their expenses in tax filings.

Recent updates from the IRS emphasize the importance of keeping W-9 information current, especially in light of digital transformations in document handling. Being proactive about changes to tax laws related to W-9 requirements can significantly benefit businesses and freelancers alike.

External links and resources

The IRS provides comprehensive guidelines on the W-9 form, including instructions on proper completion and updates on compliance protocols. For additional support, tax preparation tools and resources can assist in maintaining documentation and ensuring compliance. Consider exploring platforms that specialize in electronic documentation handling, such as pdfFiller, to streamline your form management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute w-9 online?

Can I create an electronic signature for signing my w-9 in Gmail?

How do I complete w-9 on an iOS device?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.