Get the free Personal Financial Statement

Get, Create, Make and Sign personal financial statement

How to edit personal financial statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out personal financial statement

How to fill out personal financial statement

Who needs personal financial statement?

Personal Financial Statement Form - A How-to Guide

Understanding the personal financial statement

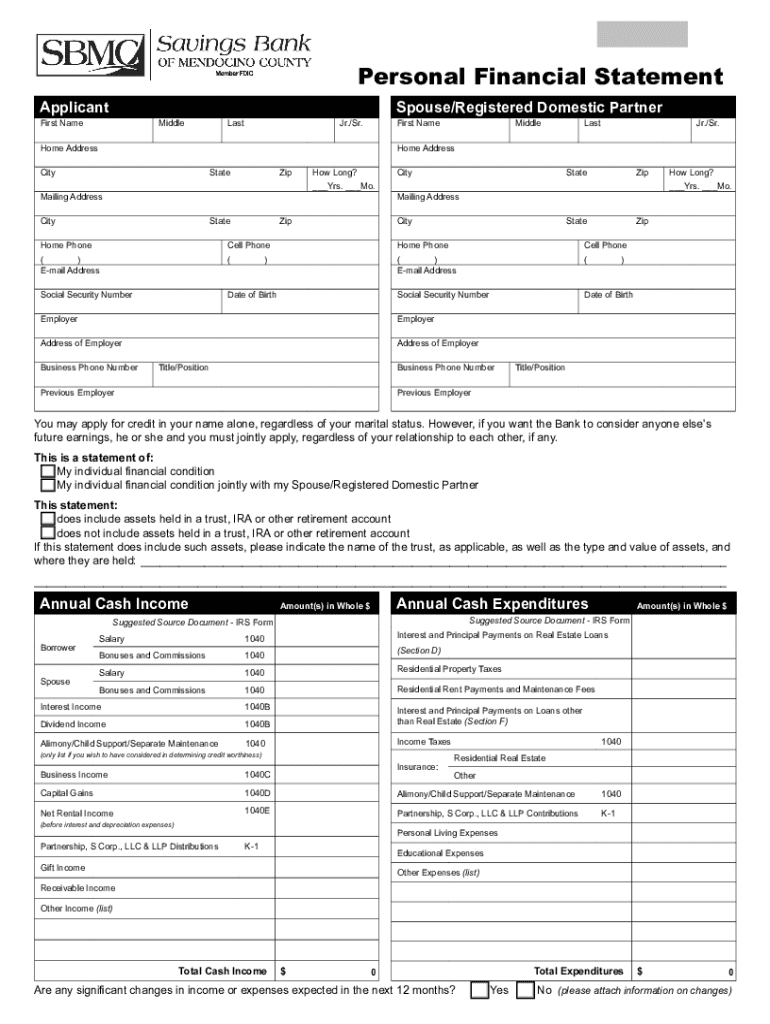

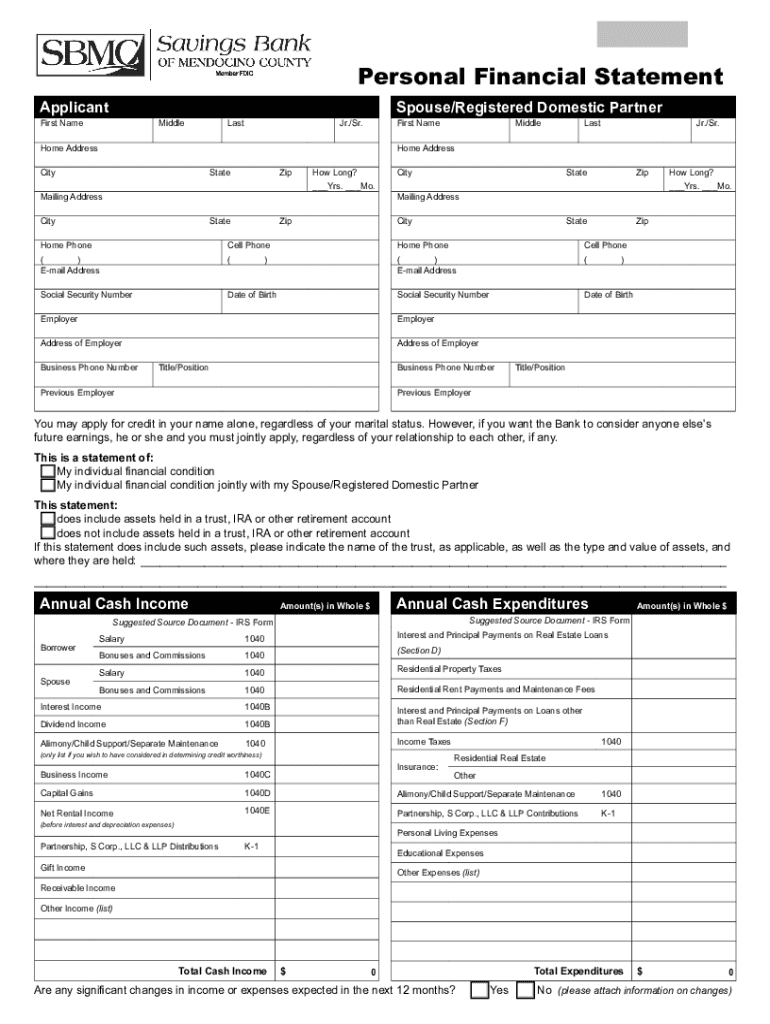

A personal financial statement is a crucial document that provides a snapshot of an individual's financial health. Its primary purpose is to summarize an individual's assets, liabilities, and net worth at a specific point in time. By compiling this information, individuals can gain insights into their financial status, which is critical for various financial transactions.

Accurate representation is essential when creating a personal financial statement. Misstating financial details can lead to negative implications, such as loan denials or unfavorable leasing terms. Furthermore, this document is commonly used in several scenarios including applying for mortgages, renting properties, and during financial planning consultations.

Key elements of a personal financial statement

A personal financial statement comprises several key elements, primarily assets and liabilities. Understanding these components is vital for calculating net worth accurately.

Assets

Assets are resources owned by an individual that carry economic value. They fall into several categories, including cash, investments, and real estate. To assess the value of these assets accurately, individuals may use various valuation methods. For example, cash can be totaled as is, while investments may require market evaluations based on current prices.

Liabilities

Liabilities represent the debts or obligations an individual owes to others. This can include credit card debts, personal loans, and mortgages. Understanding the different types of liabilities is crucial for calculating total liabilities, which is the sum of all outstanding debts.

Net worth calculation

To compute net worth, use the formula: Net Worth = Total Assets - Total Liabilities. This calculation is pivotal, as net worth offers a clear indication of financial health. A positive net worth signifies financial security, while a negative net worth can indicate financial challenges.

Step-by-step guide to filling out your personal financial statement form

Filling out a personal financial statement form can seem daunting, but breaking it down into manageable steps makes the process more accessible.

Step 1: Gathering required information

Begin by collecting all necessary documentation. This typically includes:

Step 2: Entering personal information

Provide your full name, contact information, and date of birth. This information identifies you and contextualizes your financial data effectively.

Step 3: Documenting assets

List each asset separately, including cash, real estate, or investments. For each asset, include details such as value, ownership percentages, and location. The clarity here is crucial for an insightful financial review.

Step 4: Listing liabilities

Summarize your debts. Specify the type of liability, its total amount, and the breakdown of monthly payments. This thoroughness will aid in accurately calculating your net worth.

Step 5: Calculating and reporting your net worth

With your total assets and liabilities documented, calculate your net worth using the previously mentioned formula. Understanding this figure is essential for financial assessments, and it also provides a baseline for setting future financial goals.

Editing and customizing your personal financial statement form

Once you have your personal financial statement populated, you may find areas that require adjustments. pdfFiller offers robust editing tools that allow you to make changes swiftly and accurately. Users can modify text, adjust numbers, or even format sections for clarity.

In addition to editing, sharing your document is seamless with pdfFiller. The platform allows collaborative features, enabling you to seek feedback from financial advisors or trusted family members before finalizing your statement.

eSigning your personal financial statement form

The importance of a signature on financial documentation cannot be overstated. An eSignature not only validates the document but also serves a legal purpose. pdfFiller simplifies this process through a secure eSigning feature.

The step-by-step process for eSigning includes uploading your document, adding your signature, and saving it securely. Security features in pdfFiller ensure your signed documents are protected, giving you peace of mind.

Managing your personal financial statement online

Managing your personal financial statement online offers significant advantages. Utilizing cloud storage, you can access your document anywhere, anytime, making it easier to keep your finances organized.

Storage options

Cloud storage benefits are numerous. It allows for secure document preservation, automatic backups, and easy sharing options. As your financial circumstances evolve, having easy access to your personal financial statement ensures that you can make timely updates.

Future updates

Regularly updating your personal financial statement is vital. Set reminders to revisit your information quarterly or biannually. Quick tips for maintaining current data include snapping photos of new investment statements or saving updated loan documents directly into your cloud storage.

Common mistakes to avoid when completing your personal financial statement

When filling out a personal financial statement, it’s essential to avoid several common pitfalls. One of the most significant mistakes is failing to update your information regularly. Stagnant data can misrepresent your financial situation.

Additionally, inaccuracies in values due to poor documentation can lead to an unreliable statement. Always ensure that figures are verified against physical statements and records. Lastly, omitting critical liabilities or assets compromises the integrity of your financial snapshot.

FAQs about personal financial statements

As you navigate your personal financial statement, you may have several questions. For instance, if your income or expenses fluctuate monthly, it's best to average them out over a period and note this when presenting your statement.

Many recommend reviewing your personal financial statement at least annually to capture significant life events or changes in financial circumstances. Moreover, while personal financial statements are generally for individual use, they can also be adapted for business purposes if you’re self-employed or a business owner.

Additional features of pdfFiller for personal financial management

pdfFiller offers outstanding tools for financial planning and management. Users can take advantage of templates designed for various financial situations, ensuring that all personal information remains organized and accessible.

Furthermore, pdfFiller's collaborative features allow users to engage others in their financial planning. Whether you need to consult with family members or financial advisors, sharing documents is straightforward and secure, enhancing the planning process significantly.

Conclusion: The role of a personal financial statement in your financial health

A personal financial statement serves as a cornerstone of understanding your financial health. By accurately documenting your assets, liabilities, and net worth, you create a valuable tool for both immediate and long-term financial planning.

Utilizing pdfFiller for the management of your personal financial statement ensures a user-friendly approach, allowing for seamless editing, eSigning, and updates. Harness the capabilities of pdfFiller to foster financial insight and stability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send personal financial statement to be eSigned by others?

How do I edit personal financial statement online?

How do I fill out personal financial statement using my mobile device?

What is personal financial statement?

Who is required to file personal financial statement?

How to fill out personal financial statement?

What is the purpose of personal financial statement?

What information must be reported on personal financial statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.