Get the free Fiduciary Income Tax Return

Get, Create, Make and Sign fiduciary income tax return

How to edit fiduciary income tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fiduciary income tax return

How to fill out fiduciary income tax return

Who needs fiduciary income tax return?

Fiduciary Income Tax Return Form - How-to Guide

Overview of fiduciary income tax return

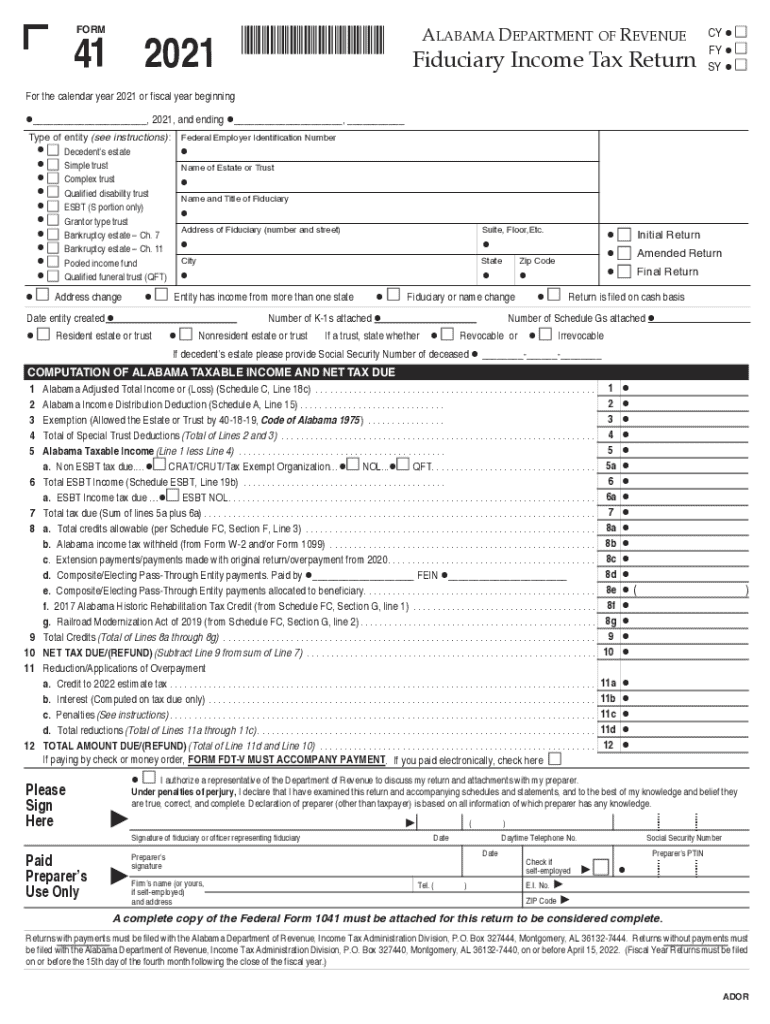

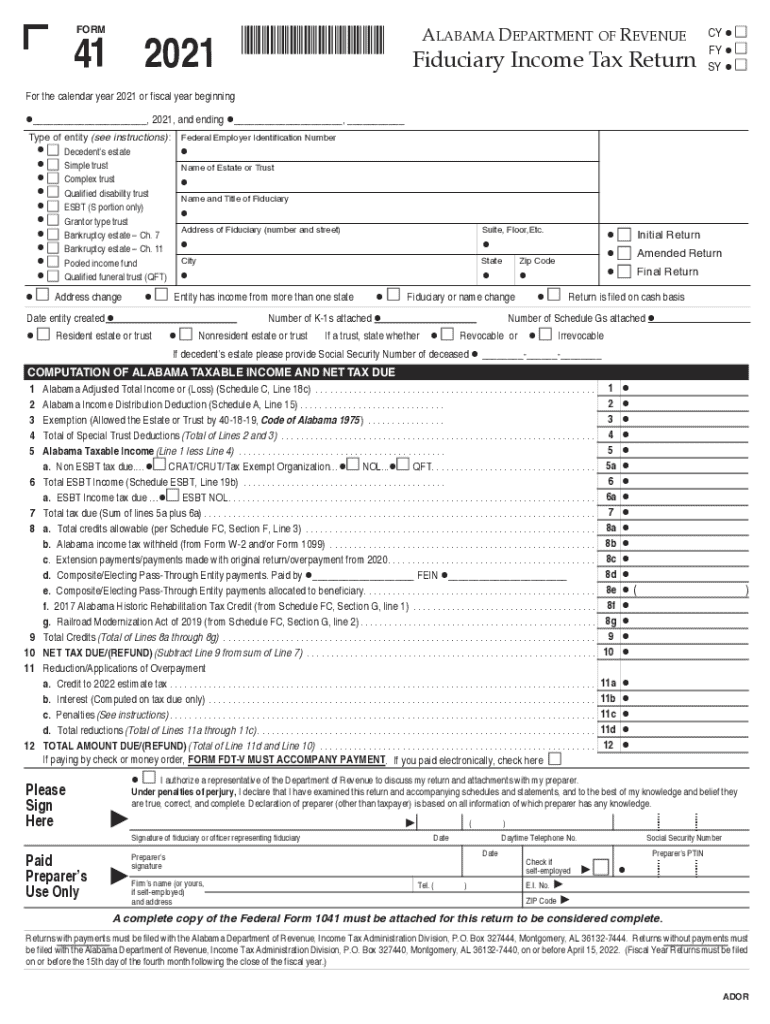

The fiduciary income tax return form, commonly referred to as IRS Form 1041, is utilized by estates and trusts to report income, deductions, and calculate the tax liability associated with the income generated by the trust or estate. This form is essential for ensuring compliance with federal tax regulations and allows fiduciaries to appropriately distribute taxable income to beneficiaries.

Accurate filing of fiduciary income tax returns is crucial as it affects not only tax obligations but also the financial well-being of the trust or estate. Misreporting income or deductions can lead to audits, penalties, and unfavorable tax consequences. Understanding the requirements and structure of this form can significantly streamline the process, thereby helping fiduciaries manage the financial aspects of the estate or trust effectively.

Key components of the fiduciary income tax return form

The fiduciary income tax return form consists of several critical sections that must be accurately completed to ensure compliance and proper tax reporting. Primarily, this involves reporting income, relevant deductions and expenses, and calculating the tax liability. Each part presents unique challenges and demands thorough attention to detail.

Income reporting includes interest, dividends, rental income, and capital gains, all of which must be meticulously documented. The deductions section allows fiduciaries to claim expenses directly associated with the production of income, such as management fees and other eligible expenditures. The tax computation section uses figures from the income and deductions sections to determine the overall tax payable.

Additionally, fiduciaries must ensure they correctly understand and complete Schedule K-1, which is issued to beneficiaries to report their portion of the trust's income on their personal tax returns. Each K-1 must be accurate and timely to avoid complications with beneficiaries’ personal filings.

Who needs to file a fiduciary income tax return?

Filing requirements for fiduciary income tax returns differ between trusts and estates. Primarily, any estate generating gross income of $600 or more must file Form 1041. For trusts, the necessity to file also generally hinges on income thresholds, with special rules applying to different types of trusts.

There are some exceptions. For example, certain irrevocable trusts or those complying with specific tax rules may not be required to file, depending on their structure and income. It’s also important to note that even if filing isn’t required, certain strategical tax advantages could prompt an advisable filing.

Filing deadlines and important dates

The standard deadline for filing the fiduciary income tax return is April 15 for calendar-year estates and trusts. If April 15 falls on a weekend or holiday, the due date moves to the next business day. It is crucial for fiduciaries to be aware of this deadline to avoid penalties.

Fiduciaries can apply for a six-month extension, which must be requested using Form 7004, to file the return by September 30. However, this extension does not grant additional time to pay any taxes owed by the original due date. Failure to file on time may lead to significant penalties for both the fiduciary and the estate or trust.

Step-by-step guide to filling out the form

Filling out the fiduciary income tax return form can be complex, but following a structured approach simplifies the process. Start by gathering necessary documentation, including financial statements, prior tax returns, and records of income generated by the estate or trust. Proper documentation forms the backbone of an accurate tax return.

In the income section, report all sources of income associated with the trust or estate. This includes interest, dividends, and profits from asset sales. Each income type has distinct reporting requirements, so accuracy is paramount. Next, move on to claiming deductions by identifying eligible expenses that relate to the administration of the trust or estate. This section often requires careful review to ensure all qualifying deductions are captured.

Completing the tax computation section comes next, where the total income and deductions are used to calculate the taxable income. Finally, the return must be signed and submitted, ensuring all paperwork is filed correctly and on time to avoid potential delays or penalties.

Common mistakes to avoid

Filing fiduciary income tax returns can be fraught with errors that compromise accuracy and compliance. Some common mistakes include inaccuracies in income reporting, such as failing to report untaxed interest or dividend income. This can lead to underreporting tax obligations, exposing the fiduciary and estate to audits.

Another frequent mistake is overlooking deductions or credits that could reduce tax liability. Beneficiaries may also be inadvertently affected if their income from the trust is misreported due to clerical errors. Finally, ensure the return is properly signed and dated, as missing signatures can delay processing and acceptance by the IRS.

Tools and resources for managing fiduciary income tax returns

pdfFiller provides an array of interactive tools designed to assist with completing fiduciary income tax return forms efficiently. For instance, users can utilize PDF editing features to directly input information, add necessary signatures, and make corrections where needed. The eSignature capability allows for secure electronic signing, streamlining the process for multiple parties involved.

Additionally, collaboration tools within pdfFiller enable teams managing trusts and estates to work together effectively, sharing document access and making real-time edits. This fosters a transparent process that mitigates mistakes while ensuring all contributors can access relevant documentation from anywhere.

How to edit and manage your fiduciary income tax return form

Using pdfFiller to manage your fiduciary income tax return forms provides significant advantages. This platform facilitates efficient document management, enabling users to edit, save, and organize forms with ease. By offering cloud-based access, pdfFiller ensures that users can retrieve their return forms from any location, thus enhancing convenience and flexibility.

Editing options are abundant; users can modify text, add annotations, and insert images or logos where necessary. The ability to save different versions of the document allows for easy tracking of changes and revisions, promoting administrative efficiency and regulatory compliance.

FAQs about fiduciary income tax returns

Frequently asked questions (FAQs) regarding fiduciary income tax returns cover essential concerns. One common question is, 'What happens if I miss the filing deadline?' In such cases, it’s critical to file as soon as possible to minimize penalties and interest on unpaid taxes.

'How do I amend my fiduciary income tax return?' is another prevalent inquiry. Amending a return involves filing Form 1041-X, which allows fiduciaries to correct mistakes made on the original filing. Finally, beneficiaries frequently ask about the tax implications for them; understanding that they are responsible for including their K-1 income on their own personal tax returns is vital.

Contacting support for assistance

Obtaining support when completing a fiduciary income tax return can be crucial for accuracy and compliance. Users can reach out to the pdfFiller customer support team for tailored guidance on form-related inquiries. With a range of resources available on the pdfFiller website, users can access informational articles, guides, and FAQs designed to enhance understanding of the fiduciary income tax return process.

Furthermore, engaging with support staff helps clarify specific questions or concerns regarding individual circumstances, ensuring that fiduciaries have the information necessary to complete their tax returns efficiently.

Recent changes in fiduciary tax regulations

Tax regulations pertaining to fiduciary income tax returns occasionally undergo updates that can impact filing requirements and tax liabilities. For the current tax year, it is advisable for fiduciaries to stay informed about any legislative changes that might affect income reporting, deductions, and credits.

Keeping abreast of new developments in tax regulations is crucial as changes can arise due to updates in tax law or adjustments made by the IRS. Such changes could result in modified thresholds for filing or shifts in deduction eligibility, necessitating careful review prior to preparing annual tax returns.

State-specific filing information

In addition to federal filing requirements, fiduciaries must adhere to specific state regulations that govern fiduciary income tax returns. Different states may impose varying rules regarding income thresholds, exemptions, and formats for filing, which adds another layer of complexity to the process.

Resources for researching state-specific requirements are available through state tax authorities and web platforms like pdfFiller. Tracking these variations ensures fiduciaries remain compliant with both federal and state regulations, comprehensively averting legal complications.

Related information and resources

To support fiduciaries in navigating the complexities of tax preparation and filing, pdfFiller offers links to relevant governmental resources, including IRS guidelines, and specialized articles focused on trust and estate management. Users benefit from the extensive collection of guides and tools that pdfFiller curates to streamline the process of tax preparation.

By accessing these resources, fiduciaries can enhance their understanding and ensure they are well-informed about their responsibilities and options when it comes to fiduciary income tax returns.

Popular searches and quick links

Common queries about fiduciary income tax returns often include topics such as filing extensions, amending returns, and understanding income distribution among beneficiaries. Quick access to tools and templates available on pdfFiller facilitates efficient processing of these tax documents.

Utilizing quick links to relevant forms, filing guides, and step-by-step instructions allows users to expedite their fiduciary income tax return preparations, ensuring compliance with tax regulations while minimizing stress and potential errors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send fiduciary income tax return for eSignature?

How do I execute fiduciary income tax return online?

Can I create an eSignature for the fiduciary income tax return in Gmail?

What is fiduciary income tax return?

Who is required to file fiduciary income tax return?

How to fill out fiduciary income tax return?

What is the purpose of fiduciary income tax return?

What information must be reported on fiduciary income tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.