Get the free Fr Y-6

Get, Create, Make and Sign fr y-6

Editing fr y-6 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fr y-6

How to fill out fr y-6

Who needs fr y-6?

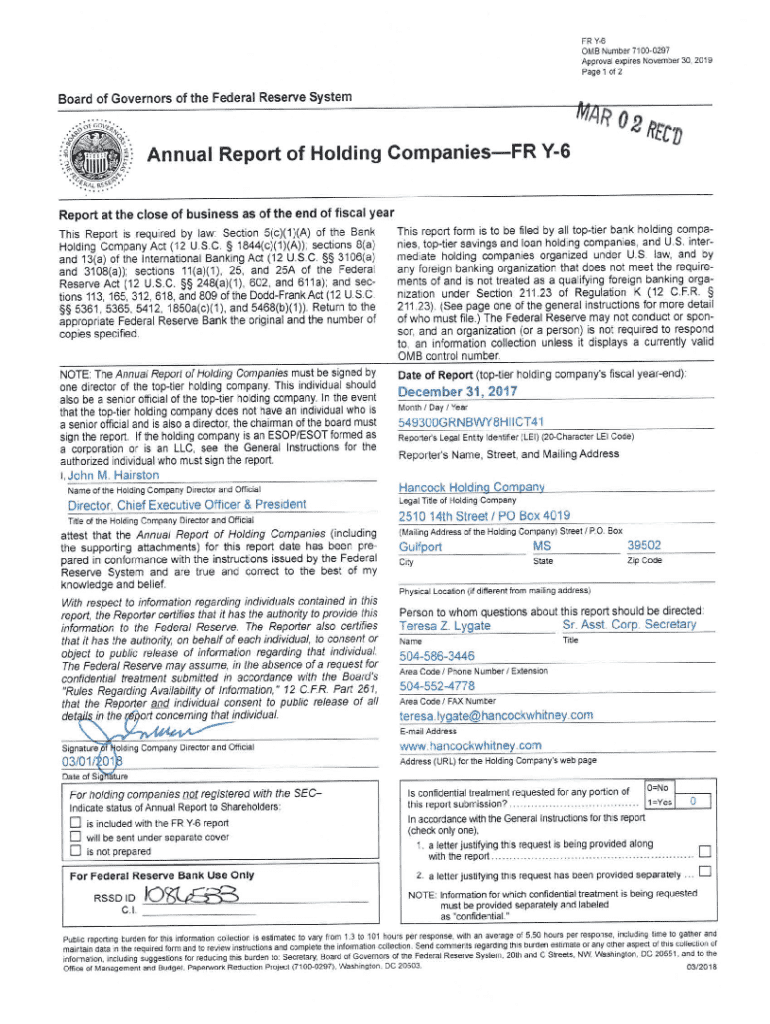

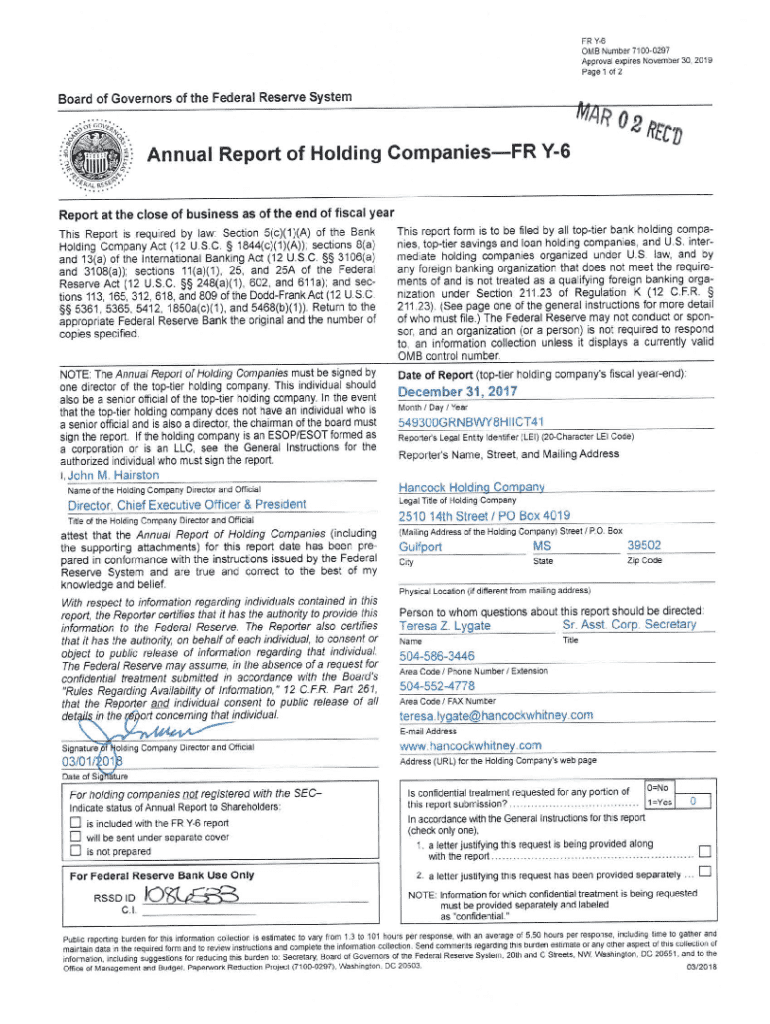

A comprehensive guide to the FR Y-6 form

Understanding the FR Y-6 form

The FR Y-6 form serves as a vital tool in the financial sector, designed to collect essential information about bank holding companies. This form is a regulatory requirement enforced by the Federal Reserve, aimed at promoting transparency within the financial system. By enabling regulators to assess and monitor risk factors within financial institutions, it plays a significant role in maintaining the integrity of the banking industry.

The importance of the FR Y-6 form extends beyond mere compliance; it represents a mechanism for oversight that supports the overall stability of the economy. For financial institutions, timely reporting through this form not only ensures compliance but also fosters trust with regulators and stakeholders.

Who needs to file the FR Y-6 form?

Generally, all bank holding companies with total consolidated assets of $100 million or more are required to file the FR Y-6 form on an annual basis. This includes not just larger institutions but also smaller entities that fall under this threshold. It's essential to understand that there are specific exceptions, notably for certain community banks which may be exempt from the reporting requirements.

Additionally, institutions must consider special circumstances. For example, those that are private or limited-purpose bank holding companies may have different filing requirements. Ensuring that the right entity files the form is crucial for maintaining regulatory compliance.

Purpose and relevance of the FR Y-6 form

The regulatory framework surrounding the FR Y-6 form is established to safeguard the financial ecosystem. It ensures that the Federal Reserve has access to critical data regarding the structure and ownership of bank holding companies, which is essential to assess systemic risk and financial stability. Non-compliance with these regulations can lead to severe penalties, including fines and other repercussions that can impact an institution's operations.

For stakeholders, this form not only serves as a reporting tool but also as a means to evaluate the health and governance of financial institutions. Accurate and timely submission of data helps regulators ensure that institutions are following safe practices, which ultimately benefits the industry as a whole.

Detailed breakdown of the FR Y-6 form

The FR Y-6 form consists of various sections, each requiring distinct sets of data. These include basic identifying information about the holding company, management structure details, and financial performance indicators. Specifically, the form requests information on ownership interests, executive officer details, and financial statements.

Common errors in completing the FR Y-6 can lead to significant ramifications. A few mistakes frequently encountered include incorrect data entry, failure to report changes in management, and omissions of required sections. To avoid these pitfalls, institutions should establish a thorough review process before submission and ensure that all team members are aware of requirements specific to their roles.

Step-by-step instructions for filling out the FR Y-6 form

Filling out the FR Y-6 form requires meticulous attention to detail. The first step is gathering necessary information, which may include previous submitted forms, financial statements, and details regarding corporate structure. Organizations can utilize checklists to ensure no necessary documentation is overlooked.

Next, complete each section of the form with thoroughness. Each part demands particular data, which can include executive names, shareholding percentages, and committee structures. Best practices suggest that data is entered carefully, using consistent terminology to avoid confusion.

Finally, engage in a comprehensive review and validation process. This means double-checking all entries against collected data, ensuring that totals match and confirming that all required sections are complete. There are online tools available to assist in validating form accuracy before final submission.

Tools for managing the FR Y-6 form

Utilizing a platform like pdfFiller can streamline the management of the FR Y-6 form significantly. This online service offers various features, including editing, filling forms, and storing documentation securely in the cloud. Users can easily navigate through the form, making real-time edits and including electronic signatures as necessary.

Moreover, pdfFiller’s collaboration features allow multiple team members to work on the FR Y-6 form simultaneously. This can enhance efficiency and ensure all required insights are incorporated seamlessly. The e-signature capabilities further facilitate an accelerated submission process, ensuring timely compliance with regulatory deadlines.

Submission process for the FR Y-6 form

Once the FR Y-6 form is completed, the next phase involves submission. Institutions can submit the form electronically through the Federal Reserve’s online platform, or they can choose to mail hard copies to the appropriate regulatory body. It is crucial to adhere to specific deadlines, typically at the end of the fiscal year, to ensure compliance.

After submission, institutions should anticipate possible follow-up inquiries or necessary clarifications. Being prepared for these interactions is vital; organizations should keep documentation organized for reference and prepare to provide additional context around the information submitted.

Common questions about the FR Y-6 form

Frequently asked questions about the FR Y-6 form often revolve around specific filings, applicable deadlines, and data requirements. For instance, many institutions wonder about the implications of failing to submit on time or what to do if they discover inaccuracies after filing. It is advisable for organizations to consult the Federal Reserve's guidelines or professional advisory services for additional clarity.

Additionally, several resources can provide further guidance, including webinars, training sessions, and format guidelines from the Federal Reserve itself. Engaging with various informational platforms can empower organization members to stay informed about the nuances of filing the FR Y-6 form.

Staying current with regulatory changes

In the ever-evolving regulatory landscape, staying updated regarding changes related to the FR Y-6 form is essential for compliance. Financial institutions should actively monitor updates from the Federal Reserve which may affect submission requirements, including filing frequencies or data specifications.

Adopting best practices for compliance is also critically important. This can involve regularly reviewing internal processes for document management, employing tools such as pdfFiller to efficiently update records, and providing training sessions for staff on updated filing protocols. Establishing a robust compliance culture reinforces the importance of adhering to regulatory expectations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my fr y-6 in Gmail?

How do I fill out the fr y-6 form on my smartphone?

Can I edit fr y-6 on an iOS device?

What is fr y-6?

Who is required to file fr y-6?

How to fill out fr y-6?

What is the purpose of fr y-6?

What information must be reported on fr y-6?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.