Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

A comprehensive guide to credit card authorization forms

Understanding credit card authorization forms

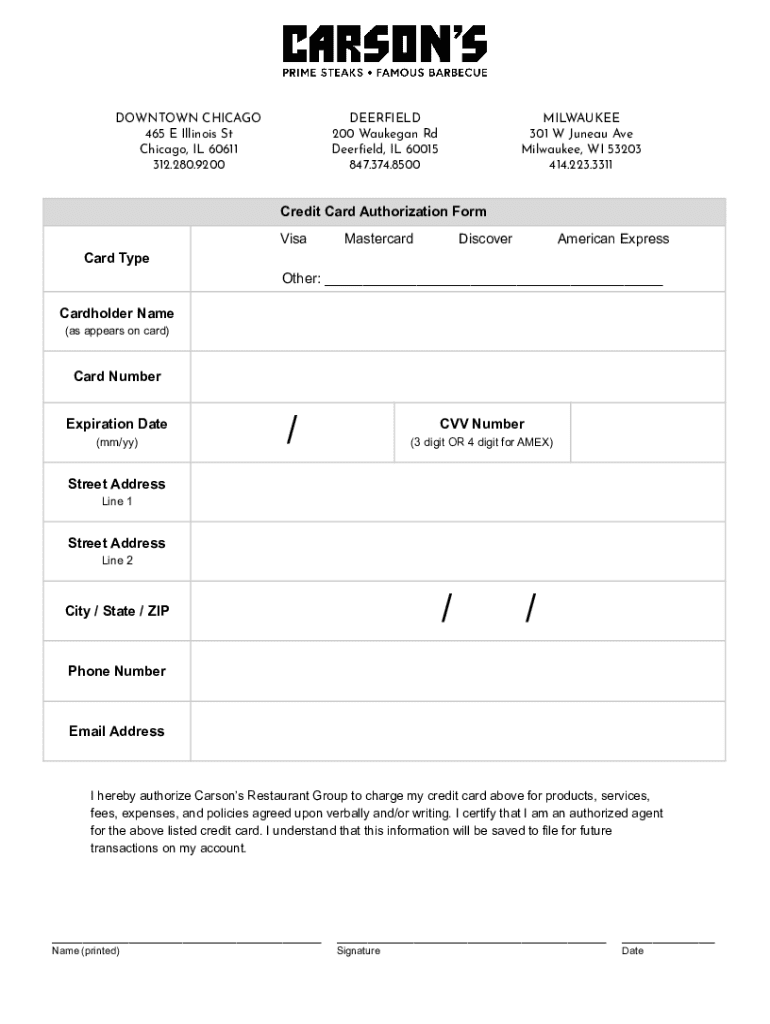

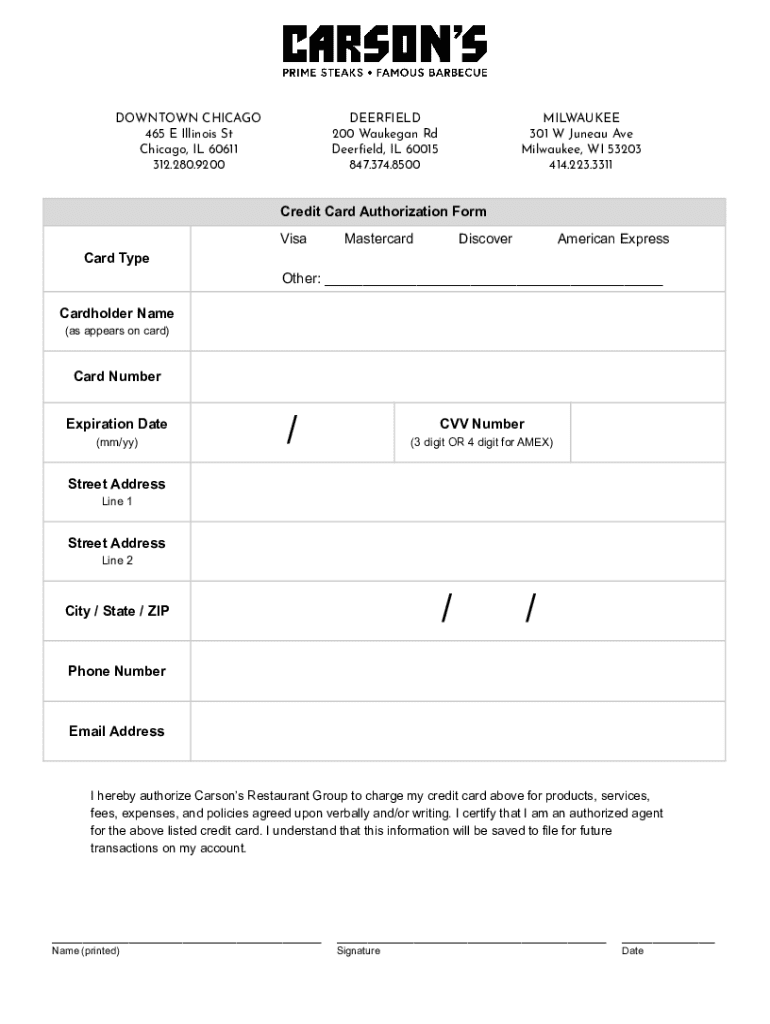

A credit card authorization form is a vital document used by businesses to obtain permission from customers to charge their credit cards for goods or services. This form serves multiple purposes, primarily acting as a safeguard against unauthorized charges for both parties involved in a transaction. For businesses, it's essential for confirming that the customer has agreed to the purchase, while for consumers, it provides a record of their consent.

The importance of credit card authorization forms cannot be overstated in the world of electronic payments. They help establish trust between vendors and consumers and play a crucial role in minimizing disputes related to unauthorized transactions. Certain situations, such as recurring billing, online purchases, or services requiring upfront payments, often necessitate the use of this form.

Key components of a credit card authorization form

A comprehensive credit card authorization form includes several key components that ensure both security and clarity. Essential information collected typically comprises:

Optional information can enhance security and accountability, such as the cardholder's signature and the date of authorization. Each component serves a specific purpose, reinforcing the legitimacy of the transaction and maintaining detailed records of consent.

Legal considerations and compliance

While not every business is legally obligated to use a credit card authorization form, utilizing one can significantly bolster legal defenses in the case of disputes. Various laws govern electronic transactions, such as the Fair Credit Billing Act (FCBA) and the Payment Card Industry Data Security Standard (PCI DSS), ensuring protection for both consumers and merchants.

Moreover, understanding chargeback protections is crucial. If consumers dispute a charge, having a signed authorization form provides evidence that they agreed to the transaction. Including specific terms within the form can also clarify the process and help avert misunderstandings.

How to fill out a credit card authorization form

Filling out a credit card authorization form may seem straightforward, but precision is vital. Here’s a step-by-step guide:

For maximum accuracy, using a digital solution like pdfFiller can streamline the process, allowing for easy editing and corrections.

Best practices for using credit card authorization forms

To enhance the security of transactions involving credit card authorization forms, certain best practices should be followed. First and foremost, implementing security measures to protect card information is critical. This includes encrypting forms, utilizing secure servers, and limiting access to sensitive data.

Proper storage and record-keeping are also important. Authorized forms should be securely stored, whether digitally or physically, with access restricted to authorized personnel only. As a rule of thumb, it’s recommended to retain signed forms for a period of 12 months, after which they should be securely disposed of to prevent any potential misuse.

When to use a credit card authorization form

There are several situations where a credit card authorization form is not only advantageous but often necessary. Common scenarios for sellers include one-time transactions, particularly in e-commerce, or when setting up recurring billing for subscription services.

Special cases may arise, such as pre-authorizations for hotels or car rentals, where a hold is placed on the card before the final charge. Additionally, understanding card-not-present (CNP) transactions is crucial; since the cardholder is not physically present, the risk of fraud increases, making a signed authorization form vital.

Common issues and FAQs

Credit card authorization forms can help prevent chargeback abuse by providing proof of consent from the cardholder. However, what happens if an authorization is denied? It’s crucial to contact the issuing bank for clarification as there may be issues with insufficient funds or discrepancies in provided information.

In some cases, you might notice that a particular credit card authorization form doesn’t include a space for CVV. It’s important to understand that while requesting CVV is a standard security measure, not all forms require it based on the specific nature of the transaction. Another related concept is 'card on file,' which denotes an arrangement where payment information is stored for future transactions, facilitating recurring payments without the need for repeated authorization.

Using pdfFiller for your credit card authorization forms

Utilizing pdfFiller can greatly simplify the process of creating and managing credit card authorization forms. One significant benefit is the ability to edit and sign forms online, which enhances convenience for both businesses and consumers.

The platform features cloud-based access, allowing users to retrieve and manage their documents from anywhere. Interactive editing tools ensure modifications can be made quickly, and eSigning capabilities streamline the authorization process. Creating your own authorization form using pdfFiller is straightforward, providing a user-friendly interface for customizing forms to fit your business needs.

Helpful resources and templates

For those looking to get started with credit card authorization forms, downloadable templates are available, facilitating ease of use and compliance. These templates not only save time but also provide a reliable starting point that can be customized to meet specific requirements.

To deepen your understanding, consider exploring related articles and whitepapers on electronic payment processing, security measures, and customer data compliance. Subscribing for updates can also keep you informed about new features and options available through platforms like pdfFiller.

Explore further

For an enriched experience, delve into other articles related to payment processing and security. Finding comprehensive business solutions for effective document management can contribute to more streamlined operations, making your financial transactions smoother and more secure.

Additionally, understanding how to handle customer data compliance ensures that your business is protected legally while fostering trust with your clientele.

Stay informed

To keep up with the latest in document management and security measures, subscribing to our newsletter offers valuable insights and updates tailored to your needs. Engaging with our content not only enhances your understanding of credit card authorization forms but also equips you with actionable knowledge for optimizing your transaction processes.

We appreciate your engagement with our resources and encourage feedback and suggestions on further topics you find beneficial. Your input helps us improve and tailor our content to better serve your informational needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete credit card authorization form online?

How do I edit credit card authorization form straight from my smartphone?

How do I fill out credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.