Get the free Form 40

Get, Create, Make and Sign form 40

How to edit form 40 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 40

How to fill out form 40

Who needs form 40?

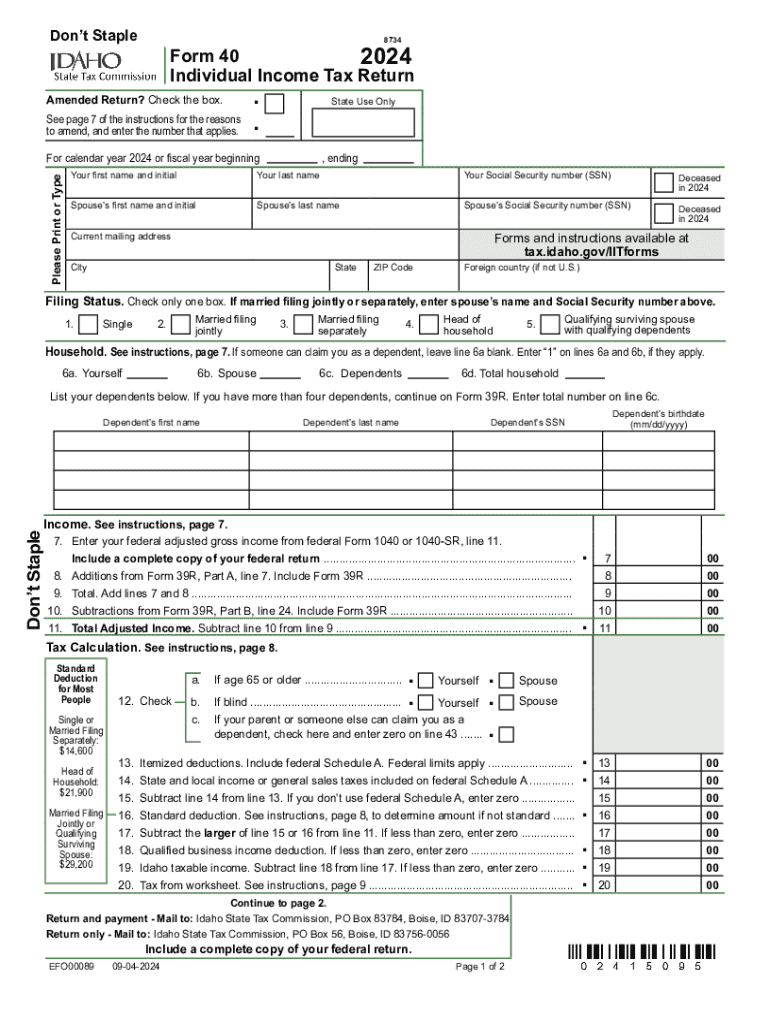

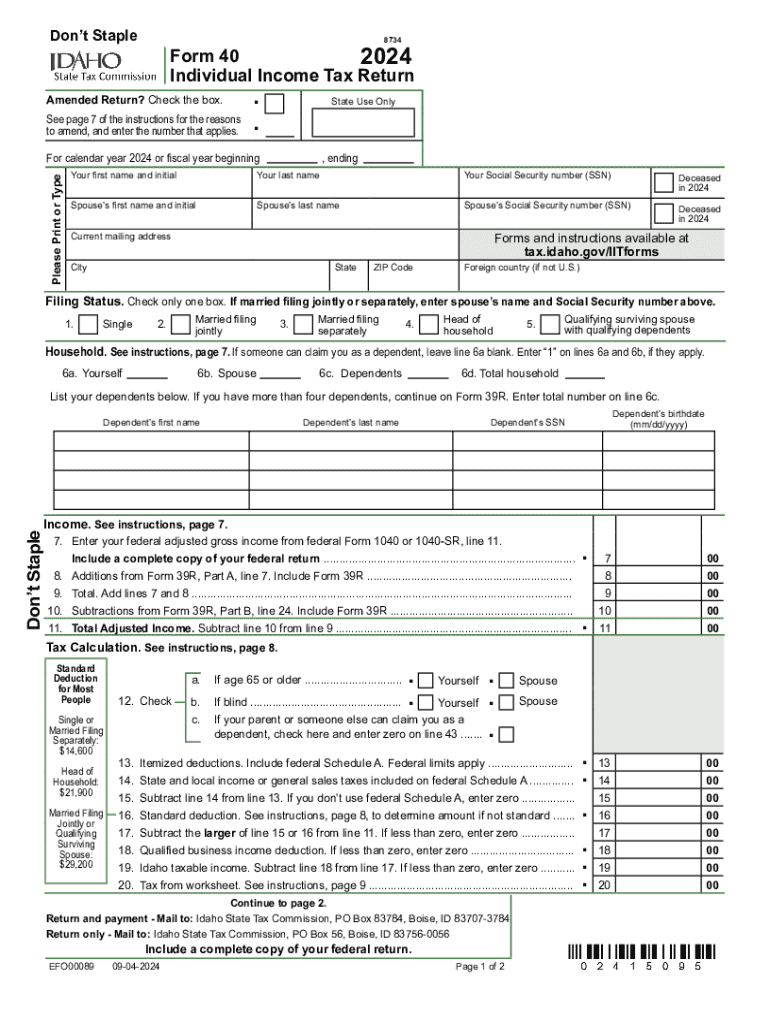

Your Comprehensive Guide to Form 40 Form

Understanding the Form 40 form

The Form 40 form is a crucial document for individuals and businesses when it comes to tax reporting. This form is primarily used by taxpayers to report their annual income and calculate their tax obligations. It serves both as a declaration of earnings and a crucial tool for tax compliance, ensuring that all taxable income is accounted for and that deductions or credits are utilized effectively.

Proper completion and submission of the Form 40 form is essential, not only to meet legal requirements but also to secure any potential refunds. Understanding its purpose and implications can significantly aid in effective tax planning and compliance.

Who needs to file Form 40?

Filing the Form 40 form is generally required for all resident individuals and corporations whose income exceeds a specific threshold defined by tax regulations. Taxpayers, including both employees and self-employed individuals, must file this form if their gross income surpasses the minimum filing requirement.

There are exceptions to filing. Certain individuals may not be required to submit the Form 40 form if their income is below the threshold, or if they qualify for specific deductions. Special cases may include dependents and certain retiree statuses.

Key components of the Form 40 form

The Form 40 form is divided into various sections, each addressing specific components of your tax situation. Understanding these sections can streamline your filing process and assist in minimizing errors.

Step-by-step guide to completing Form 40

Completing the Form 40 form may seem daunting, but breaking it down into manageable steps makes the process easier. This step-by-step guide will assist you in filing your taxes correctly and efficiently.

Common mistakes often include misreporting income or neglecting deductions. To avoid these errors, ensure alignment with supporting documents and double-check your entries before submitting.

Filing Form 40

Once you’ve completed your Form 40 form, it’s time to file it. Understanding your filing options can save you time and hassle.

Using digital platforms like pdfFiller can simplify electronic filing, helping you manage deadlines and track submissions efficiently.

Using pdfFiller for Form 40

pdfFiller offers advanced tools that make editing, signing, and managing your Form 40 form convenient and efficient.

The collaborative features of pdfFiller allow teams to work on the Form 40 form together, ensuring accuracy and compliance before submission.

Frequently asked questions about Form 40

Tax filing brings up a myriad of questions. Here are some common inquiries concerning the Form 40 form that can help you navigate the process.

Resources are available for additional assistance, including state tax websites and IRS publications to ensure you have all necessary information at your fingertips.

Final thoughts on completing Form 40

Timely filing of your Form 40 form is crucial for staying compliant with tax regulations. Adhering to deadlines not only helps in avoiding penalties but also ensures you can take full advantage of any potential refunds.

Staying informed about tax changes, understanding what forms you need, and utilizing tools like pdfFiller for preparation can enhance your filing experience. As a tax-adjusted individual or business, being proactive about your tax obligations fosters better financial planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 40?

Can I create an electronic signature for the form 40 in Chrome?

How do I edit form 40 on an Android device?

What is form 40?

Who is required to file form 40?

How to fill out form 40?

What is the purpose of form 40?

What information must be reported on form 40?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.