Get the free minority and woman-owned business program plan

Get, Create, Make and Sign minority and woman-owned business

How to edit minority and woman-owned business online

Uncompromising security for your PDF editing and eSignature needs

How to fill out minority and woman-owned business

How to fill out minority and woman-owned business

Who needs minority and woman-owned business?

Minority and Woman-Owned Business Form How-to Guide

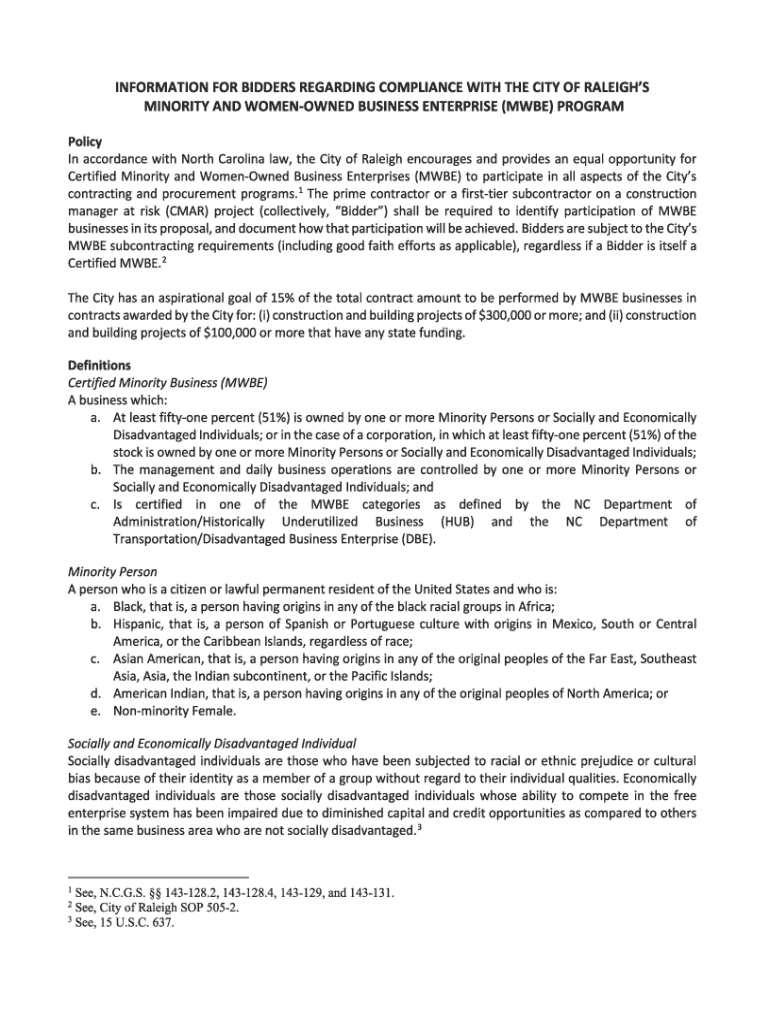

Overview of minority and woman-owned business certifications

Minority and woman-owned businesses play a crucial role in the economic landscape by driving innovation and job creation. These businesses are generally defined as entities that are at least 51% owned, controlled, and operated by women or individuals from minority groups. Certification as a minority or woman-owned business opens doors for access to government contracts and resources specifically set aside for these groups.

Getting certified can significantly enhance a business's visibility, providing advantages such as tapping into federal and state contracting opportunities, networking with other minority or woman-owned entities, and accessing tailored funding programs. The process of certification may seem daunting, but the key benefits make it worthwhile.

Types of certifications

There are several certifications available for minority and woman-owned businesses, including the Woman-Owned Small Business (WOSB), the Economically Disadvantaged Woman-Owned Small Business (EDWOSB), and the Minority Business Enterprise (MBE). Each of these certifications has specific eligibility requirements, ensuring that the businesses receiving these designations genuinely meet defined criteria.

The WOSB certification, for example, is aimed at businesses owned and controlled by women. The EDWOSB takes this further by specifying additional requirements regarding income and personal net worth. Meanwhile, the MBE certification caters to businesses owned by those from minority backgrounds, which may include racial or ethnic minorities.

Step-by-step guide to completing the minority and woman-owned business form

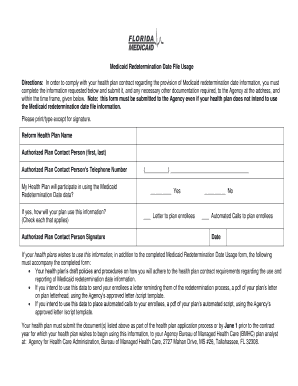

Completing the minority and woman-owned business form can be broken down into simple steps. First, gather all necessary documentation, which includes records of the business ownership structure, relevant financial statements, tax returns, and personal background information of the owners. This preparation stage is vital for a seamless certification process.

Next, select the appropriate certification form, which can be accessed through resources like pdfFiller. Ensure you choose the right form, as certification requirements can differ between federal and state levels.

Detailed instructions for completing the form

When filling out the minority and woman-owned business form, start with Section A: Business Information. You should accurately provide details such as the business name, physical address, and contact information. Poorly filled information in this section can lead to delays, so double-check for accuracy.

In Section B: Ownership and Control, define the percentage of ownership clearly. The certification bodies require detailed documentation that shows proportionate control and decision-making authority. Moving on to Section C: Financial Data, confirm financial eligibility by including acceptable financial documents such as tax returns and bank statements. Finally, in Section D: Supporting Documents, include any additional documentation required for the process, ensuring proper organization and format for easy review.

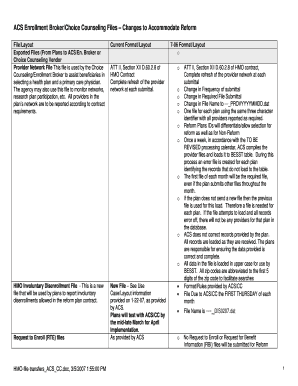

Tips for a successful application

Completing the application accurately is key to a successful certification process. Common pitfalls include providing outdated information or failing to include necessary documents. To avoid these issues, it's crucial to be thorough and honest throughout the form. Ensure that all information is current and reflective of your business's operations.

Additionally, crafting a compelling business story can make a difference. Clearly articulate the mission and vision of your business along with its unique value proposition. This narrative can enhance your application's strength and appeal to reviewing entities.

Submitting your application

Once the form is completed, follow the submission guidelines carefully. Depending on the specific certification, applications may be submitted online or by mail. Utilizing online platforms can streamline the process and provide you with instantaneous tracking of your application status, which is highly recommended.

Expect varying timelines depending on the certification being sought. While some applications can be processed quickly, others may take weeks for feedback and approval. Stay proactive by regularly checking the status and being available for any follow-up inquiries.

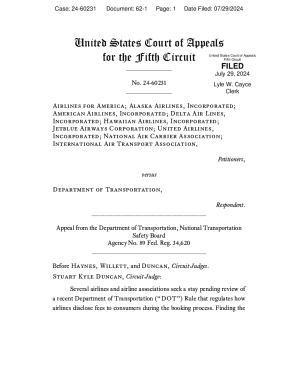

Maintaining your certification

To maintain active certification status, businesses are generally required to submit periodic reports confirming their ongoing eligibility. If there are changes in business structure, ownership, or core services, it’s imperative to notify the certifying body to avoid lapses.

Understanding the re-certification process is also critical. Many certifications require re-evaluation every few years. Being prepared in advance with updated financial documents and ownership details can help ensure a smooth re-certification process.

Resources for minority and woman-owned businesses

Numerous organizations offer critical support and resources for minority and woman-owned businesses. From local chambers of commerce to dedicated non-profits, these entities provide networking opportunities, workshops, and mentorship programs tailored to these business categories.

Access to funding and specific grants is also invaluable. Programs aimed at supporting minority or woman-owned enterprises can be found through both governmental and private sector initiatives. Platforms like pdfFiller also provide tools for document management and collaboration, making it easier to prepare for documentation and reporting needs.

FAQs about the certification process

As you navigate the certification process, you may have various questions. Common inquiries revolve around the documentation needed, processing times, and the actual benefits of certification. Each certification body has its specific FAQs, which can alleviate some confusion and provide clarity.

Many new applicants wonder if they should work with a consultant or if they can handle the process independently. While consulting can streamline the process, many businesses find success by taking a thorough and careful approach themselves. If you have specific questions, don't hesitate to reach out for direct inquiries with certification offices.

Contact information for assistance

For personalized assistance, it's essential to know how to reach the certification offices relevant to your business. Most offices offer contact details via their websites, including email addresses and support lines for direct questions.

In addition to government resources, local organizations can provide guidance and possibly workshops to help you with the certification process. To enhance your document management, consider utilizing pdfFiller’s features, which make the preparation and submission of your forms a streamlined experience thanks to its cloud-based advantages.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit minority and woman-owned business from Google Drive?

How can I send minority and woman-owned business for eSignature?

How do I fill out minority and woman-owned business using my mobile device?

What is minority and woman-owned business?

Who is required to file minority and woman-owned business?

How to fill out minority and woman-owned business?

What is the purpose of minority and woman-owned business?

What information must be reported on minority and woman-owned business?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.