Get the free Homeowners Quote Request

Get, Create, Make and Sign homeowners quote request

How to edit homeowners quote request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out homeowners quote request

How to fill out homeowners quote request

Who needs homeowners quote request?

Homeowners Quote Request Form Guide

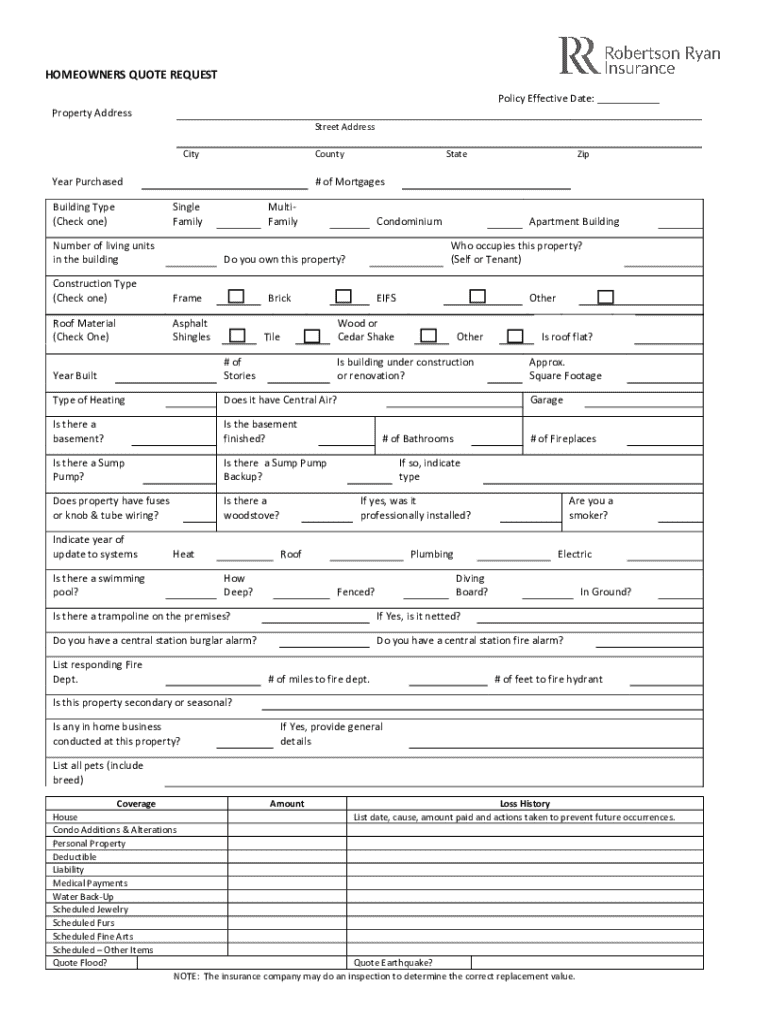

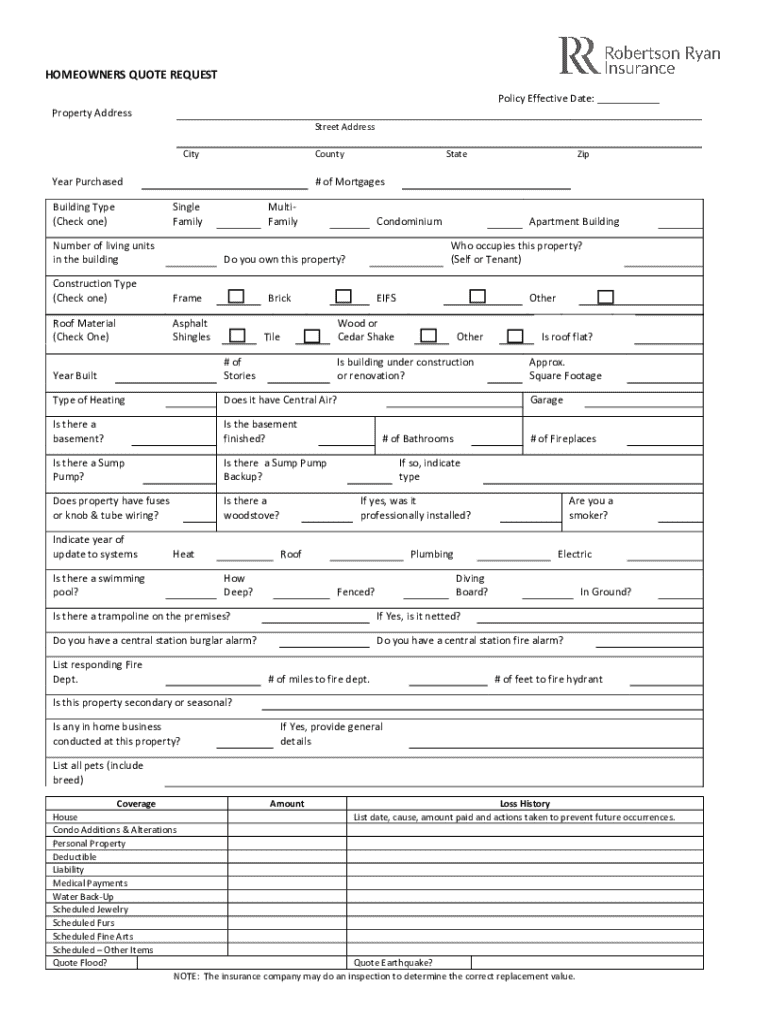

Understanding the homeowners quote request form

A homeowners quote request form is a crucial tool for property owners seeking insurance coverage. Essentially, this document collects vital information about your home and personal circumstances to help insurance providers evaluate the risks and coverage options available to you.

The importance of this form cannot be overstated; it not only provides insurers with the information they need to generate quotes but also plays a significant role in ensuring that homeowners receive the most accurate and relevant coverage for their specific needs.

Why you need a homeowners insurance quote

Obtaining multiple homeowners insurance quotes is essential. Not only does this process allow you to compare premiums, but it also helps identify the best policy that fits your coverage needs. A personalized quote can highlight options and endorsements that may not have been apparent in a generic quote.

In addition, most states require homeowners to have insurance to protect financial investments. Therefore, having a clear understanding of your needs and the coverage available is crucial in making an informed decision.

Preparing to fill out the homeowners quote request form

Before diving into the homeowners quote request form, it’s vital to gather essential information that insurance companies will need to provide an accurate quote. This process will streamline your submission and reduce potential follow-up questions from insurers.

Organizing this information efficiently can save you detailed time and reduce errors. Consider using a checklist or spreadsheet to keep track of what you need.

Common terminology explained

Understanding the terminology associated with homeowners insurance is essential when filling out the quote request form. Items such as 'deductible', 'premium', and 'coverage limit' will frequently appear.

Step-by-step instructions for completing the form

Completing the homeowners quote request form can seem daunting, but breaking it down into manageable sections can simplify the process significantly. Here's a guide to navigating each part.

1. Personal information section

The personal information section usually requests your full name, mailing address, email, and phone number. Be sure that all details, such as your zip code, are accurate, as insurers often use this information to assess risk based on your location.

2. Property information section

This section will require specific details of your home, including its type (single-family, condo, etc.), the year it was built, and total square footage. Providing an accurate description is crucial, as even minor inaccuracies can lead to incorrect quotes or insufficient coverage.

3. Coverage options

Next, you’ll encounter sections detailing the types of coverage you wish to explore. These can include dwelling coverage protecting the structure of your home, liability coverage for potential injuries on your property, and personal property coverage for possessions inside your home.

Understanding these options helps you select coverage that meets your lifestyle needs. If you own valuable assets, you might consider additional riders that ensure they are fully protected.

4. Additional information

In this section, you may be prompted to include any unique characteristics of your home or lifestyle that could affect your insurance rates. For instance, if you operate a home business or have a pool, it’s essential to disclose those details as they may impact your premium.

Reviewing your homeowners quote request form

Once you’ve completed the form, take a few minutes to conduct a thorough review. Double-checking your information for any errors not only prevents delays but also guarantees that you receive the most accurate quotes.

Understanding the quotation process

After submission, the insurers will process your request. Typically, you can expect to receive quotes within a range of 24 to 72 hours, depending on the provider. In certain instances, you might receive follow-up questions aimed at clarifying specifics about your home.

Tools for digital submission and management

Filling out the homeowners quote request form has been greatly enhanced in the digital age. Platforms like pdfFiller enable users to access an array of features that facilitate the editing and management of documents.

Using pdfFiller for easy access

pdfFiller allows users to seamlessly fill out, edit, and share PDFs online. With its easy-to-use interface, you can upload any homeowners quote request form and fill in the required fields quickly.

The platform also enables collaboration with team members, allowing multiple users to edit and review submissions for completeness and accuracy.

Signing and storing documents securely

With pdfFiller, electronic signatures can be added effortlessly, ensuring that your submissions are secure and legally binding. Additionally, you can store documents in a cloud-based system, meaning you can access your paperwork from anywhere, making the homeowners quote request form management highly efficient.

Frequently asked questions about homeowners insurance quotes

Extra resources for homeowners

Understanding different types of home insurance policies can significantly affect your coverage choices. For instance, you might encounter HO-1, HO-2, and HO-3 policies, each offering different levels of protection against various perils.

In addition, consider tips for reducing home insurance costs. Home safety improvements, like installing smoke detectors, or bundling homeowners insurance with auto insurance can lead to significant savings on your premiums.

If you need assistance with your quote request, don't hesitate to reach out to insurance advocates or utilize customer support provided by your chosen insurer. They can help navigate the complex components of homeowners insurance and support you in tailoring your policy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my homeowners quote request directly from Gmail?

How can I send homeowners quote request for eSignature?

Where do I find homeowners quote request?

What is homeowners quote request?

Who is required to file homeowners quote request?

How to fill out homeowners quote request?

What is the purpose of homeowners quote request?

What information must be reported on homeowners quote request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.