Get the free Homeowners Quote Information

Get, Create, Make and Sign homeowners quote information

Editing homeowners quote information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out homeowners quote information

How to fill out homeowners quote information

Who needs homeowners quote information?

Homeowners Quote Information Form: A Comprehensive Guide

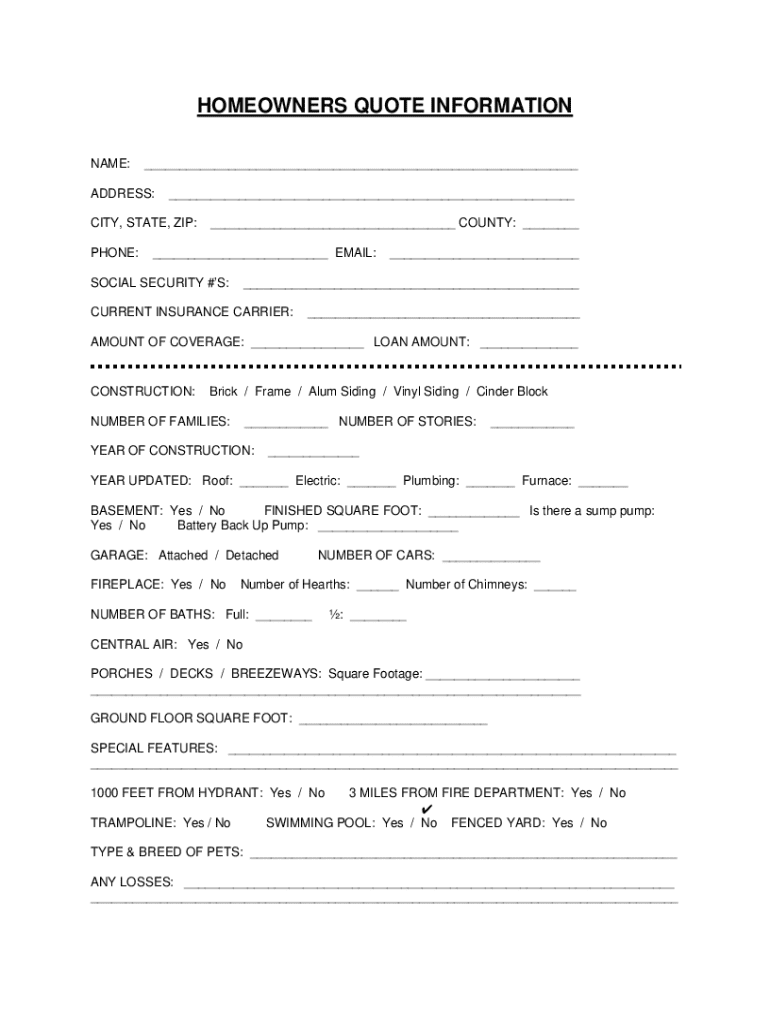

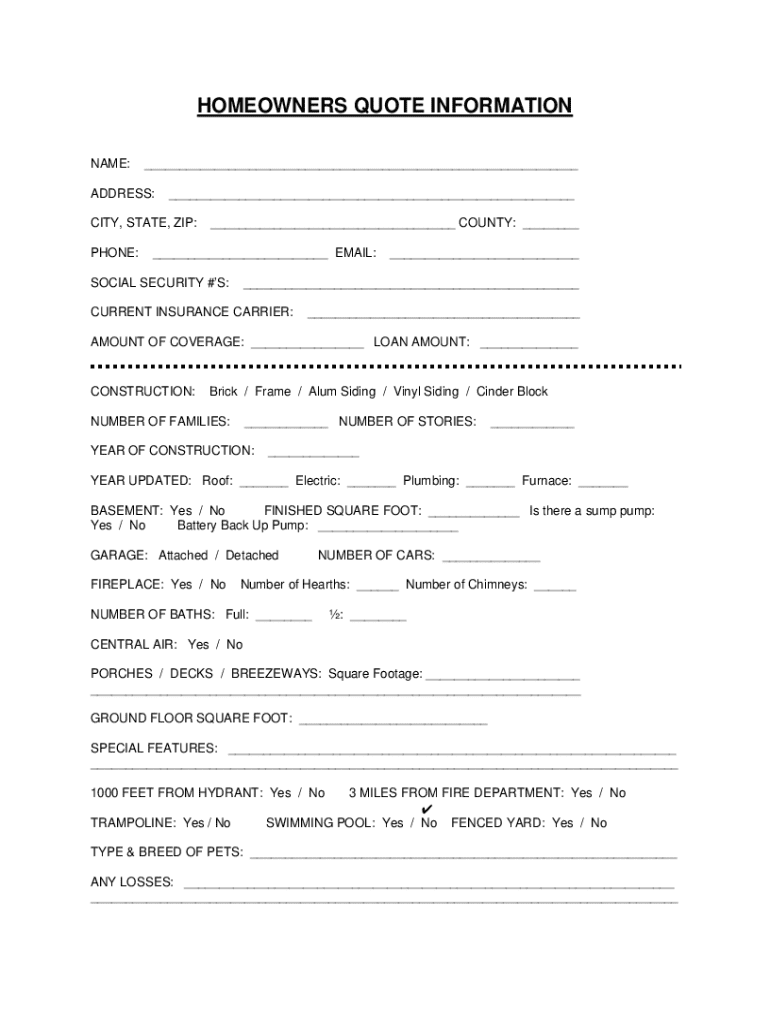

Understanding the homeowners quote information form

A homeowners quote information form is a critical document designed to gather specific details about a property and its owner to facilitate an accurate quote for homeowners insurance. This form not only helps insurance providers understand the value of the property and the risks involved but also allows homeowners to outline their desired coverage options. Obtaining a quote is essential for homeowners as it provides them with insights into potential premiums while ensuring they have suitable protection for their assets.

Homeowners insurance typically covers three broad categories: property damage, liability protection, and additional living expenses. By procuring a detailed quote, homeowners can evaluate different insurance plans, compare coverage options, and choose a policy that aligns with their needs and budgets.

Key elements of the homeowners quote information form

Filling out the homeowners quote information form requires careful attention to detail. Here are the key sections that the form typically includes:

Essential steps to filling out the homeowners quote information form

Completing the homeowners quote information form isn’t as daunting as it may seem. Here’s a step-by-step guide to ensure the process goes smoothly:

Frequently asked questions about homeowners quotes

Here are some common inquiries homeowners have when seeking quotes:

Interactive tools for enhancing your homeowners quote experience

Utilizing interactive tools can streamline the process of obtaining a homeowners quote and ensuring optimal coverage. Here are two helpful options:

Best practices for managing your homeowners quote

Successfully managing your homeowners quote is crucial for effective coverage. Here are some best practices to follow:

Case studies: Real-life examples of homeowners quote scenarios

Learning from real-life scenarios can provide valuable insights into the homeowners quote process. Here are three illustrative examples:

Exploring related forms and its importance

Sure, understanding the homeowners quote information form is only one part of a larger landscape of insurance documentation. Here are some related forms you may encounter:

About pdfFiller: Elevating your document management experience

pdfFiller provides an intuitive platform designed for seamless document management, exclusively tailored for homeowners. Key features include:

Contacting support for homeowners quote assistance

When you have questions or need support while filling out your homeowners quote information form, reaching out to the pdfFiller support team is simple. Support options include:

Expanding your knowledge: Related articles and resources

Staying informed about homeowners insurance can empower property owners to make informed choices. Additional resources include:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send homeowners quote information to be eSigned by others?

How do I fill out the homeowners quote information form on my smartphone?

Can I edit homeowners quote information on an iOS device?

What is homeowners quote information?

Who is required to file homeowners quote information?

How to fill out homeowners quote information?

What is the purpose of homeowners quote information?

What information must be reported on homeowners quote information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.