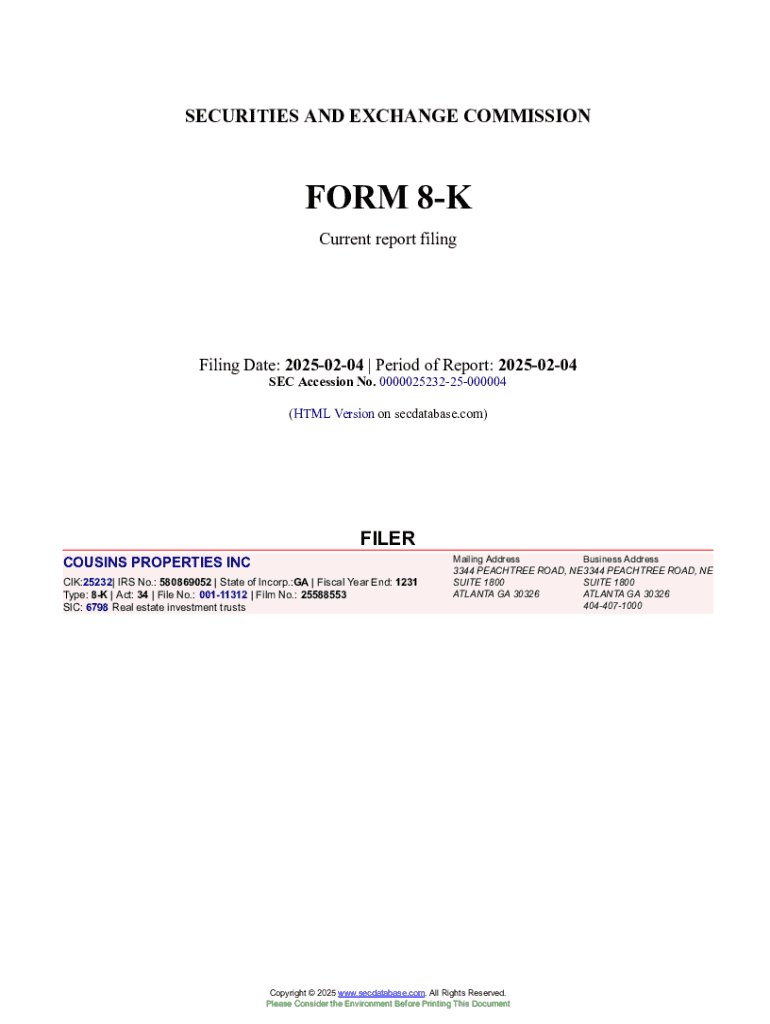

Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Form 8-K Guide: Understanding, Filing, and Managing Your Report

Overview of Form 8-K

The Form 8-K is a crucial report mandated by the Securities and Exchange Commission (SEC) that publicly traded companies must file to disclose significant events or corporate changes. This form serves as a key tool for maintaining transparency between companies and their stakeholders, ensuring that investors and the market have access to timely and relevant information.

Filing Form 8-K is important because it prompts immediate disclosure of events that might significantly affect a company's financial health or operations. Such obligations help protect investors, enhancing their ability to make informed decisions based on the latest developments. All public companies, including large corporations and smaller reporting companies, must file Form 8-K when required.

Necessity of Form 8-K filings

Form 8-K filings become necessary under various circumstances that denote significant changes within a company. These events can range from management shifts to financial dealings and other occurrences that could materially impact shareholders and stakeholders alike.

The following situations typically require a Form 8-K filing:

It is critical that companies file Form 8-K within four business days after the triggering event occurs to avoid potential regulatory consequences.

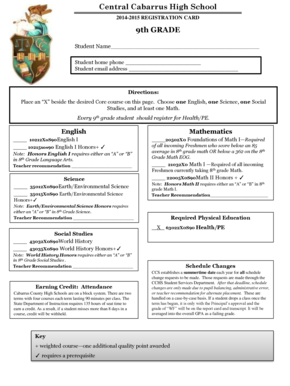

Key components of Form 8-K

Understanding the structure of Form 8-K is essential for effective compliance. The form comprises a cover page, along with detailed sections that report on various events. The cover page requires general company information, including name, address, and the specific item being reported.

The items reported on Form 8-K are categorized and denoted by numbers. Here are some of the common items reported:

Reading and interpreting Form 8-K

When assessing Form 8-K filings, investors and analysts should focus on identifying key information and evaluating its implications. Key sections often highlight corporate health or shifts in strategy, making it crucial to discern the impact of the information reported.

In addition to seeking specific updates, savvy investors should look for potential red flags, such as frequent changes in leadership or a pattern of filings related to operational challenges. These signs can indicate instability within the company.

Utilizing Form 8-K information can serve multiple purposes, from guiding investment strategies to ensuring compliance with regulatory mandates.

Historical context of Form 8-K

The Form 8-K has undergone significant evolution since its inception. Originally introduced in the 1970s, the SEC recognized the need for immediate disclosure of material events to protect investors. Over the years, amendments have expanded the scope of disclosures and refined reporting requirements.

Recent updates have emphasized transparency and the need for timely disclosures that reflect a company’s operational realities. Compared to other forms like 10-K and 10-Q, which focus on periodic financial reporting, Form 8-K is uniquely positioned to deliver immediate insights into pivotal changes occurring between these regular reports.

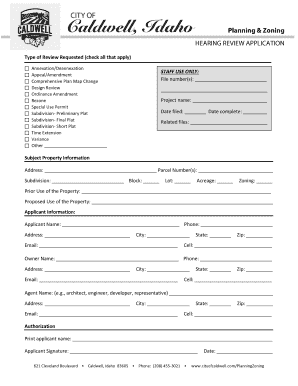

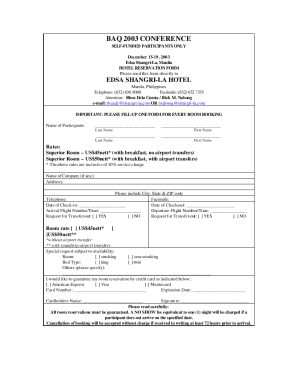

Detailed instructions for filing Form 8-K

To file Form 8-K accurately, companies should follow a structured process. Initially, accessing the form is straightforward through the SEC’s EDGAR system. It’s important to familiarize yourself with the necessary details needed, including the key events that require reporting.

Companies should ensure all fields are completed accurately to maintain compliance with regulations. Here’s a step-by-step approach:

Electronic submissions are vital for compliance, and utilizing the right software format can aid in a smooth filing process. It's also critical to avoid common errors such as incomplete sections or late submissions, which could lead to penalties.

Benefits of using pdfFiller for Form 8-K management

pdfFiller provides a robust solution for businesses seeking to fill and manage their Form 8-K filings efficiently. With its user-friendly interface, users can seamlessly edit documents, collaborate with team members, and manage approvals without the hassle of traditional methods.

Notable features of pdfFiller that enhance the filing process include:

Real-life examples showcase how businesses leverage pdfFiller to streamline their documentation processes, ultimately improving accuracy and saving valuable time in regulatory compliance.

Frequently asked questions about Form 8-K

As stakeholders navigate the complexities of Form 8-K, several common inquiries arise, including:

Conclusion: Navigating Form 8-K with confidence

Understanding and effectively filing Form 8-K is critical for maintaining corporate integrity and transparency. As the nature of business evolves, so too does the necessity for clear communication with stakeholders. Harnessing tools like pdfFiller can empower companies to manage their Form 8-K filings seamlessly, enhancing both compliance and operational efficiency.

Encouraging informed filing practices through innovative digital solutions not only mitigates risks but also promotes a culture of transparency that ultimately benefits all parties involved.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 8-k in Gmail?

Can I create an electronic signature for the form 8-k in Chrome?

Can I create an electronic signature for signing my form 8-k in Gmail?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.