Get the free Z-28-2020

Get, Create, Make and Sign z-28-2020

Editing z-28-2020 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out z-28-2020

How to fill out z-28-2020

Who needs z-28-2020?

Z-28-2020 Form How-to Guide

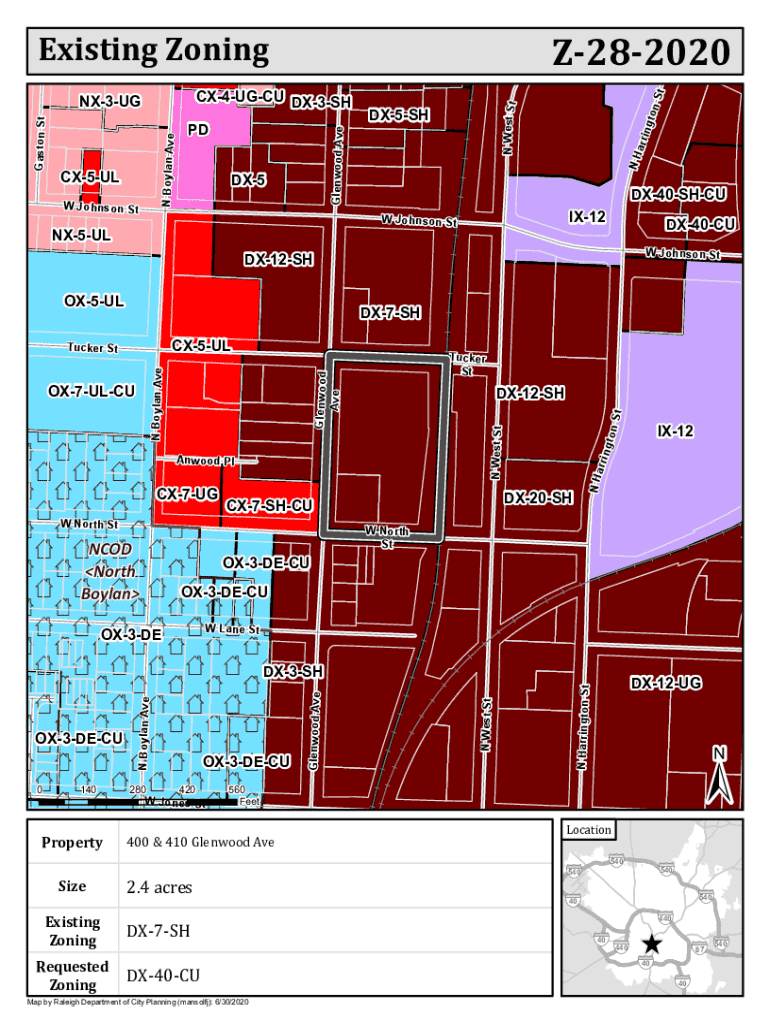

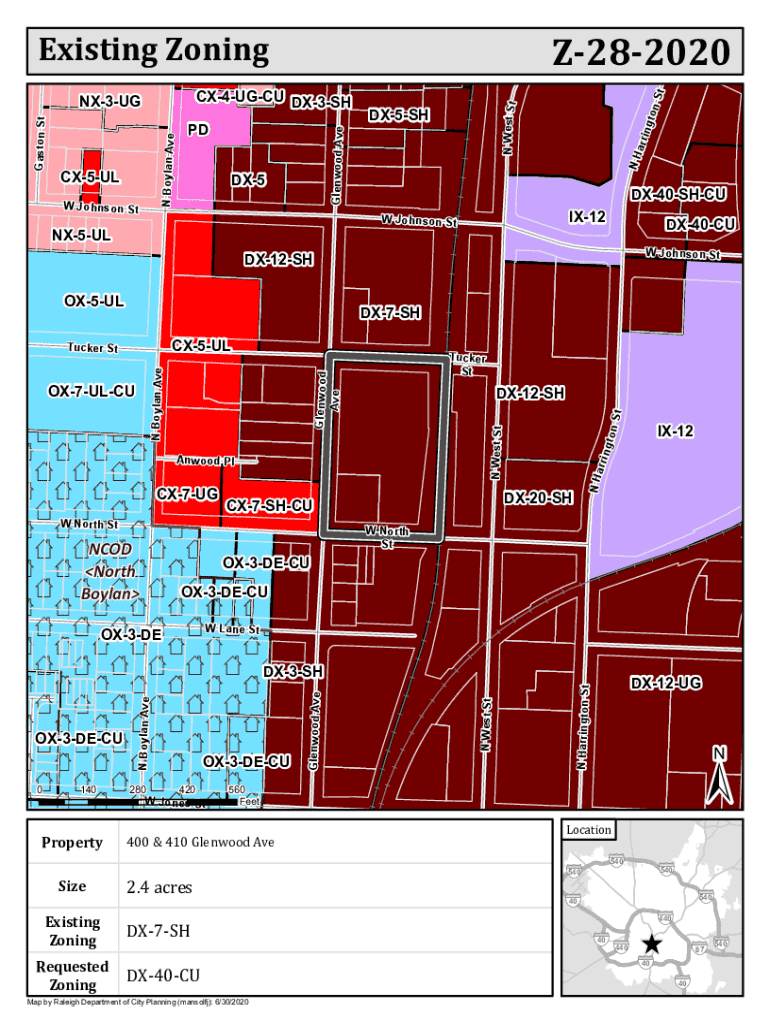

Overview of the Z-28-2020 form

The Z-28-2020 form is specifically designed for use by individuals and entities engaged in particular regulated activities, typically within a governmental context. Its primary purpose is to collect necessary data to ensure compliance with federal or state mandates related to financial disclosures, operational activities, or regulatory oversight. This form serves as a critical tool for maintaining transparency and accountability in the respective sectors.

Individuals who need to use the Z-28-2020 form include anyone mandated to report financial information, disclose specific operational data to regulatory bodies, or comply with governmental regulations. This may further extend to businesses and organizations involved in community projects, grants, or federally funded initiatives that require such disclosures.

Document requirements

Filling out the Z-28-2020 form requires specific personal and financial information. Typically, you will need to provide identifying details such as your full name, address, and social security number or employer identification number (EIN). Additionally, you will encounter sections requesting financial disclosures, including income, expenses, and any relevant project-related financial data.

Furthermore, supporting documents are often required to substantiate the information that you provide on the form. This can include copies of financial statements, tax returns, or proof of expenditures related to the projects or activities in question. Understanding which documents are needed is essential to avoid delays or rejection of your form.

Step-by-step instructions for completing the Z-28-2020 form

Section 1: Personal information

When starting to fill out the Z-28-2020 form, the first section focuses on Personal Information. Here, you must accurately enter your full name, home address, phone number, and email address. Ensuring that this information is correct is crucial, as it establishes your identity for any correspondence about the form.

Specific demographics may require additional information, such as business type or organizational role. Ensure you double-check these entries as inaccuracies can impact processing and communication.

Section 2: Financial information

The next section delves into Financial Information. You will report income generated and any expenses incurred during your reporting period. It is vital to provide accurate figures; round numbers or estimates may lead to discrepancies that could draw scrutiny. Utilize tools or software for precise calculations where necessary.

If your financial situation is complex, don’t hesitate to seek professional guidance. It’s better to invest in expertise than to risk errors that could have far-reaching implications. Ensure all figures are supported by documents, such as receipts or bank statements.

Section 3: Additional questions

The additional questions on the form might cover a broad variety of subjects; these could include inquiries about operations undertaken during the reporting period or specific compliance measures in place. Answer these thoroughly and honestly to avoid complications.

Complex situations may arise regarding compliance or reporting anomalies. Familiarize yourself with common challenges and best practices in responding to these queries. Examples include detailing how you have adapted to changes in regulations or documenting any extraordinary financial circumstances.

Common mistakes to avoid

When submitting the Z-28-2020 form, many encounter pitfalls that can easily be avoided with careful attention. Common errors include missing signatures, incomplete sections, and failure to include required supporting documents. Each of these mistakes can lead to delays or complications with your submission.

To ensure accuracy, follow best practices for data entry. Always cross-check your information and utilize tools like pdfFiller to assist with spell-checking names and figures. Keep an eye out for any mandatory fields highlighted in the form, and ensure they are duly filled.

Options for editing and managing your Z-28-2020 form

With pdfFiller, editing a completed Z-28-2020 form has never been easier. Once you have filled out the form, you can return anytime to make changes. The platform allows for simple edits, such as correcting numeric entries or updating your contact information. This feature saves you from the hassle of starting over.

Collaboration is another powerful feature available through pdfFiller. Team members can work together on the same document, making it easier to finalize the Z-28-2020 form collectively. Access your forms from anywhere, allowing seamless teamwork, which further streamlines the completion process.

Signing and submitting the Z-28-2020 form

Signing the Z-28-2020 form is a critical step before submission. With pdfFiller, you can electronically sign your document without needing to print it out. This digital signature is legally binding and simplifies the process immensely. Just navigate to the signing feature within the platform and follow the prompts to secure your signature.

When it comes to the submission process, pdfFiller offers multiple avenues. You can opt for electronic submission, which is generally faster and provides a confirmation once your form is received. If you prefer or need to submit a paper version, ensure you follow the proper postal procedures and include any required tracking information.

Troubleshooting common issues

If you encounter errors when completing your Z-28-2020 form or receive a returned submission, don’t panic. First, carefully review any feedback provided regarding why the form was rejected or needs correction. Addressing these concerns promptly can save you time in the long run.

Resources for support can often be found through the pdfFiller platform as well as relevant governmental bodies involved in processing the Z-28-2020 form. Make sure to document your communications with support teams and always keep copies of revised submissions for your records. Reaching out proactively can often clarify uncertainties and pave the way for successful resubmission.

Frequently asked questions (FAQs)

Understanding the nuances of the Z-28-2020 form can be challenging, leading to many frequent questions. Some of the most common inquiries involve the types of financial data required, how to handle specific situational questions, and the importance of certain deadlines. Each question often has multiple facets that need to be explored.

For instance, one might wonder whether all income sources need to be reported or only those related to the activities for which the form is being submitted. The general response is that full transparency is crucial; thus, reporting all relevant income streams typically protects you from future issues. Aim to gather comprehensive information on the context of each section for informed responses.

Interactive tools for the Z-28-2020 form

To streamline the process of completing the Z-28-2020 form, pdfFiller provides an interactive platform that enhances the user experience. Features such as auto-fill, templates, and guided prompts simplify each step and help minimize errors. For users with disabilities, accessibility options are also integrated into the platform to ensure everyone can navigate forms effectively.

This emphasis on interactivity not only improves accuracy but fosters efficiency, enabling users to complete complex documents like the Z-28-2020 swiftly and comprehensively. Familiarize yourself with these interactive tools to leverage their full potential during your next form completion.

Staying updated on Z-28-2020 form changes

Laws and regulations surrounding forms like the Z-28-2020 can change, so it’s crucial to stay informed about any updates that may affect your completion or submission process. Regularly visit the official government website for changes related to form requirements or deadlines.

Additionally, resources for continuous education, including webinars or workshops offered through platforms like pdfFiller, can help you stay ahead of changes in legislation or compliance requirements. Subscribing to informational newsletters can also be beneficial for ongoing updates.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send z-28-2020 for eSignature?

How can I get z-28-2020?

Can I create an eSignature for the z-28-2020 in Gmail?

What is z-28?

Who is required to file z-28?

How to fill out z-28?

What is the purpose of z-28?

What information must be reported on z-28?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.