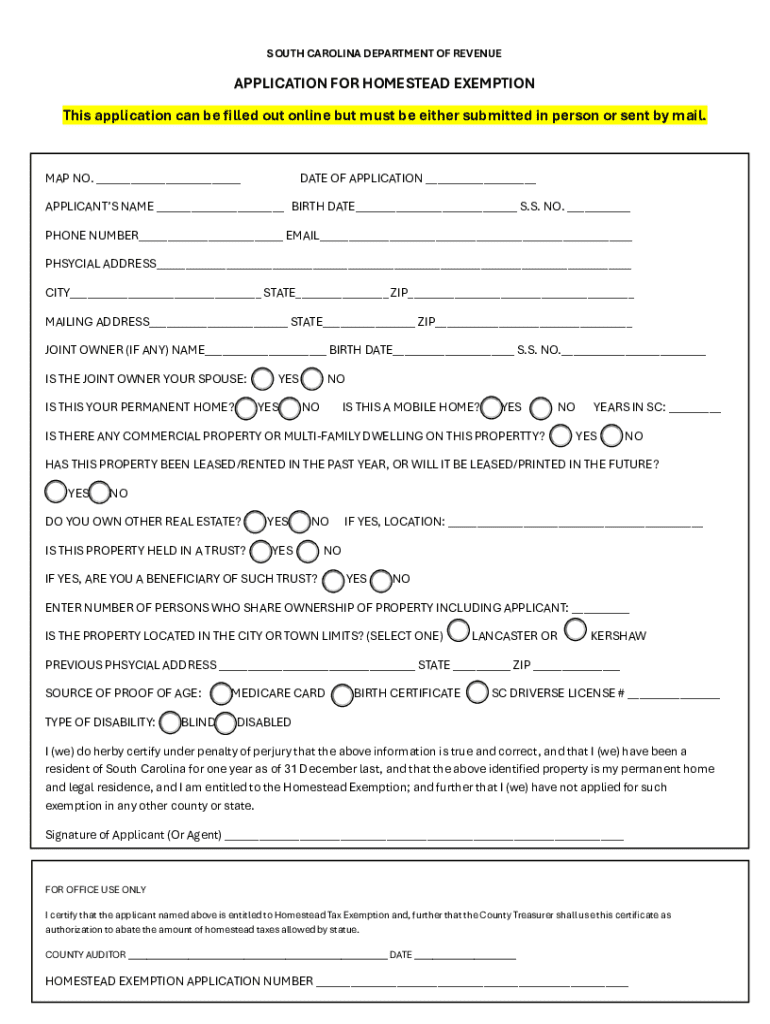

Get the free Application for Homestead Exemption

Get, Create, Make and Sign application for homestead exemption

How to edit application for homestead exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for homestead exemption

How to fill out application for homestead exemption

Who needs application for homestead exemption?

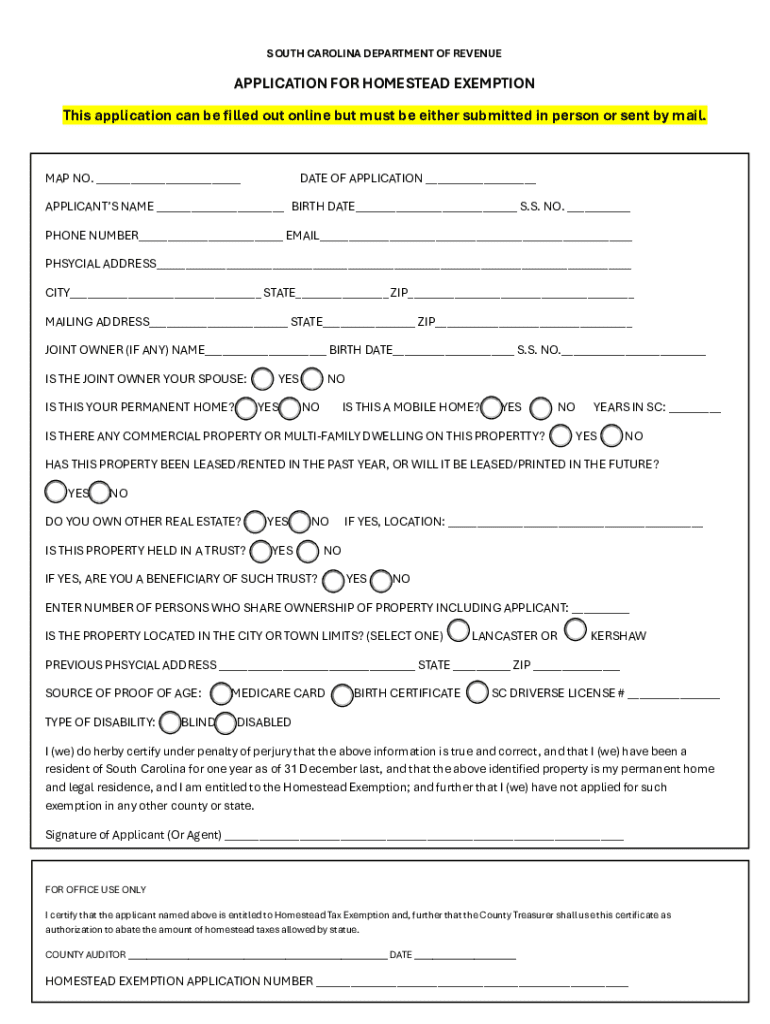

Application for Homestead Exemption Form: A Comprehensive Guide

Understanding homestead exemption

Homestead exemption is a legal provision that provides eligible homeowners with a reduction in property taxes on their primary residence. This exemption lowers the taxable value of homes, in turn reducing the overall tax liability that homeowners must pay. Understanding the nuances of homestead exemption is essential for property owners, particularly when considering financial planning and property-related expenses.

The importance of homestead exemption cannot be overstated. It not only provides financial relief to homeowners but also encourages stability in communities by aiding families in retaining their homes during economic hardships. Consequently, individuals who take advantage of this exemption may find it easier to manage their finances than those without these benefits.

Eligibility criteria for homestead exemption

To apply for a homestead exemption, homeowners must meet specific eligibility criteria that vary by state. Generally, these criteria include being the legal owner of the property and residing in it as the primary residence. However, nuances exist based on individual states, so it’s crucial to understand localized requirements. Most places in the U.S. require applicants to provide proof of ownership and residency.

Age and disability considerations also affect eligibility. Many states offer additional exemptions for senior citizens, veterans, and individuals with disabilities. Financial limitations may accompany certain exemptions, setting income caps that applicants must adhere to in order to qualify.

Types of homestead exemptions

Different states offer various types of homestead exemptions, each with its own benefits and requirements. For example, Florida's homestead exemption provides substantial property tax relief, with the potential to save homeowners hundreds or even thousands of dollars each year. Texas also has a homestead exemption that provides significant relief based on disability or age. Meanwhile, residents of California can benefit from Proposition 13, which limits property tax increases on primary residences.

In addition to state-specific exemptions, local municipalities often have their own programs that further enhance the overall tax relief for residents. Understanding both local and state exemptions can be beneficial when filing applications and maximizing savings.

Application process for homestead exemption

Navigating the application process for homestead exemption may seem daunting, but understanding the step-by-step process can make it manageable. The first step involves gathering necessary documentation that proves your eligibility for these valuable savings.

Essential documents often include proof of identity, proof of residence, and financial documentation. These documents validate ownership and residency claims that must accompany your application.

Important deadlines

Awareness of important deadlines is crucial in ensuring that you don't miss the opportunity to apply for a homestead exemption. Each state has specific key dates for submission, generally tied to the assessment date. Failing to submit your application on time may result in lost tax savings for the entire year.

Additionally, it’s important to remember that the homestead exemption typically requires renewal every year. Keeping track of these deadlines can help you establish a reminder system to ensure timely submissions.

Frequently asked questions (FAQs)

Homeowners often have numerous queries regarding the homestead exemption application process. Common questions include how to check the status of your application, what to do if your application is denied, and the specifics of eligibility criteria. Knowledgeable local property appraiser offices can help clarify misconceptions and provide authoritative answers.

Clarifying misunderstood aspects of the process can help homeowners feel more empowered and confident in their applications. To provide further aid to applicants, municipalities may offer additional resources or workshops addressing FAQs.

Managing your homestead exemption after approval

Once your application for homestead exemption is approved, managing your exemption status becomes essential for long-term financial health. Knowing how to monitor your exemption status, comprehend the renewal process, and make changes as necessary can ensure you maximize benefits over time.

Regularly reviewing your exemption status helps identify any errors or discrepancies. Also, if your living situation changes—for instance, if you sell your home or move—you may need to update your application accordingly to ensure you stay in compliance.

Troubleshooting common issues

Navigating the homestead exemption process doesn’t come without hurdles. Homeowners may face issues such as denial of their application or errors that render their submissions invalid. Understanding how to troubleshoot these common issues can empower homeowners to take swift action in correcting errors and ensuring continued eligibility.

If your application is denied, it's crucial to read the denial letter carefully to understand the reasons why. Follow up with your local property appraiser’s office for guidance on what steps you can take to rectify the situation. Knowing the appeal process can also be invaluable in these situations.

Interactive tools

In today's digital era, various online tools can enhance the application experience for homestead exemption forms. Interactive tools can help potential applicants estimate their exemption benefits, compare different types of exemptions, and create organized document checklists for a smooth application.

Using these tools, homeowners can navigate the potentially complex exemption landscape with ease, allowing for a more efficient application process.

Additional support and resources

Finding help when navigating the complexities of homestead exemption forms can make the process significantly more manageable. Local property appraiser's offices often provide resources, information, and in-person support to assist applicants.

Moreover, various state and local government resources have helpful websites that offer step-by-step guidance on completing applications. Connecting with legal assistance may also be pertinent, especially in complex cases.

Why use pdfFiller for your homestead exemption application?

Utilizing pdfFiller for your homestead exemption application offers numerous advantages that streamline the process from document creation to submission. This platform allows seamless editing of PDF forms, facilitating the addition of necessary information without hassle. With pdfFiller, filling out the application form can be done easily, ensuring that it meets all state requirements.

Additionally, pdfFiller provides easy eSigning and document collaboration, allowing you to obtain necessary signatures without needing to print anything. The secure cloud-based platform ensures that your documents are safely stored and easily accessible at any time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get application for homestead exemption?

How do I execute application for homestead exemption online?

How can I fill out application for homestead exemption on an iOS device?

What is application for homestead exemption?

Who is required to file application for homestead exemption?

How to fill out application for homestead exemption?

What is the purpose of application for homestead exemption?

What information must be reported on application for homestead exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.