Get the free Retirement Options Form

Get, Create, Make and Sign retirement options form

How to edit retirement options form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out retirement options form

How to fill out retirement options form

Who needs retirement options form?

Comprehensive Guide to Retirement Options Form

Understanding the retirement options form

The retirement options form serves as a critical tool in planning your financial future, specifically regarding retirement. This form captures essential details about an individual's preferences and choices related to various retirement plans. It’s essential for anyone looking to establish or optimize their retirement savings strategy.

Understanding the retirement options form is crucial because it helps ensure that individuals make informed decisions about their retirement savings. By clearly specifying options such as contribution levels and plan types, you can align your retirement planning with your unique financial goals.

Types of retirement options available

When contemplating retirement, understanding the variety of retirement plans is vital. The primary retirement plans include employer-sponsored plans and individual accounts, each with distinct benefits and features.

Apart from traditional plans, there are alternative retirement savings options worth considering. For instance, annuities provide periodic payments, helping to ensure a steady income stream post-retirement. Additionally, Health Savings Accounts (HSAs) allow individuals to set aside money for future medical expenses while enjoying tax benefits during their working years.

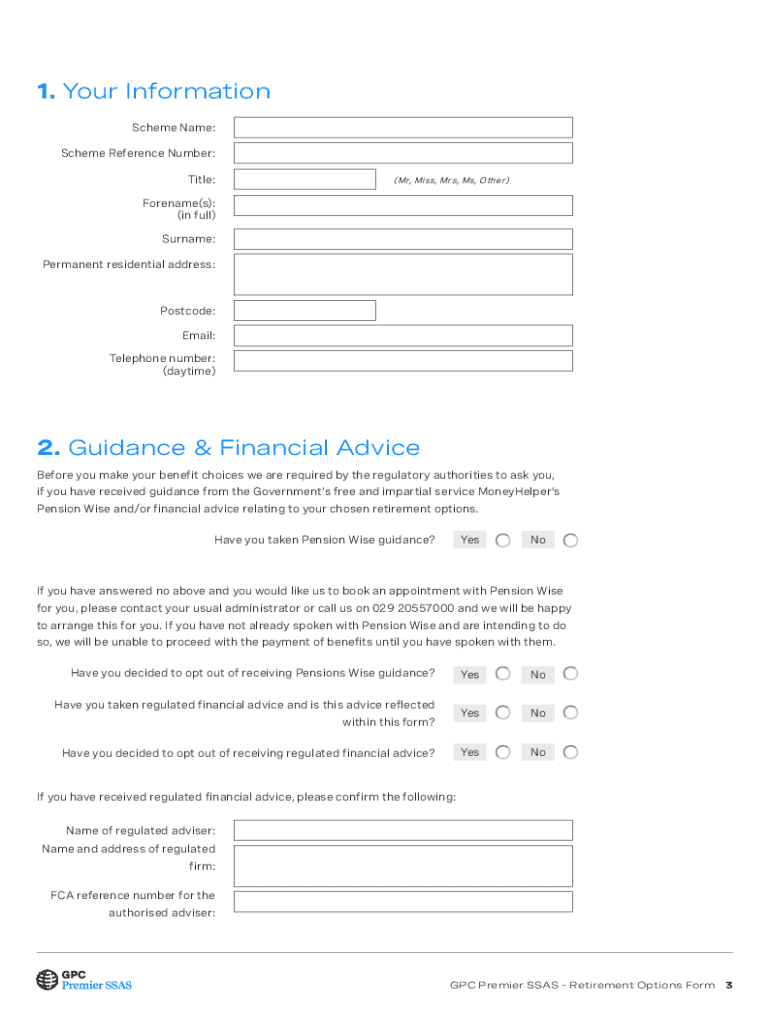

Key components of the retirement options form

Filling out the retirement options form accurately is foundational for effective retirement planning. Typically, the form is structured into several sections, each requiring specific information that guides the selection of suitable retirement options.

Step-by-step instructions for filling out the retirement options form

Completing the retirement options form requires careful attention to detail. Following a step-by-step approach can help ensure you provide the necessary information correctly.

First, gather necessary documents such as recent financial statements and identification documents. Having these on hand will streamline the process significantly.

Avoid common mistakes such as leaving sections incomplete or entering incorrect personal information. Double-checking your entries can save you from future issues.

Editing and customizing your retirement options form

Once your retirement options form is filled out, you may want to make adjustments or edits. Thanks to online tools, customizing your form has never been easier.

Using pdfFiller, you can upload your retirement options form directly onto the platform, making it possible to make changes easily and efficiently. This cloud-based solution allows for hassle-free document editing.

Additionally, adding digital signatures to your retirement options form can make your submission legally binding. Following a simple step-by-step guide for eSigning ensures that your document is complete and secure.

Managing your retirement options form

Once completed, managing your retirement options form effectively is equally crucial. Proper organization of this important document aids in maintaining your retirement planning activities.

Additional tools and resources through pdfFiller

pdfFiller offers an array of tools and resources designed to streamline your retirement planning process. Utilizing these can bolster your understanding of retirement options significantly.

FAQs about the retirement options form

As you work on your retirement options form, questions may arise. Understanding common queries can facilitate the process.

Conclusion: The importance of proactive retirement planning

Being proactive about your retirement planning is essential for achieving a secure financial future. Filling out the retirement options form lays the groundwork for making informed, beneficial decisions regarding your retirement savings.

By continually seeking the best retirement options and leveraging resources like pdfFiller, you empower yourself to navigate retirement planning with confidence, ultimately enhancing your financial well-being.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the retirement options form in Chrome?

How do I edit retirement options form straight from my smartphone?

How do I fill out retirement options form on an Android device?

What is retirement options form?

Who is required to file retirement options form?

How to fill out retirement options form?

What is the purpose of retirement options form?

What information must be reported on retirement options form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.