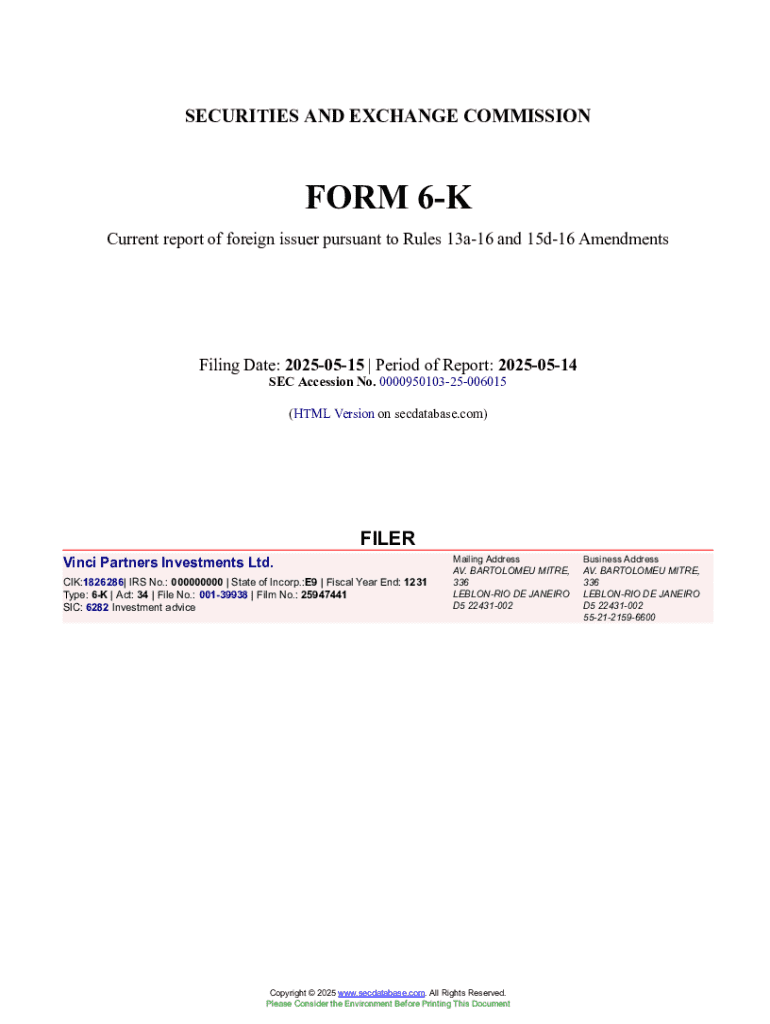

Get the free Form 6-k

Get, Create, Make and Sign form 6-k

Editing form 6-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 6-k

How to fill out form 6-k

Who needs form 6-k?

How to Complete a Form 6-K: A Comprehensive Guide

Understanding Form 6-K

Form 6-K is a crucial compliance document mandated by the U.S. Securities and Exchange Commission (SEC) specifically for foreign companies trading on U.S. exchanges. This form serves as a bridge for these companies to disclose material information to the public and the SEC on an ongoing basis. Unlike other SEC forms, Form 6-K is designed to keep investors and analysts updated with significant events that fall under various categories such as financial results, business acquisitions, or changes in management.

The significance of Form 6-K cannot be understated. It acts not only as a regulatory requirement but also as a mechanism for foreign entities to enhance transparency in their operations. If filed accurately and timely, it can bolster investor confidence, ensuring stakeholders are well-informed about developments that could affect their investments.

Key components of Form 6-K

Form 6-K consists of several key components that foreign companies must include, such as detailed financial statements, management discussions, and other significant disclosures. These components ensure that all relevant information is accessible to investors and regulators alike.

It’s essential to recognize the differences between Form 6-K and other SEC forms, such as Form 10-K or Form 20-F. Unlike those forms, which compile annual reports, Form 6-K is filed on an ad-hoc basis, signifying the importance of timely disclosures as they arise in real-time.

Preparing to file Form 6-K

Determining the necessity of filing Form 6-K requires an understanding of what qualifies as a material event. Events triggering the need for this form can include changes in executive management, significant acquisitions, or updates on financial performance that deviate from expectations. Failure to file timely may lead to legal repercussions, ranging from fines to more severe consequences impacting public trust and stock value.

Companies should prioritize gathering all required information and documents before initiating the filing process. This includes financial statements, press releases, and other pertinent documentation that corroborates the disclosed information.

Filling out the Form 6-K

Filling out the Form 6-K involves several precise steps that ensure compliance and accuracy. Initially, companies must identify the appropriate filing period, which influences the information that must be included within the form. Ensuring accurate company details such as the official name, SEC file number, and contact information is critical, as discrepancies can lead to delays or penalties.

Completing financial statements and disclosures needs careful attention to detail. All relevant figures should be current and reflect accurate financial health. Moreover, attaching relevant exhibits to the filing is crucial. This can include detailed financial reports or any supporting documents that enhance the context of the disclosure.

Common mistakes to avoid during this process include incomplete disclosures or misinterpretations of SEC regulations, both of which can lead to significant repercussions. Taking the time to review requirements can help streamline the filing process.

Editing and reviewing your Form 6-K

Thorough review before submission is essential. Errors may have implications not only for compliance but also related to the company’s public perception. A meticulously reviewed Form 6-K enhances credibility, while mistakes could convey negligence or unprofessionalism, impacting investor confidence and stock prices.

Utilizing tools like pdfFiller can greatly aid in editing and reviewing the Form 6-K. Moreover, the eSigning and collaborative features streamline the process, allowing different team members to contribute their expertise and insights into the document efficiently.

Submitting Form 6-K

Before submission, a final review is paramount. Creating a verification checklist can be instrumental in ensuring all components are complete. This checklist should include company identification, financial data accuracy, and all required exhibits to mitigate the risk of filing issues.

Preparation for electronic submission via EDGAR is the next step. Companies must be familiar with the submission process, ensuring compliance with the SEC’s electronic filing requirements. It’s crucial to be aware of key submission deadlines, as timely filing is essential for maintaining compliance.

Post-submission management

Once Form 6-K is filed, understanding what to expect next is crucial. Companies should track the status of their submission on the SEC’s EDGAR database, ensuring that all documentation is processed correctly. This allows companies to maintain control and transparency, addressing any discrepancies immediately.

Additionally, being prepared to respond to SEC comments or feedback efficiently is vital for maintaining compliance. Companies should develop a strategy to manage the review process, ensuring that they can address regulatory inquiries promptly to uphold their corporate reputation.

Best practices for maintaining compliance

To successfully maintain compliance, companies should implement regular updates and monitoring of their reporting processes. Staying informed about changes in regulatory requirements through resources provided by the SEC aids in ensuring timely compliance. This proactive approach also supports developing internal schedules for review periods, keeping the company prepared for disclosures that may arise.

Moreover, leveraging collaborative tools such as pdfFiller can streamline document management and compliance efforts across teams. By incorporating cloud-based solutions, organizations can foster teamwork on filings, streamline processes, and enhance efficiency, ultimately improving accuracy in their documentation.

FAQs about Form 6-K

When it comes to filing Form 6-K, several common questions arise. A frequent concern is what to do if a filing deadline is missed. The SEC has strict guidelines surrounding late filings, and it is critical for companies to have a plan in place for such scenarios, including potential penalties and necessary corrective filings.

Another common inquiry involves the capacity to amend filings after submission. Companies should be aware that amendments can be made; however, understanding the process and ensuring that all necessary approvals are in place is essential to minimize complications.

Additional insights

Examining real-life examples of companies successfully navigating the Form 6-K process reveals strategies that can be replicated. Successful firms often share the underlying principles of early preparation, meticulous documentation, and transparent communication, all of which contribute significantly to their positive stock market performance post-filing.

Expert tips from financial reporting professionals often emphasize the importance of not treating Form 6-K as a mere regulatory obligation. Instead, viewing it as an opportunity to engage positively with investors can differentiate a company in the crowded marketplace. Quality disclosures can significantly influence investor perception and market response.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 6-k directly from Gmail?

How do I edit form 6-k in Chrome?

How do I fill out form 6-k on an Android device?

What is form 6-k?

Who is required to file form 6-k?

How to fill out form 6-k?

What is the purpose of form 6-k?

What information must be reported on form 6-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.