Get the free - Edelweiss Life Wealth Premier (A Unit

Get, Create, Make and Sign edelweiss life wealth

Editing edelweiss life wealth online

Uncompromising security for your PDF editing and eSignature needs

How to fill out edelweiss life wealth

How to fill out edelweiss life wealth

Who needs edelweiss life wealth?

Understanding the Edelweiss Life Wealth Form: A Comprehensive Guide

Overview of the Edelweiss Life Wealth Form

The Edelweiss Life Wealth Form is a flexible investment solution designed to cater to the diverse financial goals of individuals seeking comprehensive protection and wealth accumulation. It represents a blueprint for financial planning, allowing policyholders to tailor their investments according to their unique requirements. This form stands out in the market due to its blend of life insurance benefits and savings components, making it an essential tool for informed financial decision-making.

In financial planning, having a structured approach is crucial, and the Edelweiss Life Wealth Form plays an integral role in establishing a solid foundation. It incorporates elements that enhance long-term wealth accumulation while simultaneously providing risk cover, ensuring that individuals and their families are well-protected against life's uncertainties.

Key features of the Edelweiss Life Wealth Form

The key features of the Edelweiss Life Wealth Form are designed to provide a robust platform for financial security and growth. One of the standout features is its comprehensive financial coverage, ensuring that policyholders are protected not just in emergencies but also in their wealth enhancement strategies.

The form gives users significant flexibility in investment options. This means policyholders can adjust their premiums and investment amounts based on evolving financial goals. Additionally, the Edelweiss Life Wealth Form offers options for additional benefits and riders, such as accidental death coverage or critical illness benefits, adding layers of security to the investment.

Another notable feature is the joint life cover capability, allowing couples or partners to secure one policy that offers coverage for both. This feature not only simplifies purchasing but also maximizes the insurance benefits.

Eligibility criteria for Edelweiss Life Wealth Form

To apply for the Edelweiss Life Wealth Form, there are specific eligibility criteria that potential policyholders must meet. The age limits for applicants generally range from 18 to 65 years, catering primarily to young professionals and middle-aged individuals looking to secure their financial future.

Income and employment requirements focus on ensuring that policyholders can sustain their premium payments. Additionally, the policy tenure is flexible, typically falling between 10 to 30 years, allowing individuals to select a period that aligns best with their financial strategies. When applying, applicants must provide certain documentation, which includes proof of identity, proof of income, and medical history.

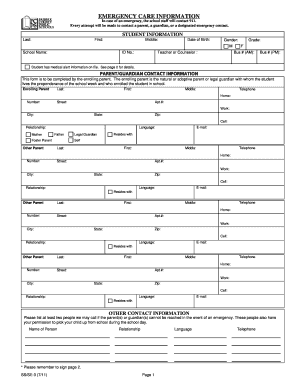

Step-by-step guide to completing the Edelweiss Life Wealth Form

Completing the Edelweiss Life Wealth Form can significantly influence your financial planning outcomes. Start by gathering necessary documents such as proof of identity, income statements, and any health-related records that may be required. Having these at hand will streamline the process.

Most sections of the form are self-explanatory, but careful attention to detail is vital. Begin with the personal information section, where basic details such as name, address, and contact information are required. Following this, provide your health history truthfully, including any pre-existing conditions.

Designate beneficiaries wisely, as this can affect how benefits are distributed in the event of your demise. Lastly, choose your payment options based on your financial situation, whether you prefer monthly, quarterly, or annual payments.

Common mistakes to avoid include not reading instructions thoroughly, failing to provide all required documentation, and underestimating the importance of accurate health disclosures.

Managing your Edelweiss Life Wealth Form

Once you have your Edelweiss Life Wealth Form, managing it efficiently is paramount for ensuring that it continues to serve your needs. Editing and updating your policy information can typically be done through the insurer's customer portal, allowing you to keep your details current as your life circumstances change.

Understanding your policy status is crucial for maintaining awareness of coverage limits and investment performances. Regularly check your policy documents online, ensuring you are not missing any benefits or opportunities for enhancement. This proactive approach assists in maximally utilizing your investment.

You can easily access your documents online through the insurer's website or app. Utilizing tools like pdfFiller can make document management straightforward, allowing policyholders to edit, store, and share their documents securely and efficiently.

How to sign and submit the Edelweiss Life Wealth Form

Signing the Edelweiss Life Wealth Form can be done in various ways, providing flexibility to policyholders. You may choose to utilize an electronic signature or plan for a manual signature that can later be scanned and submitted. This versatility caters to preferences regarding digital versus traditional documentation.

Submitting your form can be accomplished through multiple channels. Online submission is often encouraged for its speed and convenience, but some may prefer to submit their forms in person. Each route has its merits, so select the one that aligns with your comfort level.

Once your form has been submitted, expect a confirmation and a timeline for processing your application. Keep track of any communications from the insurer to stay updated on the progress.

Benefits of using pdfFiller for your Edelweiss Life Wealth Form

pdfFiller is an invaluable resource for managing your Edelweiss Life Wealth Form. Its cloud-based document management capabilities streamline the process of filling, signing, and sharing forms. Users can access their documents from anywhere, ensuring that important paperwork is always within reach.

The platform provides collaboration tools that enhance communication and efficiency, especially useful for teams managing shared documents or collective financial decision-making. pdfFiller's seamless PDF editing and eSigning allow for quick changes without the need for cumbersome software or reprints.

Moreover, its accessibility means you can manage your financial documents at your convenience, making it easy to stay organized and responsive to changes in your financial plans.

Frequently asked questions (FAQs) about the Edelweiss Life Wealth Form

Understanding the nuances of the Edelweiss Life Wealth Form may raise several questions. It's common for applicants to wonder what steps to take if they encounter issues during their application process. If you face difficulties, reaching out to customer support is always the best course of action. They can assist with technical problems or clarify any policy-related inquiries.

Policy modifications post-issuance are also a frequent concern. Fortunately, many adjustments can be made, including changing beneficiaries or modifying coverage amounts, provided they align with policy stipulations. Additionally, it’s important to be aware of any lock-in periods or withdrawal limits that could affect how and when you can access your funds.

For direct assistance, contacting customer support via email or phone is encouraged, allowing for immediate clarification of any uncertainties.

Additional insights on wealth management with Edelweiss Life

Edelweiss Life offers a range of wealth plans, each tailored to meet specific financial goals. The flexibility of the Wealth Form allows investors to integrate it effectively into a broader financial strategy. It's crucial to understand how the Wealth Form fits within your overall investment landscape, as this can dictate the paths available for growth or protection.

Selecting the right investment strategy is critical to achieving long-term financial goals. Whether you are aiming for short-term gains or long-term stability, the Edelweiss Life Wealth Form equips you with tools to secure your financial future. Regularly revisiting your investment strategy in line with evolving market conditions and personal needs ensures you remain on track.

User feedback and testimonials

User experiences with the Edelweiss Life Wealth Form highlight its effectiveness in managing financial security while building wealth. Many users appreciate the clarity and ease of the application process, noting that the step-by-step instructions laid out in the form guide them to providing all necessary information accurately.

Furthermore, testimonials reveal that users feel confident using tools like pdfFiller for document management. These solutions streamline the process, enhance collaboration, and ultimately save time during what can be a cumbersome task. User feedback underscores the significance of having a reliable way to handle important documents, particularly in the financial sector.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit edelweiss life wealth from Google Drive?

How do I fill out the edelweiss life wealth form on my smartphone?

Can I edit edelweiss life wealth on an Android device?

What is edelweiss life wealth?

Who is required to file edelweiss life wealth?

How to fill out edelweiss life wealth?

What is the purpose of edelweiss life wealth?

What information must be reported on edelweiss life wealth?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.