Get the free Group Life Insurance Evidence of Insurability

Get, Create, Make and Sign group life insurance evidence

Editing group life insurance evidence online

Uncompromising security for your PDF editing and eSignature needs

How to fill out group life insurance evidence

How to fill out group life insurance evidence

Who needs group life insurance evidence?

A Comprehensive Guide to Group Life Insurance Evidence Form

Understanding the group life insurance evidence form

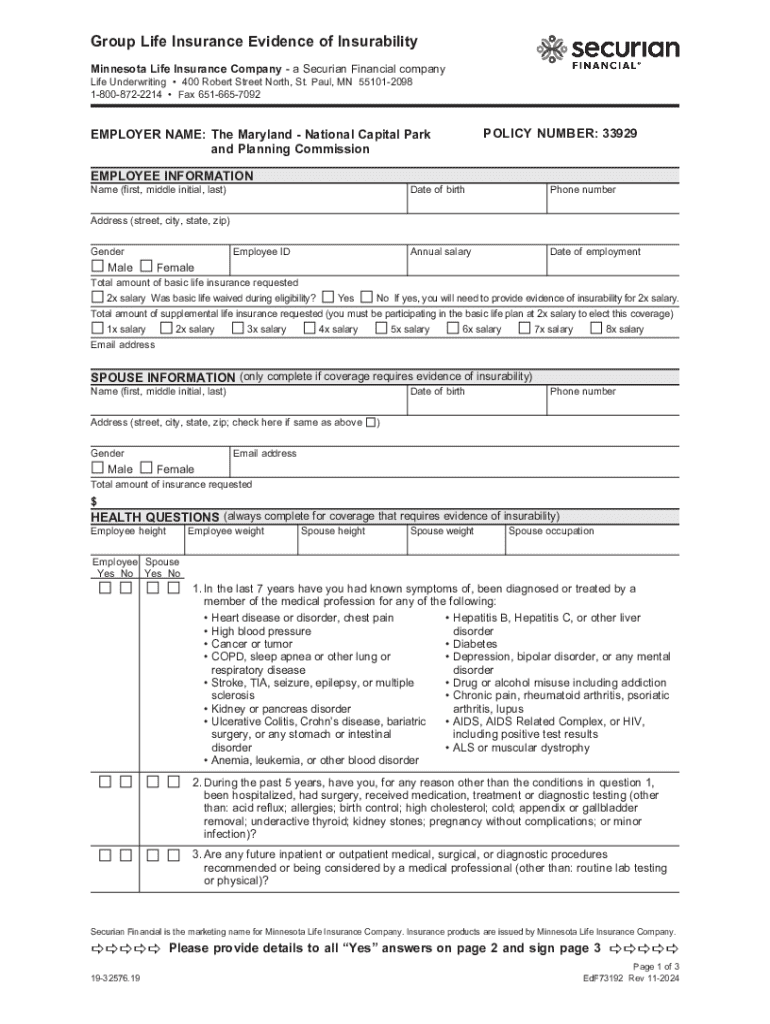

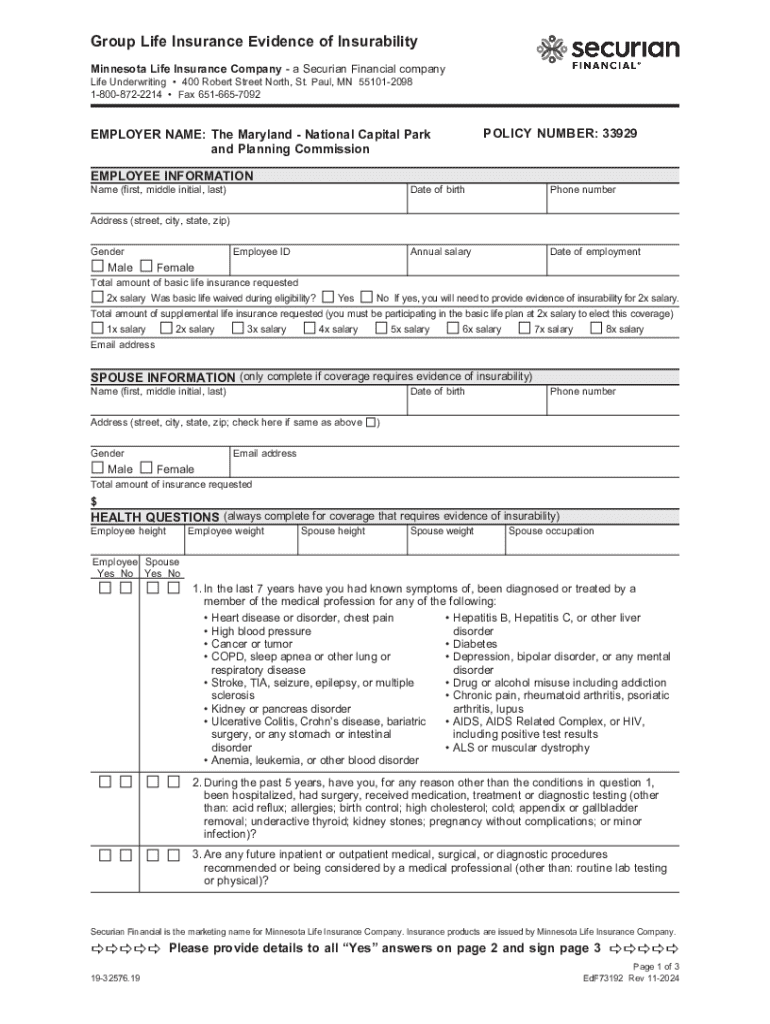

A Group Life Insurance Evidence Form plays a critical role in the application process for group life insurance policies, allowing insurers to collect necessary personal and health information from employees or members applying for coverage. This form is designed to assess the insurability of applicants and is essential for determining eligibility and premium rates.

By accurately completing the evidence form, individuals can ensure they receive the appropriate coverage tailored to their needs. The importance of this form cannot be overstated; it serves as the first line of communication regarding an applicant's health status and lifestyle choices, which are vital factors in underwriting decisions.

Typically, this evidence form comprises various sections such as personal information, employment details, health questionnaires, and beneficiary designations. Each section is designed to gather essential details that insurers need to process the application effectively.

Key components of the group life insurance evidence form

The group life insurance evidence form is structured in a manner that facilitates comprehensive data collection. Below are the primary components:

Step-by-step guide to filling out the group life insurance evidence form

Completing the group life insurance evidence form might seem daunting, but by following a structured approach, applicants can navigate the process smoothly.

Editing and managing your group life insurance evidence form with pdfFiller

To streamline the form completion process, pdfFiller offers several features that make editing and managing your evidence form straightforward and efficient.

Common mistakes to avoid when filing the evidence form

Filing the group life insurance evidence form correctly is essential for ensuring that your application is processed without delay. Here are some common mistakes to steer clear of:

Frequently asked questions (FAQs) about the group life insurance evidence form

Understanding the group life insurance evidence form is crucial, but applicants often have lingering questions. Here are some commonly asked queries regarding the process:

Tips for a smooth application process

Navigating the application process for group life insurance can be made easier with a few practical tips:

Interactive tools available on pdfFiller for document management

pdfFiller provides several interactive tools designed to enhance the document management experience for users dealing with the group life insurance evidence form:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit group life insurance evidence straight from my smartphone?

How do I fill out the group life insurance evidence form on my smartphone?

How do I complete group life insurance evidence on an Android device?

What is group life insurance evidence?

Who is required to file group life insurance evidence?

How to fill out group life insurance evidence?

What is the purpose of group life insurance evidence?

What information must be reported on group life insurance evidence?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.