Get the free Ct-2658-att

Get, Create, Make and Sign ct-2658-att

Editing ct-2658-att online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-2658-att

How to fill out ct-2658-att

Who needs ct-2658-att?

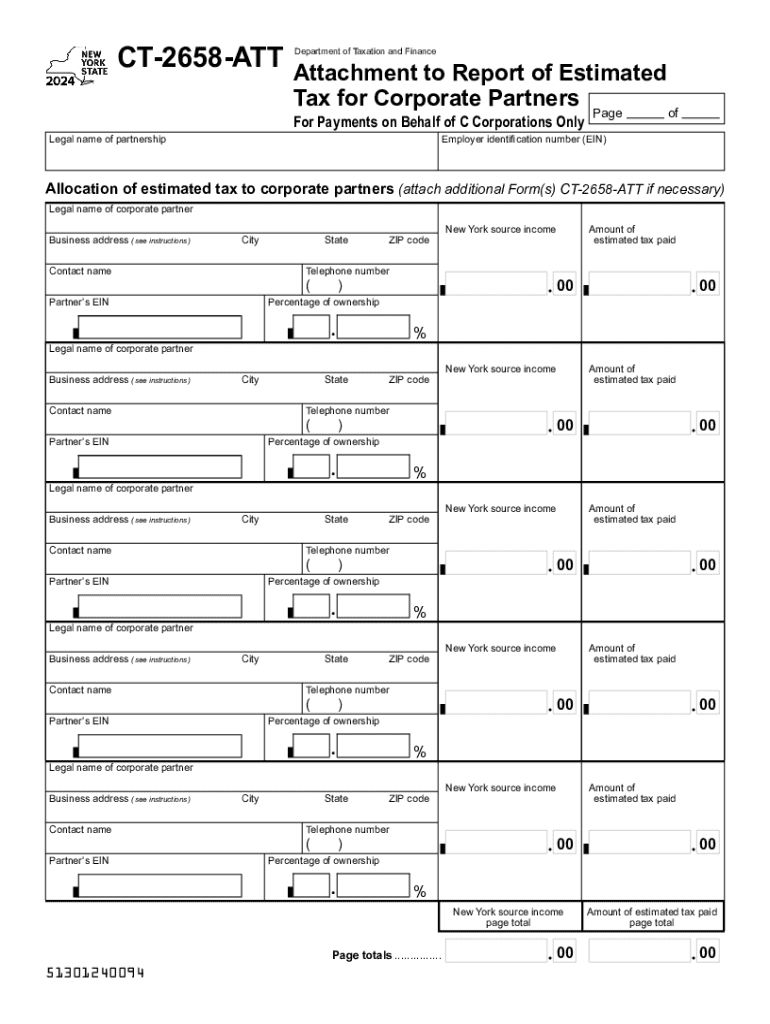

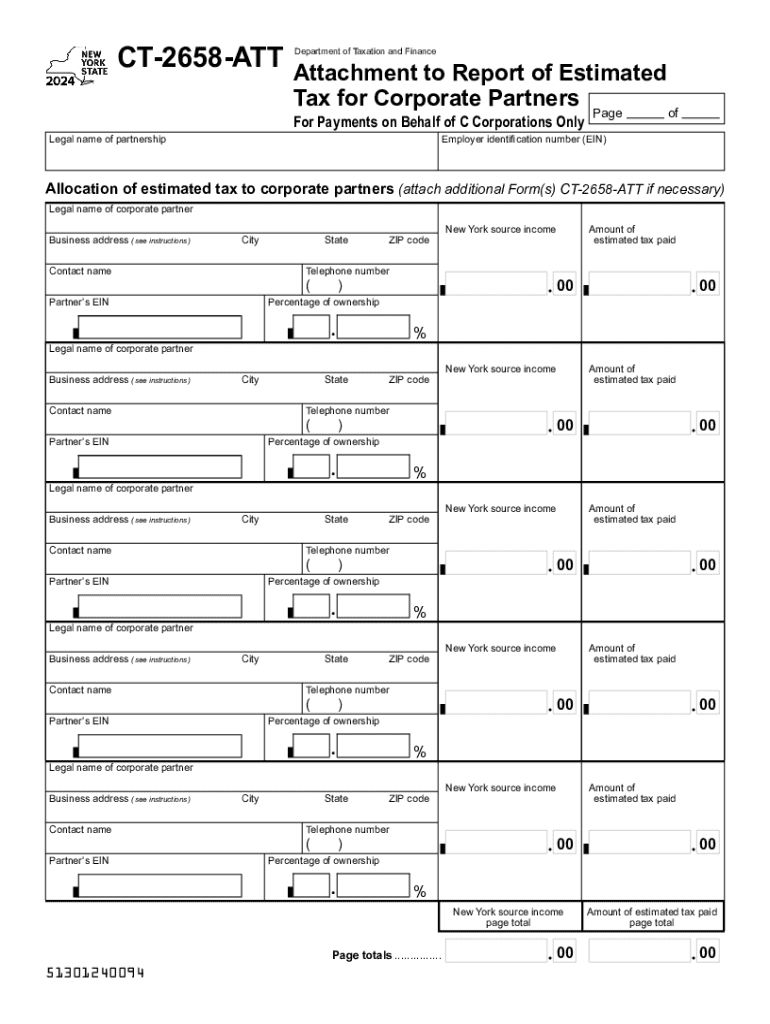

A comprehensive guide to the CT-2658-ATT form

Overview of the CT-2658-ATT form

The CT-2658-ATT form is an essential document utilized primarily for informing the Department of Revenue in Connecticut about the various attributes of certain tax-related situations. This form is crucial for individuals and businesses aiming to maintain compliance with Connecticut tax regulations.

The importance of the CT-2658-ATT form extends beyond mere completion; it is pivotal in various contexts, especially concerning taxation and regulatory compliance. Failure to accurately file this form may lead to penalties or complications with tax authorities, emphasizing its role within fiscal responsibility.

Understanding the key components of the CT-2658-ATT form

To effectively manage the CT-2658-ATT form, it’s vital to comprehend its structure. The form is divided into several fields, each with a distinct purpose to ensure that all required information is collected.

Key fields include:

Translating these components into actionable steps can simplify the process of filling out the CT-2658-ATT form and eliminate potential errors.

Step-by-step guide to filling out the CT-2658-ATT form

Completing the CT-2658-ATT form demands a systematic approach. Follow this step-by-step guide to ensure a smooth experience.

1. Gather necessary documentation

Start by assembling all required documentation, which typically includes personal identification, relevant financial records, and prior tax returns.

Tips for organizing your documentation efficiently include:

2. Filling out personal information

Accurate completion of personal information fields is crucial. Ensure you include your full name, address, and accurate contact details.

Remember to avoid common mistakes such as misspellings or incorrect number formatting, which can lead to processing delays.

3. Completing financial statements

Provide exact figures for income, expenditures, and deductions. Ensure that your financial statements align with your supporting documents.

You might have questions about financial reporting on the form, such as: - What documents can substantiate my income? - How should I detail my deductions?

4. Reviewing and finalizing the form

Once filled out, it’s crucial to double-check all entries for errors. A meticulous review aids in ensuring compliance with tax guidelines and avoids costly mistakes in the long run.

Interactive tools for efficient form management

Utilizing pdfFiller, users can take advantage of several interactive tools to streamline the completion and management of the CT-2658-ATT form.

pdfFiller provides features like:

Common challenges when dealing with the CT-2658-ATT form

Even with a systematic approach, individuals may face challenges when completing the CT-2658-ATT form. Common stumbling blocks include misplacing required information and technical difficulties with online submissions.

Identifying and troubleshooting common errors often requires attention to specific aspects, such as:

If problems persist, contacting the support team of pdfFiller can provide immediate assistance.

Related topics and resources

Understanding the CT-2658-ATT form requires familiarity with related forms and tax documents. One such important form is the CT-2659, which individuals should also review.

Further, pdfFiller provides links to relevant documents that can aid in understanding other tax filing procedures. Familiarity with general tax forms is also beneficial.

Advanced tips for using the CT-2658-ATT form with pdfFiller

Using the CT-2658-ATT form on pdfFiller offers advanced functionalities that can enhance user experience. Some tips to maximize efficiency include:

Case studies: successful use of the CT-2658-ATT form

Real-life examples showcase how individuals and businesses have effectively utilized the CT-2658-ATT form. Common scenarios include business tax filings and personal tax matters.

Testimonials from users who have successfully filed the form indicate the positive impact of thorough preparation and utilizing platforms like pdfFiller, which ease the overall process.

Keeping up-to-date with changes to the CT-2658-ATT form

Staying informed about modifications to the CT-2658-ATT form is essential for compliance. Historical changes emphasize the importance of this vigilance, as the form evolves to suit regulatory requirements.

Users can subscribe to notifications from the Department of Revenue or utilize resources on pdfFiller to remain aware of future updates.

Conclusion of the guide

The CT-2658-ATT form plays a critical role in tax compliance within Connecticut. By understanding its components, utilizing tools available on pdfFiller, and following a systematic approach, individuals can ensure accurate submissions.

Utilizing pdfFiller not only enhances the document management experience but also allows users to navigate through their tax obligations seamlessly and efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ct-2658-att for eSignature?

How do I make edits in ct-2658-att without leaving Chrome?

Can I create an eSignature for the ct-2658-att in Gmail?

What is ct-2658-att?

Who is required to file ct-2658-att?

How to fill out ct-2658-att?

What is the purpose of ct-2658-att?

What information must be reported on ct-2658-att?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.