Get the free Form 4

Get, Create, Make and Sign form 4

How to edit form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 4

How to fill out form 4

Who needs form 4?

Understanding Form 4: A Comprehensive Guide

Understanding Form 4

Form 4 is a vital document submitted to the U.S. Securities and Exchange Commission (SEC) that allows corporate insiders to report changes in their ownership of a company’s securities. The main purpose of this form is to provide transparency and maintain compliance with securities regulations, which is crucial for investor confidence.

The significance of Form 4 in financial reporting cannot be overstated. By mandating timely disclosures of stock transactions by company insiders, it ensures that investors have access to relevant information that can affect stock prices. This form plays a crucial role in preventing insider trading and promotes ethical standards in financial markets.

Who needs to use Form 4?

The primary users of Form 4 are corporate officers, directors, and significant shareholders of publicly traded companies, often referred to as 'insiders'. These individuals typically own a substantial number of shares or have access to sensitive company information that could influence their buying or selling behavior. Therefore, it is imperative for these stakeholders to report any changes in their ownership promptly.

Specific scenarios for using Form 4 include selling or purchasing shares, receiving stock as compensation, or transferring stock ownership—for example, in the case of estate planning. Each of these circumstances requires timely and accurate reporting to maintain legal compliance and provide necessary transparency to other investors.

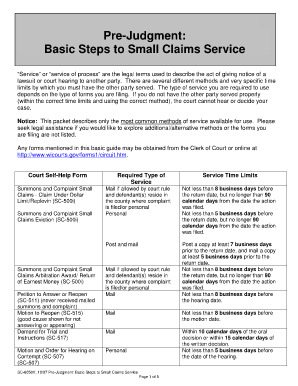

Key elements of Form 4

Form 4 consists of several key sections that need to be completed appropriately. Each section allows insiders to disclose specific details regarding their transactions and ownership status. The primary sections generally include: identification of the reporting individual, information about the issuer, and details of the securities being traded or owned.

Additionally, Form 4 uses different transaction codes to categorize the type of ownership change being reported. These codes are crucial for interpreting the intentions behind the transactions. Common examples of transaction codes include:

Step-by-step instructions for filling out Form 4

Filling out Form 4 can seem daunting, but by following specific steps, you can ensure accuracy and compliance. Begin by gathering the necessary information, including your full name, transaction dates, company name, and details of the securities involved.

Next, fill in each section methodically. Here’s how to approach it:

After completing the form, take the time to review your Form 4 carefully. Pay special attention to the accuracy of your details. Common mistakes include incorrect transaction dates and missing signatures, which can lead to compliance issues.

Editing and managing Form 4 with pdfFiller

pdfFiller is an excellent platform for managing Form 4. Start by accessing the Form 4 template within the platform, which can be easily located through their search functionality. This allows users to find the necessary document quickly.

Once you have the template, pdfFiller provides comprehensive editing features, such as text edits, adding signatures, and attaching supporting documents. This flexibility ensures that all information can be accurately represented and easily modified as needed.

Moreover, pdfFiller offers collaboration tools that enable multiple users to contribute to the completion of Form 4. You can share the document for team input and approval, which enhances the efficiency of the process.

eSigning Form 4

An electronic signature (eSignature) is crucial for the legal validity of Form 4. eSignatures are recognized legally in many jurisdictions, provided they meet certain security standards. Using eSignatures on Form 4 not only streamlines the process but also safeguards the document against unauthorized changes.

To add an eSignature using pdfFiller, follow these steps: first, navigate to the signature section of the platform. Then, create a new signature or select an existing one. Finally, place the eSignature in the appropriate location on Form 4 before finalizing the document.

Common challenges and troubleshooting

Filling out Form 4 can present several challenges, such as misunderstanding the requirements for certain sections or using incorrect transaction codes. Insiders may also encounter difficulties in meeting deadlines, which can lead to compliance issues.

Solutions include consulting the SEC guidelines for Form 4, utilizing support tools on pdfFiller, and ensuring regular communication with compliance teams within the company. Using pdfFiller’s features to track version history can also help manage changes and avoid confusion.

Best practices for managing Form 4

Effective storage of completed Form 4 is critical for future reference and compliance tracking. Recommended storage solutions include secure cloud-based services, like pdfFiller, which not only protect your documents but also provide easy retrieval when necessary.

Additionally, keeping track of updates and filing requirements is essential. This can be accomplished by setting reminders for filing deadlines and subscribing to updates from the SEC or financial news outlets to remain informed of changes in reporting regulations.

Interactive tools available on pdfFiller

pdfFiller offers a range of interactive tools that enhance the user experience with Form 4. Their customizable templates make it easy to create a compliant Form 4 specific to your requirements without starting from scratch.

Furthermore, live support and rich resource guidance through pdfFiller are readily accessible. Users can leverage live chat for immediate help or access comprehensive guides that can assist them in navigating the complexities of completing Form 4.

Moving forward with Form 4

Understanding the impact of Form 4 on investor relations is critical for companies. Timely and accurate reports on insider trading not only promote transparency but also foster trust with stakeholders. Poor reporting can undermine investor confidence and lead to reputational risks.

Looking forward, it's important to stay alert regarding future regulations that may affect Form 4. Keeping abreast of changes in filing requirements or SEC rules is essential for maintaining compliance and ensuring effective communication with investors.

Where to find additional assistance

For personalized assistance with Form 4, contacting pdfFiller support is straightforward. You can reach out via their contact form or live chat feature for quick answers to your inquiries. Their support team is knowledgeable about the complexities of form management.

Additionally, community forums can provide invaluable insights. Engaging with industry experts through online forums can yield advice and strategies that enhance your understanding of Form 4 and its implications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 4?

How do I complete form 4 online?

How do I make changes in form 4?

What is form 4?

Who is required to file form 4?

How to fill out form 4?

What is the purpose of form 4?

What information must be reported on form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.