Get the free Tax Certificate Application

Get, Create, Make and Sign tax certificate application

Editing tax certificate application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax certificate application

How to fill out tax certificate application

Who needs tax certificate application?

Understanding the Tax Certificate Application Form: A Comprehensive Guide

Understanding the tax certificate

A tax certificate is a formal document that serves as proof of an individual or entity's compliance with tax obligations. This certification verifies that all due taxes have been paid and that there are no outstanding liabilities against the taxpayer. Unlike a tax return, which details yearly income and tax liability, a tax certificate encapsulates the taxpayer's overall tax status.

Tax certificates are not just routine pieces of paperwork; they play an essential role in various legal and financial transactions. For example, financial institutions often require this certificate during loan applications to ensure the applicant's fiscal integrity. They can also be crucial when bidding for contracts that require proof of tax compliance.

Requirements for applying for a tax certificate

To apply for a tax certificate, specific information and documentation are required. This information verifies your identity and tax compliance history. Applicants need to collect personal identification details, such as ownership of property or active confirmed social security numbers, to facilitate the application process.

Along with personal information, a Tax Identification Number (TIN) is a crucial element. The TIN serves as your unique identifier in the tax system, helping authorities locate your tax records. Without this, obtaining a tax certificate may be impossible.

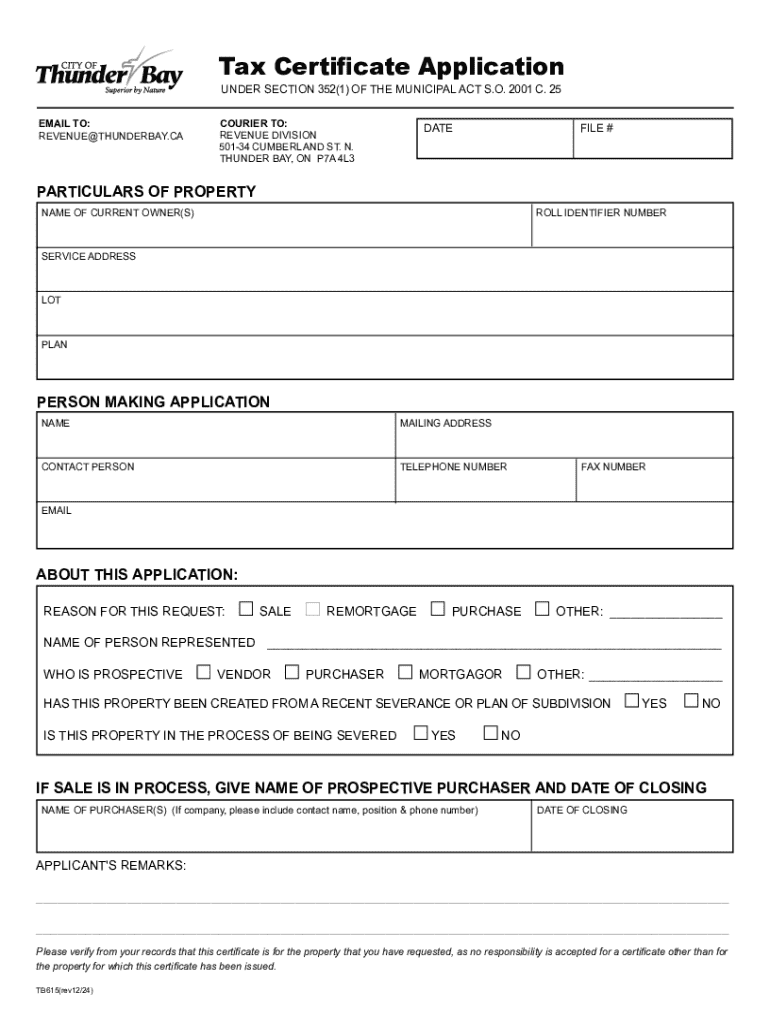

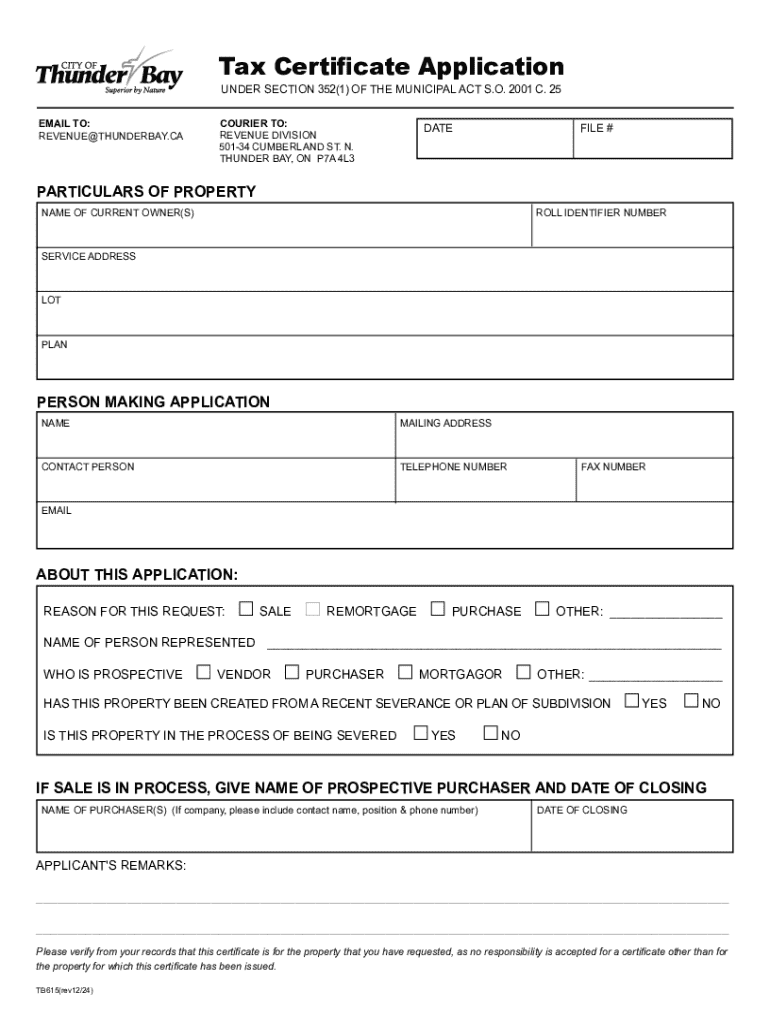

Tax certificate application form overview

The Tax Certificate Application Form serves as the key document to apply for tax certification. This form collects all pertinent information about the applicant and their tax status, ensuring that authorities have everything they need to process the request effectively.

The application form typically contains a variety of sections, each meticulously crafted to simplify the gathering of essential information. By understanding the sections in detail, applicants can ensure they provide complete and accurate data on their first attempt.

Step-by-step guide to filling out the tax certificate application form

Filing the Tax Certificate Application Form is a systematic process that can save you time and frustration if done meticulously. Here’s how to navigate through it:

When it comes to the application form, pdfFiller makes accessing and filling out the document simpler. You can easily edit and fill out forms in a user-friendly format.

Editing and formatting your tax certificate application

pdfFiller provides a robust platform for editing your Tax Certificate Application Form. Users can manipulate PDF documents seamlessly, adding necessary signatures, comments, or collaboration inputs to cross-check with team members.

Enhancing your application improves its clarity and presentation, creating a more professional outlook that might contribute to the approval process.

Frequently asked questions (FAQ)

The tax certificate application process can generate many questions. Here are some common queries to clarify the experience:

Exploring interactive tools and resources

Using pdfFiller, applicants can access various tools and features designed to streamline the tax certificate application process. Templates are available for quick customization, ensuring your documents meet all necessary requirements without starting from scratch.

Additionally, users can set reminders for certificate renewals, helping maintain compliance during tax seasons without oversight. Understanding the resources available enhances the chances of a successful application.

Additional considerations for teams and businesses

Teams and businesses often face unique challenges when applying for tax certificates, primarily if multiple applications are involved. It is crucial to have a centralized approach to manage these applications, ensuring recordkeeping is efficient and that all team members work cohesively.

Best practices include assigning roles within the team for document management, maintaining organized records for easy access, and ensuring security compliance when handling sensitive financial information.

Key takeaways

Navigating the tax certificate application process does not have to be daunting. Understanding the requirements, ensuring accurate documentation, and utilizing tools like pdfFiller can simplify the experience significantly. Critical aspects include gathering all necessary forms and submitting complete applications to avoid processing delays.

In summary, tax certificates are essential for establishing fiscal credibility. Timely application and adherence to procedures ensure that you uphold your monetary responsibilities while effectively managing the documentation process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find tax certificate application?

How do I make edits in tax certificate application without leaving Chrome?

Can I edit tax certificate application on an iOS device?

What is tax certificate application?

Who is required to file tax certificate application?

How to fill out tax certificate application?

What is the purpose of tax certificate application?

What information must be reported on tax certificate application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.