Get the free Form 990-ez

Get, Create, Make and Sign form 990-ez

How to edit form 990-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-ez

How to fill out form 990-ez

Who needs form 990-ez?

Form 990-EZ Form How-to Guide

Understanding Form 990-EZ

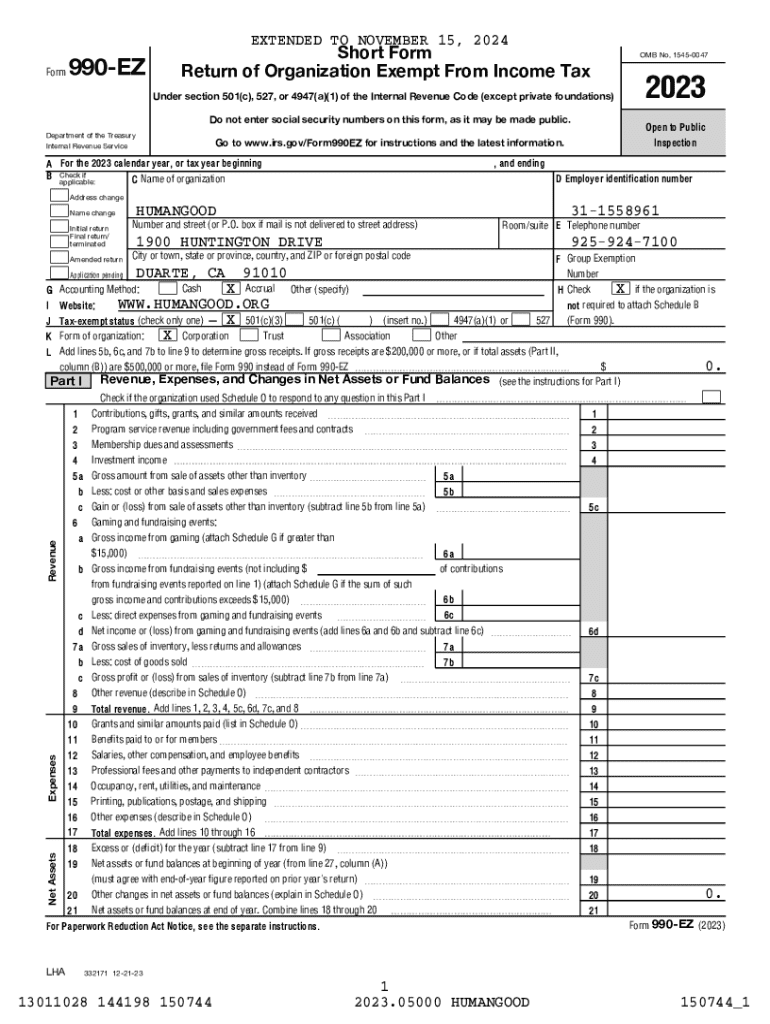

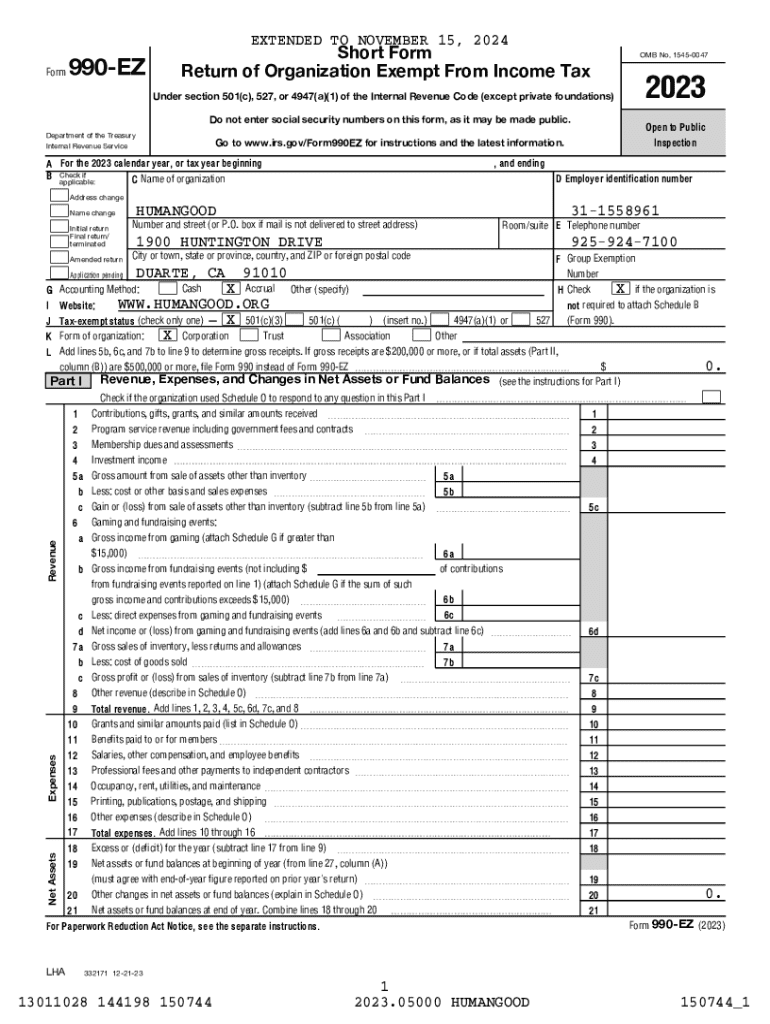

Form 990-EZ is a streamlined version of Form 990, tailored for small to mid-sized tax-exempt organizations. Its primary purpose is to provide the IRS with a concise overview of a nonprofit's financial status, governance, and activities. Organizations that meet specific criteria, typically those with gross receipts between $200,000 and $500,000, are eligible to file this form instead of the more comprehensive Form 990. This can significantly reduce the time and complexity involved in annual tax reporting.

Filing Form 990-EZ is crucial for maintaining an organization’s tax-exempt status. Nonprofits must meet legal requirements for reporting and transparency, which can affect funding opportunities and community trust. Failure to file could lead to penalties or even revocation of tax-exempt status, making compliance essential for nonprofits.

Who needs to file Form 990-EZ?

Eligibility to file Form 990-EZ is determined by several factors, primarily the organization's size and revenue. Nonprofits with annual gross receipts not exceeding $500,000 and total assets not exceeding $1.25 million can file this version of the form. This creates a clear delineation from larger organizations, which must file the more comprehensive Form 990.

Filing deadlines and extensions

Timing is critical for nonprofits, as Form 990-EZ must be filed on the 15th day of the 5th month after the end of the organization's fiscal year. For organizations operating on a calendar year, this typically translates to a May 15 deadline. However, nonprofit organizations can request an extension to gain extra time to prepare their filings, ensuring accuracy and compliance.

To file for an extension, organizations must submit Form 8868, which is straightforward. By completing this form, nonprofits can receive an automatic 6-month extension, allowing them additional time to gather necessary documentation and finalize their records.

Key components of Form 990-EZ

The structure of Form 990-EZ is designed to be user-friendly, consisting of several key sections that require specific information. Organizations must provide details about their mission, governance, financial activities, and expenditures. Each section plays a pivotal role in delivering a comprehensive financial picture to the IRS.

In addition to the main form, several schedules may need to be included depending on the nature of the organization's activities. For instance, Schedule A provides information about the organization’s public charity status and public support, while Schedule B details contributors who donated more than $5,000.

Preparing to file Form 990-EZ

Preparation is crucial before diving into the filing process. Organizations should gather financial statements, including income statements, balance sheets, and cash flow statements, alongside fundamental organizational documents such as articles of incorporation and by-laws. This information will not only facilitate accurate completion of Form 990-EZ but will also ensure compliance with IRS requirements.

Utilizing digital tools can significantly simplify the preparation of Form 990-EZ. Platforms like pdfFiller provide eSigning and editing tools that ensure documents are easily editable, accessible, and collaborative. This streamlines the preparation process and allows team members to work together effectively, regardless of their location.

The filing process for Form 990-EZ

E-filing Form 990-EZ can make the process faster and less error-prone. When using an online platform, you'll typically start by entering your organization's details, including its legal name and Employer Identification Number (EIN). Next, proceed to input financial data such as revenue, expenses, and net assets in the respective sections.

After you've filled in all required sections, review the summaries generated by the platform to ensure accuracy. Once everything seems correct, transmit your results securely to the IRS. Most e-filing systems automatically confirm receipt, providing peace of mind that your Form 990-EZ has been filed correctly.

Common challenges and solutions

Despite its streamlined structure, many organizations face common challenges when filing Form 990-EZ. Frequent errors include miscalculating financial data, failing to provide necessary supporting documents, or missing deadlines. To avoid such pitfalls, double-check your numbers and ensure all requisite schedules are attached before submission.

Understanding the penalties for late filing is another crucial aspect. Nonprofits can incur fines of up to $20 per day, up to a maximum of $10,000 for failure to file on time. Organizations that need to amend their Form 990-EZ can easily do so by filing a new return marked 'Amended.' This can help correct errors and update any information since the original filing.

Helpful tools and resources

Nonprofits looking to simplify the filing of Form 990-EZ can leverage an array of free online tools. Budget calculators and document templates can help organizations project future financial health and maintain organized records throughout the year. Using data import features can also save time, allowing nonprofits to prepopulate their form from previous filings.

pdfFiller provides invaluable support for your filing journey. Its collaborative features allow multiple team members to work on documents simultaneously, and customer support options ensure assistance is available when needed. Educational resources such as training sessions can also empower organizations to navigate the complexities of form filing confidently.

Frequently asked questions (FAQ)

Many organizations have specific questions regarding Form 990-EZ and its filing requirements. For example, if you need to file Form 990-T along with your 990-EZ, understanding the relationship between these forms is essential, as 990-T is used for reporting unrelated business income. Organizations may also inquire about amending previously filed returns. The IRS allows amendments, but they must be submitted in the same manner as the original form.

Real experiences from nonprofits filing Form 990-EZ

Nonprofits often share valuable insights and successes when filing Form 990-EZ. Many organizations have adopted tools like pdfFiller to enhance their filing processes, resulting in fewer errors and a more straightforward experience. Testimonials reveal how the collaboration features of pdfFiller allowed teams to manage documents more effectively, leading to a tidier and more efficient filing process.

For example, an arts nonprofit recounted how pdfFiller's user-friendly interface helped them navigate the completion of Form 990-EZ quickly. With the ability to work collaboratively, their team prepared the form efficiently, reducing stress during tax season.

Additional insights for nonprofit tax preparation

Effective nonprofit tax preparation requires diligence and proactive measures. Internal audits play a crucial role in ensuring accurate financial reporting and compliance with IRS standards. Regularly reviewing organizational financials helps mitigate risks and promote transparency with donors and stakeholders.

Emerging technologies like AI can also lend a hand by assisting in data validation and identifying potential discrepancies. Furthermore, for firms managing multiple clients' filings, leveraging features provided by platforms like pdfFiller can facilitate effective management, ensuring each client receives tailored attention while minimizing workload.

Final thoughts on Form 990-EZ filing

A confident filing process for Form 990-EZ involves knowing the requirements and utilizing the right tools for preparation and submission. Organizations that harness the capabilities of platforms like pdfFiller benefit from enhanced document management, improved collaboration, and an overall smoother experience. This streamlines the annual reporting burden, allowing nonprofits to focus on their mission and community impact while ensuring compliance with tax obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 990-ez?

How do I make edits in form 990-ez without leaving Chrome?

How do I edit form 990-ez on an Android device?

What is form 990-ez?

Who is required to file form 990-ez?

How to fill out form 990-ez?

What is the purpose of form 990-ez?

What information must be reported on form 990-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.