Get the free Estimates of Quarterly Gross Domestic Product by ...

Get, Create, Make and Sign estimates of quarterly gross

Editing estimates of quarterly gross online

Uncompromising security for your PDF editing and eSignature needs

How to fill out estimates of quarterly gross

How to fill out estimates of quarterly gross

Who needs estimates of quarterly gross?

Estimates of Quarterly Gross Form: A Comprehensive Guide

Overview of quarterly gross estimates

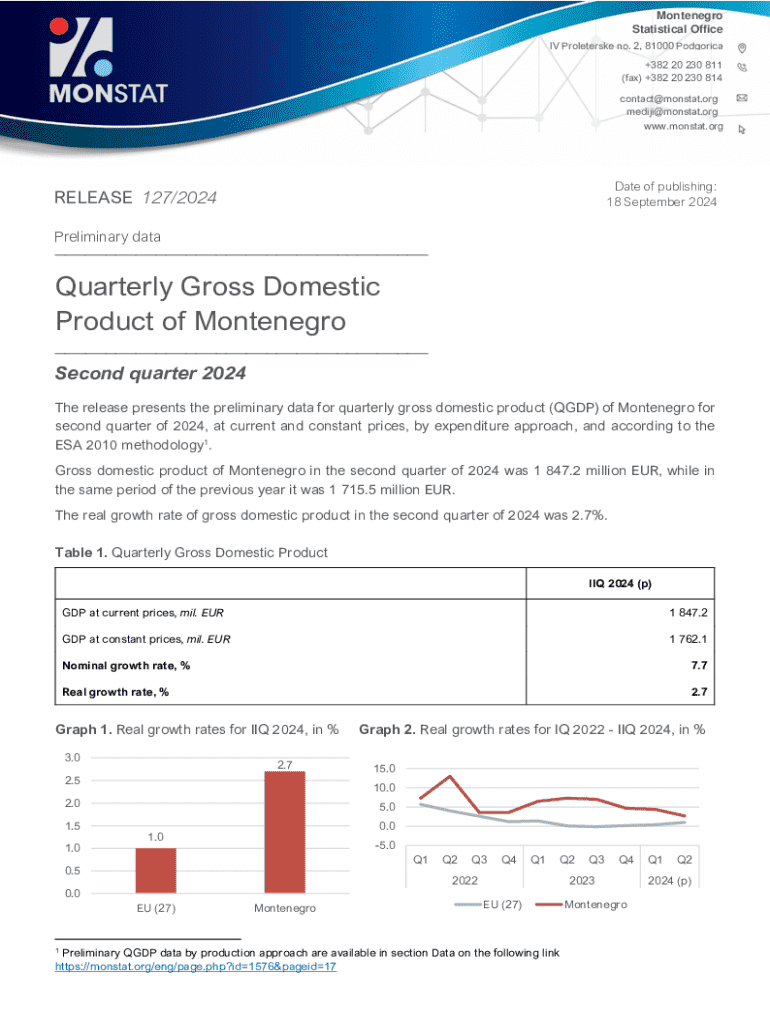

Quarterly gross estimates represent the projected financial performance of a business over a three-month period, capturing its revenues before deducting any expenses. This metric serves as an essential tool for stakeholders ranging from company executives to investors, impacting decision-making at all levels.

Accurate quarterly gross estimates are crucial for effective financial reporting. They help organizations gauge performance, compare to historical data, and make real-time adjustments to strategies. Decision-makers rely heavily on these figures, which is why estimating methodologies can significantly influence corporate strategies.

Various methodologies are employed in estimating quarterly gross figures, often tailored to industry standards and specific business models. Companies may utilize historical data comparisons, trend analysis, and economic indicators to develop these estimates, leading to a more nuanced understanding of potential financial outcomes.

Methodological framework for estimating quarterly gross

Establishing a robust methodology for collecting and analyzing gross data is vital for obtaining accurate quarterly estimates. Key to this process are reliable data sources such as internal sales records, market research reports, and economic databases, all of which provide foundational figures for projections.

Once data is collected, various processing techniques come into play. Analysts may use statistical software to interpret trends and patterns, employing regression analysis or moving averages to smooth out irregularities in data sets. Seasonal adjustments are also critical, particularly for businesses affected by seasonal fluctuations, ensuring that estimates are reflective of true economic conditions.

Tools and resources for analyzing estimates

Utilizing interactive tools can significantly enhance the process of analyzing quarterly gross estimates. pdfFiller offers robust tools that allow users to engage with data in real-time, facilitating better insights into financial projections. These tools can simplify complex data interpretation and aid in visualizing potential outcomes based on different scenarios.

In addition to real-time analysis features, pdfFiller provides templates explicitly designed for projecting quarterly gross figures. These templates streamline the data entry process and minimize the risk of errors. A comparative analysis of different estimation types, such as flash versus advanced estimates, reveals distinct advantages and challenges associated with each methodology.

Filling out the quarterly gross estimation form

Accurate completion of the quarterly gross estimation form is vital for creating sound financial projections. It begins with a detailed understanding of each data field. Users must carefully input essential metrics like projected sales, market conditions, and historical data trends into the template provided by pdfFiller.

To enhance accuracy, ensure all data is current and sourced from reliable references. Common errors may arise from incorrect data entry or miscalculations, which can skew the entire estimation. Taking the time to double-check figures and confirming that all entries reflect true business conditions can save considerable time and resources.

eSigning and collaborating on quarterly gross estimates

Utilizing the eSigning feature in pdfFiller streamlines the approval process for your quarterly gross estimation forms, eliminating the need for paper and ink. This feature allows stakeholders to sign documents from anywhere, promoting efficiency and reducing bottlenecks. Coupled with collaborative features, teams can easily share documents and provide input throughout the estimation process.

To maximize the benefits of collaboration, create clear guidelines for feedback and revisions. Establish who will review and approve the final document, and set deadlines to keep the process moving. This not only aids in finishing estimates efficiently but also encourages a higher quality of input from various departments.

Managing your quarterly gross documents

Proper management of quarterly gross estimates is integral to maintaining organizational knowledge and ensuring compliance. Save documents in the cloud, and categorize them effectively for easy retrieval. Using platforms like pdfFiller allows users to leverage features such as tagging and folders to create an organized document management system.

Version control is also essential to track changes and updates over time. Maintaining a clear history of document revisions helps prevent the use of outdated information and enhances transparency. Always ensure that the latest version is easily accessible to all relevant stakeholders, which strengthens collaboration and consistency in financial reporting.

Frequently asked questions about quarterly gross estimates

Many users may have questions regarding the process of estimating quarterly gross figures. Important queries include how to respond when data changes after submission, and how to handle discrepancies in estimates. Transparency in these processes is key, as it helps maintain trust and clarity with stakeholders.

Understanding the timelines for releases and updates is equally important. Knowing when to expect new data or revised estimates allows businesses to plan their strategic moves effectively. Regular communication with involved parties can alleviate potential frustrations surrounding timelines as updates are rolled out.

Case studies: Real-world applications of quarterly gross estimates

Examining successful implementations of quarterly gross estimates provides practical insights into their significance. Many businesses have successfully leveraged these estimates to refine their strategic goals and meet financial expectations. For example, a technology startup utilized quarterly gross estimates to project growth, attracting substantial investments that facilitated their expansion.

Insights gained from such case studies highlight the importance of accuracy in estimations and robust estimation methodologies. Companies can gain a better understanding of market trends and customer demands, leading to improved financial forecasting and strategy development.

Additional insights

As the economic landscape evolves, new changes may affect how quarterly gross estimates are conducted. Recent announcements, such as shifts in regulatory environments, can significantly impact reporting standards. Stakeholders must stay informed about such developments to ensure compliance and accuracy in their documentation.

The influence of external factors, including economic shifts and global events, further emphasizes the need for adaptability in financial strategies. Companies need to respond swiftly to changing conditions to ensure their quarterly gross estimates remain relevant and reliable.

Contact and support information

For specific queries about quarterly gross estimates, reaching out to pdfFiller's support team can provide valuable guidance. Users can easily access resources and personalized assistance to address their unique document management questions.

In addition, numerous online resources are available, including FAQs, tutorials, and user manuals, designed to enhance your experience with pdfFiller's platform. Engaging with these resources can unlock new capabilities and streamline your document handling skills.

Legal and compliance considerations

Businesses must navigate various legal regulations and compliance standards pertaining to quarterly gross estimates. Compliance with established guidelines ensures that financial documents maintain their integrity, reflecting an organization’s commitment to transparency and accountability.

Failure to adhere to legal requirements can result in severe penalties and reputational damage. Consequently, it’s imperative for organizations to have a clear understanding of applicable laws, ensuring each quarterly gross estimate is prepared and shared in adherence to relevant regulatory frameworks.

Subscription and access to premium features

Opting for premium subscription services through pdfFiller can unlock powerful features for managing quarterly gross estimates and other important documents. Premium users enjoy enhanced capabilities, including advanced analytics, customizable templates, and expanded storage options.

Understanding the pricing models is essential to make informed decisions. Different tiers offer varying levels of access and service, enabling teams of all sizes to find a solution that aligns with their operational needs and budget.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the estimates of quarterly gross in Chrome?

How can I edit estimates of quarterly gross on a smartphone?

How do I complete estimates of quarterly gross on an Android device?

What is estimates of quarterly gross?

Who is required to file estimates of quarterly gross?

How to fill out estimates of quarterly gross?

What is the purpose of estimates of quarterly gross?

What information must be reported on estimates of quarterly gross?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.