Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

A Comprehensive Guide to the Form 8-K Form

Understanding Form 8-K

Form 8-K is a crucial document in corporate finance that public companies must file with the U.S. Securities and Exchange Commission (SEC) to disclose significant events. This form serves multiple purposes, including informing investors and regulators about developments that could materially affect a company’s financial condition or operations. It ensures transparency and provides timely updates to stakeholders, allowing them to make informed decisions.

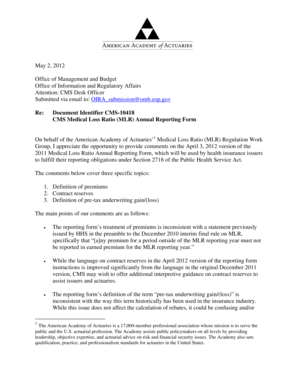

The regulatory requirements surrounding Form 8-K are defined by the SEC. Companies are mandated to file this form under specific circumstances to uphold market integrity and protect investors. For instance, the requirement recognizes a variety of events that could impact investor decision-making, thus forming a bedrock of corporate governance.

When is Form 8-K required?

Form 8-K is not filed regularly but is triggered by specific corporate events. This can include matters such as mergers, acquisitions, or any major corporate restructuring. Changes in control of the registrant—such as the sale of significant shares or a management change—also necessitate filing this form. Other common triggers include departures of directors or key officers and notable changes in a company’s financial condition.

The timeline for submission is equally critical. Companies are generally required to file Form 8-K within four business days after the triggering event. This swift response allows timely dissemination of information to the public and helps maintain market efficiency.

Navigating through Form 8-K

Understanding the format and structure of Form 8-K is essential for proper navigation. The form is divided into several key sections, each designed to capture different elements of disclosure. The first section often details the triggering event, followed by additional disclosures that provide context and implications for investors. Organizations typically have the option to file online through the SEC's EDGAR system or submit paper forms, although the online method is preferred for its efficiency and speed.

When reading through Form 8-K, focus on specific sections to ensure you grasp the salient points—especially if you are an investor or stakeholder. Be aware of common pitfalls, such as overlooking late filings which may signal underlying issues within the reporting company.

Form 8-K items explained

Among the numerous items within Form 8-K, three stand out due to their frequent occurrence and impact on stakeholder decisions. Item 1.01 pertains to the company’s entry into a material definitive agreement, detailing significant contracts that could affect future operations or revenues. Item 2.02 covers the results of operations and financial condition, providing financial performance updates that are critical for investor assessments. Importantly, Item 3.01 addresses any notices of delisting, or failures to satisfy continued listing rules, signaling possible risks for investors.

Each item has considerable implications. For instance, a filing under Item 2.02 that shows a drop in earnings might sway investor sentiment, while notifications under Item 3.01 can induce swiftly negative reactions in stock prices. Understanding these items helps stakeholders to gauge corporate health and make informed investment choices.

Using historical data from Form 8-K

Historical Form 8-K filings serve as a vital resource for both academic and professional analysis. Analyzing past filings lets stakeholders track how companies respond to various triggers and events. This historical context can reveal significant trends in corporate behavior and provide insights into management strategies or governance issues that might be lurking beneath the surface.

Accessing and analyzing these historical filings is straightforward; the SEC's EDGAR database offers a user-friendly interface for retrieving past forms. By identifying patterns—such as repeating issues leading to filings—analysts can predict potential future problems or opportunities for the company.

Tips for creating and managing Form 8-K

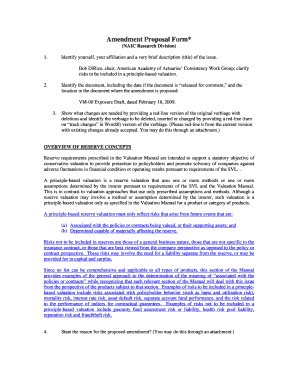

Efficiently managing and filing Form 8-K isn't merely about filling out a template; it requires collaboration and precision. Companies can utilize tools like pdfFiller, which streamline the document management process, allowing teams to collaborate in real time. The electronic signing features integrated into pdfFiller significantly speed up the approval processes, ensuring adherence to deadlines.

To effectively fill out Form 8-K, companies should leverage templates to ensure compliance with SEC specifications. Moreover, adopting a meticulous approach can help avoid inaccuracies in reporting, which can have significant ramifications for a company’s reputation and investor trust.

Frequently asked questions about Form 8-K

Misconceptions about Form 8-K can lead to confusion and mismanagement. A common myth is that filing late does not pose any consequences. In reality, late filings can result in regulatory scrutiny, possible fines, and may adversely affect investor confidence. The responsibility for filing lies primarily with the company’s management or designated officers, typically the Chief Financial Officer (CFO) or Secretary.

Additionally, inaccuracies in the filed form can lead to penalties, suggesting that accuracy and timeliness are paramount. A company must prioritize these elements to maintain regulatory compliance and safeguard its credibility.

Benefits of utilizing Form 8-K

Utilizing Form 8-K offers numerous benefits that extend beyond mere compliance. It enhances transparency with stakeholders, ensuring that investors receive timely updates about critical events that could affect their interests. This transparency builds rapport and trust, which are vital for a company’s reputation in the marketplace.

Moreover, timely filings through Form 8-K help companies demonstrate accountability, which can be advantageous during investor relations initiatives or while negotiating with financial institutions. By fostering an environment of openness, companies can contribute positively to their overall corporate governance posture.

Resources for further learning

To deepen your understanding of Form 8-K and associated regulatory requirements, numerous resources are at your disposal. The SEC's official website provides comprehensive guidelines and regulatory updates relating to Form 8-K. You can also find external educational resources such as webinars and workshops that focus specifically on corporate filings.

Additionally, subscribing to financial news outlets or academic journals can keep you updated on best practices and case studies dealing with Form 8-K filings. Continuous education is key to navigating the complexities of corporate disclosures efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form 8-k in Chrome?

How can I edit form 8-k on a smartphone?

How do I fill out form 8-k using my mobile device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.