Get the free Official Form 201

Get, Create, Make and Sign official form 201

How to edit official form 201 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out official form 201

How to fill out official form 201

Who needs official form 201?

Official Form 201: A Comprehensive Guide to Understanding and Managing Your Document Needs

Understanding the Official Form 201: Purpose and Importance

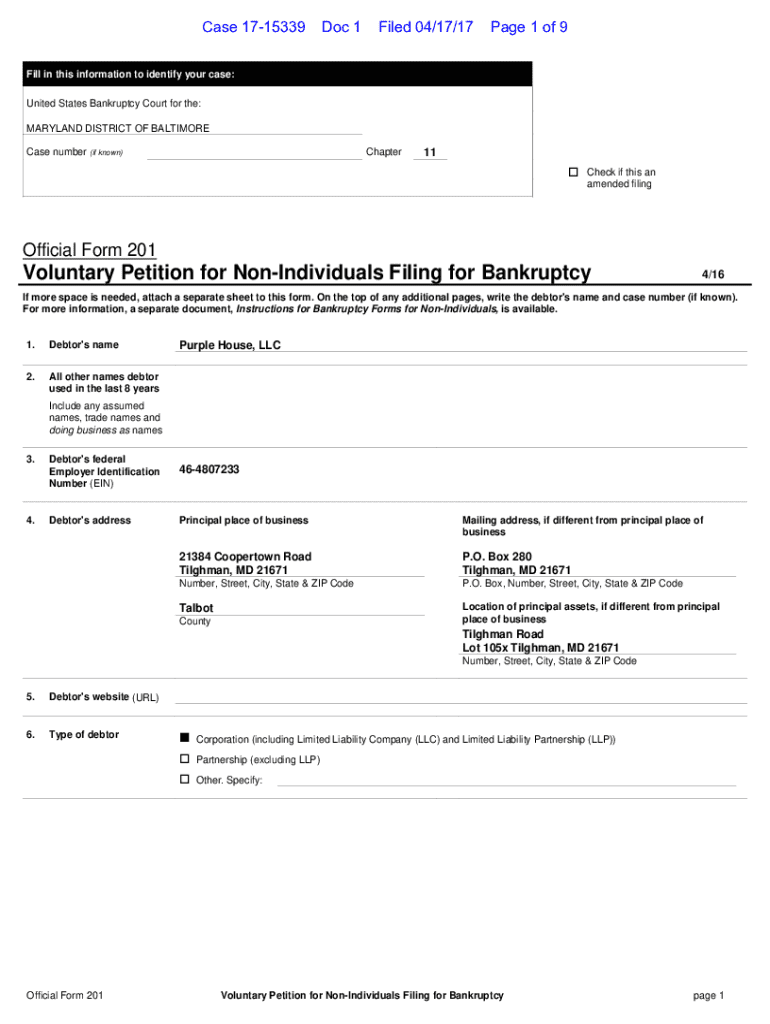

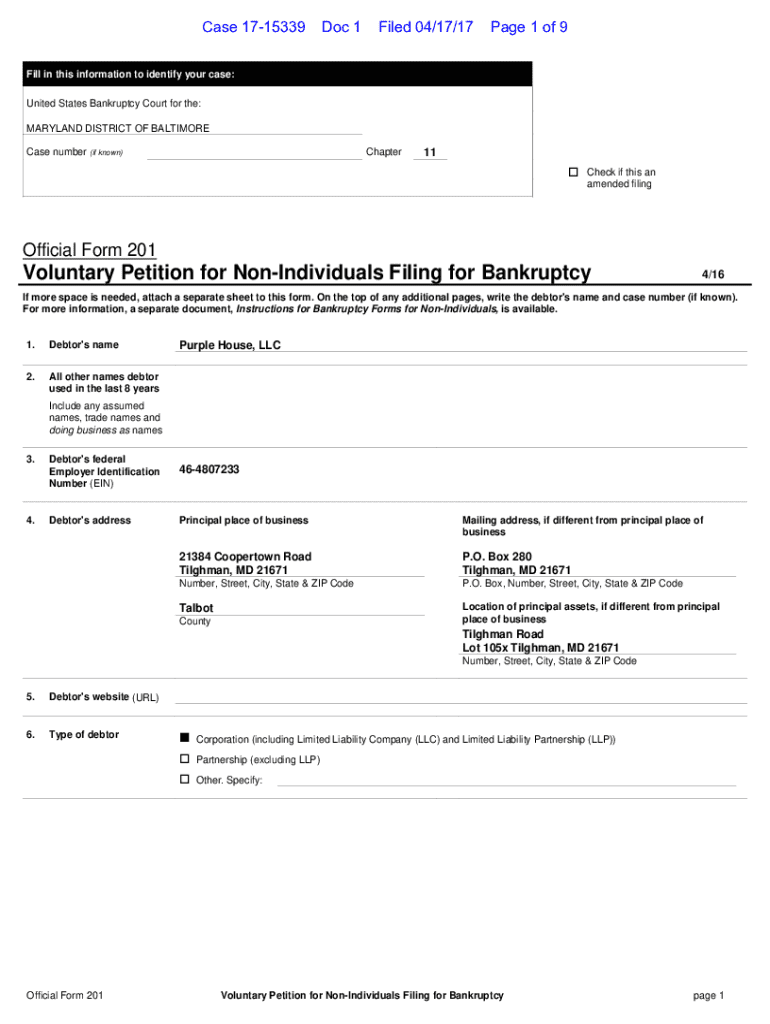

The Official Form 201 is a crucial legal document used in various administrative processes, most notably concerning bankruptcy filings. This form clearly outlines the individual or entity's financial status, obligations, and a summary of their assets. It serves as a foundational document to help courts assess the feasibility of debt relief for individuals or organizations.

Beyond bankruptcy, Form 201 is also utilized in election processes and certain legal petitions, showcasing its versatility in administrative contexts. Its importance cannot be overstated, as accurate and timely submissions can influence the outcomes of legal proceedings and administrative actions.

Who needs to fill out Official Form 201?

Individuals facing financial distress or organizations seeking bankruptcy protection are primary candidates for completing Official Form 201. Additionally, candidates involved in elections may also be required to submit this form, making its reach broad. Anyone who has been engaged in recent financial activities must consider whether their situation necessitates Form 201 submission.

Additionally, common scenarios requiring the completion of Form 201 include declaring bankruptcy, petitioning for debt relief, or fulfilling legal obligations when running for office. Misfiling or submitting an incomplete form can cause delays, potential legal repercussions, and missed opportunities, emphasizing the need for diligent attention.

Step-by-step guide to filling out Official Form 201

Completing Official Form 201 involves careful preparation and accurate information. Before you begin, gather all the necessary documents, including identification, financial statements, and legal paperwork relevant to your case. It is also prudent to have your Social Security number and tax identification numbers handy.

When you start filling out the form, you'll encounter several sections designed to collect specific data. Here’s a breakdown of each section:

Editing Official Form 201: Tips and tools

Mistakes on Official Form 201 can have serious repercussions, making it essential to review and edit the form prior to submission. pdfFiller offers a powerful cloud-based editing feature that enables users to modify, correct, and enhance their forms with ease.

To correct mistakes or update information on the Official Form 201, use the following features:

eSigning the Official Form 201

The electronic signature (eSignature) plays a vital role in modern document management processes. It ensures the integrity of the signed document and reflects a clear intent to agree to the content of the document. When using pdfFiller, eSigning Official Form 201 is straightforward and legally binding.

To eSign Official Form 201 using pdfFiller, follow these steps:

Collaborating on Official Form 201

Collaboration on Official Form 201 is essential when multiple parties are involved, especially in business settings or legal teams. With pdfFiller, sharing the form for input or review is seamless. You can involve teammates, advisors, or anyone who might need to contribute to the form’s accuracy.

Managing permissions and privacy settings is also crucial to ensuring that sensitive information remains secure. Establish who can view or edit the document and set permissions accordingly.

Managing your Official Form 201 submission

Staying organized is vital when dealing with Official Form 201 submissions. Keeping track of submission deadlines and following up on your form’s status will help you avoid unnecessary complications. PdfFiller provides you with tools to manage your forms effectively.

To optimize your submissions, consider these tips:

Common challenges in filling out Official Form 201 and solutions

Users often encounter various challenges when filling out Official Form 201, including confusion regarding specific sections, difficulty in gathering necessary information, and ensuring the accuracy of data. Knowing how to tackle these issues head-on can make a significant difference.

Resolutions to frequently faced problems include:

Conclusion: Streamlining your document management with pdfFiller

Official Form 201 encapsulates critical aspects of financial and legal procedures, necessitating precise attention while filling it out. PdfFiller offers a robust platform to streamline document management efficiently.

By leveraging pdfFiller's state-of-the-art cloud solutions, users can effortlessly edit, eSign, collaborate, and store their documents in one accessible location, significantly enhancing productivity and reducing the administrative burden associated with form submission.

Embracing digital tools like pdfFiller represents a significant improvement in managing essential documents like Official Form 201, paving the way for a more efficient and organized approach to handling your legal needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the official form 201 electronically in Chrome?

Can I create an eSignature for the official form 201 in Gmail?

How do I complete official form 201 on an iOS device?

What is official form 201?

Who is required to file official form 201?

How to fill out official form 201?

What is the purpose of official form 201?

What information must be reported on official form 201?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.